10 minute read

Exness vs Delta Exchange Comparison: Which is better?

In the fast-paced world of online trading, choosing the right platform can make or break your financial journey. Whether you're a forex enthusiast, a crypto derivatives trader, or someone exploring both markets, the decision between Exness and Delta Exchange is a critical one. Both platforms have carved out significant niches in the trading landscape—Exness as a versatile forex and CFD broker, and Delta Exchange as a specialized cryptocurrency derivatives exchange. But when it comes to Exness vs Delta Exchange comparison: which is better?, the answer depends on your trading goals, experience level, and market preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers

This in-depth guide explores every aspect of these two platforms, from their features and fees to their security measures and user experiences. By the end of this analysis, you’ll have a clear understanding of which platform aligns best with your needs in 2025. Let’s dive into the details and uncover the strengths, weaknesses, and unique offerings of Exness and Delta Exchange.

What Are Exness and Delta Exchange?

Before we compare Exness vs Delta Exchange, it’s essential to understand their foundations and target audiences.

Exness: A Multi-Asset Trading Powerhouse

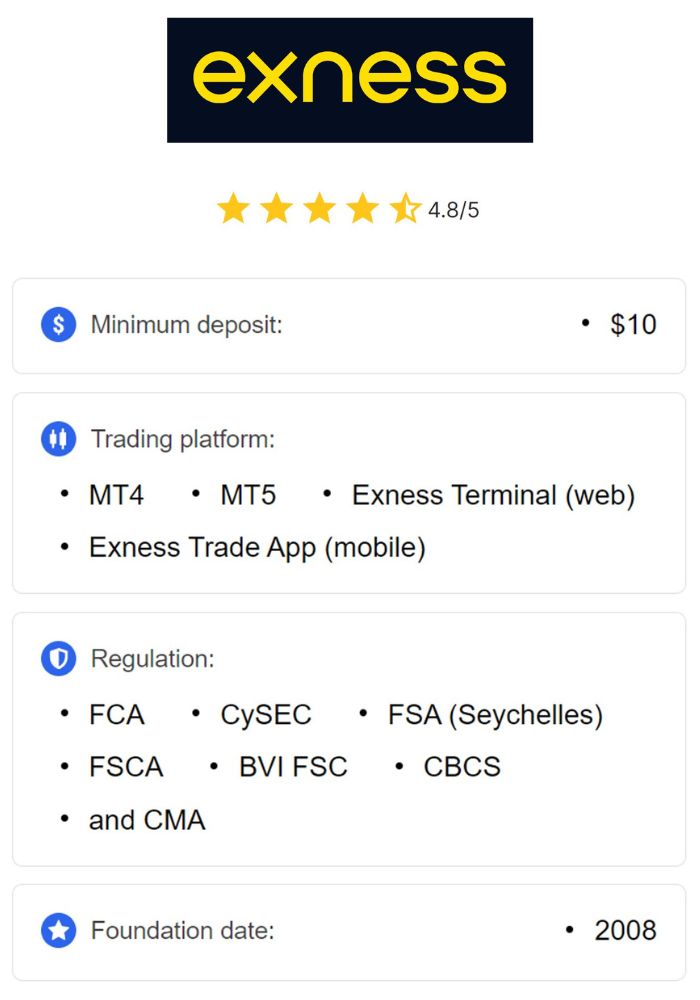

Founded in 2008, Exness has grown into one of the most reputable brokers in the forex and CFD (Contracts for Difference) trading space. Headquartered in Cyprus, Exness operates globally, serving millions of traders with a wide range of financial instruments. From forex pairs and commodities to cryptocurrencies and stocks, Exness offers a versatile trading ecosystem. Known for its low spreads, high leverage, and robust regulatory oversight, Exness appeals to both beginners and seasoned traders looking for reliability and flexibility.

Exness prides itself on transparency and innovation. With execution speeds often under 0.1 seconds and a user-friendly interface, it has earned a loyal following. Whether you’re scalping forex pairs or exploring crypto CFDs, Exness provides the tools and conditions to succeed.

Delta Exchange: A Crypto Derivatives Specialist

Launched in 2018, Delta Exchange is a younger player, headquartered in Singapore and registered in Saint Vincent and the Grenadines. Unlike Exness, Delta Exchange focuses exclusively on cryptocurrency derivatives, offering futures, options, and perpetual swaps. It caters to traders who thrive on the volatility of digital assets like Bitcoin, Ethereum, and various altcoins. Delta Exchange stands out with innovative products like MOVE contracts—allowing traders to profit from price movements—and leverage up to 100x.

Delta Exchange targets crypto enthusiasts and advanced traders seeking specialized tools in a niche market. While it lacks the multi-asset diversity of Exness, its laser focus on crypto derivatives makes it a compelling choice for digital asset traders.

Why Your Choice of Trading Platform Matters

The Exness vs Delta Exchange comparison isn’t just about features—it’s about finding a platform that aligns with your financial strategy. A trading platform is your gateway to global markets, influencing your profitability, security, and overall experience. A poor choice could mean high fees, slow execution, or even risks to your funds. With forex markets boasting a daily turnover of $7.6 trillion and cryptocurrencies gaining mainstream traction in 2025, the stakes are higher than ever.

Imagine a forex trader missing a key market move due to laggy execution, or a crypto trader losing capital on an unregulated platform. These scenarios highlight why comparing Exness vs Delta Exchange is crucial. Let’s break down their offerings across key categories to determine which is better for you.

Regulation and Security: Trusting Your Funds

When entrusting your money to a trading platform, regulation and security are non-negotiable. Here’s how Exness and Delta Exchange stack up.

Exness: Robust Regulatory Framework

Exness operates under strict oversight from multiple financial authorities, ensuring transparency and client protection:

Financial Conduct Authority (FCA) in the UK: One of the world’s toughest regulators, enforcing stringent capital and client fund rules.

Cyprus Securities and Exchange Commission (CySEC): An EU regulator adhering to MiFID II standards, including segregated accounts.

Other Licenses: Exness is also regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Commission (FSC) in Mauritius, and more.

Exness enhances security with segregated client accounts—keeping your funds separate from company assets—and negative balance protection. This multi-layered approach makes Exness a trustworthy option for traders prioritizing safety.

Delta Exchange: Crypto-Focused Security

Delta Exchange operates in a less regulated space, typical of many crypto exchanges. It’s registered in Saint Vincent and the Grenadines, a jurisdiction with lighter oversight compared to the FCA or CySEC. While it lacks the multi-tiered regulation of Exness, Delta Exchange emphasizes security through:

Cold Storage: Most user funds are stored offline, reducing hacking risks.

Multi-Signature Wallets: Adding an extra layer of protection for withdrawals.

Two-Factor Authentication (2FA): Mandatory for account security.

However, Delta Exchange’s lack of top-tier regulation may concern risk-averse traders. It’s a trade-off between crypto-specific security and the broader regulatory credibility Exness offers.

Verdict: Regulation and Security

For regulatory trust, Exness takes the lead with its extensive licenses and client protections. Delta Exchange suits crypto traders comfortable with lighter oversight, provided they value its security measures.

Trading Instruments: Variety vs Specialization

The range of assets you can trade is a defining factor in the Exness vs Delta Exchange comparison.

Exness: A Diverse Portfolio

Exness excels in variety, offering over 200 tradable instruments across multiple asset classes:

Forex: Over 90 currency pairs, including majors (EUR/USD), minors, and exotics.

Cryptocurrencies: CFDs on Bitcoin, Ethereum, Litecoin, and more.

Commodities: Gold, silver, oil, and other energies.

Stocks and Indices: Access to global markets like the S&P 500 and FTSE 100.

This diversity makes Exness ideal for traders who want to diversify their portfolios or explore multiple markets under one roof.

Delta Exchange: Crypto Derivatives Focus

Delta Exchange takes a narrower approach, specializing in cryptocurrency derivatives:

Futures: Contracts on Bitcoin, Ethereum, and altcoins with leverage up to 100x.

Options: Call and put options for advanced strategies.

Perpetual Swaps: Continuous contracts without expiry dates.

MOVE Contracts: Unique products betting on crypto price volatility.

While Delta Exchange lacks forex, commodities, or stocks, its deep focus on crypto derivatives appeals to traders seeking sophisticated tools in the digital asset space.

Verdict: Trading Instruments

Exness wins for versatility, catering to multi-asset traders. Delta Exchange is better for crypto enthusiasts who prioritize derivatives and don’t need traditional markets.

Fees and Costs: Keeping Your Profits

Trading fees directly impact your bottom line. Let’s compare the cost structures of Exness vs Delta Exchange.

Exness: Competitive and Transparent

Exness is known for its low-cost trading environment:

Spreads: Starting from 0.0 pips on Raw Spread and Zero accounts; 1.0 pips on Standard accounts (below the industry average of 1.08 pips).

Commissions: No commissions on Standard accounts; $3.50 per lot/side on Raw Spread accounts.

Deposits/Withdrawals: Free for most methods, though some third-party fees may apply.

Inactivity Fees: Charged after 12 months of inactivity, but moderate compared to competitors.

Exness’s fee structure benefits high-volume traders and scalpers who rely on tight spreads and low costs.

Delta Exchange: Crypto Fee Model

Delta Exchange uses a maker-taker fee model common in crypto exchanges:

Maker Fees: 0.02% (liquidity providers pay less).

Taker Fees: 0.05% (liquidity takers pay more).

Spreads: Vary by market conditions but remain competitive for crypto derivatives.

Deposits: Free for cryptocurrencies; no fiat support.

Withdrawals: Network fees apply, depending on the blockchain (e.g., Bitcoin or Ethereum fees).

Delta Exchange’s fees are low for crypto trading, especially for makers, but the lack of fiat options limits flexibility.

Verdict: Fees and Costs

Exness offers better value for forex and multi-asset traders with its tight spreads and no-commission options. Delta Exchange is more cost-effective for crypto derivatives traders, particularly those adding liquidity.

💥 Trade with Exness now: Open An Account or Visit Brokers

Trading Platforms and Tools: Usability Meets Functionality

A platform’s interface and tools can define your trading experience. Here’s how Exness vs Delta Exchange compare.

Exness: Versatile and User-Friendly

Exness supports multiple platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Industry standards with advanced charting, indicators, and automation (Expert Advisors).

Exness Terminal: A proprietary web platform with fast execution and customizable tools.

Mobile Apps: Intuitive apps for iOS and Android, syncing seamlessly with desktop platforms.

Exness also offers trading calculators, an economic calendar, and real-time news from FXStreet, making it accessible for beginners and powerful for pros.

Delta Exchange: Crypto-Optimized

Delta Exchange provides a single, web-based platform tailored for crypto derivatives:

TradingView Integration: Advanced charting with real-time data.

Order Types: Market, limit, stop-loss, and take-profit orders.

API Access: Ideal for algorithmic traders automating strategies.

Mobile App: A simple, adaptive app for trading on the go.

While functional, Delta Exchange’s platform lacks the multi-asset versatility of Exness and may feel niche for non-crypto traders.

Verdict: Trading Platforms

Exness shines with its multi-platform support and broad tools, appealing to all trader types. Delta Exchange excels for crypto traders needing specialized derivative features.

Leverage: Amplifying Your Trades

Leverage can magnify profits—and losses. Let’s see how Exness vs Delta Exchange handle it.

Exness: High Leverage Options

Exness offers some of the highest leverage in the industry:

Forex: Up to 1:2000 (via its offshore entity in Seychelles).

Crypto CFDs: Up to 1:200.

Other Assets: Varies by instrument (e.g., 1:20 for stocks).

High leverage suits experienced traders, but Exness caps it for beginners to reduce risk, showing a balanced approach.

Delta Exchange: Crypto Leverage Leader

Delta Exchange pushes the boundaries for crypto trading:

Futures and Perpetuals: Up to 100x leverage.

Options: Varies by contract but supports high-risk strategies.

This aggressive leverage appeals to crypto traders chasing big gains, though it demands caution due to volatility.

Verdict: Leverage

Exness offers more flexibility across assets, while Delta Exchange leads for crypto-specific high-leverage trading.

Account Types: Tailored to Your Needs

Both platforms offer account options to suit different traders.

Exness: Variety for All Levels

Standard Account: No commissions, beginner-friendly.

Raw Spread Account: Ultra-low spreads with a small commission.

Zero Account: Zero spreads on top instruments, higher commissions.

Pro Account: Instant execution for advanced traders.

Exness’s range caters to everyone, from novices to professionals.

Delta Exchange: One-Size-Fits-Crypto

Delta Exchange uses a single account model:

Unified Account: Access to all derivatives (futures, options, perpetuals).

Customization: Adjust leverage and strategies within the account.

Its simplicity suits crypto traders but lacks the tiered options of Exness.

Verdict: Account Types

Exness wins for its diverse, tailored accounts. Delta Exchange keeps it straightforward for crypto-focused users.

Customer Support: Help When You Need It

Reliable support can save your trading day.

Exness: 24/7 Multi-Lingual

Availability: 24/7 via live chat, email, and phone.

Languages: Over 15, including English, Chinese, and Arabic.

Response Time: Fast, often within minutes.

Exness’s global reach ensures accessible, responsive support.

Delta Exchange: Crypto-Centric

Availability: 24/7 via email and live chat.

Languages: Primarily English, with limited multi-lingual support.

Response Time: Decent but slower during peak times.

Delta Exchange’s support is solid but less extensive than Exness.

Verdict: Customer Support

Exness takes the edge with broader, faster support.

Educational Resources: Learning to Trade

Education can empower your trading success.

Exness: Comprehensive Learning

Webinars: Regular sessions on forex and CFD strategies.

Articles: In-depth guides and market analysis.

Trading Tools: Calculators and converters for beginners.

Exness prioritizes trader education across all levels.

Delta Exchange: Crypto-Focused Academy

Delta Academy: Video courses and guides on crypto derivatives.

Blog: Insights into market trends and strategies.

While useful, Delta Exchange’s resources are narrower, focusing solely on crypto.

Verdict: Education

Exness offers broader learning tools; Delta Exchange excels for crypto-specific education.

User Experience: Real Traders’ Insights

What do actual users say about Exness vs Delta Exchange?

Exness: Praise and Critique

Pros: Traders love the low spreads, fast withdrawals, and MT5 features.

Cons: Some note occasional slippage during volatile markets.

Delta Exchange: Mixed Feedback

Pros: High leverage and MOVE contracts earn praise from crypto traders.

Cons: Complaints about withdrawal delays and limited asset range.

Both platforms have strengths, but Exness enjoys a broader positive reputation.

Final Verdict: Which is Better?

The Exness vs Delta Exchange comparison boils down to your trading style:

Choose Exness if you want a regulated, multi-asset platform with low fees, versatile tools, and strong support. It’s ideal for forex traders, beginners, and those diversifying beyond crypto.

Choose Delta Exchange if you’re a crypto enthusiast seeking high-leverage derivatives, innovative products, and a specialized focus on digital assets.

In 2025, Exness stands out as the better all-rounder, while Delta Exchange shines for crypto derivatives traders. Assess your goals, and let this guide steer you to success.

💥 Trade with Exness now: Open An Account or Visit Brokers

Read more: