8 minute read

Exness Global Review Safe or Scam Broker?

from Exness Review

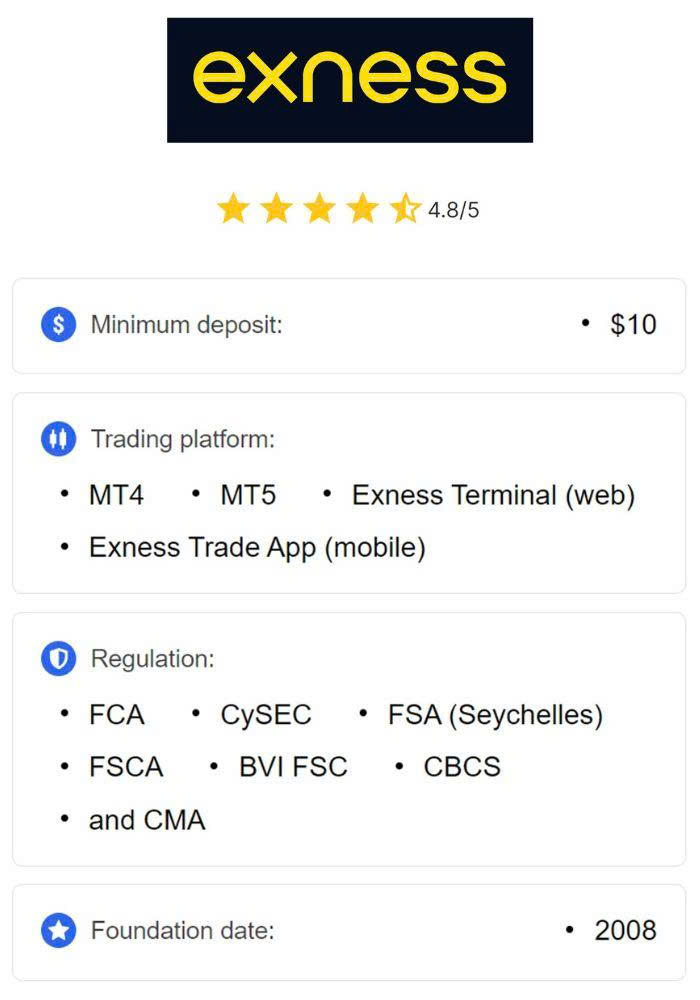

So, you’re thinking about trading with Exness, but you’re wondering: Is Exness a safe broker, or is it just another scam waiting to take your money? Let’s cut to the chase—Exness is a legitimate, regulated broker with a solid reputation in the forex and CFD trading world. Founded in 2008, it’s grown into a global powerhouse serving over a million active traders. But, like with any broker, there are nuances to consider before you dive in. In this Exness Global review, I’ll break down everything you need to know about its safety, features, and potential red flags, so you can decide if it’s the right fit for your trading journey.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Who Is Exness, Anyway?

Let’s start with the basics. Exness is a Cyprus-based online broker that’s been around since 2008. It offers trading in forex, cryptocurrencies, commodities, indices, and stocks via Contracts for Difference (CFDs). With a presence in over 190 countries and a user base exceeding 1 million, Exness has made a name for itself with tight spreads, high leverage, and a user-friendly platform. But a shiny website and big numbers don’t automatically mean “safe.” So, let’s dig deeper into what makes Exness tick—and whether it’s trustworthy.

Is Exness Regulated? The Safety Check

When it comes to online trading, regulation is your first line of defense against scams. The good news? Exness is regulated by several top-tier financial authorities, which is a strong indicator of its legitimacy. Here’s the rundown:

Financial Conduct Authority (FCA) in the UK: One of the strictest regulators globally, ensuring brokers follow rigorous financial standards.

Cyprus Securities and Exchange Commission (CySEC): A well-respected European regulator that enforces transparency and client fund protection.

Financial Sector Conduct Authority (FSCA) in South Africa: Adds another layer of oversight for Exness’s operations in specific regions.

Other regulators: Exness also holds licenses from the Financial Services Authority (FSA) in Seychelles, the FSC in Mauritius, and more.

These regulatory bodies require Exness to segregate client funds from its operational accounts, maintain adequate capital reserves, and undergo regular audits. This means your money is kept separate and protected, even if the broker faces financial trouble. Exness also offers negative balance protection, ensuring you can’t lose more than you deposit—a huge plus for beginners navigating volatile markets.

But here’s a heads-up: Exness operates multiple entities, and the level of regulation depends on where you’re trading from. For example, if you’re under their Seychelles entity, the oversight is less stringent than with the FCA or CySEC. Always check which entity you’re signing up with to understand the protections in place.

Exness’s Safety Features: More Than Just Regulation

Regulation is great, but what else does Exness do to keep your funds and data safe? Quite a bit, actually:

Segregated Accounts: Your money is stored in separate bank accounts, away from Exness’s business funds.

SSL Encryption: Industry-standard encryption protects your personal and financial data from cyber threats.

Two-Factor Authentication (2FA): Adds an extra layer of security to your account login.

3D Secure for Payments: Enhances fraud protection for card transactions with a one-time PIN.

Negative Balance Protection: Prevents you from owing money if the market moves against you.

Exness also runs a Zero Trust security model and a Bug Bounty program to catch vulnerabilities before hackers do. These measures show a serious commitment to keeping your trading experience secure.

Trading with Exness: What’s the Experience Like?

Now that we’ve covered safety, let’s talk about what it’s like to trade with Exness. Spoiler: It’s pretty impressive, but it’s not perfect.

Platforms and Tools

Exness offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms in the world. Both are packed with advanced charting tools, technical indicators, and support for automated trading via Expert Advisors (EAs). If you prefer trading on the go, their Exness Trader App is sleek, intuitive, and offers real-time market access. The Exness Web Terminal is another great option for browser-based trading without downloads.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Account Types

Exness caters to all kinds of traders with a variety of account types:

Standard Cent: Perfect for beginners with a low minimum deposit (as little as $10 in some regions).

Standard: A no-frills account with competitive spreads.

Pro: Designed for experienced traders with tighter spreads and faster execution.

Raw Spread: Ultra-low spreads with a small commission.

Zero: Near-zero spreads on major pairs, ideal for high-frequency traders.

This flexibility makes Exness accessible whether you’re starting with pocket change or trading big.

Spreads and Fees

Exness is known for its tight spreads, often as low as 0.0 pips on major currency pairs for Raw Spread and Zero accounts. There are no deposit or withdrawal fees from Exness’s side, though your payment provider might charge something. Leverage is another standout, with options up to 1:2000 (though this varies by region and regulation). High leverage is a double-edged sword—it can amplify profits but also losses, so tread carefully.

Deposits and Withdrawals

One of Exness’s biggest selling points is its instant withdrawals. Many users report getting their money within minutes, which is a rarity in the brokerage world. You can use bank cards, e-wallets like Skrill and Neteller, or even crypto for funding your account. Just make sure to verify your account fully to avoid withdrawal delays.

Customer Support

Exness offers 24/7 customer support in 14 languages via live chat, email, and phone. Reviews often praise their responsiveness, though some users have reported mixed experiences with complex issues. Their educational resources, including webinars and tutorials, are a big help for new traders.

What Do Traders Say About Exness?

User reviews are a mixed bag, as with any broker, but Exness generally enjoys a positive reputation. On platforms like Trustpilot, Exness has a 4-star rating from over 18,000 reviews, with traders praising the platform’s ease of use, fast withdrawals, and low spreads. Many highlight the demo account as a great way to practice without risking real money.

However, there are some complaints. A few traders have reported issues with withdrawals, often tied to incomplete verification or technical glitches. Others have mentioned occasional slippage during high market volatility, though Exness claims a less than 1% slippage rate on certain assets. There are also rare allegations of account issues or platform slowdowns, but these don’t seem widespread or substantiated enough to label Exness a scam.

One thing to watch out for: fake websites. Some users have fallen victim to copycat sites mimicking Exness to steal funds. Always double-check you’re on the official Exness website exness.com before depositing money.

Red Flags or Just Misunderstandings?

Let’s address the elephant in the room: scam accusations. Some online posts, particularly on Reddit, have called Exness a scam, citing issues like withdrawal delays or unexpected account activity. However, many of these complaints seem to stem from user errors (like incomplete KYC verification) or misunderstandings about trading risks. For instance, high leverage can wipe out accounts quickly if not managed properly, but that’s not the broker’s fault.

There’s also the issue of regional differences. Traders under less-regulated entities (like Seychelles) might face fewer protections, which can lead to frustration. Plus, some scam allegations point to fraudulent websites posing as Exness, not the broker itself. Exness has been operating for over 15 years without major scandals, which is a strong sign it’s not out to scam anyone.

Is Exness Legal in Your Country?

Exness operates globally, but its legality depends on your location. For example, it’s not regulated by India’s SEBI or RBI, so Indian traders use offshore entities, which carry some risks. Always check your local regulations before signing up. Exness’s transparency about its licensing and regional restrictions is a point in its favor.

Should You Trade with Exness?

So, is Exness safe or a scam? Based on its regulation, security measures, and track record, Exness is a safe and legitimate broker. It’s not perfect—some users face withdrawal hiccups, and high leverage can be risky for newbies—but there’s no evidence of systemic fraud. Its competitive spreads, fast withdrawals, and robust platforms make it a solid choice for both beginners and pros.

Here’s a quick pros and cons list to sum it up:

Pros

Regulated by top-tier authorities (FCA, CySEC, FSCA).

Tight spreads and instant withdrawals.

User-friendly platforms (MT4, MT5, Exness Trader App).

Negative balance protection and strong security.

Excellent customer support and educational resources.

Cons

Less stringent regulation for some offshore entities.

Occasional complaints about withdrawals or slippage.

High leverage can lead to significant losses if mismanaged.

Final Thoughts

Exness has earned its spot as a trusted broker in the trading world. Its commitment to regulation, transparency, and client protection sets it apart from fly-by-night operations. That said, trading is inherently risky, and no broker is immune to occasional hiccups. Do your homework, start with a demo account, and always verify you’re on the official Exness site. If you’re looking for a reliable platform with competitive conditions, Exness is worth a shot.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: