14 minute read

Is forex trading legal in Singapore? A Comprehensive Guide

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, short for foreign exchange trading, involves buying and selling currency pairs to profit from fluctuations in exchange rates. In the Forex market, participants trade one currency for another, speculating on whether the currency they’re buying will strengthen or weaken against the currency they’re selling. For example, if a trader believes the US dollar will rise against the Singapore dollar, they might buy USD/SGD. If their prediction is correct and the dollar appreciates, they can sell it back for a profit.

Top 4 Best Forex Brokers in Singapore

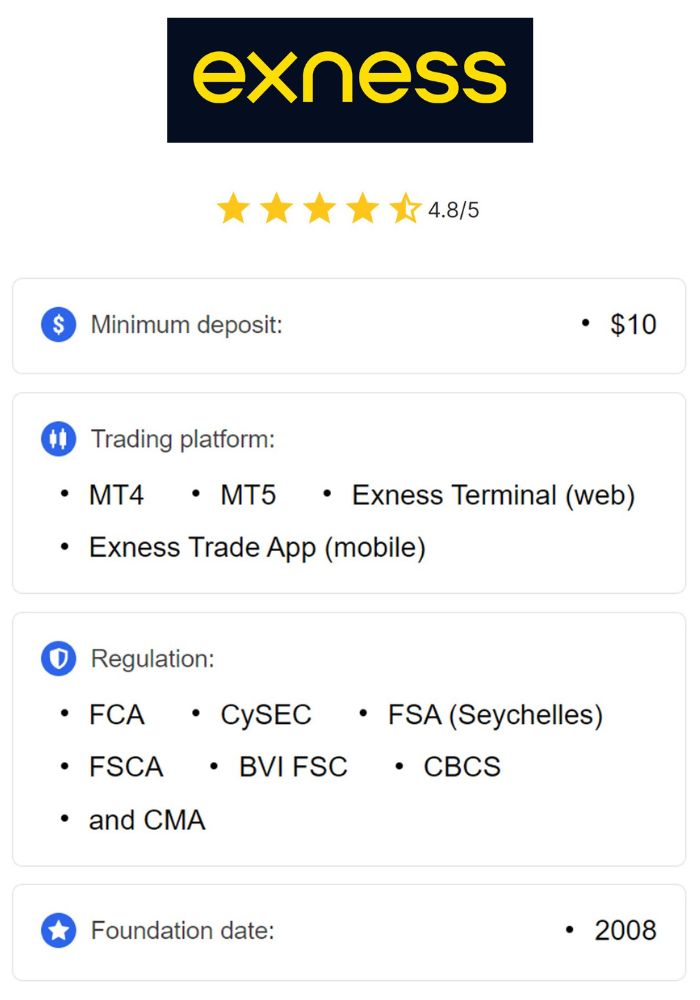

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

The goal of Forex trading is to capitalize on the frequent price fluctuations caused by economic, political, and social factors. By using analytical techniques and tools, traders can make informed decisions and manage the risks involved. With the growth of online trading platforms, Forex trading has become accessible to individuals around the world, including those in Singapore.

Overview of the Forex Market

The Forex market is the largest and most liquid financial market globally, with an average daily trading volume exceeding $6 trillion. It operates 24 hours a day, five days a week, across different financial centers, including London, New York, Tokyo, and Sydney. This round-the-clock market enables traders to respond quickly to news and events that influence currency values, creating numerous opportunities to profit.

Due to its decentralized nature, the Forex market is accessible to retail traders, institutions, banks, and corporations alike. The vast size of the market and its continuous operation provide liquidity, allowing traders to execute trades quickly and at low costs. For traders in Singapore, the Forex market offers a chance to participate in global currency movements, benefiting from a well-established regulatory environment and cutting-edge trading infrastructure.

Regulatory Framework Governing Forex Trading in Singapore

Monetary Authority of Singapore (MAS)

In Singapore, the regulatory body overseeing Forex trading and other financial activities is the Monetary Authority of Singapore (MAS). MAS is responsible for ensuring the stability and integrity of Singapore’s financial system, providing strict regulations and guidelines for Forex brokers operating in the country. MAS enforces high standards to protect traders and promote a transparent financial environment, making Singapore one of the most reputable Forex trading hubs in Asia.

