16 minute read

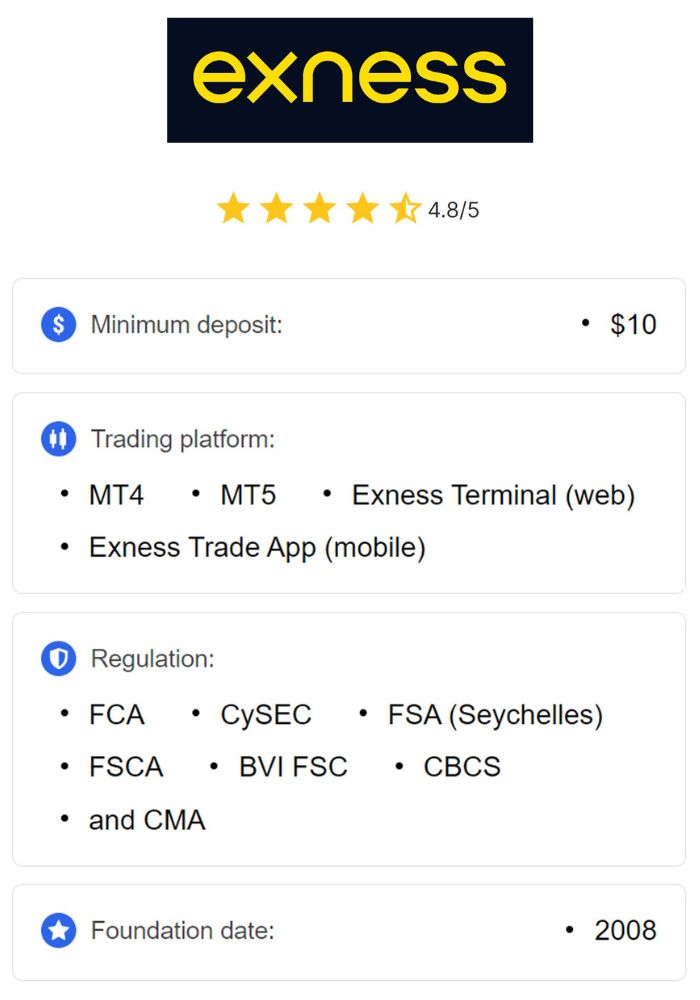

Exness Broker Review India: Is a good broker? Pros and Cons

Exness Broker Review India: Is a good broker? Pros and Cons - When exploring the world of online trading, it's essential to choose a broker that aligns with your needs and goals. In this review, we'll delve into various aspects of Exness, a broker that has gained popularity among Indian traders. From its regulatory status to account offerings and user experiences, we'll analyze if Exness is a good fit for you.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

In the competitive landscape of online trading, Exness stands out as a broker that appeals to both novice and experienced traders alike. Founded in 2008, Exness has quickly garnered a reputation for its user-friendly platform, diverse financial instruments, and comprehensive customer support. With offices spread across various countries, including a significant focus on the Indian market, it's worth investigating what makes Exness a popular choice among traders in India.

Overview of Exness Broker

Exness operates under several licenses, which means it adheres to strict regulatory standards in various jurisdictions. This commitment to regulation ensures that traders can trust the broker with their funds while benefiting from a transparent trading environment. The broker offers a range of trading options, including forex, cryptocurrencies, commodities, and more. By catering to different trader profiles, Exness has earned a loyal customer base.

For Indian traders, Exness presents an attractive proposition. With local payment methods and support services tailored specifically for Indian clients, Exness aims to enhance the trading experience for users in India. Moreover, the availability of educational resources and tools helps empower traders to make informed decisions.

History and Background of Exness in India

Exness entered the Indian market with the objective of providing a reliable and efficient trading platform for local traders. Over the years, the broker has built a reputation for transparency and customer-centric policies. The company not only focuses on offering competitive spreads and commissions but also provides a robust trading infrastructure designed to meet the unique needs of Indian traders.

By establishing a strong presence in India, Exness has developed relationships with local partners and stakeholders, leading to a deeper understanding of the Indian trading landscape. This localized approach has helped Exness tailor its services to better cater to its Indian clientele, ensuring that they receive the support and resources necessary to succeed in their trading endeavors.

Regulation and Licensing

When considering a trading broker, one of the most critical factors to assess is its regulatory status. Regulation plays a vital role in ensuring that the broker operates within legal frameworks, offering traders a level of protection for their funds.

Regulatory Bodies Governing Exness

Exness is regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulators impose stringent rules that brokers must adhere to, such as maintaining adequate capital reserves and providing client protection measures.

Indian traders should be particularly aware of the regulations governing forex trading in India, as the Reserve Bank of India (RBI) has specific guidelines in place. While Exness is not directly regulated by the RBI, its adherence to international regulations can provide a level of assurance to Indian traders.

Importance of Regulation for Indian Traders

Understanding the importance of regulation is crucial for Indian traders when choosing a broker. Regulatory oversight not only protects traders from fraudulent practices but also enhances the overall credibility of the broker. A well-regulated broker ensures that client funds are segregated from operational funds, minimizing the risk of loss in case of financial difficulties.

Moreover, regulatory bodies conduct regular audits and inspections to ensure the broker complies with industry standards. For Indian traders, selecting a broker that adheres to recognized international regulations can offer peace of mind and confidence in their trading experience.

Trading Platforms Offered by Exness

A broker's trading platform is its primary interface, connecting traders to the financial markets. Therefore, the quality and features of the trading platform significantly impact the overall trading experience.

MetaTrader 4 Features and Benefits

One of the most popular platforms offered by Exness is MetaTrader 4 (MT4). Renowned for its user-friendly interface and advanced charting capabilities, MT4 is favored by many traders worldwide. The platform provides access to a wide array of technical analysis tools, enabling traders to make informed decisions based on real-time data.

MT4 also supports automated trading through Expert Advisors (EAs), allowing traders to set up algorithms that execute trades on their behalf. This feature is especially beneficial for traders who prefer a hands-off approach or wish to capitalize on market opportunities even when they're away from the screens.

MetaTrader 5 Advantages for Users

In addition to MT4, Exness offers MetaTrader 5 (MT5), which includes several enhancements over its predecessor. MT5 is designed for multi-asset trading, incorporating additional financial instruments such as stocks and futures. The platform's improved analytical tools, including depth of market and economic calendar features, equip traders with valuable insights.

MT5 also supports more order types and allows for advanced algorithmic trading capabilities. Traders looking for a more sophisticated platform may find MT5 aligns better with their trading strategies and preferences.

Mobile Trading Capabilities

In today's fast-paced world, mobile trading has become a necessity for many traders. Exness recognizes this trend and provides robust mobile applications for both MT4 and MT5. These apps allow traders to access their accounts, monitor market movements, and execute trades on-the-go.

The mobile platforms maintain the core functionality of their desktop counterparts while offering an intuitive design. With push notifications and real-time updates, traders can stay informed about market developments, ensuring they never miss an opportunity.

Account Types Available

To cater to a diverse range of traders, Exness offers several account types, each designed to meet specific trading needs.

Standard Account Overview

The Standard Account is ideal for beginners and retail traders. It features low minimum deposit requirements and provides access to a variety of trading instruments. This account type offers fixed spreads, making it easier for traders to calculate potential profits and losses without worrying about fluctuating costs.

Additionally, the Standard Account allows for micro-lots, which enables traders to manage risks effectively while practicing their strategies. Overall, this account type serves as an excellent starting point for those new to the trading world.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pro Account Details

For more experienced traders seeking tighter spreads and advanced trading conditions, the Pro Account is an attractive option. This account type typically comes with variable spreads and the ability to trade larger positions. The Pro Account is suited for scalpers and high-frequency traders who prioritize speed and efficiency in their execution.

Furthermore, this account type often allows for higher leverage, enabling traders to amplify their positions. However, it’s essential to note that while higher leverage can increase potential profits, it also elevates risk levels.

Cent Account for Beginners

Exness also offers a Cent Account, which is particularly advantageous for novice traders. This account type allows users to trade in cents rather than standard units, making it a low-risk option for those who want to practice and refine their trading skills without risking significant capital.

The Cent Account is perfect for traders who are cautious and prefer to start small. It offers access to the same trading instruments as other account types, allowing traders to gain valuable experience while minimizing their exposure to potential losses.

Deposit and Withdrawal Methods

An important consideration for any trader is how easy it is to deposit and withdraw funds. Exness offers a range of payment methods tailored to the Indian market.

Supported Payment Methods in India

Exness supports various payment methods suitable for Indian traders, including bank transfers, e-wallets like Neteller and Skrill, and local payment options such as UPI and Paytm. This versatility ensures that traders have flexibility in managing their funds, whether they are transferring money into or out of their trading accounts.

The availability of local payment methods simplifies the transaction process and reduces the friction associated with currency conversion, making it easier for Indian traders to engage with the financial markets.

Deposit and Withdrawal Processing Times

Speed of transactions is another crucial aspect for traders. Exness prides itself on offering rapid processing times for both deposits and withdrawals. Most transactions are processed instantly, allowing traders to take advantage of market opportunities without delays. However, methods such as bank transfers may take longer to complete due to the banking system's processes.

It's important for traders to familiarize themselves with the specific processing times associated with their chosen payment methods to ensure timely fund availability.

Fees Associated with Transactions

While Exness strives to keep fees minimal, traders should remain vigilant about potential transaction costs. Most deposit methods are fee-free, but certain withdrawal methods may incur charges. Additionally, depending on the currency, there may be conversion fees.

Understanding the fee structure associated with each payment method is crucial for effective portfolio management, as these costs can impact overall profitability.

Spreads and Commissions

Understanding a broker's spread and commission structures is vital for determining trading costs and potential profitability.

Comparison of Spreads Across Account Types

Exness offers competitive spreads across its various account types, catering to different trading styles. The Standard Account features fixed spreads that provide predictability in trading costs, while the Pro Account offers tighter, variable spreads conducive to day traders and scalpers who demand lower trading costs.

Traders should compare spreads carefully, considering their trading strategies and frequency of trades. Even minor differences in spreads can significantly impact overall profitability, especially for high-volume traders.

Understanding Commission Structures

In addition to spreads, traders should be aware of the commission structures applicable to different account types. The Pro Account typically incurs a commission fee per trade, while the Standard and Cent Accounts operate on a no-commission basis.

Understanding the commission dynamics will help traders choose the right account based on their trading volume and style. High-frequency traders might benefit more from an account with lower spreads and reasonable commission rates.

Impact on Trading Profitability

Ultimately, the interplay between spreads and commissions significantly affects trading profitability. Traders must evaluate how these costs align with their strategies and risk tolerance to make informed decisions. Comprehensive analysis of potential costs will lead to enhanced trading outcomes and more successful trading endeavors.

Leverage Options

Leverage is one of the most powerful tools available to traders, allowing them to control larger positions with smaller investments.

Leverage Explained for Indian Traders

Exness offers varying leverage levels based on the account type, ranging from 1:1 to 1:2000. This flexibility enables traders to customize their trading strategy based on their risk appetite and market perspective.

Leverage can dramatically amplify potential profits, but it requires careful consideration. For Indian traders, understanding how leverage works and its implications on margin requirements is essential for responsible trading practices.

Risks and Benefits of High Leverage

While high leverage presents opportunities for greater returns, it also carries inherent risks. The potential for significant losses can increase alongside profits, making it essential for traders to implement solid risk management strategies.

Educational resources provided by Exness can help traders understand leverage and its implications in depth, promoting better decision-making regarding its use in their trading strategies.

Customer Support Services

Robust customer support is a hallmark of a reputable broker, and Exness places great emphasis on helping its traders succeed.

Availability of Multilingual Support

Recognizing the diversity of its clientele, Exness provides multilingual customer support to cater to traders from various regions, including India. This accessibility ensures that traders feel understood and supported in their native language, fostering a positive trading experience.

Multilingual support is particularly beneficial for Indian traders, as it eliminates communication barriers that might hinder their ability to seek assistance and resolve issues promptly.

Contact Channels Provided (Chat, Email, Phone)

Exness offers multiple contact channels for customer support, including live chat, email, and phone support. The live chat feature is especially advantageous for traders seeking immediate assistance, enabling them to connect with support representatives in real time.

Additionally, the availability of email and telephone support provides alternatives for traders who prefer more traditional forms of communication. These varied contact channels help create a comprehensive support system for traders at all levels.

Response Time and Quality of Service

The response time and quality of service provided by a broker's support team greatly influence the customer experience. Exness has received praise for its prompt responses and knowledgeable support staff. Traders can expect quick resolutions to their inquiries, enabling them to focus on their trading activities without unnecessary interruptions.

Overall, the commitment to quality customer support reflects Exness's dedication to fostering long-term relationships with its traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Educational Resources and Tools

Education is a fundamental component of successful trading, and Exness recognizes the need to equip its traders with knowledge and skills.

Webinars and Online Courses

Exness provides a range of educational resources, including webinars and online courses, covering a variety of topics relevant to both novice and experienced traders. These educational sessions allow traders to expand their knowledge and stay updated on market trends and developments.

Webinars often feature industry experts sharing insights and strategies, creating valuable opportunities for traders to learn from seasoned professionals. The convenience of online courses allows individuals to learn at their own pace, enhancing their trading skills.

Trading Analysis Tools and Market Insights

To aid traders in making informed decisions, Exness offers a suite of trading analysis tools and market insights. These resources include technical indicators, economic calendars, and market news updates that help traders gauge market conditions and identify potential trading opportunities.

Traders equipped with comprehensive analysis tools are better positioned to execute successful trades and adapt their strategies as market dynamics evolve.

Demo Accounts for Practice

Exness provides demo accounts that allow traders to practice their strategies in a risk-free environment. This feature is particularly beneficial for beginners who want to familiarize themselves with the trading platform and test their trading plans without using real capital.

Demo accounts enable users to gain valuable experience, build confidence, and refine their skills before transitioning to live trading. The availability of this resource underscores Exness's commitment to supporting traders' growth and development.

Pros of Trading with Exness

Like any broker, Exness has its strengths that appeal to a broad spectrum of traders.

Low Minimum Deposit Requirements

One of the standout features of Exness is its low minimum deposit requirement, making it accessible for traders with varying budgets. The affordable entry point encourages individuals to explore the world of trading without significant financial commitments.

This flexibility is especially appealing to beginner traders who may be hesitant to invest large sums initially. By lowering the barrier to entry, Exness promotes inclusivity in the trading community.

Wide Range of Financial Instruments

Exness offers a diverse selection of financial instruments, including forex pairs, cryptocurrencies, commodities, and indices. This extensive range allows traders to diversify their portfolios and tailor their trading strategies based on market conditions.

Having access to multiple asset classes can enhance trading opportunities, enabling traders to adapt to changing market dynamics and optimize their results.

Flexible Trading Conditions

Exness provides flexible trading conditions, including variable leverage options and different account types to suit traders’ preferences. This adaptability fosters a trading environment where individuals can customize their experiences according to their strategies and risk tolerance.

Whether a trader prefers a conservative approach or seeks to maximize potential returns, Exness caters to various trading styles, empowering clients to pursue their objectives effectively.

Cons of Trading with Exness

Despite its numerous advantages, Exness has some limitations that traders should consider before opening an account.

Limited Local Presence in India

While Exness operates globally, its physical presence in India is limited. This lack of local offices can sometimes lead to challenges in building personal relationships and accessing on-the-ground support. Indian traders may prefer brokers with a more established local presence, especially when facing critical issues.

Additionally, limited local representation may affect the broker's ability to fully understand and cater to the unique needs of Indian traders.

Mixed Reviews on User Experience

User experiences with Exness can vary, with some traders expressing concerns about specific aspects of the trading platform. Mixed reviews can stem from factors such as execution speed, ease of use, and connectivity issues. While many positive testimonials exist, potential clients should approach the broker with caution and conduct thorough research before committing.

Understanding the nuances of user experiences can help traders develop realistic expectations before engaging with Exness.

Potential Regulatory Concerns

Although Exness is regulated by reputable authorities, potential regulatory concerns can arise in certain markets. Indian traders must navigate the complexities of forex regulations imposed by the RBI, which could introduce uncertainties when working with brokers that are not directly regulated by local authorities.

Being aware of the regulatory landscape is essential for traders seeking to protect their interests and ensure compliance.

User Experiences and Testimonials

Feedback from existing users provides valuable insights into the key strengths and weaknesses of Exness.

Positive Feedback from Indian Traders

Many Indian traders commend Exness for its user-friendly platform, competitive spreads, and responsive customer support. The broker's commitment to providing educational resources has also received praise, with traders highlighting the usefulness of webinars and demo accounts in developing their skills.

Positive testimonials reflect the broker's efforts to create a supportive trading environment, which resonates well with traders looking for comprehensive guidance and assistance.

Common Complaints and Issues Raised

While numerous traders express satisfaction with Exness, some common complaints include issues related to slippage during volatile market conditions and delays in withdrawals. Although these experiences may not represent the majority, they highlight areas where the broker may need to improve.

Addressing customer feedback is vital for any broker, and Exness would benefit from implementing changes to enhance user experience further and minimize areas of concern.

Overall Assessment of Exness Broker

After reviewing various aspects of Exness, it's essential to evaluate the broker's position in comparison to others in the market.

Comparative Analysis with Other Brokers

In comparison to other brokers operating in India, Exness holds its ground, thanks to its low minimum deposit, diverse instrument offerings, and user-friendly trading platforms. While some competitors may excel in specific areas, such as localized support or unique product offerings, Exness provides a well-rounded experience for traders seeking flexibility and value.

Carefully comparing offerings among brokers will help traders determine the best fit for their individual trading styles and preferences.

Suitability for Different Trader Profiles

Exness is suitable for various trader profiles, from novices looking to learn the ropes to experienced traders aiming for higher profits. The flexibility in account types and trading conditions makes it possible for traders to customize their approaches as they grow and evolve.

By catering to diverse needs, Exness can accommodate a wide range of trading strategies, fostering an inclusive environment that appeals to a broad audience.

Conclusion

In conclusion, the Exness Broker Review India: Is a good broker? Pros and Cons reveals that Exness offers a compelling package for Indian traders. With its low minimum deposit, competitive spreads, and extensive educational resources, Exness stands out as a viable option for anyone interested in the financial markets.

However, prospective clients should weigh the pros against the cons, keeping in mind factors such as regulatory considerations and mixed user experiences. Ultimately, conducting thorough research and understanding personal trading goals will enable traders to make informed decisions. Whether you’re a beginner or an experienced trader, Exness presents an opportunity worth considering in your trading journey.

Read more: