10 minute read

Is Exness Available in Pakistan? Review Broker 2025

The global financial landscape has been significantly transformed by the advent of online trading platforms, providing individuals worldwide with unprecedented access to financial markets. Among these platforms, Exness has emerged as a prominent player, renowned for its user-friendly interface, competitive trading conditions, and robust regulatory framework. For traders in Pakistan, the question often arises: Is Exness available in Pakistan? This comprehensive guide aims to provide a detailed understanding of Exness's availability, legality, and suitability for Pakistani traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

1. Understanding Exness: An Overview

a. What is Exness?

Exness is an international online broker that offers a wide range of trading instruments, including forex, commodities, indices, cryptocurrencies, and CFDs (Contracts for Difference). Established in 2008, Exness has grown to become one of the most trusted names in the online trading industry, serving millions of clients across the globe.

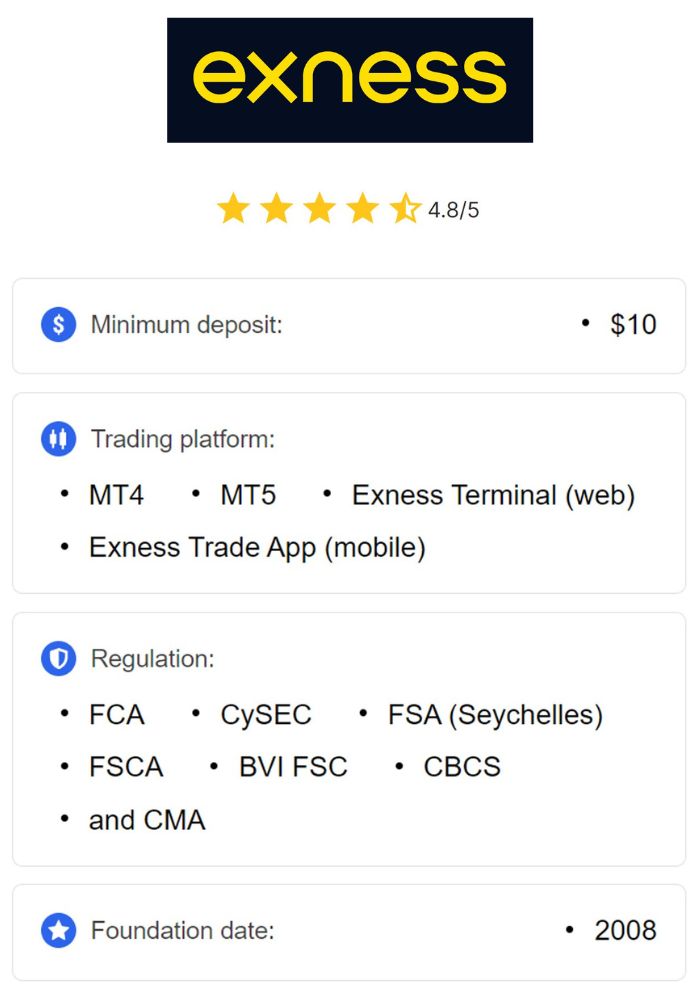

b. Regulatory Framework

Exness operates under a stringent regulatory framework, ensuring the safety and security of its clients' funds. The broker is regulated by several top-tier financial authorities, including:

Financial Conduct Authority (FCA) - UK: One of the most respected regulatory bodies globally, ensuring high standards of financial conduct.

Cyprus Securities and Exchange Commission (CySEC): Provides oversight for financial services in Cyprus, ensuring compliance with EU regulations.

Seychelles Financial Services Authority (FSA): Regulates financial services in Seychelles, ensuring transparency and fairness.

These regulations require Exness to adhere to strict operational standards, including client fund segregation, regular audits, and adherence to anti-money laundering (AML) policies.

c. Trading Platforms and Tools

Exness offers access to industry-standard trading platforms, namely MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms provide advanced charting tools, automated trading capabilities through Expert Advisors (EAs), and a wide range of technical indicators. Additionally, Exness offers its proprietary platform, Exness Web Terminal, which is accessible directly through web browsers without the need for downloads.

2. Regulatory Landscape for Online Trading in Pakistan

a. Overview of Pakistan's Financial Regulatory Bodies

Pakistan's financial markets are primarily regulated by two key institutions:

Securities and Exchange Commission of Pakistan (SECP): Oversees the securities market, including stock exchanges and brokers, ensuring compliance with financial regulations.

State Bank of Pakistan (SBP): Acts as the central bank, regulating the banking sector and overseeing foreign exchange transactions.

b. Forex Trading Regulations

Forex trading in Pakistan is subject to strict regulations under the Foreign Exchange Regulation Act (FERA) and guidelines issued by the SBP. Key points include:

Authorized Dealers: Forex transactions must be conducted through SBP-authorized banks and financial institutions.

Prohibition of Unauthorized Trading: Engaging in forex trading through unauthorized brokers or platforms is prohibited and can lead to legal consequences.

Purpose of Transactions: Forex trading is permitted for legitimate purposes such as hedging and investment, not for speculative trading.

c. Legal Implications for Using Offshore Brokers

While Pakistan allows forex trading, it emphasizes that such activities should be conducted through authorized channels. Using offshore brokers like Exness, which are not directly regulated by Pakistani authorities, operates in a legal gray area. However, as long as traders comply with SBP guidelines, including reporting earnings and adhering to tax obligations, using reputable offshore brokers is generally tolerated.

3. Is Exness Available in Pakistan?

a. Accessibility of Exness for Pakistani Traders

Yes, Exness is available in Pakistan, and Pakistani traders can open and operate accounts with Exness. The broker's global reach ensures that individuals from Pakistan can access its services, provided they meet the necessary requirements and adhere to local regulations.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

b. Opening an Account with Exness in Pakistan

The process of opening an account with Exness from Pakistan is straightforward:

Visit the Exness Website: Navigate to Exness's official website.

Choose Account Type: Exness offers various account types, including Standard, Raw Spread, and Zero accounts. Traders can select the one that best suits their trading style.

Complete Registration: Provide personal details such as name, email, phone number, and country of residence.

Verify Identity: Submit necessary documents for KYC (Know Your Customer) compliance, including a government-issued ID and proof of address.

Deposit Funds: Fund the account using approved payment methods, such as bank transfers, credit/debit cards, or online payment systems.

c. Payment Methods Available to Pakistani Traders

Exness supports multiple payment methods, making it convenient for Pakistani traders to deposit and withdraw funds. Common options include:

Bank Transfers: Direct transfers from Pakistani banks.

Credit/Debit Cards: Visa and MasterCard are widely accepted.

Online Payment Systems: Services like Skrill, Neteller, and WebMoney.

Cryptocurrencies: For traders preferring digital currencies.

d. Currency Support

Exness allows trading in various currencies, including Pakistani Rupees (PKR), facilitating seamless transactions for local traders.

4. Regulatory Compliance and Legal Considerations

a. Adherence to Pakistani Regulations

While Exness operates under international regulations, Pakistani traders must ensure that their trading activities comply with local laws:

Authorized Trading: Conduct trading through SBP-authorized channels.

Tax Compliance: Declare earnings from forex trading in annual tax filings.

Purpose of Trading: Ensure that trading is for legitimate purposes and not speculative or related to illicit activities.

b. Risks of Using Offshore Brokers

Using offshore brokers like Exness carries inherent risks, including:

Regulatory Oversight: Limited direct oversight by Pakistani authorities.

Legal Protections: Less legal recourse in case of disputes compared to domestic brokers.

Compliance Requirements: Responsibility falls on the trader to adhere to local laws and reporting requirements.

c. Mitigating Legal Risks

To mitigate potential legal risks, Pakistani traders should:

Choose Regulated Brokers: Prefer brokers regulated by reputable authorities.

Stay Informed: Keep abreast of changes in Pakistani financial regulations.

Consult Professionals: Seek advice from financial and legal experts regarding forex trading.

5. Advantages of Using Exness in Pakistan

a. Competitive Trading Conditions

Exness offers some of the most competitive trading conditions in the industry, including:

Low Spreads: Tight spreads minimize trading costs.

High Leverage: Up to 1:2000 leverage allows traders to maximize their positions.

Fast Execution: Quick order execution reduces slippage and enhances trading efficiency.

b. Diverse Range of Instruments

Traders in Pakistan can access a wide array of trading instruments on Exness, including:

Forex: Over 70 currency pairs, including major, minor, and exotic pairs.

Commodities: Gold, silver, oil, and other precious metals.

Indices: Major global indices like the S&P 500, NASDAQ, and FTSE 100.

Cryptocurrencies: Bitcoin, Ethereum, Ripple, and more.

CFDs: Contracts for Difference on various assets, allowing speculative trading on price movements.

c. Advanced Trading Platforms

Exness provides access to advanced trading platforms, including:

MetaTrader 4 (MT4): Widely used for its user-friendly interface and extensive features.

MetaTrader 5 (MT5): Offers additional functionalities and improved performance.

Exness Web Terminal: Accessible directly through web browsers without the need for downloads.

d. Educational Resources and Support

Exness offers a wealth of educational resources to help traders enhance their skills:

Webinars and Tutorials: Regularly scheduled sessions covering various trading topics.

E-books and Guides: Comprehensive materials for both beginners and advanced traders.

Customer Support: 24/7 multilingual support to assist traders with any queries or issues.

e. Safety and Security

With robust regulatory oversight and advanced security measures, Exness ensures that traders' funds and personal information are protected. Features include:

Fund Segregation: Client funds are kept separate from the company's operational funds.

Encryption Technologies: Protects data transmission between clients and servers.

Regular Audits: Ensures compliance with regulatory standards and operational transparency.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

6. Potential Risks of Trading with Exness in Pakistan

a. Market Volatility

Forex and CFD markets are inherently volatile, leading to significant price fluctuations. Traders must be prepared for potential losses and employ effective risk management strategies.

b. Leverage Risks

While high leverage can amplify profits, it also increases the risk of substantial losses. Traders should use leverage cautiously and understand its implications fully.

c. Regulatory Uncertainty

Operating through an offshore broker introduces regulatory uncertainties. Changes in Pakistani financial regulations could impact the legality and operation of forex trading activities.

d. Cybersecurity Threats

Despite advanced security measures, online trading platforms are susceptible to cybersecurity threats. Traders should ensure they use secure devices and maintain strong security practices.

e. Dependency on Internet Connectivity

Online trading requires a stable internet connection. Interruptions or slow connectivity can lead to missed trading opportunities or execution delays.

7. How to Trade Legally on Exness in Pakistan

a. Registering an Account

To trade legally on Exness in Pakistan, follow these steps:

Complete Registration: Provide accurate personal information during the sign-up process.

Verify Identity: Submit necessary documents for KYC compliance, including a valid ID and proof of address.

Fund Your Account: Use authorized payment methods to deposit funds into your Exness account.

b. Adhering to Local Regulations

Ensure that your trading activities comply with Pakistani regulations by:

Using Authorized Payment Methods: Avoid using unregulated or suspicious channels for transactions.

Reporting Earnings: Declare profits from forex trading in your annual tax filings.

Avoiding Speculative Trading: Engage in trading for legitimate purposes like hedging or investment, not for speculative gains.

c. Implementing Effective Risk Management

To trade responsibly, adopt the following risk management practices:

Set Stop-Loss Orders: Limit potential losses on each trade.

Risk Only a Small Percentage: Avoid risking more than 1-2% of your account on any single trade.

Diversify Your Portfolio: Spread investments across different instruments to mitigate risk.

d. Staying Informed

Keep abreast of the latest developments in forex trading and Pakistani financial regulations by:

Following Financial News: Stay updated with economic indicators and geopolitical events that impact the markets.

Participating in Educational Programs: Utilize Exness's educational resources to enhance your trading knowledge.

8. Comparative Analysis: Exness vs. Local Brokers in Pakistan

a. Regulation and Safety

Exness: Regulated by international authorities like FCA, CySEC, and FSA, ensuring high safety standards.

Local Brokers: Regulated by SECP and SBP, offering compliance with Pakistani laws but may have limited instrument offerings.

b. Trading Instruments

Exness: Offers a diverse range of instruments including forex, commodities, indices, cryptocurrencies, and CFDs.

Local Brokers: Primarily focus on forex and commodities with fewer options for cryptocurrencies and CFDs.

c. Trading Platforms

Exness: Provides access to MT4, MT5, and Exness Web Terminal with advanced features.

Local Brokers: May offer proprietary platforms with limited functionalities compared to Exness.

d. Leverage and Spreads

Exness: Offers high leverage up to 1:2000 and tight spreads, benefiting active traders seeking competitive conditions.

Local Brokers: Typically offer lower leverage and wider spreads, aligning with conservative trading approaches.

e. Customer Support

Exness: 24/7 multilingual support with extensive educational resources.

Local Brokers: Support may be limited to business hours with fewer educational tools available.

f. Deposit and Withdrawal Options

Exness: Multiple payment methods including bank transfers, credit/debit cards, online payment systems, and cryptocurrencies.

Local Brokers: Limited to bank transfers and local payment methods, with fewer options for cryptocurrencies.

9. Testimonials and User Experiences from Pakistani Traders

a. Positive Feedback

Many Pakistani traders have praised Exness for its:

Ease of Use: User-friendly platforms and intuitive interfaces.

Competitive Conditions: Low spreads and high leverage enabling greater trading flexibility.

Customer Support: Responsive and helpful support teams available around the clock.

b. Areas for Improvement

Some traders have noted:

Regulatory Awareness: A need for more localized regulatory information and support.

Payment Processing: Occasional delays in deposit and withdrawal processes.

Educational Resources: Desire for more region-specific educational content and webinars.

c. Success Stories

Several Pakistani traders have shared their success stories, highlighting how Exness's advanced tools and competitive conditions have helped them achieve significant profits. These testimonials often emphasize the importance of disciplined trading and effective risk management.

Conclusion

Is Exness available in Pakistan? The unequivocal answer is yes. Exness provides a robust and secure trading environment for Pakistani traders, offering a wide range of trading instruments, competitive conditions, and advanced platforms. While operating through an offshore broker like Exness introduces certain regulatory and logistical considerations, Pakistani traders can navigate these challenges by adhering to local laws, implementing effective risk management, and leveraging Exness's comprehensive resources.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness's global reputation, coupled with its commitment to transparency and client protection, makes it a suitable choice for Pakistani traders seeking to participate in the dynamic forex market. However, it is imperative for traders to remain informed about regulatory changes, maintain compliance with tax obligations, and engage in responsible trading practices to maximize their trading potential and safeguard their investments.

As the financial landscape in Pakistan continues to evolve, platforms like Exness will play a pivotal role in shaping the future of online trading, offering traders the tools and opportunities needed to succeed in the global markets.

Read more: