19 minute read

Exness Review Bangladesh: Legit, Safe, Is a good broker?

Exness is a well-known global forex broker that has gained traction in Kenya’s growing trading market. With its user-friendly platform, competitive conditions, and regulatory compliance, Exness has become a popular choice among traders. This review examines whether Exness is a legitimate, safe, and reliable broker for Kenyan traders, offering key insights into its features and services.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

When it comes to Forex and online trading, selecting a suitable broker can significantly impact your trading journey. Exness has garnered attention in various markets, including Bangladesh, for its competitive offerings and diverse range of services tailored to meet the needs of local traders.

Choosing the right broker involves evaluating factors such as regulatory compliance, account types, trading platforms, fees, and customer support. Understanding how these elements contribute to a trader's experience is essential, especially in a dynamic market like forex.

Brief Overview of Exness

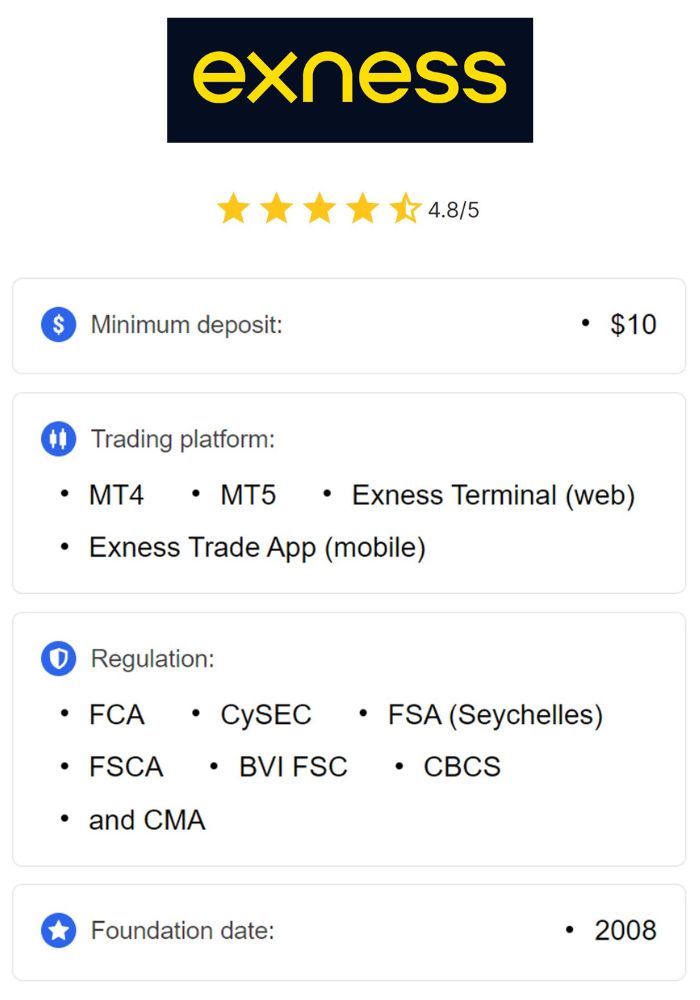

Exness was founded in 2008 and has since evolved into one of the leading online trading platforms globally. With a mission to empower traders, it offers a wide array of financial instruments across multiple asset classes. The broker is particularly renowned for its user-friendly platform and robust trading conditions, making it an appealing choice for both novice and experienced traders alike.

Exness operates with the core values of transparency, accessibility, and flexibility. The company prides itself on providing real-time trading capabilities, ensuring that traders can react quickly to market movements. With advanced technology and innovative tools, Exness aims to deliver a superior trading environment that enhances trader performance.

Importance of Choosing the Right Broker

The importance of choosing the right broker cannot be overstated. A reputable broker acts as the bridge between traders and the financial markets, influencing aspects such as execution speed, trading costs, and the overall user experience.

Additionally, the level of regulation a broker adheres to plays a crucial role in safeguarding traders' funds and data. Traders need to ensure that their chosen broker aligns with their specific trading style and objectives, as well as offering adequate support and educational resources.

In Bangladesh, where retail trading is gaining popularity, understanding the nuances of brokers like Exness helps traders make informed decisions that can lead to successful trading outcomes.

Regulatory Framework

Understanding the regulatory framework is vital when considering a broker's credibility. Regulations ensure that brokers adhere to strict guidelines that protect traders and maintain market integrity.

In Bangladesh, the regulatory landscape for forex trading is evolving, and traders should stay informed about the legal frameworks governing trading activities.

Overview of Financial Regulations in Bangladesh

In Bangladesh, the regulatory environment for forex trading is primarily overseen by the Bangladesh Securities and Exchange Commission (BSEC) and the Bangladesh Bank. While traditional forex trading is not as widely recognized compared to other regions, increasing interest from retail traders is prompting discussions regarding regulation.

The BSEC is responsible for protecting investors' rights, while the Bangladesh Bank regulates foreign exchange transactions. As the market develops, traders must remain vigilant regarding any changes in regulations that could influence their trading opportunities and responsibilities.

Exness's Regulatory Compliance and Licenses

Exness operates under multiple licenses granted by reputable regulatory authorities around the world, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. These licenses are indicators of Exness's commitment to maintaining high standards of operation and adhering to stringent compliance requirements.

For Bangladeshi traders, it's reassuring to know that Exness is regulated by recognized entities. These regulatory bodies enforce strict operational guidelines that promote fair trading practices and ensure that client funds are managed securely.

Impact of Regulation on Trading Safety

Regulations play a crucial role in enhancing trading safety. A regulated broker like Exness must comply with rules that involve regular audits, transparent reporting, and client fund segregation. This means that traders' funds are held separately from the broker's operating capital, providing additional protection in case of financial difficulties.

For Bangladeshi traders, opting for a regulated broker mitigates risks associated with fraud or unethical practices. It creates an environment of trust where traders can focus on honing their skills without excessive worry about the safety of their investments.

Account Types Offered by Exness

A significant factor to consider when choosing a broker is the variety of account types available. Different accounts cater to different trading styles, risk appetites, and experience levels.

Exness provides various account options that suit both beginner and professional traders, enabling them to select the most appropriate setup for their trading strategies.

Standard Accounts Explained

Standard accounts at Exness are designed for traders looking for simplicity and ease of use. These accounts typically feature fixed spreads and no commission on trades, which can be particularly appealing for beginners.

New traders can benefit from the straightforward nature of standard accounts, as they allow for easy navigation without overwhelming complexities. The absence of commissions also simplifies cost structures, enabling traders to focus on their strategies rather than worrying about additional fees.

Moreover, standard accounts often come with lower minimum deposit requirements, making them accessible to a broader range of traders. This inclusivity encourages new entrants to the forex market while giving them room to grow as they gain experience.

Professional Accounts and Their Benefits

For seasoned traders seeking advanced trading conditions, Exness offers professional accounts. These accounts boast variable spreads, allowing more flexibility during volatile market conditions. Additionally, they may involve lower trading costs due to competitive commissions on certain instruments.

Professional accounts cater to traders who require specialized tools and features to enhance their trading experience. They often provide access to higher leverage levels, enabling traders to maximize their potential returns. Furthermore, experience in managing risk becomes vital when handling larger positions.

By separating professional and standard accounts, Exness caters to diverse trader needs – from those just starting out to those with substantial trading experience. The varied offerings ensure that all traders find a suitable home within Exness’s ecosystem.

Comparison of Account Types for Bangladeshi Traders

When comparing account types, Bangladeshi traders should consider their individual trading goals, risk tolerance, and experience level. Standard accounts may attract newcomers due to their simplicity, while professional accounts can appeal to skilled traders aiming to optimize their trading conditions.

It's essential to assess the differences in spreads, commissions, leverage, and additional features offered by each account type. By aligning choices with individual trading strategies, Bangladeshi traders can maximize their chances of success.

Ultimately, Exness’s diverse account offerings empower traders to choose what best suits their unique circumstances, facilitating a personalized trading experience.

Trading Platforms Available

An effective trading platform is the backbone of any trading operation. It serves as the interface through which traders execute orders, analyze market conditions, and manage their portfolios.

Exness provides access to industry-standard trading platforms, ensuring that traders have the necessary tools to engage effectively in the market.

MetaTrader 4 Features and Usability

One of the standout platforms offered by Exness is MetaTrader 4 (MT4). Renowned for its intuitive interface, MT4 is a favorite among forex traders worldwide. It provides a range of technical analysis tools, customizable charts, and automated trading options through Expert Advisors (EAs).

Traders appreciate MT4 for its user-friendly design, which enables them to navigate seamlessly between various functions. Whether analyzing price movements or executing trades, the platform delivers a smooth experience, even for less tech-savvy users.

Furthermore, MT4 allows traders to conduct backtesting on their strategies, enabling them to refine their approaches before committing real capital. This analytical capability fosters confidence among traders, making it a cornerstone of Exness’s trading offerings.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

MetaTrader 5 Advantages for Advanced Traders

For those seeking more advanced features, Exness also offers MetaTrader 5 (MT5). This platform builds upon the strengths of MT4 and introduces additional capabilities, such as more timeframes, advanced charting options, and an expanded range of order types.

MT5 is particularly advantageous for multi-asset trading, allowing traders to access various markets beyond forex, including stocks and commodities. Its enhanced analytical tools and integrated economic calendar cater to traders looking to deepen their market insights.

Additionally, MT5 supports advanced order management and netting capabilities, making it ideal for experienced traders engaged in complex trading strategies.

Mobile Trading Options and Experience

Exness recognizes the significance of mobile trading in today's fast-paced environment. Both MT4 and MT5 are available as mobile applications, allowing traders to monitor their accounts and execute trades on-the-go.

The mobile platforms retain the essential features of their desktop counterparts, ensuring that traders can access their trading tools anytime, anywhere. This flexibility empowers traders to seize opportunities as they arise, regardless of their physical location.

Overall, the availability of these trading platforms underscores Exness's commitment to providing traders with the necessary resources to operate effectively in the market.

Trading Instruments and Markets

Traders want access to a diverse range of financial instruments to enhance their trading strategies. Exness offers an extensive selection of trading instruments across various asset classes, catering to the preferences of Bangladeshi traders.

Understanding the breadth of instruments available allows traders to diversify their portfolios and capitalize on multiple market opportunities.

Forex Pairs Offered by Exness

Forex trading is at the heart of Exness's offerings, with a wide array of currency pairs available for trading. From major pairs like EUR/USD and GBP/USD to exotic pairs involving local currencies, traders can explore numerous opportunities.

Having access to various currency pairs enhances liquidity and provides traders with options to hedge against risks. Moreover, the ability to trade different pairs throughout the day allows for adaptability in changing market conditions.

Exness ensures competitive spreads on its forex pairs, enabling traders to capitalize on market movements without incurring excessive costs. This structure is essential for both day traders and long-term investors looking to optimize their trading performance.

Availability of CFDs on Commodities and Indices

Beyond forex, Exness provides Contracts for Difference (CFDs) on commodities and indices, expanding traders’ opportunities even further. This diversity allows traders to participate in various markets, accommodating different trading styles and preferences.

Commodities such as gold and oil often act as safe havens during turbulent times, allowing traders to hedge against volatility in the forex market. Similarly, trading indices provides exposure to entire market sectors, creating opportunities for diversification.

Exness's access to these asset classes opens up avenues for traders to develop balanced portfolios that reflect their investment philosophies and risk profiles.

Cryptocurrencies and Other Asset Classes

With the rise of digital assets, Exness offers cryptocurrency trading, providing Bangladeshi traders with access to popular cryptocurrencies like Bitcoin and Ethereum. The cryptocurrency market is characterized by high volatility, presenting both opportunities and risks for traders.

Having the option to trade cryptocurrencies alongside traditional assets enhances flexibility and responsiveness to market trends. Traders can take advantage of the rapid fluctuations in the crypto market, complementing their forex trading strategies.

By offering a broad spectrum of instruments, Exness positions itself as a versatile broker capable of catering to the diverse needs of Bangladeshi traders.

Spreads and Commissions

Understanding the cost structure is essential for any trader. Spreads and commissions represent trading costs that can significantly affect profitability.

Exness's approach to spreads and commissions is worth examining, as it influences the overall trading experience for Bangladeshi traders.

Understanding Spreads in Different Account Types

Spreads refer to the difference between the buying and selling price of an asset. For traders, lower spreads can mean reduced trading costs and improved profitability. Exness offers different spread structures based on account types.

Standard accounts typically feature fixed spreads, providing predictability in trading costs. This arrangement is beneficial for traders who prefer straightforward pricing structures. On the other hand, professional accounts offer variable spreads, which can tighten during optimal market conditions, ultimately benefiting active traders.

By tailoring spreads to match various trading strategies, Exness caters to both casual traders and those who seek to capitalize on short-term price movements.

Commission Structures for Various Instruments

In addition to spreads, the commission structure is a critical factor affecting trading costs. Exness implements a transparent commission model, particularly for professional accounts and specific instruments.

While standard accounts do not incur commissions, professional accounts may feature commission charges based on the trading volume. Commission structures can be advantageous for high-volume traders who seek tighter spreads on their trades.

Understanding how commissions impact overall costs can help Bangladeshi traders assess their trading strategies and align them with their preferred account types.

Cost Competitiveness Compared to Other Brokers

When comparing Exness to other brokers, it's important to evaluate the overall cost competitiveness of their spreads and commissions. Exness is regarded for its low-cost trading environment, which appeals to a broad range of traders.

The combination of competitive spreads, transparent commissions, and an array of account types makes Exness a compelling choice for Bangladeshi traders. This cost-efficiency contributes to enhanced trading results and encourages more disciplined trading behavior.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Deposit and Withdrawal Options

A seamless deposit and withdrawal process is crucial for traders, as it directly impacts their overall experience. Exness provides a range of payment methods tailored to meet the needs of Bangladeshi traders.

Understanding the available options and associated procedures can enhance the convenience of managing funds effectively.

Payment Methods Supported in Bangladesh

Exness supports a variety of payment methods for deposits and withdrawals. These methods include bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller. The inclusion of multiple payment options makes it easier for Bangladeshi traders to fund their accounts and withdraw profits.

The availability of local payment methods further enhances accessibility, allowing traders to transact conveniently without encountering significant hurdles.

Processing Times and Fees for Deposits

Processing times for deposits typically vary based on the chosen payment method. Exness strives for quick transaction processing, with many deposits being processed almost instantaneously. However, bank transfers may take longer depending on the bank's policies.

Fees associated with deposits depend on the payment method used, but Exness aims to minimize costs wherever possible. Clear communication about any applicable fees ensures that traders can plan their transactions accordingly.

Overall, efficient processing times and minimal fees contribute to an enhanced user experience, allowing traders to focus on market opportunities rather than logistical concerns.

Withdrawal Procedures and Customer Experiences

Withdrawal procedures at Exness are designed to be user-friendly and efficient. Traders can initiate withdrawals through the same payment methods used for deposits, promoting consistency in managing funds.

Customer experiences often highlight the smooth withdrawal process, though it's essential for traders to verify any specific requirements or processing times. Transparency in withdrawal procedures reinforces trust, encouraging traders to engage confidently with their funds.

Bangladeshi traders can look forward to a hassle-free experience when managing their accounts, thanks to Exness's commitment to accessible and efficient transaction services.

Customer Support Services

Reliable customer support is a fundamental aspect of a successful trading experience. Exness prioritizes providing exceptional support services, ensuring that traders have access to assistance whenever needed.

Assessing the quality and availability of customer support helps traders gauge the overall reliability of the broker.

Availability of Support Channels

Exness offers several channels through which traders can seek assistance, including live chat, email, and phone support. The availability of multiple communication options caters to individual preferences, allowing traders to choose the most convenient method for their inquiries.

Live chat support is particularly valued for its immediacy, enabling traders to receive prompt responses to urgent questions.

Quality of Customer Service

The quality of customer service is integral to fostering a positive trading experience. Feedback from users indicates that Exness's customer support team is knowledgeable and responsive, addressing queries effectively.

Support agents undergo training to ensure they possess a thorough understanding of Exness's offerings and the broader forex market. This expertise allows them to provide tailored solutions to traders, enhancing their overall satisfaction with the broker.

Resources for Trader Education and Assistance

Exness recognizes the importance of trader education and empowerment. Alongside customer support, the broker provides a range of educational resources, including webinars, articles, and video tutorials.

These resources aim to enhance traders' knowledge and skills, equipping them with the tools necessary for successful trading. By investing in education, Exness helps foster a community of informed traders who can navigate the complexities of the forex market.

Trading Conditions and Leverage

Trading conditions significantly influence a trader's ability to succeed. Factors such as leverage and margin requirements play an essential role in determining how traders approach the market.

Exness's trading conditions are designed to accommodate a wide range of traders, reflecting varying risk tolerances and trading strategies.

Leverage Options Available for Bangladeshi Traders

Leverage represents the ability to control larger positions with smaller amounts of capital. Exness offers competitive leverage options, allowing Bangladeshi traders to amplify their trading potential.

Higher leverage can enhance profit potential, but it also increases risk. Therefore, traders must employ sound risk management strategies to mitigate potential losses. Exness provides educational resources on leveraging effectively, helping traders understand the implications of their choices.

Margin Requirements and Risk Management

Margin requirements dictate the amount of capital a trader needs to maintain open positions. Exness aims to establish reasonable margin requirements that align with their leverage offerings. This structure ensures that traders can participate in the market without facing excessive barriers.

Effective risk management is essential for all traders, particularly those operating with higher leverage. Exness educates traders on implementing risk management techniques, such as setting stop-loss and take-profit orders, to safeguard their investments.

By providing favorable trading conditions, Exness fosters an environment where Bangladeshi traders can pursue their trading goals while managing risk effectively.

Influence of Trading Conditions on Performance

Trading conditions directly impact a trader's performance and decision-making processes. Favorable conditions, such as tight spreads and high leverage, can enhance profitability; however, they can also introduce heightened risk.

Understanding how trading conditions affect performance allows traders to adapt their strategies accordingly. Exness's commitment to transparency ensures that traders can make informed decisions about their trading approaches.

Security Measures Implemented by Exness

Security is paramount in the online trading landscape. Traders must feel confident that their funds and personal information are safeguarded against potential threats.

Exness implements a range of security measures to ensure that clients can trade with peace of mind.

Data Protection and Privacy Policies

Exness places a strong emphasis on data protection and user privacy. The broker adheres to strict data protection policies and employs encryption technology to safeguard sensitive information.

User data is handled responsibly, ensuring compliance with relevant regulations. Traders can trust that their personal and financial details are secure, fostering confidence in Exness's operations.

Fund Segregation and Client Security

Client fund security is a top priority for Exness. The broker maintains segregated accounts for clients, ensuring that traders' funds are kept separate from the company's operating capital. This practice protects clients' money in the event of financial difficulties faced by the broker.

Additionally, Exness implements anti-fraud measures and protocols to detect and prevent unauthorized access to accounts. This proactive approach minimizes risks associated with online trading.

Anti-Fraud Measures and Protocols

Exness adopts a multifaceted approach to combat fraud and enhance security. Regular monitoring of suspicious transactions and user activity helps identify potentially fraudulent behavior.

Traders are encouraged to enable two-factor authentication (2FA) for an added layer of security. This measure requires users to provide verification codes generated on their personal devices, reducing the likelihood of unauthorized access.

Through these comprehensive security measures, Exness reinforces its commitment to providing a safe trading environment for Bangladeshi traders.

User Reviews and Reputation

Understanding user feedback and reputation is essential when evaluating a broker's performance. Exness has received a range of reviews from traders, shedding light on their experiences with the platform.

Analyzing this feedback helps potential traders gauge whether Exness aligns with their expectations.

Analysis of Online Trader Feedback

Online trader feedback reveals a mixed landscape of experiences with Exness. Many traders commend the broker for its user-friendly platform, competitive spreads, and reliable customer support.

Users often highlight the efficiency of the deposit and withdrawal processes, noting that transactions are processed swiftly and transparently. Additionally, the range of educational resources is frequently appreciated by traders seeking to improve their skills.

However, some traders express concerns regarding occasional technical issues or delays in response times from customer support. While these concerns are not universal, they highlight areas for improvement in Exness's services.

Common Complaints and Praise from Users

Common complaints among users often revolve around technical glitches encountered during busy trading sessions or delays in obtaining customer support responses. Such issues can be frustrating for traders, especially during critical trading moments.

Conversely, praise tends to center around the broker's competitive pricing, diverse instrument offerings, and commitment to educating traders. Users appreciate Exness's efforts to create a supportive trading environment, enhancing their overall trading experience.

Overall Reputation in the Bangladeshi Market

Exness has established a favorable reputation in the Bangladeshi market, largely owing to its regulatory compliance and dedication to customer service. The broker’s international presence bolsters its credibility, attracting traders looking for trustworthy partners in their forex trading endeavors.

While there are areas for improvement, the overall consensus among Bangladeshi traders leans toward a positive perception of Exness as a viable broker.

Pros and Cons of Trading with Exness

Like any trading platform, Exness comes with its own set of advantages and disadvantages that traders should consider.

Evaluating these pros and cons allows potential users to make informed decisions about whether Exness aligns with their trading preferences.

Key Advantages of Using Exness as a Broker

Exness offers several key advantages that appeal to traders:

Regulatory Compliance: Exness operates under multiple regulatory frameworks, enhancing trust and reliability.

Diverse Account Types: The range of account types allows traders to select options that align with their trading strategies and experience levels.

Competitive Pricing: Low spreads and transparent commission structures contribute to a cost-effective trading environment.

Robust Trading Platforms: Access to industry-standard platforms like MT4 and MT5 provides traders with essential tools for analysis and execution.

Educational Resources: Exness invests in trader education, offering a wealth of resources to help users improve their trading skills.

Potential Drawbacks or Limitations

Despite its strengths, Exness does present some potential drawbacks:

Technical Issues: Some users report occasional technical glitches on the platform, which can hinder trading performance.

Customer Support Response Times: While generally reliable, there are instances where traders experience delays in receiving support.

Limited Availability of Certain Assets: Although Exness offers a wide range of instruments, some traders may desire access to unique assets not available on the platform.

Variable Spreads: While variable spreads can be advantageous, they may widen during periods of high volatility, impacting trading costs.

By weighing these pros and cons, traders can determine if Exness is the right fit for their trading aspirations.

Conclusion

In conclusion, Exness presents a compelling option for Bangladeshi traders seeking a legitimate and trustworthy broker.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With a strong regulatory framework, a diverse range of account types, competitive pricing, and robust trading platforms, Exness demonstrates a commitment to supporting traders on their journeys.

While there are areas for improvement, particularly concerning customer support and potential technical issues, the overall experience offered by Exness is positive.

Ultimately, traders should assess their individual needs and preferences when considering Exness, but the broker’s reputation, regulatory compliance, and educational resources position it favorably in the Bangladeshi market.

Whether you’re a novice trader starting your journey or a seasoned professional seeking advanced features, Exness has something to offer that aligns with your trading goals.

Read more: