14 minute read

Is forex trading legal in Indonesia? A Comprehensive Guide

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, is the practice of buying and selling currencies with the aim of profiting from fluctuations in exchange rates. Traders speculate on the value of one currency relative to another, participating in a decentralized market where transactions happen directly between participants rather than through a centralized exchange. This market structure allows for constant trading activity across various time zones.

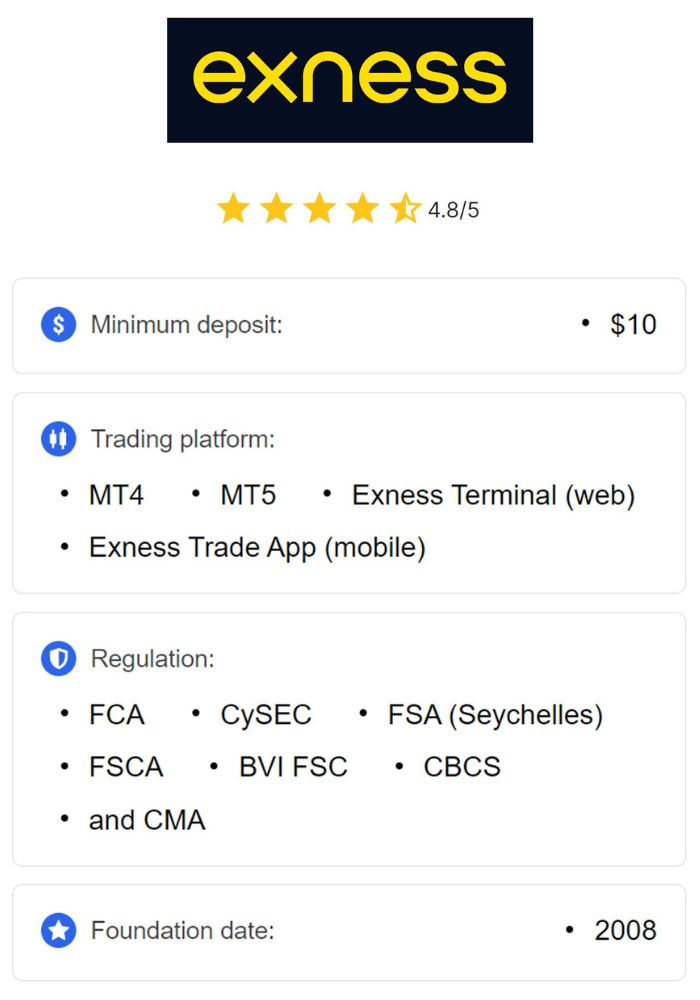

Top 4 Best Forex Brokers in Indonesia

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

As one of the largest and most liquid financial markets, forex trading is accessible to both individuals and institutions worldwide. The continuous operation of forex markets creates opportunities for traders to capitalize on currency price movements. Because of its scale and accessibility, forex trading has become a popular choice for those looking to diversify their investment portfolios or pursue short-term profit.

Overview of the Forex Market

The forex market is a global network that operates 24 hours a day across key trading hubs in financial centers like London, New York, and Tokyo. With daily trading volumes exceeding $6 trillion, it is the largest financial market in the world. This round-the-clock activity is made possible by overlapping trading sessions, allowing traders to respond to global economic developments as they unfold.

Unlike centralized exchanges, forex operates over-the-counter (OTC), where transactions occur directly between buyers and sellers. This decentralized structure offers flexibility for traders but also requires a good understanding of market dynamics, as currency prices can be influenced by a range of factors, from geopolitical events to economic data releases.

Importance of Forex Trading in Global Economy

Forex trading plays a crucial role in the global economy, providing a mechanism for currency exchange that facilitates international trade and investment. Businesses and governments rely on the forex market to convert currencies, manage risks, and conduct cross-border transactions smoothly. This flow of currency helps stabilize international economies and enables efficient trade between nations.

For investors, forex trading is a way to diversify portfolios and hedge against currency-related risks. The market’s high liquidity allows for quick entry and exit from trades, and its responsiveness to economic news means that traders can adjust their positions in real-time, benefiting from a dynamic and flexible investment environment.

Regulatory Framework in Indonesia

Role of Bank Indonesia

Bank Indonesia (BI) is the central bank of Indonesia and serves as the primary regulatory authority overseeing financial stability and currency control in the country. Its responsibilities include managing monetary policy, regulating money supply, and overseeing payment systems. Bank Indonesia also plays an important role in setting guidelines for forex trading to ensure a stable and transparent financial environment.

In the context of forex trading, Bank Indonesia enforces measures to protect the integrity of the national currency and limit the risks associated with currency speculation. By monitoring market activities, BI seeks to prevent issues such as excessive speculation and potential currency manipulation, which can have far-reaching effects on the Indonesian economy.

Financial Services Authority (OJK) and Its Functions

The Financial Services Authority, known as OJK (Otoritas Jasa Keuangan), is an independent institution tasked with regulating and supervising financial services in Indonesia. OJK’s main functions include overseeing the financial services industry, ensuring compliance with regulatory standards, and protecting consumers’ financial interests. By setting standards for transparency and accountability, OJK promotes trust in Indonesia’s financial markets.

For forex trading, OJK works in tandem with Bank Indonesia to regulate brokers and trading platforms, ensuring they operate within the legal framework. OJK’s oversight helps prevent fraudulent practices and safeguards the rights of forex traders, contributing to a secure trading environment that aligns with international best practices.

Legal Requirements for Forex Brokers

Forex brokers operating in Indonesia must obtain a license from OJK to provide trading services legally. Licensed brokers are required to meet strict criteria regarding financial stability, client fund protection, and operational transparency. These requirements aim to protect traders from potential risks and ensure that brokers adhere to ethical practices.

By working with licensed brokers, Indonesian traders can trade forex with confidence, knowing their investments are better protected. Legal requirements for brokers also include measures to combat money laundering and ensure compliance with reporting standards, fostering a responsible trading ecosystem.

Is Forex Trading Legal in Indonesia?

Yes, Forex trading is legal in Indonesia, but it is regulated to ensure fair practices and protect traders. The legal framework, overseen by Bank Indonesia and OJK, sets standards for both brokers and traders to follow. This regulation ensures that trading activity does not disrupt the country’s financial stability and that traders have access to safe, regulated platforms.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Indonesian traders are encouraged to work with brokers licensed by OJK to avoid the risks associated with unregulated brokers. Following the guidelines established by local authorities allows traders to participate in the forex market without legal concerns, fostering a responsible and compliant trading environment.

Tax Implications on Forex Trading

Tax Responsibilities of Forex Traders

Forex traders in Indonesia are required to report their trading profits as part of their income for tax purposes. Trading profits are subject to personal income tax, and traders are responsible for accurately declaring their earnings in compliance with Indonesian tax laws. This requirement applies to both individual traders and companies engaged in forex trading.

Understanding tax obligations is crucial for Indonesian traders, as failure to comply can result in penalties. Consulting a tax professional can help traders stay informed about current tax rates and reporting requirements, ensuring they fulfill their tax responsibilities correctly and avoid potential issues.

Reporting Profits and Losses

In Indonesia, forex traders must report both profits and losses from their trading activities when filing taxes. Accurate record-keeping is essential, as it allows traders to calculate their net taxable income correctly. Traders are advised to keep detailed records of each transaction, including the trade date, currency pair, profit or loss amount, and any fees associated with the trade.

Proper documentation not only ensures compliance with tax regulations but also helps traders monitor their performance over time. By maintaining comprehensive records, Indonesian traders can streamline the tax filing process and demonstrate transparency in their financial reporting.

Compliance with Indonesian Tax Laws

Compliance with Indonesian tax laws is mandatory for forex traders to maintain a transparent trading practice. Traders must stay updated on any changes in tax regulations, as these can affect their reporting requirements and tax obligations. Penalties for non-compliance can be severe, so traders should prioritize understanding and adhering to tax laws.

Many traders seek advice from tax professionals or use accounting software to simplify compliance. Staying informed and prepared helps Indonesian traders meet their tax responsibilities, ensuring a legally compliant trading experience that aligns with national tax policies.

Popularity of Forex Trading Among Indonesians

Demographics of Forex Traders in Indonesia

Forex trading in Indonesia has grown in popularity across various demographics, with many young adults and professionals exploring it as an investment avenue. The ease of access provided by online trading platforms and the potential for quick profits attract a tech-savvy, younger population. University students, young professionals, and even retirees are increasingly showing interest in forex trading as an additional source of income.

The diverse range of participants highlights forex trading's appeal across different age groups and backgrounds. As more Indonesians gain exposure to financial markets, the profile of the average forex trader in Indonesia is expanding, contributing to a more inclusive investment environment.

Trends in Forex Trading Participation

The number of Indonesian forex traders has increased due to factors such as improved internet access, educational resources, and awareness of global financial markets. The ability to trade from home and the potential for profit during market volatility have fueled a steady rise in forex trading interest. Additionally, social media and online communities have made it easier for newcomers to learn from experienced traders, further driving participation.

These trends suggest that forex trading is becoming a mainstream investment option in Indonesia. As interest grows, traders are seeking better tools, brokers, and learning materials, indicating a maturing forex trading community focused on sustainable growth and knowledge-sharing.

Impact of Technology on Accessibility

Advances in technology, including mobile trading apps and user-friendly platforms, have made forex trading more accessible to Indonesians. Mobile apps allow traders to monitor the market, execute trades, and manage their portfolios from anywhere, providing a level of convenience that was previously unavailable. This increased accessibility has encouraged a new wave of traders to explore forex as a viable investment.

Technology has also facilitated the use of automated trading tools, social trading platforms, and analytical software, making forex trading easier and more efficient. As technology continues to evolve, it is expected to further enhance accessibility, allowing more Indonesians to participate in the forex market with confidence.

Risks Associated with Forex Trading

Volatility and Market Fluctuations

Forex trading is inherently volatile, with currency prices influenced by a wide range of factors such as economic indicators, geopolitical events, and market sentiment. These price fluctuations can lead to significant profit opportunities but also expose traders to considerable financial risks, especially when leverage is used.

To manage these risks, Indonesian traders must develop solid risk management strategies, such as setting stop-loss orders and avoiding excessive leverage. A thorough understanding of market dynamics and careful planning are essential for navigating the volatility of forex trading successfully.

Legal Risks Related to Unlicensed Brokers

Trading with unlicensed brokers poses a serious legal risk, as these brokers may not adhere to regulatory standards. In Indonesia, it is essential to work with brokers licensed by OJK to ensure compliance with local laws and avoid fraudulent practices. Unlicensed brokers often operate without oversight, which increases the risk of unfair practices or loss of funds.

Indonesian traders can protect themselves by conducting due diligence on brokers and confirming their licensing status. Using licensed brokers helps ensure transparency, fair trading conditions, and legal recourse if issues arise, minimizing the risks associated with unregulated trading environments.

Managing Financial Risk in Forex Trading

Financial risk management is a critical component of successful forex trading, especially in a volatile market. Traders should adopt risk management techniques, such as limiting leverage, diversifying currency pairs, and setting predefined loss limits. These strategies help protect capital and maintain a balanced portfolio.

For Indonesian traders, implementing risk management practices is essential for achieving long-term stability. By focusing on preserving capital and managing risks effectively, traders can build a sustainable trading approach that mitigates potential losses in the forex market.

Resources for Forex Traders in Indonesia

Educational Materials and Online Courses

Educational resources, including online courses, webinars, and tutorials, are readily available to Indonesian traders interested in forex trading. Many brokers offer free or low-cost courses that cover everything from the basics of forex to advanced strategies, helping traders develop their skills at their own pace.

By participating in these courses, Indonesian traders can improve their understanding of market analysis, technical indicators, and trading psychology. These resources are valuable for traders looking to deepen their knowledge and gain confidence in their trading abilities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Local and International Broker Options

Indonesian forex traders have access to both local brokers licensed by OJK and reputable international brokers. Local brokers often provide services tailored to Indonesian traders, including support in the local language and convenient payment methods. International brokers may offer more diverse trading options and advanced tools but may not always comply with Indonesian regulations.

Choosing between local and international brokers depends on the trader’s needs and regulatory preferences. Indonesian traders should ensure that any broker they select is either licensed locally or by a well-respected international authority, ensuring a safe and transparent trading environment.

Support Groups and Trading Communities

Support groups and online trading communities play a significant role in helping Indonesian traders share knowledge and experiences. Platforms like Telegram, WhatsApp, and Facebook host groups where traders discuss strategies, market trends, and broker reviews. Engaging in these communities allows traders to learn from each other and build a network of support.

For beginner traders, these communities offer valuable insights and mentorship from experienced traders. Active participation in trading communities provides a sense of camaraderie and ongoing education, fostering a collaborative environment where traders can thrive.

Notes

Key Considerations for New Traders

New traders in Indonesia should focus on building a strong foundation by learning forex fundamentals and practicing with demo accounts. Starting with small investments and gradually increasing exposure helps traders develop skills without taking on excessive risks. Choosing a reputable broker and understanding basic trading strategies are also crucial for early success.

In addition to learning, new traders should establish realistic goals and remain disciplined. Forex trading requires patience and a willingness to learn from mistakes, so taking a cautious and calculated approach can lead to more sustainable growth in the long term.

Understanding the Local Investment Climate

Forex trading in Indonesia is influenced by local economic factors and regulatory requirements. Staying informed about the Indonesian economy and understanding how it impacts the forex market can help traders make informed decisions. Being aware of local regulations and maintaining compliance ensures a safe trading experience.

By familiarizing themselves with Indonesia’s investment climate, traders can align their strategies with market trends and regulatory standards. This understanding helps traders adapt to changes and find opportunities that fit the unique characteristics of the Indonesian market.

Mistakes to Avoid

Choosing Unregulated Brokers

Trading with unregulated brokers is a common mistake that can expose traders to high risks, including fraud and lack of legal recourse. Indonesian traders should prioritize brokers licensed by OJK or respected international authorities to ensure safety and transparency. Unregulated brokers often lack oversight, increasing the chance of encountering unethical practices.

By selecting licensed brokers, traders can access a secure trading environment with legal protections. Researching broker credentials and avoiding unregulated platforms are essential steps for mitigating risks in forex trading.

Neglecting Risk Management Strategies

Risk management is crucial in forex trading, yet many traders overlook it, especially when aiming for quick profits. Effective risk management involves setting stop-loss orders, limiting leverage, and diversifying trades, all of which protect against excessive losses.

For Indonesian traders, prioritizing risk management ensures long-term trading sustainability. Neglecting these strategies can lead to significant financial setbacks, so traders are encouraged to integrate risk management into every trade decision.

Overtrading and Emotional Decision Making

Overtrading, or trading too frequently, often results from emotional decisions and can lead to increased losses. Traders who react impulsively to market movements risk deviating from their strategies, which can harm their overall performance.

To avoid overtrading, Indonesian traders should stick to their trading plans and avoid letting emotions influence their decisions. Maintaining discipline helps traders make rational choices, enhancing their ability to stay consistent and focused on long-term goals.

Frequently Asked Questions

Is it safe to trade Forex in Indonesia?

Yes, forex trading is safe in Indonesia when conducted through licensed brokers who follow regulatory standards. Choosing brokers regulated by OJK or reputable international authorities ensures a secure trading environment that protects traders’ interests.

Sticking with regulated brokers minimizes the risks associated with unlicensed platforms, allowing traders to engage in forex safely and responsibly. Adhering to local regulations further enhances trading security.

What should I look for in a licensed broker?

When selecting a licensed broker, Indonesian traders should consider factors such as regulatory status, trading fees, platform usability, and customer support. Brokers regulated by OJK or internationally recognized bodies offer more credibility and better client protections.

A reputable broker will also provide clear information about trading conditions and have a strong customer support system. Taking time to research brokers ensures a safer and more reliable trading experience.

Can I legally trade Forex from my home?

Yes, Indonesians can legally trade forex from home through licensed brokers, as long as they comply with local regulations. The rise of online trading platforms has made forex trading accessible, allowing individuals to manage their trades from the comfort of their homes.

Trading from home offers flexibility, but traders should ensure they are using secure internet connections and following best practices to protect their accounts. Staying informed about regulatory updates is also important for a compliant trading experience.

Conclusion

Forex trading in Indonesia is a legal and regulated activity, offering a way for individuals to participate in global financial markets. By following local regulations, working with licensed brokers, and using sound risk management practices, Indonesian traders can engage in forex safely and effectively. Staying informed about tax obligations, market risks, and available resources ensures a responsible trading journey.

As the forex market continues to grow in popularity in Indonesia, ongoing education and adherence to best practices will empower traders to make the most of their trading experiences. A well-informed and disciplined approach provides a strong foundation for success in the dynamic world of forex trading.

Read more: