12 minute read

Best Time To Trade XAUUSD EST

from Exness Blog

Understanding XAUUSD Market Dynamics

Overview of XAUUSD Trading

XAUUSD represents the trading pair of gold (XAU) priced in US dollars (USD), one of the most actively traded assets in the forex market. Gold’s unique status as both a commodity and a currency alternative makes it a key instrument for traders seeking to hedge against economic instability, inflation, or currency fluctuations.

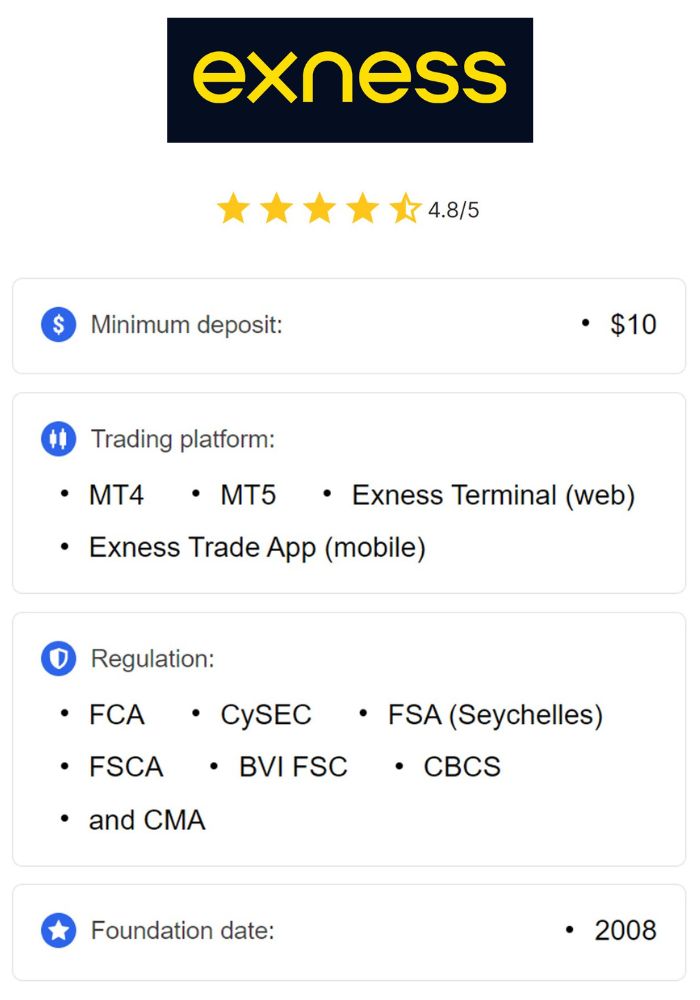

Top 4 Best XAUUSD Brokers

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Gold trading operates 24/5, overlapping with various financial centers worldwide. Its liquidity and volatility depend on global economic events, geopolitical tensions, and central bank policies. This flexibility allows traders to find opportunities during different sessions, making it essential to identify the best trading hours for maximizing profitability.

Importance of Gold in Forex Markets

Gold holds a special position in the financial markets due to its historical role as a store of value. Central banks and institutional investors often turn to gold during times of economic uncertainty, making XAUUSD a reliable indicator of market sentiment.

Traders favor XAUUSD because of its correlation with the US dollar and its reaction to major economic data releases, such as non-farm payrolls and Federal Reserve announcements. Understanding these dynamics helps traders capitalize on gold’s movements and anticipate price trends effectively.

Factors Influencing XAUUSD Prices

XAUUSD prices are influenced by various factors, including interest rates, inflation, and global economic stability. A decrease in interest rates often boosts gold prices as the opportunity cost of holding non-yielding assets diminishes. Conversely, rising interest rates typically pressure gold.

Geopolitical events, such as wars or political instability, can cause gold prices to surge as investors seek safe-haven assets. Similarly, movements in the US dollar directly affect XAUUSD, with a weaker dollar making gold more attractive and driving demand.

Key Trading Sessions for XAUUSD

Overview of Global Trading Hours

The forex market operates 24 hours a day, divided into major trading sessions: Asian, European, and North American. Each session has unique characteristics that influence XAUUSD liquidity and volatility.

The North American session, coinciding with the EST timezone, often experiences heightened activity due to its overlap with the European session and major economic announcements from the US. Understanding these sessions helps traders plan their strategies around market dynamics.

Major Financial Centers and Their Influence

Key financial hubs like London, New York, and Tokyo play significant roles in shaping XAUUSD movements. London, as a global gold trading hub, sets the benchmark for pricing, while New York drives volatility with its futures market and economic releases.

The Tokyo session, although quieter, sets the tone for the day’s trading by reacting to overnight developments and influencing early movements in XAUUSD prices. Traders can use this session to prepare for the more active European and North American overlaps.

Impact of Overlapping Trading Sessions

Overlapping sessions, such as the London-New York overlap, are crucial for XAUUSD trading as they bring together the highest levels of liquidity and volatility. During this time, traders can expect sharp price movements and increased trading opportunities.

For traders in the EST timezone, the overlap between 8:00 AM and 12:00 PM EST offers some of the best opportunities to capitalize on market trends, as significant economic data from both regions is released.

Best Times to Trade XAUUSD

Early Morning Trading Opportunities

In the EST timezone, early morning trading between 7:00 AM and 9:00 AM often provides opportunities to catch initial market reactions to overnight news. As European markets are fully active during this time, XAUUSD often experiences directional trends influenced by economic data or geopolitical events.

Traders focusing on technical analysis can use early morning activity to identify breakout patterns or reversals. Additionally, preparing for the London-New York overlap ensures traders are well-positioned for the day’s volatility.

Midday Volatility and Market Activity

The period between 9:00 AM and 12:00 PM EST coincides with the peak of the London-New York session overlap, often regarded as the most volatile time for XAUUSD. This window offers the highest liquidity, with significant price movements driven by US economic reports, Federal Reserve commentary, or corporate earnings announcements.

Traders leveraging fundamental analysis should focus on this period to act on real-time data. Scalpers and day traders often find midday trading ideal for short-term opportunities due to the frequency of rapid price changes.

Evening Trends and Price Movements

Evening trading in the EST timezone, between 6:00 PM and 10:00 PM, aligns with the Asian session. While generally less volatile than the European or North American sessions, this period is valuable for traders seeking consistent trends or consolidations.

The evening session allows traders to assess market sentiment and plan for the next day’s activity. Price movements during this time are often influenced by developments in Asia-Pacific economies, which can provide insights into the direction of XAUUSD for the following day.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Economic Indicators Affecting XAUUSD

Top Economic Reports to Watch

Key economic indicators such as the US non-farm payrolls, GDP growth rates, and inflation reports significantly impact XAUUSD. These data points influence market sentiment and the valuation of the US dollar, directly affecting gold prices.

Traders should keep an eye on the release schedule of these reports, particularly during the North American session. Preparing for high-impact events ensures traders can respond effectively to rapid market changes.

The Role of Interest Rates in Gold Trading

Interest rates are a pivotal factor in gold trading. Lower rates reduce the opportunity cost of holding gold, often leading to price increases. Conversely, rising interest rates can diminish gold’s appeal, exerting downward pressure on XAUUSD.

Federal Reserve policy announcements are closely watched by XAUUSD traders, as changes in monetary policy often lead to immediate price adjustments. By tracking rate forecasts, traders can anticipate market sentiment and position themselves accordingly.

Geopolitical Events and Their Effects

Geopolitical instability, such as conflicts or trade disputes, often triggers a surge in gold prices as investors seek safe-haven assets. XAUUSD reacts swiftly to news of uncertainty, making it essential for traders to stay informed about global events.

Traders can capitalize on these movements by monitoring breaking news and using stop-loss orders to manage risk. Exogenous shocks can create significant opportunities for well-prepared traders.

Seasonal Trends in Gold Trading

Historical Performance of XAUUSD by Month

Gold prices often exhibit seasonal patterns influenced by macroeconomic and cultural factors. Historically, XAUUSD tends to perform well during the first quarter of the year, driven by heightened demand during festivals and holidays in countries like India and China. Additionally, market uncertainty at the start of a new year can lead to increased safe-haven buying.

During the summer months, gold prices might see consolidation due to lower trading volumes, as many financial markets experience a lull. Conversely, the final quarter often witnesses increased activity as traders position themselves before the year ends, making December a notable month for XAUUSD trading.

Seasonal Demand Fluctuations in Gold

Gold demand is heavily influenced by cultural and economic cycles. Festivals like Diwali in India or the Lunar New Year in China typically increase physical gold purchases, indirectly impacting XAUUSD prices. These seasonal demands create predictable periods of higher market activity, offering traders opportunities to align their strategies with these trends.

Additionally, central bank buying, often scheduled in specific quarters, can significantly influence XAUUSD. Traders should track these patterns and consider integrating seasonal factors into their trading decisions to better time market entries and exits.

Holiday Impacts on Trading Volume

Holidays can create unique trading conditions for XAUUSD. During major global holidays, such as Christmas or New Year’s Day, trading volumes typically decrease, resulting in thinner markets and potential price spikes due to reduced liquidity.

For traders operating in the EST timezone, it’s crucial to account for these periods by avoiding overleveraged positions and preparing for abrupt price movements. Holidays in major gold-consuming countries, such as India or China, can also lead to fluctuations that influence global gold prices.

Technical Analysis for Optimal Trading Times

Identifying Key Support and Resistance Levels

Support and resistance levels are fundamental in determining the best times to trade XAUUSD. These levels act as psychological barriers where prices tend to bounce or reverse, providing traders with actionable entry or exit points.

Using technical indicators like Fibonacci retracement or pivot points can help identify these critical areas. In the EST timezone, monitoring support and resistance during high-volume sessions, such as the London-New York overlap, increases the likelihood of executing profitable trades.

Using Moving Averages to Determine Timing

Moving averages are valuable tools for timing trades in XAUUSD. By analyzing the interaction between short-term and long-term moving averages, traders can identify potential trend reversals or continuations. For example, a crossover between the 50-day and 200-day moving averages often signals a significant change in momentum.

During the most active trading hours, moving averages can serve as real-time guides for determining market sentiment. Traders can combine these with other indicators, such as the Relative Strength Index (RSI), for more accurate timing.

Chart Patterns and Their Significance

Chart patterns like triangles, head and shoulders, or double tops and bottoms provide visual cues for identifying potential breakouts or reversals. Recognizing these patterns during high-activity periods can give traders an edge in anticipating price movements.

In the context of XAUUSD trading, patterns observed during overlapping sessions between London and New York are often more reliable due to higher liquidity. Traders should use these patterns in conjunction with volume analysis to confirm their predictions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Strategies for Trading XAUUSD Efficiently

Day Trading vs. Swing Trading Approaches

Day trading XAUUSD involves making multiple trades within a single session, capitalizing on short-term price fluctuations. This strategy is ideal for traders who thrive in volatile environments and can dedicate significant time to market analysis. The most suitable hours for day trading in EST are during the London-New York overlap when XAUUSD volatility peaks.

Swing trading, on the other hand, focuses on capturing larger price movements over several days or weeks. This approach suits traders who prefer less frequent monitoring and rely on broader market trends. Swing traders often use daily charts and economic forecasts to guide their decisions.

Utilizing Stop-Loss Orders Effectively

Stop-loss orders are essential for managing risk in XAUUSD trading. By setting predetermined levels to exit a losing position, traders can protect their capital from significant losses during volatile periods.

In the EST timezone, placing stop-loss orders before high-impact economic events, such as Federal Reserve announcements, ensures traders minimize exposure to unexpected price swings. Trailing stops can also be used to lock in profits as the market moves favorably.

Risk Management Techniques for Gold Traders

Effective risk management involves setting a risk-reward ratio for each trade and adhering to it consistently. Traders should avoid overleveraging, especially in a highly volatile instrument like XAUUSD, and diversify their positions to spread risk.

Using position-sizing calculators and maintaining a disciplined trading journal can help traders refine their strategies and reduce emotional decision-making. Risk management becomes particularly critical during active trading hours, where quick price movements can amplify both gains and losses.

Psychological Factors in Trading XAUUSD

Understanding Trader Sentiment

Trader sentiment plays a significant role in XAUUSD price movements. Monitoring sentiment indicators, such as the Commitment of Traders (COT) report, provides insights into how institutional investors view gold’s prospects.

In the EST timezone, aligning sentiment analysis with technical and fundamental data ensures a well-rounded trading approach. Positive sentiment often drives prices higher, while bearish sentiment can lead to sell-offs.

The Impact of Fear and Greed on Trading Decisions

Fear and greed are common psychological pitfalls for XAUUSD traders. Fear can lead to premature exits, while greed may cause traders to hold losing positions longer than necessary. Recognizing these emotions and sticking to a pre-defined strategy helps maintain discipline.

Establishing clear rules for trade entry, exit, and position size minimizes the influence of emotions. Regular self-assessment and mindfulness practices can further enhance emotional resilience during volatile trading sessions.

Maintaining Discipline During Market Fluctuations

Market fluctuations in XAUUSD can be intense, especially during overlapping trading sessions. Maintaining discipline during these periods is crucial for long-term success. Traders should avoid chasing losses and stick to their risk management plans.

Using automated tools, such as algorithmic trading or alerts, can help traders execute strategies without being swayed by impulsive decisions. Reviewing trades post-session ensures continuous improvement and accountability.

Tools and Resources for XAUUSD Traders

Recommended Trading Platforms

Choosing the right platform is essential for trading XAUUSD effectively. Platforms like MetaTrader 4 and MetaTrader 5 are popular for their advanced charting tools, customizable indicators, and algorithmic trading capabilities.

For EST-based traders, platforms offering seamless execution and real-time data during high-activity periods are invaluable. Mobile compatibility ensures traders can monitor the market and make quick decisions on the go.

Utilizing Economic Calendars for Planning

An economic calendar is a vital resource for XAUUSD traders, as it provides a schedule of upcoming events and data releases that impact gold prices. Keeping track of these events, especially during the North American session, allows traders to anticipate volatility and plan accordingly.

Calendars with alerts and customizable settings ensure traders never miss critical updates. Combining this with technical analysis creates a robust framework for decision-making.

Mobile Apps for On-the-Go Trading

Mobile trading apps have revolutionized the way traders interact with markets. Apps like TradingView and broker-specific platforms provide access to charts, news, and trading tools from anywhere.

For XAUUSD traders in the EST timezone, mobile apps are particularly useful during evening sessions when desktop access may be limited. Real-time notifications and trade execution capabilities keep traders connected and responsive to market changes.

Conclusion

Trading XAUUSD effectively in the EST timezone requires an understanding of market dynamics, key trading sessions, and the factors influencing gold prices. By focusing on the London-New York overlap and leveraging technical and fundamental analysis, traders can identify optimal trading opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Incorporating seasonal trends, risk management strategies, and psychological discipline ensures a holistic approach to trading XAUUSD. Utilizing tools like economic calendars and mobile apps further enhances efficiency, allowing traders to navigate the market confidently and maximize their potential for success.

Read more: