20 minute read

Exness vs IUX Comparison: Which is better?

In the rapidly evolving world of online trading platforms, traders often find themselves in a dilemma when choosing between different options. One such comparison that stands out is the Exness vs IUX Comparison: Which is better? This article delves into various aspects of both platforms, providing an insight that will assist you in making an informed decision based on your trading needs and preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Online Trading Platforms

Online trading platforms have democratized access to financial markets, allowing individuals to trade from the comfort of their homes. The proliferation of these platforms means that investors have a plethora of choices, each offering different features, benefits, and drawbacks. As we dive deeper into our exploration of Exness vs IUX, it’s vital to understand what makes a trading platform reliable and user-friendly.

When comparing platforms, potential traders should consider elements like regulatory compliance, security measures, account types, available trading instruments, costs, leverage options, customer support, educational resources, payment methods, and user feedback. In this extensive comparison, we will analyze how Exness vs IUX stack up against one another across these critical dimensions.

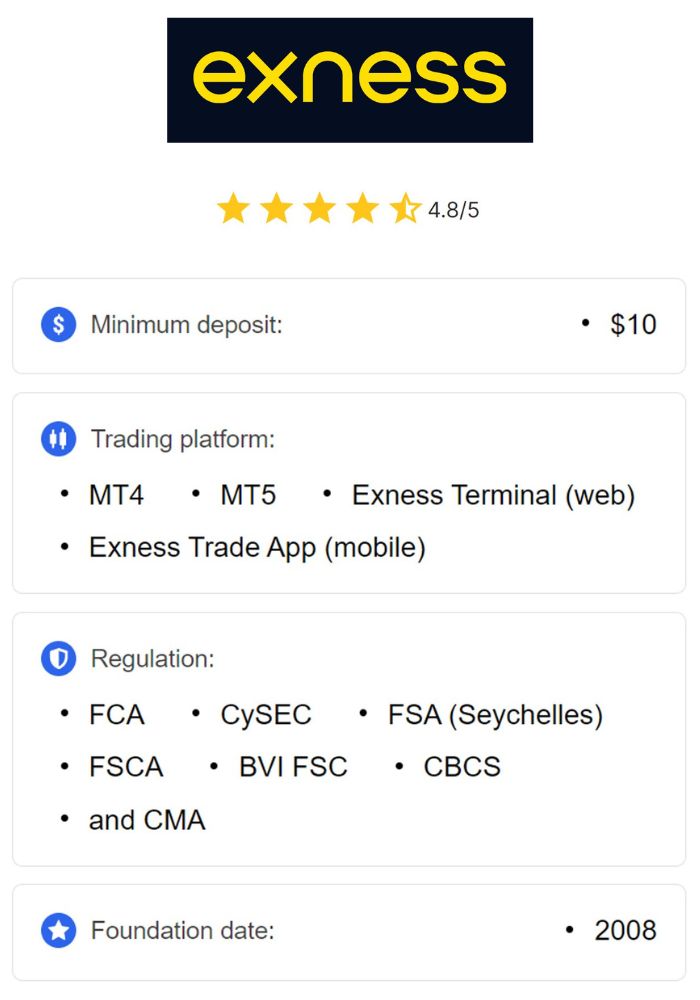

Overview of Exness

Exness has garnered a reputation as one of the leading trading platforms in the forex market since its inception in 2008. The company prides itself on providing traders with easy access to various financial instruments, competitive spreads, and a user-friendly interface. It supports multiple languages and caters to a global audience, which is a significant advantage for non-English speaking traders.

One of the unique selling propositions of Exness is its commitment to transparency and efficiency. Traders can expect an innovative approach to online trading, characterized by real-time market analysis, automated trading options, and comprehensive customer support. Furthermore, Exness offers a variety of account types tailored to suit different trading strategies and risk profiles.

Overview of IUX

IUX, while relatively newer compared to Exness, has made strides in establishing itself in the competitive online trading landscape. Launched with the intent of providing a more streamlined trading experience, IUX aims to cater to both novice and experienced traders alike. The platform emphasizes technological integration, speed in execution, and a diverse range of trading instruments.

What sets IUX apart is its focus on creating an intuitive trading environment that minimizes complexity while maximizing user engagement. IUX boasts an array of educational tools and resources designed to empower traders with knowledge, thus enhancing their trading skills. With a solid foundation and a clear vision, IUX is positioning itself as a serious contender in the realm of online trading.

Regulatory Framework and Security

When engaging in online trading, regulatory adherence and security are non-negotiable factors that prospective users must evaluate. Both Exness vs IUX operate under specific regulations designed to protect traders’ interests; however, the extent of these regulations varies significantly.

Regulation of Exness

Exness operates under notable global regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory frameworks ensure that Exness adheres to strict guidelines regarding transparency, client fund protection, and operational integrity.

Regulation not only builds trust but also guarantees that traders have recourse in case of disputes. For instance, in instances of insolvency, segregated accounts help ensure that traders can retrieve their funds. This level of regulation positions Exness favorably in the eyes of potential users who prioritize safety and reliability.

Regulation of IUX

IUX, on the other hand, is still in the process of securing full regulatory licenses. While it may operate under certain jurisdictions, the absence of stringent regulations can be perceived as a red flag by cautious traders. Nevertheless, IUX promotes its commitment to compliance and transparency, aiming to secure appropriate licenses in due course.

The lack of established regulatory frameworks may create an environment of uncertainty. However, IUX emphasizes internal policies and practices aimed at safeguarding user data and transactions. As the platform matures, obtaining recognized regulatory endorsements will likely enhance its credibility in the marketplace.

Security Measures Implemented by Exness

Security is paramount in the online trading environment, and Exness takes this aspect seriously. The platform employs advanced encryption technologies to safeguard personal and financial information from cyber threats. Additionally, two-factor authentication (2FA) is implemented to add another layer of protection during the login process.

Exness also utilizes secure socket layer (SSL) technology, ensuring that all transmitted data remains confidential. By regularly updating their security protocols to counteract emerging threats, Exness strives to maintain a robust defense against potential breaches. Their proactive stance on security instills confidence in traders, assuring them that their investments are well-guarded.

Security Measures Implemented by IUX

While IUX may not yet boast the same level of regulatory oversight as Exness, it does employ several security measures aimed at protecting user data. Encryption protocols form the backbone of the platform's security strategy, helping prevent unauthorized access to sensitive information.

Moreover, IUX aims to foster a secure trading environment by continuously monitoring for suspicious activities. Regular audits and updates to security infrastructure further bolster their commitment to safeguarding traders' interests. Nonetheless, as a newer player, the establishment of recognized security certifications would significantly enhance their standing in this area.

Account Types Offered

Traders come with varying levels of experience and distinct trading styles. Recognizing this diversity, brokers often offer multiple account types to accommodate the unique needs of different traders. Let’s take a closer look at the account offerings from both Exness vs IUX.

Exness Account Types

Exness provides several types of accounts tailored to different trading preferences. Its major offerings include the Standard and Pro accounts, both of which offer competitive spreads and no commissions. The Standard account is ideal for beginners, as it requires a lower minimum deposit and provides access to essential trading tools.

For more experienced traders, the Pro account includes tighter spreads and quicker execution times, making it suitable for high-frequency trading. Additionally, Exness provides an ECN account option for professional traders looking for direct market access and greater liquidity.

By offering a broad range of accounts, Exness allows traders to choose an option that aligns best with their financial goals, risk tolerance, and trading style, fostering a more personalized trading experience.

IUX Account Types

IUX, though less extensive in its account offerings compared to Exness, provides fundamental accounts aimed at beginner and intermediate traders. The platform typically features a standard account type, with some added premium options for those willing to invest higher capital.

While the account structure may not be as diverse as Exness, IUX strives to simplify the trading experience by focusing on essential features that appeal to new traders. As they continue to evolve, one can expect IUX to develop more nuanced account types catering to varying levels of expertise and investment strategies.

Comparison of Account Features

When contrasting the account types offered by Exness vs IUX, the former clearly emerges as the leader in terms of variety and additional features. Exness’s range of accounts caters to different trader segments and preferences, while IUX’s straightforward offerings emphasize simplicity.

The comprehensive nature of Exness’s accounts ensures that traders can select options suited to their objectives, whether they’re just starting or are seasoned professionals. In contrast, IUX’s limited options may result in a less personalized experience for traders seeking flexibility.

Ultimately, the choice between Exness vs IUX hinges upon individual needs. Experienced traders may gravitate toward Exness for its robust offerings, while beginners might appreciate IUX’s simplified account structures.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Trading Instruments Available

A trading platform's success largely depends on the variety of instruments it offers. Traders tend to prefer platforms that allow them to diversify their portfolios across multiple asset classes. Let's examine the trading instruments available on both Exness vs IUX.

Forex Trading with Exness

Exness excels in forex trading, providing access to over 100 currency pairs, encompassing major, minor, and exotic options. This extensive selection allows traders to capitalize on global economic trends and fluctuations in exchange rates.

The platform’s user-friendly interface coupled with detailed analytics empowers traders to make informed decisions. Moreover, Exness’s low spreads and flexible leverage options make it particularly appealing for forex traders. The broker frequently updates its trading conditions, ensuring competitiveness in the fast-paced forex market.

Forex Trading with IUX

While IUX offers forex trading options, the selection is more limited than what Exness provides. Traders can expect a decent variety of major currency pairs, but the lack of exotic options may deter those looking to diversify their forex exposure.

Nevertheless, IUX places emphasis on ease of use, which can benefit newcomers to forex trading. The platform provides adequate resources to facilitate effective trading decisions, even with a smaller pool of currency pairs. As IUX continues to grow, expanding its forex offerings could significantly enhance its attractiveness.

Commodities, Indices, and Crypto Options

Both Exness vs IUX provide opportunities to trade commodities, indices, and cryptocurrencies, thereby enriching the trading experience. Exness offers a wide range of commodities, including precious metals such as gold and silver, which are often sought after during times of economic uncertainty.

Additionally, Exness features various global indices that enable traders to gain exposure to entire markets without needing to buy individual stocks. On the cryptocurrency front, the broker includes several popular coins, offering traders avenues to participate in this rapidly evolving sector.

Conversely, IUX also provides access to popular commodities and indices; however, its cryptocurrency offerings may be limited compared to Exness. As cryptocurrencies gain traction among traders, IUX might want to expand this segment to capture interest.

In summary, Exness stands out for its extensive variety of trading instruments, allowing traders to diversify their portfolios effectively. IUX, while having a respectable offering, may need to expand its product range to compete with Exness fully.

Trading Platforms and Technology

The effectiveness of a trading platform is heavily influenced by the technology powering it. Users expect fast execution times, intuitive interfaces, and seamless functionality. Here we compare the trading platforms provided by Exness vs IUX.

Exness Trading Platform Features

Exness primarily utilizes the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms—industry standards known for their advanced charting capabilities, analytical tools, and automation features. These platforms allow traders to implement algorithmic trading strategies and utilize expert advisors, which can be especially beneficial for those who wish to optimize their trading performance.

The user interface of MT4 and MT5 is highly customizable, enabling traders to tailor their workspaces according to personal preferences. The platforms also support mobile applications, allowing traders to monitor their positions and execute trades on-the-go.

IUX Trading Platform Features

IUX promotes a proprietary trading platform designed to simplify the trading experience. Focusing on usability and accessibility, the platform features an intuitive layout that appeals to beginners. While it may lack some of the advanced functionalities found in MT4 and MT5, IUX compensates with a user-friendly approach that enhances engagement.

As technology advances, IUX appears committed to incorporating new features and capabilities to its platform. Continued enhancements can lead to a more comprehensive user experience, making it easier for traders to navigate their way through trades effectively.

User Interface and Experience

User experience plays a crucial role in a trader's ability to execute strategies and manage risks. Exness’s integration of MetaTrader significantly boosts the overall user experience, providing traders with a familiar interface packed with powerful tools.

IUX’s proprietary platform, while simplistic and accessible, might not satisfy traders looking for advanced functionalities. However, this could change as IUX invests in developing new features to cater to a wider audience.

In conclusion, while Exness excels in providing a technologically robust platform, IUX's ease of use may attract beginners looking for a straightforward trading experience.

Costs and Fees Comparison

Understanding the costs associated with trading is essential for maintaining profitability. Spreads, commissions, and additional fees can significantly impact a trader’s bottom line. Let’s explore the fee structures offered by Exness vs IUX.

Spread and Commission Structure for Exness

Exness operates on a variable spread model, which means that spreads fluctuate depending on market conditions. For most account types, Exness charges zero commissions on trades, making it an attractive option for cost-conscious traders. However, spreads can widen during periods of high volatility.

The standard spread for currency pairs is competitive, and traders can benefit from tight spreads, especially on the Pro accounts. This structure allows traders to minimize transaction costs, enhancing their potential for profitability.

Spread and Commission Structure for IUX

IUX typically employs a fixed spread structure along with reasonable commission fees. This feature may provide some predictability for traders regarding costs, although it may not always be as competitive as Exness, particularly for high-volume trading.

While fixed spreads can be advantageous during stable market conditions, traders may find that they incur higher costs during volatile periods. IUX aims to balance affordability with consistent pricing, but traders should carefully evaluate their trading strategy before committing.

Additional Fees and Charges

Both Exness vs IUX implement additional fees that traders should be aware of. Exness imposes fees for inactivity if accounts remain dormant for extended periods. This policy is relatively common within the industry and serves as a deterrent against unengaged accounts.

IUX also has its share of fees related to services like withdrawals or deposits, which may vary based on the chosen method. Understanding these ancillary costs is crucial for traders aiming to optimize their trading expenses.

Ultimately, Exness tends to offer more competitive pricing structures, while IUX’s fixed spreads can benefit specific trading styles. Each trader must assess their situation to determine which fee structure aligns with their goals.

Leverage and Margin Requirements

Leverage is a double-edged sword in trading—it can amplify gains but also magnify losses. Therefore, understanding leverage and margin requirements is fundamental for responsible trading.

Leverage Options at Exness

Exness provides leverage options that allow traders to increase their market exposure without needing substantial capital. Depending on the account type, leverage can go as high as 1:2000, supporting aggressive trading strategies. This high degree of leverage can offer opportunities for substantial profits, but it also requires careful risk management.

Exness emphasizes the importance of understanding the risks associated with high leverage, ensuring that traders are equipped to make informed decisions about their trading strategies.

Leverage Options at IUX

IUX generally offers lower leverage compared to Exness, with maximum levels around 1:100 or 1:200. This limitation may be viewed as a positive attribute for beginner traders, as it encourages a more cautious approach to trading.

While reduced leverage may restrict profit potential, it also serves to mitigate risk. IUX’s conservative approach may resonate with traders prioritizing capital preservation over aggressive growth.

Margin Requirements and Calculations

Margin requirements dictate how much capital must be held in a trading account to open a position. Exness typically maintains lower margin requirements, allowing traders to enter trades with relatively less risk. This can be particularly advantageous for high-frequency traders looking to maximize opportunities.

IUX’s margin requirements, while higher, can serve as a form of risk control, particularly for novice traders. Understanding how margin affects trading positions is crucial in assessing both platforms.

In summary, Exness’s high leverage options may attract seasoned traders, while IUX’s more conservative approach could appeal to risk-averse individuals.

Customer Support Services

Quality customer support can significantly influence a trader's overall experience. A responsive support team can help resolve issues quickly, minimizing disruption to trading activities.

Availability of Customer Support for Exness

Exness prides itself on offering robust customer support, available 24/7 through various channels, including live chat, email, and phone. This extensive availability enables traders to seek assistance at any time, enhancing the overall experience.

The support team is multilingual, catering to a global audience. Furthermore, Exness maintains a dedicated FAQ section and educational resources, allowing users to troubleshoot common issues independently.

Availability of Customer Support for IUX

IUX’s customer support is also available around the clock, with various communication channels, including live chat and email. However, responsiveness may vary, as newer platforms sometimes struggle with maintaining high service levels during peak times.

Although IUX provides support in multiple languages, the comprehensiveness of assistance may not match that offered by Exness. To build credibility and trust, IUX would benefit from investing further in customer service infrastructure.

Channels of Communication Offered

Both platforms offer similar channels for reaching customer support, but Exness’s quick response times and thorough assistance stand out. Live chat options enable users to connect instantly, while the inclusion of telephone support adds an extra layer of accessibility.

By ensuring that traders can communicate easily with customer service representatives, both platforms enhance user experiences. However, the overall quality and speed of responses can play a critical role in determining user satisfaction.

In conclusion, while both Exness vs IUX offer reasonable customer support services, Exness’s reputation for responsiveness and quality assistance provides it with a distinct advantage.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Educational Resources and Tools

The availability of educational resources can significantly impact a trader’s ability to succeed. Comprehensive materials can foster skill development and promote informed trading decisions.

Learning Materials Provided by Exness

Exness offers an extensive library of educational resources, including webinars, tutorials, articles, and eBooks. These materials cover various topics, ranging from fundamental trading concepts to advanced strategies, catering to traders of all skill levels.

Furthermore, Exness hosts regular webinars featuring expert traders and analysts, allowing users to engage with thought leaders in the industry. Access to such resources empowers traders to refine their skills and knowledge, ultimately enhancing their trading performance.

Learning Materials Provided by IUX

IUX also recognizes the importance of education and provides basic learning materials to help traders understand the fundamentals. However, the breadth and depth of these resources may not be as extensive as what Exness offers.

The platform does feature educational articles and guides, but traders may find themselves seeking additional resources elsewhere to complement their learning journey. As IUX develops, expanding their educational offerings could establish them as a more significant challenger in the marketplace.

Trading Tools and Analysis Features

Exness incorporates a suite of trading tools, including market analysis reports, economic calendars, and charting software, to help traders make informed decisions. These tools facilitate technical and fundamental analysis, empowering users to identify opportunities within the market.

While IUX may provide basic analysis features, it may need to enhance its tools to compete with Exness effectively. As traders learn and grow, the right tools can become a crucial component of their trading arsenal, making this area a priority for future development.

Overall, Exness stands out for its commitment to education and research, while IUX has room for improvement in this domain.

Payment Methods and Withdrawal Process

Efficient payment methods and withdrawal processes enhance the overall trading experience. Traders want to know that they can deposit and withdraw funds seamlessly and securely.

Deposit Methods for Exness

Exness supports a wide variety of deposit methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. These multiple options cater to traders worldwide, accommodating differing preferences and situations.

Deposits are usually processed quickly, allowing traders to access their funds almost immediately. This level of efficiency contributes positively to the user experience and fosters confidence in the platform.

Deposit Methods for IUX

IUX also offers several deposit options, emphasizing convenience and security. While the selection may not be as extensive as Exness’s, it typically includes credit/debit cards and e-wallets.

Deposit processing times are generally swift, allowing traders to begin their activities promptly. However, the limited options may be a drawback for those seeking alternative funding methods.

Withdrawal Processes and Timeframes

Exness provides transparent withdrawal options, with processing times varying depending on the chosen method. E-wallet withdrawals are often instant, while bank transfers may take several days. Users appreciate the clarity surrounding withdrawal times, enhancing trust in the platform.

IUX’s withdrawal processes are comparably efficient, though specific timeframes may differ based on the chosen method. Clarity regarding withdrawal policies is essential, and IUX should strive to maintain transparency to build credibility.

In summary, both platforms offer reasonable deposit and withdrawal options; however, Exness’s broader variety and efficient processing times give it an edge.

User Reviews and Testimonials

Personal experiences shared by users can provide valuable insights into a trading platform's reliability and quality. Examining user reviews and testimonials reveals patterns in satisfaction and areas for improvement.

Feedback on Exness from Users

Feedback on Exness is predominantly positive, with many users praising its robust features, competitive pricing, and excellent customer support. Traders often highlight the transparency of the platform, which contributes to a sense of security while trading.

However, some users have reported occasional concerns regarding the execution speed during high-volatility periods. Despite these criticisms, the overall sentiment remains favorable as traders appreciate the comprehensive suite of tools and resources available.

Feedback on IUX from Users

Reviews for IUX are mixed, with some users expressing satisfaction regarding the platform’s ease of use and accessibility. New traders often appreciate the straightforward approach and supportive educational materials provided.

However, seasoned traders may find the platform lacking in advanced features and trading instruments. As IUX continues to evolve, addressing these shortcomings could significantly enhance user satisfaction and retention.

Overall User Satisfaction Comparison

When comparing overall user satisfaction, Exness comes out ahead due to its extensive features, competitive pricing, and commendable customer support. While IUX garners positive feedback for its simplicity, it may struggle to meet the expectations of more experienced traders.

To build a loyal user base, IUX should continue refining its offerings, aiming to bridge the gap between novice and advanced trading features.

Pros and Cons of Exness

Every trading platform comes with its advantages and disadvantages. Understanding these trade-offs is essential for traders to align their needs with platform offerings.

Advantages of Using Exness

Extensive range of trading instruments, including various forex pairs, commodities, indices, and cryptocurrencies.

Competitive spread and commission structures that cater to various trading styles.

High leverage options that enable traders to amplify their market exposure.

Robust educational resources and tools to support skill development.

Strong regulatory oversight enhances trust and security for users.

Disadvantages of Using Exness

Some users report occasional execution delays during high-volatility situations.

The numerous features might overwhelm novice traders.

Inactivity fees can be a disadvantage for long-term investors or those taking breaks.

Pros and Cons of IUX

As with Exness, IUX presents its own set of advantages and disadvantages that traders should consider.

Advantages of Using IUX

User-friendly platform designed to cater to beginner traders.

Accessible educational materials that help new traders grasp fundamental concepts.

Responsive customer support available 24/7.

Disadvantages of Using IUX

Limited range of trading instruments compared to more established platforms like Exness.

Lower leverage options may hinder aggressive trading strategies.

Fewer advanced tools and features may not satisfy experienced traders seeking versatility.

Final Thought on Exness vs IUX

Choosing between Exness vs IUX ultimately boils down to individual trading preferences, experience levels, and goals. While Exness offers a comprehensive and competitive trading environment, IUX is carving out a niche for itself by focusing on simplicity and user-centric design.

Which Platform Suits Different Types of Traders?

For beginner traders, IUX may provide an easier entry point into the world of online trading. Its focus on accessibility, along with its basic educational resources, can guide novices through initial learning curves.

Conversely, experienced traders seeking advanced features, a diverse range of instruments, and more competitive pricing will likely find Exness better suited to their needs. The platform's solid reputation and extensive offerings can bolster sophisticated trading approaches.

Summary of Key Comparisons

In summary, Exness leads in terms of regulatory compliance, instrument variety, advanced trading tools, customer support, and educational resources. Meanwhile, IUX focuses on user-friendliness and accessibility, making it a strong contender for beginners.

Conclusion

In the Exness vs IUX Comparison: Which is better?, one can see that both platforms cater to different facets of the trading community. Exness stands out for its comprehensive offerings and robust framework, while IUX appeals to those seeking simplicity and ease of use. Ultimately, the best choice will depend on individual trading goals, experience, and preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

As the online trading landscape continues to evolve, both platforms may adapt and enhance their offerings, making it essential for traders to stay informed and reassess periodically. Whether you lean towards Exness or IUX, investing time in understanding the intricacies of each platform can pay dividends in your trading journey.

Read more: