10 minute read

Exness App is Legal in India? A Comprehensive Guide for Traders

from Exness App India

The rise of online forex trading has transformed how Indian investors engage with global financial markets. Among the numerous trading platforms available, the Exness app has gained significant traction due to its user-friendly interface, competitive spreads, and diverse range of financial instruments. However, one question looms large for Indian traders: Exness App is Legal in India?

This comprehensive guide dives deep into the legal status of the Exness app in India, exploring regulatory frameworks, compliance requirements, risks, and practical tips for traders. Whether you're a beginner or an experienced trader, this article will equip you with the knowledge to make informed decisions while navigating India’s complex forex trading landscape.

✅ Join Exness now! Open An Account or Visit Brokers 👈

What is the Exness App?

Exness, founded in 2008, is a globally recognized online trading platform offering access to forex, commodities, indices, stocks, and cryptocurrencies. Headquartered in Cyprus, Exness serves millions of traders worldwide and is known for its fast execution speeds, low spreads, and robust trading tools, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. The Exness app, available for Android and iOS, allows traders to manage accounts, execute trades, and monitor markets on the go.

The app’s intuitive design, real-time data, and advanced charting tools make it a preferred choice for mobile traders. With features like instant withdrawals, high leverage (up to 1:2000), and support for over 100 currency pairs, Exness has built a strong reputation globally. But how does it fare in India, where forex trading is heavily regulated?

Understanding Forex Trading Regulations in India

To determine the legality of the Exness app in India, we must first understand the regulatory framework governing forex trading. In India, forex trading is regulated by two primary authorities:

· Reserve Bank of India (RBI): The RBI oversees foreign exchange transactions under the Foreign Exchange Management Act (FEMA), 1999. FEMA restricts speculative forex trading and limits Indian residents to trading only currency pairs involving the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. These trades must occur on authorized Indian exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Multi Commodity Exchange (MCX).

· Securities and Exchange Board of India (SEBI): SEBI regulates securities and commodities markets, including forex trading platforms. It enforces strict guidelines, such as Know Your Customer (KYC) norms, to ensure transparency and protect investors from fraud. Only SEBI-registered brokers are authorized to offer forex trading services in India.

Under these regulations, trading non-INR currency pairs (e.g., EUR/USD or GBP/USD) through offshore brokers like Exness is considered a violation of FEMA. Additionally, depositing funds to offshore brokers in foreign currencies can lead to legal scrutiny, as it may breach India’s foreign exchange laws.

Is Exness Regulated in India?

Exness is a globally regulated broker, holding licenses from reputable authorities such as:

· Cyprus Securities and Exchange Commission (CySEC)

· Financial Conduct Authority (FCA) in the UK

· Financial Sector Conduct Authority (FSCA) in South Africa

· Seychelles Financial Services Authority (FSA)

· Financial Services Commission (FSC) in Mauritius and the British Virgin Islands

These licenses ensure that Exness adheres to international standards for transparency, client fund protection, and ethical trading practices. Client funds are held in segregated accounts, and the broker undergoes regular audits to maintain compliance.

However, Exness is not regulated by SEBI or the RBI, meaning it lacks a local license to operate in India. This places Exness in a legal grey area for Indian traders. While the platform is legitimate globally, its operations in India do not fall under the direct oversight of Indian authorities. As a result, Indian traders using the Exness app may face legal and financial risks, particularly when trading non-INR currency pairs or using international payment methods to fund accounts.

Can Indian Traders Legally Use the Exness App?

The short answer is: It’s complicated. Indian traders can technically access the Exness app and open accounts, as the platform is available globally. However, using it for forex trading may violate Indian regulations under certain conditions. Here’s a breakdown:

Legal Aspects:

· INR-Based Pairs Only: Indian traders are legally restricted to trading INR-based currency pairs on SEBI-regulated platforms. Exness offers a wide range of non-INR pairs (e.g., EUR/USD, GBP/JPY), which are not permitted under FEMA. Trading these pairs could lead to legal consequences, including penalties or account restrictions.

· Offshore Broker Status: As an offshore broker, Exness is not authorized by SEBI or RBI. While many Indian traders use the platform, they do so at their own risk, as they lack the legal protections offered by SEBI-regulated brokers.

· Funding and Withdrawals: Depositing funds to Exness using foreign currencies or international payment gateways (e.g., e-wallets or cryptocurrencies) may violate FEMA. Indian banks often flag such transactions, leading to delays, frozen accounts, or regulatory scrutiny.

Practical Reality:

Despite these restrictions, many Indian traders use Exness due to its competitive features, such as low spreads, high leverage, and fast withdrawals. Enforcement of FEMA violations against individual retail traders is rare, especially for small-scale trading. However, this does not mean trading with Exness is risk-free. Traders must weigh the benefits against potential legal and financial risks.

Risks of Using the Exness App in India

While the Exness app offers a robust trading experience, Indian traders should be aware of the following risks:

· Lack of Legal Protection: Since Exness is not regulated by SEBI or RBI, Indian traders have limited recourse in case of disputes or financial losses. Unlike SEBI-regulated brokers, Exness is not obligated to comply with Indian investor protection laws.

· FEMA Violations: Trading non-INR pairs or transferring funds to offshore accounts may breach FEMA regulations, potentially leading to penalties, account freezes, or legal action.

· Banking Restrictions: Indian banks may block transactions to offshore brokers or flag withdrawals as suspicious, causing delays or complications.

· Tax Implications: Profits from trading on Exness are considered foreign income, which may be subject to higher tax rates or complex compliance requirements. Consulting a tax expert is advisable to ensure proper reporting.

· High Leverage Risks: Exness offers leverage up to 1:2000, significantly higher than the 1:30 limit imposed by SEBI-regulated brokers. While this can amplify profits, it also increases the risk of substantial losses.

· Scams and Fake Platforms: Some scammers create fake Exness apps or websites to steal login credentials or funds. Always download the Exness app from official sources like the Google Play Store, Apple App Store, or exness.com.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Benefits of Using the Exness App

Despite the legal grey area, the Exness app offers several advantages that attract Indian traders:

· User-Friendly Interface: The app is intuitive, lightweight, and optimized for mobile trading, making it accessible for beginners and experienced traders alike.

· Diverse Trading Instruments: Exness provides access to over 100 currency pairs, commodities, indices, stocks, and cryptocurrencies, allowing traders to diversify their portfolios.

· Low Minimum Deposit: With a minimum deposit of just $10, Exness is accessible to traders with limited capital.

· Fast Withdrawals: Exness is known for instant withdrawals, with over 98% of transactions processed in under a minute (subject to payment provider delays).

· Advanced Tools: Integration with MT4 and MT5 offers sophisticated charting, technical indicators, and automated trading via Expert Advisors (EAs).

· Global Regulation: Licenses from CySEC, FCA, and other authorities ensure a secure trading environment, even if not directly applicable in India.

How to Trade Safely with Exness in India

If you choose to use the Exness app, follow these best practices to minimize risks:

· Stick to INR-Based Pairs: To comply with FEMA, focus on trading INR-based currency pairs like USD/INR or EUR/INR. Avoid non-INR pairs to stay within legal boundaries.

· Use Authorized Payment Methods: Fund your account through SEBI-compliant channels or consult a financial advisor to ensure compliance with RBI guidelines. Avoid using cryptocurrencies or e-wallets for large transactions, as they may attract scrutiny.

· Verify the Platform: Download the Exness app only from official sources (Google Play Store, Apple App Store, or exness.com to avoid scams. Check for SSL security on the website.

· Consult a Tax Expert: Understand the tax implications of trading profits on an offshore platform. Ensure proper reporting to avoid penalties from Indian tax authorities.

· Start Small: Begin with a low deposit (e.g., $10) and avoid high-leverage trades until you’re familiar with the platform and its risks.

· Use SEBI-Regulated Alternatives When Possible: Consider brokers like Zerodha, Upstox, Angel One, or ICICI Direct, which are fully compliant with Indian regulations and offer INR-based forex trading.

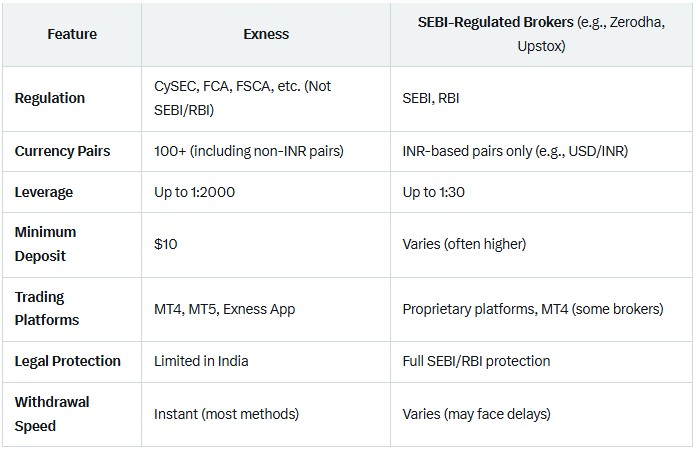

Comparing Exness with SEBI-Regulated Brokers

To make an informed decision, let’s compare Exness with SEBI-regulated brokers:

While Exness offers greater flexibility and advanced features, SEBI-regulated brokers provide legal security and compliance with Indian laws. Traders must decide whether the benefits of Exness outweigh the regulatory risks.

Exness Go: A Mobile Trading Alternative

In addition to the standard Exness app, the Exness Go app is designed specifically for mobile traders. It offers a streamlined interface, real-time market monitoring, and quick trade execution. Like the main app, Exness Go is legitimate and available on official app stores, but it operates under the same regulatory constraints in India. Traders using Exness Go must adhere to the same FEMA and SEBI guidelines to avoid legal issues.

Common Myths About Exness in India

· Myth: Exness is Fully Legal in India

· Fact: Exness is not regulated by SEBI or RBI, placing it in a legal grey area. Trading non-INR pairs or using offshore payment methods may violate FEMA.

· Myth: Exness is Unsafe

· Fact: Exness is a globally regulated broker with a strong reputation for transparency and client fund protection. However, Indian traders face risks due to the lack of local regulation.

· Myth: You Can’t Withdraw Funds from Exness in India

· Fact: Many traders successfully withdraw funds using e-wallets or bank transfers, but delays or restrictions may occur due to Indian banking policies.

Final Verdict: Should You Use the Exness App in India?

The Exness app is a powerful and reliable platform for forex and CFD trading, offering a wealth of features that appeal to traders worldwide. However, its legal status in India remains ambiguous due to the lack of SEBI or RBI regulation. While Indian traders can access the app, they must navigate significant risks, including potential FEMA violations, lack of legal protection, and banking restrictions.

For those prioritizing compliance and safety, SEBI-regulated brokers like Zerodha, Upstox, or Angel One are better choices, as they align with Indian laws and offer INR-based trading. However, if you’re drawn to Exness for its advanced tools and global offerings, proceed with caution, stick to INR-based pairs, and consult legal or financial experts to ensure compliance.

✅ Join Exness now! Open An Account or Visit Brokers 👈

FAQs About the Exness App in India

1. Is Exness registered with SEBI or RBI?No, Exness is not registered with SEBI or RBI. It operates under international licenses from CySEC, FCA, and other authorities.

2. Can I trade non-INR pairs on Exness from India?Trading non-INR pairs (e.g., EUR/USD) is restricted under FEMA and may lead to legal consequences.

3. Is Exness Go a legitimate app?Yes, Exness Go is an official mobile trading app available on Google Play and the Apple App Store. Always download from official sources to avoid scams.

4. What are the risks of trading with Exness in India?Risks include FEMA violations, lack of SEBI protection, banking restrictions, and potential tax complications.

5. How can I trade forex legally in India?Use SEBI-regulated brokers and trade only INR-based currency pairs on authorized exchanges like NSE or BSE.