13 minute read

Is Exness Allowed in Pakistan? Review Broker 2025

Introduction to Exness

Overview of Exness as a Trading Platform

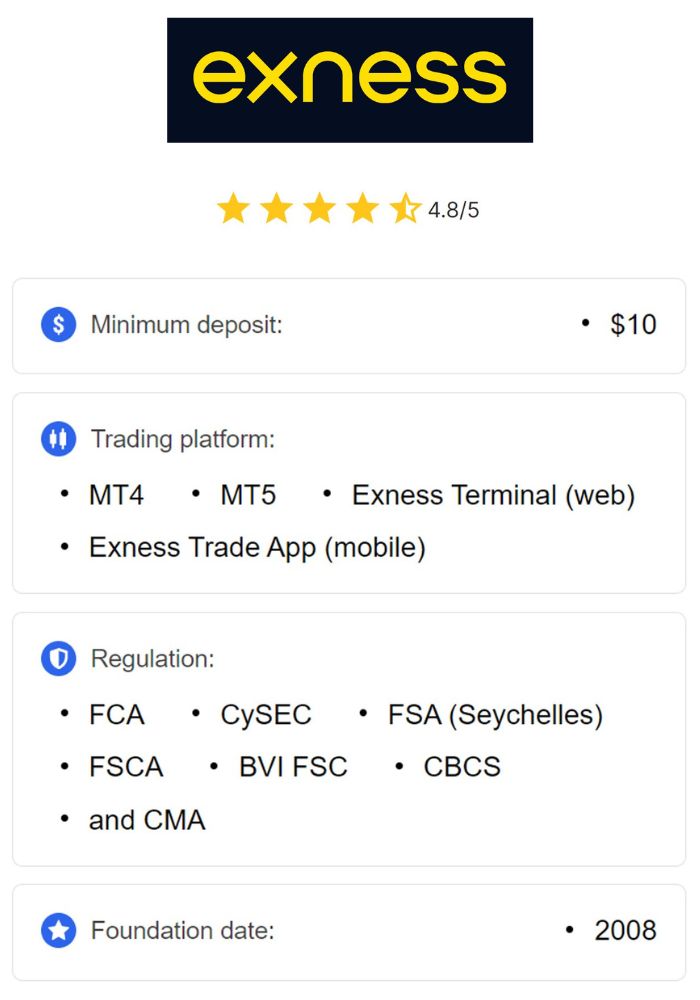

Exness is a global online forex and trading platform that allows individuals to trade financial instruments such as foreign currencies, commodities, indices, and stocks. Founded in 2008, Exness has quickly gained recognition as one of the leading online brokers due to its wide range of trading options, competitive pricing, and transparency in its operations. Exness operates in over 190 countries and serves thousands of clients from around the world.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

One of the main attractions of Exness is its robust trading platforms, which include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are industry-standard platforms used by traders globally. Additionally, Exness offers a range of account types that cater to the needs of different kinds of traders, whether beginner or professional. It has also established a reputation for providing clients with fast execution times, low spreads, and high leverage options.

Exness has become a trusted name in the online trading community, known for its excellent customer support, transparency, and user-friendly interface. Its ability to offer competitive spreads and high leverage options, combined with its strong commitment to customer service, has made it a popular choice among traders in many countries, including Pakistan.

Key Features of Exness

Exness has several standout features that make it an attractive platform for traders around the world. Some of its key features include:

Low Spreads and High Leverage: One of the major selling points of Exness is its low spreads, which make it an attractive option for traders looking to minimize trading costs. It also offers high leverage options, allowing traders to maximize their trading potential and increase their position sizes with a relatively smaller capital investment.

Multiple Account Types: Exness offers a variety of account types that cater to different types of traders. Whether you're a beginner, intermediate, or advanced trader, Exness has an account option that suits your needs. Each account type comes with its own set of features, such as different minimum deposit amounts, spreads, and access to specific trading tools.

User-Friendly Platforms: Exness provides traders with access to some of the most popular trading platforms in the industry, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms offer advanced charting tools, technical analysis, automated trading, and other features designed to enhance the trading experience.

24/7 Customer Support: Exness offers multilingual customer support that operates 24/7 to assist traders with any issues or inquiries. Whether through live chat, email, or phone support, Exness ensures that traders are always able to get the help they need.

Global Accessibility: Exness is available in over 190 countries and provides trading services in multiple languages, allowing traders from different regions to access the platform and trade in their preferred language.

Regulatory Landscape in Pakistan

Overview of Financial Regulation in Pakistan

The financial market in Pakistan is governed by various regulatory bodies designed to ensure the integrity and stability of the financial system. The primary financial regulatory authority in Pakistan is the Securities and Exchange Commission of Pakistan (SECP), which oversees the capital markets, stock exchanges, and other financial institutions. However, when it comes to forex trading, the regulatory landscape is more complex.

While the SECP plays a significant role in regulating the stock market, there is no direct regulatory oversight over the forex market in Pakistan. This leaves room for foreign brokers, such as Exness, to operate in the country without being subject to local financial regulations. As a result, Pakistani traders who wish to engage in forex trading often look to international brokers like Exness.

Additionally, Pakistan's State Bank of Pakistan (SBP) plays a role in managing the country’s foreign exchange policies. However, while the SBP imposes certain restrictions on currency exchange and cross-border transactions, it does not directly regulate online forex brokers such as Exness.

Role of the Securities and Exchange Commission of Pakistan (SECP)

The SECP is the key regulatory body responsible for overseeing the capital markets and ensuring investor protection in Pakistan. It primarily regulates the securities market, including activities related to stocks, bonds, mutual funds, and corporate governance.

However, when it comes to forex trading, the SECP has not yet established a specific regulatory framework to govern the operation of forex brokers. As a result, forex brokers like Exness are not required to obtain a license or approval from the SECP to operate in Pakistan. This has led to concerns about the lack of regulatory protection for local traders engaging in forex trading with international brokers.

Despite the absence of a dedicated regulatory framework for forex trading, the SECP has expressed interest in creating regulations to bring more oversight to the market. While this is a positive development, the lack of local regulatory oversight means that traders who choose to use Exness must rely on the regulatory bodies in other countries where Exness is licensed and operates.

Exness Licensing and Regulations

Global Operating Licenses of Exness

Exness operates under the regulation of several reputable global financial authorities, which helps ensure that the broker adheres to strict operational standards. Some of the key regulatory bodies that license Exness include:

Financial Conduct Authority (FCA) - Exness is regulated by the FCA in the UK, one of the most respected financial regulators globally. The FCA ensures that Exness operates in a manner that is transparent, fair, and compliant with high standards of financial conduct.

Cyprus Securities and Exchange Commission (CySEC) - Exness is also licensed by CySEC in Cyprus, which is another well-regarded regulatory authority in the European Union. This license allows Exness to offer its services to clients in EU member states.

Financial Services Commission (FSC) - In Mauritius, Exness holds a license from the FSC, which oversees financial services in the region and ensures that the broker complies with international financial standards.

Other Regulatory Bodies - Exness is also regulated in various other jurisdictions around the world, which helps enhance its credibility and attract traders from different regions.

These global licenses provide a level of confidence for traders who wish to use Exness, even though the broker is not licensed by the SECP in Pakistan. Exness operates in compliance with strict financial regulations and adheres to guidelines that protect investors.

Comparison with Other Brokers in the Region

Exness is often compared to other forex brokers operating in the region, especially those that are regulated in countries with similar financial regulatory frameworks. Many brokers operating in Pakistan are either local or licensed in other jurisdictions, and they offer a range of services similar to Exness.

For example, brokers licensed by SECP may offer limited leverage, higher spreads, and fewer account options compared to Exness. Exness, on the other hand, offers more competitive trading conditions, including low spreads, higher leverage, and a wider range of trading instruments.

However, the primary disadvantage of using Exness is the lack of direct regulatory oversight by Pakistani authorities. Local brokers that are licensed by SECP may offer more legal protection for Pakistani traders but may not provide the same level of flexibility, advanced trading tools, and global market access that Exness does.

Availability of Exness in Pakistan

Accessibility for Pakistani Traders

Despite not being directly regulated by Pakistan's financial authorities, Exness is fully accessible to Pakistani traders. The platform operates internationally, and Pakistani traders can easily register an account, deposit funds, and start trading on Exness without any specific legal restrictions. The platform allows users to trade a variety of instruments, including forex pairs, commodities, and indices, making it an appealing option for traders in Pakistan.

Since Exness operates globally, traders from Pakistan can access its services without any regional barriers. However, traders must be aware of the risks involved when trading with an unregulated broker in the absence of local financial oversight.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Supported Languages and Customer Support

Exness offers customer support in multiple languages, including Urdu and English, which makes it an accessible platform for Pakistani traders. The support team is available 24/7, and traders can contact Exness through various communication channels, such as live chat, email, and phone. This ensures that Pakistani traders can receive assistance whenever they encounter issues or have questions about the platform.

Additionally, Exness provides educational resources in multiple languages, which can help Pakistani traders better understand the complexities of online trading and make informed decisions.

Benefits of Trading with Exness

Flexible Trading Conditions

Exness is known for offering flexible trading conditions, which is one of its key attractions. Traders can choose from different account types, including Standard and Professional accounts, each tailored to suit varying levels of experience and capital. This flexibility allows traders to select an account type that best matches their trading style and risk tolerance.

Exness also offers competitive spreads, low commissions, and high leverage options, making it an appealing choice for those looking to maximize their trading potential. The ability to trade with high leverage allows traders to control larger positions with smaller capital investments, potentially increasing profits.

Variety of Trading Instruments Offered

Exness offers a wide range of financial instruments, including currency pairs, stocks, commodities, indices, and cryptocurrencies. This variety gives traders the ability to diversify their trading portfolios and take advantage of different market opportunities.

By providing access to global markets, Exness allows Pakistani traders to trade instruments that are not always available through local brokers. This broader selection of assets gives traders more options for creating diversified trading strategies and seeking profit in various markets.

Risks Associated with Trading on Exness

Market Volatility and Risk Management

One of the primary risks associated with trading on Exness, or any online trading platform, is market volatility. The forex market can experience significant fluctuations, and these price movements can result in substantial profits or losses. Traders must use proper risk management strategies, such as setting stop losses, taking profits, and using appropriate leverage, to protect their capital.

Exness offers a variety of risk management tools, including automated trading features and risk calculators, to help traders mitigate risk. However, due to the volatile nature of the markets, trading remains inherently risky.

Legal Implications of Trading Without Local Regulation

Another risk associated with trading on Exness is the lack of direct regulatory oversight by Pakistani authorities. While Exness is licensed in multiple countries, it is not regulated by the SECP in Pakistan. This means that Pakistani traders do not have the same level of legal protection they might have if they were trading with a local broker licensed by the SECP.

If issues arise, such as disputes over trade execution, withdrawal problems, or account issues, Pakistani traders may find it difficult to seek recourse through local regulatory bodies. However, Exness does offer a reliable dispute resolution system and strong customer support to handle such concerns.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Alternative Options for Pakistani Traders

Local Brokers and Their Offerings

Pakistani traders who are concerned about trading with an unregulated broker like Exness can consider local brokers licensed by the SECP. These brokers are subject to Pakistani regulations and offer services that align with the country’s financial laws.

However, the drawback of local brokers is that they may offer fewer trading instruments and less competitive conditions compared to Exness. While local brokers may provide greater legal protection, they typically do not offer the same level of flexibility, leverage, or global market access.

International Brokers Available in Pakistan

In addition to Exness, there are other international brokers that Pakistani traders can use. Some of these brokers are licensed in reputable jurisdictions and offer competitive trading conditions, including low spreads, high leverage, and access to various trading instruments.

Traders must carefully evaluate the licensing, fees, and reputation of these brokers before making a decision.

Opening an Exness Account from Pakistan

Step-by-Step Guide to Account Registration

Opening an Exness account from Pakistan is a straightforward process. Here’s a step-by-step guide:

Visit the Exness website and click on the “Sign Up” or “Open Account” button.

Provide your personal information, including your name, email, and contact details.

Choose your preferred account type (Standard, Professional, etc.).

Complete the verification process by uploading the required documents (ID proof, address proof).

Deposit funds into your account using one of the supported payment methods.

Once your account is set up, you can start trading on Exness by downloading the MetaTrader platform or using the web-based terminal.

Required Documentation for Account Setup

To open an Exness account, Pakistani traders will need to provide the following documents:

A valid government-issued ID (passport or national ID card).

Proof of address (a utility bill or bank statement dated within the last three months).

These documents are necessary to verify the trader's identity and comply with anti-money laundering (AML) regulations.

Deposit and Withdrawal Methods

Payment Options Available for Pakistani Traders

Exness offers a variety of payment options for Pakistani traders to deposit and withdraw funds. These options include:

Bank transfers (local and international)

E-wallets (Skrill, Neteller, etc.)

Credit/debit cards

Each payment method has its own processing times and fees, so traders should select the method that suits their preferences.

Processing Times and Fees

Deposits with Exness are typically processed instantly for most payment methods, while withdrawals can take anywhere from a few hours to a few business days, depending on the method used.

Exness does not charge deposit fees, but withdrawal fees may apply depending on the chosen payment method.

User Experience and Feedback

Reviews from Pakistani Traders

Reviews from Pakistani traders about Exness are generally positive, with many praising the platform's ease of use, customer support, and competitive trading conditions. Traders often highlight the low spreads and high leverage options as key benefits of using Exness.

Common Issues Faced by Users

Some users have reported issues related to withdrawal processing times and the lack of local regulation. However, Exness is generally responsive to these concerns and works to resolve issues in a timely manner.

Conclusion

In conclusion, while Exness is not directly regulated by the Securities and Exchange Commission of Pakistan (SECP), it is a globally recognized broker with multiple licenses from reputable financial authorities. Pakistani traders can access Exness’s platform and enjoy its competitive trading conditions, but they must also be aware of the risks involved, particularly due to the lack of local regulatory oversight.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Traders in Pakistan should weigh the benefits of trading with an internationally regulated broker like Exness against the potential legal risks of trading without local regulation. For those seeking alternative options, local brokers licensed by the SECP may provide more legal protection but at the cost of fewer trading options and less competitive conditions.

Ultimately, the decision to trade with Exness or other brokers depends on the trader's preferences, risk tolerance, and investment goals.