For traders, MAS regulation offers added security, as MAS-licensed brokers are required to adhere to specific guidelines related to client fund protection, risk management, and ethical practices. By maintaining a robust regulatory framework, MAS plays a pivotal role in building trust among Forex traders and supporting the sustainable growth of the trading industry in Singapore.

Licensing Requirements for Forex Brokers

Forex brokers operating in Singapore must obtain a Capital Markets Services (CMS) license from MAS to offer trading services legally. To qualify for a CMS license, brokers must demonstrate financial stability, a proven track record, and compliance with regulatory standards. This includes maintaining segregated client accounts, implementing risk management policies, and providing transparent fee structures.

These licensing requirements ensure that only reputable and trustworthy brokers can operate in Singapore, protecting traders from potential fraud and unfair practices. By choosing a MAS-regulated broker, Singaporean traders can feel confident that they are working with a legitimate and reliable provider, thus minimizing risks associated with unregulated brokers.

Is Forex Trading Legal in Singapore?

Yes, Forex trading is legal in Singapore, provided that it is conducted through licensed brokers regulated by the Monetary Authority of Singapore (MAS). Singapore’s regulatory framework supports Forex trading, with MAS actively monitoring and overseeing market participants to ensure compliance with established guidelines. This regulatory approach allows Singaporean residents to trade Forex safely and confidently, knowing that they are operating within a legal and well-structured system.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

The legal status of Forex trading in Singapore is strengthened by the country's commitment to transparency and financial integrity. MAS regulations protect traders and promote ethical trading practices, making Singapore a favorable environment for Forex trading. As long as traders adhere to local regulations and trade with licensed brokers, they can legally participate in the Forex market.

Benefits of Forex Trading in Singapore

Access to a Global Market

One of the main advantages of Forex trading in Singapore is access to the global Forex market, which allows traders to buy and sell currencies from around the world. With various currency pairs available, traders can diversify their portfolios and take advantage of different market conditions. This global accessibility gives traders the flexibility to adapt to changing economic conditions and benefit from worldwide economic trends.

Additionally, Singapore's strategic location in Asia makes it easier for traders to participate in the overlapping trading hours of major financial centers, increasing opportunities to trade during active market sessions. This international reach is a significant benefit for traders looking to capitalize on global events and currency movements.

Flexible Trading Hours

Forex trading operates 24 hours a day, five days a week, providing unparalleled flexibility for traders in Singapore. This round-the-clock schedule means that traders can engage in Forex trading at any time, whether during regular business hours, after work, or even late at night. With the flexibility to trade at their convenience, Singaporean traders can accommodate Forex trading into their busy schedules and avoid missing potential opportunities.

This flexibility is particularly advantageous for those looking to supplement their income while maintaining other responsibilities. By managing trading hours effectively, traders in Singapore can adapt their strategies to different time zones and maximize their profit potential.

Potential for High Returns

Forex trading offers the potential for significant profits due to the high liquidity and volatility of the currency markets. Traders can profit from both rising and falling markets, as they have the flexibility to buy or sell currency pairs depending on market conditions. Additionally, Forex brokers in Singapore often provide leverage, allowing traders to control larger positions with a smaller amount of capital, which can amplify returns.

However, while leverage can increase profit potential, it also raises the risk of losses. Traders in Singapore are encouraged to approach Forex trading with a well-thought-out strategy and risk management plan. By combining disciplined trading with informed decision-making, Forex trading can be a profitable venture for those who are well-prepared and aware of the associated risks.

Risks Associated with Forex Trading

Market Volatility

The Forex market is highly volatile, with exchange rates constantly fluctuating due to economic indicators, geopolitical events, and market sentiment. This volatility creates profit opportunities but also increases the risk of losses, particularly for inexperienced traders. Sudden changes in currency values can result in significant gains or losses within minutes, depending on how well traders anticipate market movements.

Singaporean traders must be prepared to handle this volatility by implementing risk management strategies such as stop-loss orders, position sizing, and diversifying their portfolios. Understanding market trends and analyzing price action can help traders make better predictions and manage the risks associated with volatile market conditions.

Leverage Risks

Leverage is a tool widely offered by Forex brokers that allows traders to control larger positions with a smaller investment. In Singapore, brokers may offer leverage ratios of 1:10, 1:50, or even higher, depending on the trader’s experience and broker’s policy. While leverage amplifies potential profits, it also increases exposure to losses, as unfavorable price movements can lead to rapid capital depletion.

For Singaporean traders, understanding how to use leverage responsibly is essential. It’s recommended to start with lower leverage levels and gradually increase as experience and confidence grow. By managing leverage wisely and setting realistic expectations, traders can avoid excessive risk and protect their capital from substantial losses.

Psychological Factors

Forex trading requires discipline and mental resilience, as traders must handle the emotional highs and lows of the market. Emotions like fear, greed, and impatience can lead to impulsive decisions, causing traders to deviate from their strategies. Emotional trading often results in poor decision-making, which can lead to unnecessary losses and missed opportunities.

Singaporean traders can improve their trading mindset by maintaining a disciplined approach, setting clear goals, and adhering to a well-defined strategy. Practicing emotional control and regularly reviewing trades can help traders develop a more objective perspective, enabling them to make sound decisions even during volatile market conditions.

Choosing a Forex Broker in Singapore

Key Factors to Consider

Selecting a Forex broker is one of the most critical steps in starting a successful trading journey. For traders in Singapore, key factors to consider include the broker’s regulatory status, fees, available trading platforms, customer service, and overall reputation. A MAS-regulated broker is ideal, as this guarantees compliance with local regulations and provides added security for client funds.

Additional factors, such as the broker’s trading fees, available currency pairs, and educational resources, can influence the trading experience. Singaporean traders should evaluate each broker's offerings based on their specific trading goals and preferences to choose a reliable partner for their Forex journey.

Comparing Different Brokers

Comparing brokers involves examining factors like spreads, commissions, leverage options, and available tools. Many brokers offer demo accounts, allowing traders to test their platforms and services before committing funds. Comparing brokers enables traders to find the most cost-effective options and identify features that align with their trading needs.

Using comparison websites and reading reviews from other Singaporean traders can provide insights into each broker’s strengths and weaknesses. By thoroughly researching and testing different brokers, traders can make an informed decision, ensuring a smooth and reliable trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tax Implications of Forex Trading in Singapore

Understanding Capital Gains Tax

In Singapore, individual Forex trading profits are generally not subject to capital gains tax, as Singapore does not have a capital gains tax for individuals. This is advantageous for Forex traders, as they can retain their full profits without needing to allocate a portion to taxes. However, for those who trade as their main source of income or as part of a business, profits may be subject to income tax, depending on the frequency and nature of the trading activities.

Singaporean traders should consult a tax professional if they are uncertain whether their Forex earnings qualify as capital gains or income. For most individual traders, the absence of capital gains tax makes Forex trading a financially attractive option, as it allows traders to maximize their returns.

Reporting Requirements for Traders

Although individual Forex traders may not have to pay capital gains tax, it is still essential to keep accurate records of trading activities. For individuals trading as part of a business or those who meet certain income criteria, the Inland Revenue Authority of Singapore (IRAS) may consider Forex earnings as taxable income. In such cases, traders should be prepared to report their earnings accurately and comply with local tax regulations.

For traders operating as a business or frequent trading professionals, proper record-keeping and consulting with a tax advisor can help ensure compliance with Singapore’s tax requirements. By staying informed about tax obligations and understanding reporting requirements, traders can avoid potential issues with tax authorities.

Forex Trading Strategies

Technical Analysis

Technical analysis involves analyzing price charts, patterns, and indicators to make informed trading decisions. This approach relies on historical price data to predict future price movements, with the assumption that market trends and patterns repeat over time. Indicators such as moving averages, RSI, and MACD are commonly used to identify trends, overbought or oversold conditions, and potential reversal points in the market.

For Singaporean traders, mastering technical analysis provides valuable insights into short-term market trends and enhances their ability to execute timely trades. By understanding and applying technical indicators, traders can improve their decision-making and create more precise entry and exit points for each trade.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, geopolitical events, and central bank policies to understand the underlying factors that influence currency values. This approach is particularly useful for long-term traders, as it focuses on the overall economic health and stability of a country. Key indicators in fundamental analysis include GDP growth rates, inflation, employment figures, and interest rates set by central banks.

Singaporean traders can use fundamental analysis to anticipate major price movements and identify opportunities aligned with global economic trends. By combining both technical and fundamental analysis, traders gain a holistic view of the Forex market, allowing them to adapt their strategies to evolving economic conditions.

Risk Management Techniques

Effective risk management is essential for sustainable Forex trading. This involves setting stop-loss orders to limit potential losses, calculating appropriate position sizes, and diversifying trades to minimize exposure to a single currency or market event. Risk management also includes using leverage conservatively to avoid overexposing capital to the market's volatility.

Singaporean traders are encouraged to create a risk management plan tailored to their risk tolerance and trading goals. By implementing these techniques, traders can protect their capital, reduce emotional stress, and improve their long-term profitability in the Forex market.

Trading Platforms Available in Singapore

Popular Trading Platforms

Several trading platforms are popular among Forex traders in Singapore, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. MT4 and MT5 are renowned for their user-friendly interfaces, extensive charting tools, and automated trading options, making them suitable for both beginners and experienced traders. cTrader, known for its advanced charting capabilities and intuitive design, is also a favorite among traders who prefer a more streamlined experience.

Singaporean traders should explore each platform’s features and functionality to determine which best suits their trading style and objectives. Many brokers offer demo accounts, allowing traders to test platforms before committing to a live account. Choosing the right platform can significantly enhance the trading experience and provide valuable tools for analysis and decision-making.

Mobile Trading Options

In today’s fast-paced world, mobile trading apps have become essential for traders who want to stay connected to the market while on the go. Many brokers offer mobile versions of popular platforms like MT4 and MT5, enabling Singaporean traders to monitor trades, analyze charts, and execute orders from their smartphones or tablets. Mobile trading provides flexibility, allowing traders to respond quickly to market changes and manage their positions from anywhere.

For Singaporean traders with busy lifestyles, mobile trading options offer convenience and accessibility, making it easier to stay engaged with the market. By choosing a broker with a robust mobile app, traders can ensure they never miss an opportunity to take advantage of price movements in the Forex market.

Resources and Tools for Forex Traders

Educational Resources

Education is key to success in Forex trading, and there are numerous educational resources available to Singaporean traders. Online courses, webinars, e-books, and tutorials provided by brokers and financial websites cover essential topics like technical analysis, risk management, and trading psychology. These resources are designed to help traders build a solid foundation, understand market dynamics, and refine their trading strategies.

For Singaporean traders, dedicating time to education and continuous learning can make a significant difference in trading performance. By investing in quality educational materials, traders can gain the knowledge needed to navigate the Forex market with confidence.

Analytical Tools

Analytical tools, such as economic calendars, news feeds, and sentiment indicators, are crucial for making informed trading decisions. Economic calendars help traders stay updated on important data releases, while sentiment indicators provide insights into the overall market mood. Many trading platforms also offer in-built tools for technical analysis, including charting software and custom indicators, which enable traders to perform in-depth analysis of price trends.

Singaporean traders can enhance their analysis by combining these tools with other resources, allowing them to make data-driven decisions. Utilizing analytical tools effectively can give traders a competitive edge in the market, improving their accuracy and timing in executing trades.

Conclusion

Forex trading is legal in Singapore and operates within a well-regulated framework under the supervision of the Monetary Authority of Singapore (MAS). With a robust regulatory environment, access to global markets, and numerous reputable brokers, Singapore offers an ideal setting for individuals interested in Forex trading. By following local guidelines, choosing MAS-regulated brokers, and practicing sound risk management, Singaporean traders can engage in Forex trading responsibly and confidently.

While Forex trading presents unique opportunities, it also comes with inherent risks, such as market volatility and leverage. To succeed, traders need to focus on education, develop a solid trading plan, and continually adapt to market changes. With dedication, informed decision-making, and a disciplined approach, Singaporean traders can unlock the full potential of Forex trading and achieve their financial goals in this dynamic market.

Read more: