8 minute read

JustMarkets Review Dubai: Is This Broker Right for You?

from JustMarkets

by Exness_India

If you’re in Dubai and looking for a reliable online trading platform, you’ve probably come across JustMarkets. But is it the right choice for your trading journey? In this JustMarkets review tailored for Dubai traders, I’ll dive straight into what makes this broker stand out, its pros and cons, and whether it suits your needs—whether you’re a newbie or a seasoned trader. Let’s break it down in a so you can decide if JustMarkets is your next trading home. Ready? Let’s go!

✅ Trade with JustMarkets now: Open An Account or Visit Brokers 👈

What Is JustMarkets?

JustMarkets is an online forex and CFD broker that’s been making waves since its inception in 2012. It’s regulated by multiple authorities, including the Financial Services Authority (FSA) of Seychelles and the Cyprus Securities and Exchange Commission (CySEC), which gives it some credibility in the trading world. For traders in Dubai, JustMarkets offers access to forex, stocks, commodities, indices, and cryptocurrencies, all through a user-friendly platform. But what’s the real deal for those trading from the UAE? Let’s explore.

Why Dubai Traders Are Checking Out JustMarkets

Dubai’s a hub for finance and trading, with a diverse crowd of expats and locals looking to grow their wealth. JustMarkets has caught attention here because of its low-cost trading, tight spreads, and a variety of account types tailored to different skill levels. Plus, it’s got a reputation for being beginner-friendly while still offering tools for pros. But before you jump in, let’s unpack the key features that matter to you.

1. Low Spreads and Fees

One of the biggest draws of JustMarkets is its competitive pricing. The broker offers spreads starting from 0.0 pips on its Pro and Raw Spread accounts, which is a big deal if you’re trading high volumes. For Dubai traders, where every dirham counts, this means more of your profits stay in your pocket. There’s also no commission on most account types, except for the Raw Spread account, which charges a small fee per trade. Compared to other brokers, this is pretty cost-effective.

2. User-Friendly Platforms

JustMarkets supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are industry-standard platforms loved by traders worldwide. Whether you’re analyzing charts on your laptop in Jumeirah or placing trades from your phone in Downtown Dubai, the platforms are intuitive and packed with tools like technical indicators, charting options, and automated trading features. Plus, their mobile app is a lifesaver for traders on the go.

3. Account Types for Everyone

JustMarkets offers four main account types: Standard, Pro, Raw Spread, and Standard Cent. If you’re just starting out in Dubai’s fast-paced trading scene, the Standard Cent account is perfect—it lets you trade smaller lot sizes with minimal risk. For experienced traders, the Raw Spread account offers tighter spreads and faster execution, ideal for scalping or high-frequency trading. This variety makes JustMarkets appealing to both beginners and pros.

4. Regulation and Safety

Safety is a big concern for Dubai traders, especially with the UAE’s strict financial regulations. JustMarkets is regulated by CySEC and the FSA, which adds a layer of trust. They also use segregated accounts to keep your funds separate from the company’s, reducing the risk of loss in case of insolvency. However, keep in mind that the UAE’s regulatory framework, overseen by bodies like the Dubai Financial Services Authority (DFSA), may require you to verify if JustMarkets complies with local standards for your peace of mind.

5. Islamic Accounts

For Muslim traders in Dubai, JustMarkets offers swap-free Islamic accounts that comply with Sharia law. This is a huge plus in the UAE, where a significant portion of the population prefers interest-free trading. You can trade forex and CFDs without worrying about overnight swap fees, making it a tailored option for the local market.

What’s the Catch? The Downsides

No broker is perfect, and JustMarkets has a few quirks you should know about before signing up. Here’s the honest scoop:

· Limited Local Presence: While JustMarkets serves Dubai traders, it doesn’t have a physical office in the UAE. If you prefer face-to-face support, this might be a drawback. That said, their 24/7 customer support via live chat, email, and phone is responsive and multilingual, which helps bridge the gap.

· Educational Resources Could Be Better: If you’re new to trading, JustMarkets’ educational materials are a bit basic. They offer webinars and articles, but compared to some competitors, the content isn’t as in-depth. You might need to supplement your learning elsewhere if you’re starting from scratch.

· Withdrawal Fees: While deposits are free, some withdrawal methods come with fees, depending on the payment option (e.g., bank transfers or e-wallets). This can be a minor annoyance, especially for frequent withdrawals.

✅ Trade with JustMarkets now: Open An Account or Visit Brokers 👈

How Does JustMarkets Stack Up for Dubai Traders?

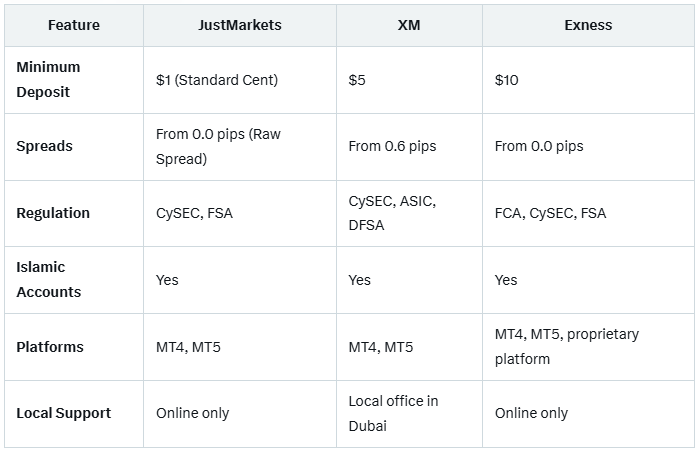

To give you a clearer picture, let’s compare JustMarkets to other popular brokers in Dubai, like XM and Exness, based on key factors:

JustMarkets holds its own with low costs and flexible account types, but if local support is a priority, XM might have an edge with its Dubai office. Exness, on the other hand, offers a proprietary platform, which some traders prefer for its advanced features.

Getting Started with JustMarkets in Dubai

Ready to give JustMarkets a try? Here’s a quick guide to get you started:

1. Sign Up: Head to the JustMarkets website and create an account. The process is straightforward and takes just a few minutes. You’ll need to verify your identity with documents like a passport or Emirates ID, which is standard for regulated brokers.

2. Choose Your Account: Pick an account type that matches your experience level and goals. The Standard Cent account is great for beginners, while the Raw Spread account suits advanced traders.

3. Deposit Funds: JustMarkets accepts various payment methods, including bank cards, e-wallets like Skrill and Neteller, and even cryptocurrencies. The minimum deposit is as low as $1 for the Standard Cent account, making it accessible for Dubai traders on a budget.

4. Start Trading: Download MT4 or MT5, explore the platform, and start placing trades. You can also try a demo account to test strategies risk-free.

Tips for Success with JustMarkets in Dubai

To make the most of JustMarkets, here are some practical tips tailored for Dubai traders:

· Leverage Local Market Insights: Dubai’s economy is tied reopening markets like oil, real estate, and tourism. Keep an eye on these sectors when trading commodities or indices to capitalize on local trends.

· Use Risk Management Tools: JustMarkets offers tools like stop-loss orders and negative balance protection. Use them to protect your capital, especially in volatile markets.

· Stay Updated on Regulations: While JustMarkets is regulated internationally, check if it aligns with UAE regulations or consult a financial advisor to ensure compliance.

· Test with a Demo Account: If you’re new to trading or unsure about JustMarkets, start with a demo account to get a feel for the platform without risking real money.

What Dubai Traders Are Saying

Based on online reviews and feedback from trading communities, Dubai traders appreciate JustMarkets for its low spreads and fast execution. Some users on platforms like Trustpilot praise the broker’s customer support, with one trader noting, “The live chat team resolved my issue in minutes, even at 2 a.m. Dubai time.” However, a few users mention occasional delays in withdrawals, so it’s worth double-checking the terms for your preferred payment method.

Is JustMarkets Right for You?

So, should you choose JustMarkets as your trading platform in Dubai? If you’re looking for a broker with low costs, a variety of account types, and Islamic account options, JustMarkets is a strong contender. It’s especially great for beginners due to its low minimum deposit and user-friendly platforms. However, if you need extensive educational resources or prefer a broker with a local office, you might want to explore other options like XM.

Ultimately, JustMarkets offers a solid balance of affordability, reliability, and flexibility for Dubai traders. Whether you’re trading forex in Deira or crypto in Dubai Marina, it’s worth considering for its competitive edge.

Final Thoughts

JustMarkets is a versatile broker that caters well to Dubai’s diverse trading community. Its low spreads, Islamic accounts, and MT4/MT5 platforms make it a practical choice for both newbies and pros. While it has minor drawbacks, like limited educational content and no local office, the overall package is compelling for traders in the UAE.

✅ Trade with JustMarkets now: Open An Account or Visit Brokers 👈

Read more: