9 minute read

Can We Trade in Exness in India? A Comprehensive Guide

from Trade Exness India

Forex trading has surged in popularity across India, driven by increasing internet access, technological advancements, and a growing interest in global financial markets. Among the many brokers available, Exness has emerged as a prominent name, attracting attention for its competitive spreads, user-friendly platform, and diverse trading instruments. However, a critical question looms for Indian traders: Can we trade in Exness in India? In this article, we’ll explore the legality, features, benefits, and considerations of trading with Exness in India, offering a detailed guide to help you navigate this dynamic landscape.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Is Forex Trading Legal in India?

Before diving into Exness specifically, it’s essential to understand the broader legal framework for forex trading in India. Forex trading is legal in India, but it comes with specific regulations enforced by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). According to the RBI, Indian residents are permitted to trade forex, but only in currency pairs that include the Indian Rupee (INR), such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Trading in non-INR pairs, such as EUR/USD, is not allowed for Indian residents under current regulations.

Additionally, forex trading must be conducted through platforms or brokers authorized by SEBI or registered with recognized Indian exchanges like the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or Metropolitan Stock Exchange (MSE). Any profits earned from forex trading are subject to taxation in India, and traders must declare their earnings to comply with local laws.

So, where does Exness fit into this framework? Let’s explore.

Is Exness Legal in India?

Exness is a globally recognized online trading platform, founded in 2008, that offers forex and CFD (Contracts for Difference) trading. It is regulated by multiple international authorities, including the Financial Services Authority (FSA) in Seychelles, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA) in the UK. However, Exness is not regulated by SEBI, which raises questions about its legality for Indian traders.

The short answer is: Yes, Indian traders can use Exness, but with caveats. While Exness itself is a legitimate and regulated broker, Indian traders must ensure they comply with RBI regulations by trading only INR-based currency pairs. Using Exness to trade non-INR pairs could violate Indian forex laws, potentially leading to legal consequences. Therefore, Indian traders must exercise caution and stick to permissible currency pairs to stay within the legal framework.

Why Choose Exness for Trading in India?

Exness has gained popularity among Indian traders for several reasons. Here’s a breakdown of why Exness stands out:

1. User-Friendly Trading Platform

Exness offers a seamless trading experience through its Exness Trading Terminal and Exness Go mobile app. These platforms are designed for both novice and experienced traders, providing real-time market data, advanced charting tools, and fast trade execution. The mobile app is particularly appealing for Indian traders who prefer trading on the go.

2. Competitive Spreads and Leverage

Exness is known for its tight spreads, particularly on popular instruments like gold, oil, and forex pairs. For Indian traders, this means lower trading costs, which can enhance profitability. Additionally, Exness offers leverage up to 1:2000, allowing traders to maximize their returns, though high leverage also increases risk.

3. Local Payment Methods

One of Exness’s strengths in India is its support for local payment methods, including bank transfers, UPI, and other digital payment systems. Deposits and withdrawals are processed quickly, often within 24 hours, making it convenient for Indian traders to manage their funds.

4. Wide Range of Trading Instruments

Exness provides access to a diverse range of instruments, including forex, commodities, indices, and cryptocurrencies. While Indian traders must focus on INR pairs for forex, they can also explore other assets like gold and oil, which are popular in the Indian market.

5. Educational Resources and Support

Exness offers robust educational resources, including tutorials, webinars, and market analysis tools. For Indian traders new to forex, these resources can be invaluable in building knowledge and confidence. Additionally, Exness provides 24/7 customer support, ensuring traders can resolve issues promptly.

How to Trade with Exness in India Legally

To trade with Exness in India while staying compliant with local laws, follow these steps:

1. Open a Demo Account

If you’re new to Exness or forex trading, start with a demo account. This allows you to explore the platform, test strategies, and understand its features without risking real money. Exness’s demo account mirrors live trading conditions, making it an excellent learning tool.

2. Verify Your Account

To comply with international regulations, Exness requires account verification. You’ll need to submit identity proof (e.g., Aadhaar, passport) and address proof (e.g., utility bill). This ensures your account is secure and meets regulatory standards.

3. Stick to INR-Based Currency Pairs

As mentioned, Indian traders must trade only INR pairs (e.g., USD/INR, EUR/INR) to comply with RBI regulations. Exness offers these pairs, so ensure you select them when placing trades.

4. Use Local Payment Methods

Fund your account using UPI, bank transfers, or other supported methods. Exness’s fast withdrawal process ensures you can access your funds efficiently. Always keep records of transactions for tax purposes.

5. Understand Tax Implications

Forex trading profits in India are treated as business income or capital gains, depending on the nature of your trading. Consult a tax professional to ensure compliance with Indian tax laws and avoid penalties.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Risks of Trading with Exness in India

While Exness is a reputable platform, trading with an unregulated broker (in the context of SEBI) carries risks. Here are some considerations:

1. Regulatory Risk

Since Exness is not SEBI-regulated, there’s a lack of local oversight. In case of disputes, Indian traders may need to rely on international regulators, which can be challenging. Always verify Exness’s licensing status and read user reviews before trading.

2. High Leverage Risks

Exness’s high leverage (up to 1:2000) can amplify profits but also magnifies losses. Indian traders, especially beginners, should use leverage cautiously and implement risk management strategies like stop-loss orders.

3. Currency Pair Restrictions

The restriction to INR pairs limits the trading options available to Indian traders. Attempting to trade non-INR pairs could result in legal issues, so strict adherence to RBI guidelines is crucial.

4. Market Volatility

Forex and CFD trading are inherently risky due to market volatility. Economic events, geopolitical developments, and market fluctuations can impact your trades. Stay informed with Exness’s market analysis tools to make educated decisions.

Tips for Successful Trading with Exness in India

To maximize your success and minimize risks, consider these actionable tips:

1. Conduct Thorough Keyword Research

While this article focuses on trading, principles can apply to researching trading-related terms. Use tools like Google Keyword Planner or SEMrush to understand what Indian traders are searching for (e.g., “Exness India review,” “forex trading in India”). This can help you stay informed about market trends and trader preferences.

2. Match Search Intent

When exploring trading platforms, Indian traders often seek information on legality, safety, and ease of use. Exness’s educational resources and demo account cater to this informational intent, helping you make informed decisions.

3. Leverage Long-Tail Keywords

For traders creating content or researching Exness, targeting long-tail keywords like “is Exness legal in India 2025” or “how to trade forex with Exness in India” can attract organic traffic with less competition.

4. Stay Updated on Regulations

India’s forex regulations may evolve. Regularly check RBI and SEBI guidelines to ensure compliance. Subscribing to Exness’s newsletters or following financial news can keep you informed.

5. Practice Risk Management

Use tools like stop-loss orders and position sizing to protect your capital. Exness’s platform allows you to set these parameters, reducing the risk of significant losses.

Exness Go: A Mobile Trading Solution for Indian Traders

Exness Go, the mobile app launched by Exness, has gained traction in India for its convenience and accessibility. Designed for traders who prefer managing portfolios on their smartphones, Exness Go offers:

· Real-Time Trading: Execute trades instantly with live market data.

· Portfolio Management: Monitor and adjust your positions on the go.

· Market Analysis Tools: Access charts, indicators, and news to inform your trades.

· User-Friendly Interface: Ideal for beginners and experienced traders alike.

For Indian traders, Exness Go is a game-changer, enabling seamless trading from anywhere. However, ensure you use it to trade only INR pairs to stay compliant.

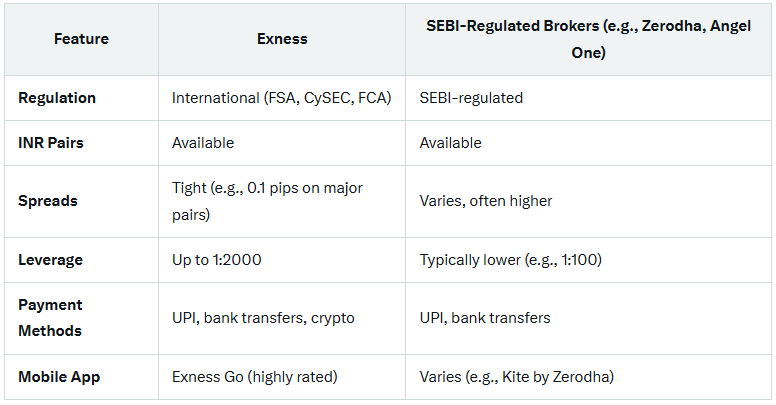

How Does Exness Compare to Other Brokers in India?

To provide a balanced perspective, let’s compare Exness to other brokers popular in India:

While SEBI-regulated brokers offer local oversight, Exness provides competitive spreads and higher leverage, making it attractive for experienced traders. However, the lack of SEBI regulation means you must prioritize compliance with RBI rules.

Common Questions About Trading with Exness in India

1. Is Exness safe for Indian traders?

Exness is regulated by reputable international authorities, making it a safe platform for trading. However, Indian traders must ensure they trade only INR pairs to comply with local laws.

2. Can I withdraw funds easily from Exness in India?

Yes, Exness supports local payment methods like UPI and bank transfers, with withdrawals typically processed within 24 hours.

3. Does Exness charge high fees?

Exness is known for its low spreads and no hidden fees on most accounts. However, check the fee structure for your specific account type (e.g., Standard, Pro, or Raw Spread).

4. Can beginners use Exness?

Absolutely. Exness’s demo account, educational resources, and intuitive platform make it beginner-friendly.

Conclusion: Is Exness Right for You?

Trading with Exness in India is possible and can be rewarding, provided you adhere to RBI regulations by trading only INR-based currency pairs. Exness offers a robust platform, competitive spreads, high leverage, and convenient payment methods, making it a strong choice for Indian traders. However, the lack of SEBI regulation means you must exercise caution, verify the platform’s credibility, and stay compliant with local laws.

For beginners, starting with a demo account and leveraging Exness’s educational resources is a smart move. Experienced traders can benefit from the platform’s advanced tools and Exness Go for mobile trading. Always prioritize risk management and consult a tax professional to handle forex trading profits.

✅ Join Exness now! Open An Account or Visit Brokers 👈

Read more: