15 minute read

Is Exness safe in India? Review Broker

Introduction to Exness

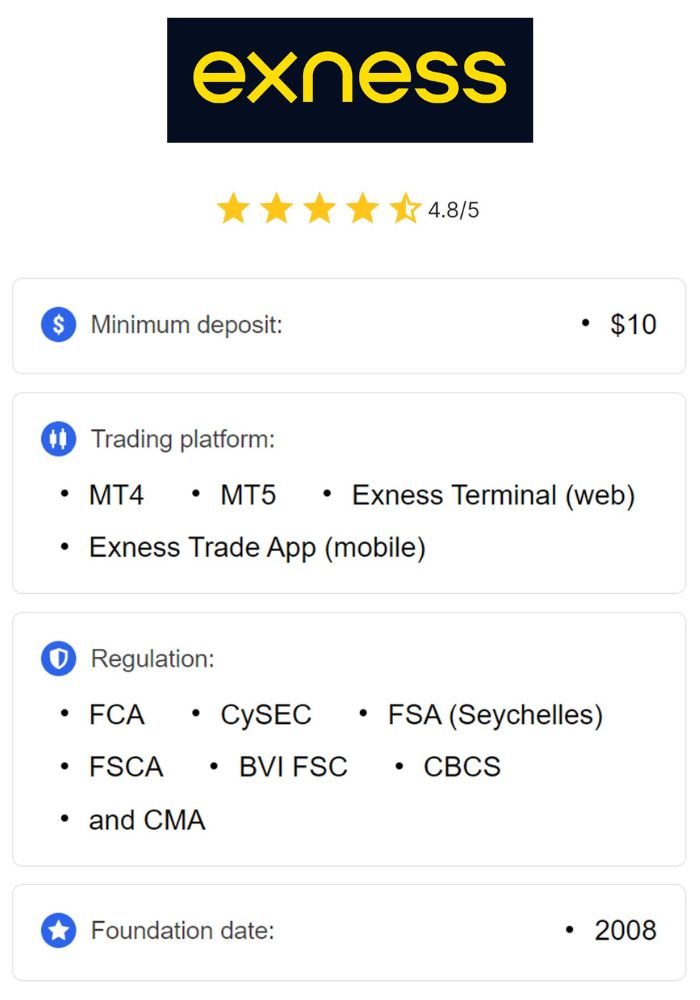

Overview of Exness as a Forex Broker

Exness is a prominent forex and CFD broker founded in 2008, offering access to a wide range of financial instruments including currency pairs, commodities, cryptocurrencies, and indices. Known for its competitive spreads, advanced trading tools, and commitment to transparency, Exness has become a popular choice among traders globally. The broker caters to both novice and professional traders, providing user-friendly platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with a proprietary platform.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With an emphasis on fast execution, low fees, and robust security features, Exness has established itself as a reliable broker within the forex community.

Global Presence and Regulatory Compliance

Exness operates across various regions and holds licenses from several respected regulatory bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-jurisdictional regulation provides traders with a high level of assurance regarding fund security and operational transparency.

While Exness does not hold a local license in India, it remains accessible to Indian traders through its international licenses. However, the absence of local regulation by the Securities and Exchange Board of India (SEBI) raises questions about Exness’s safety for Indian clients, which this article will address in depth.

Understanding Safety in Online Trading

Definition of Safety in Forex Trading

In forex trading, "safety" refers to measures that protect traders' funds and personal information. A safe trading environment includes strict regulatory oversight, secure transaction processes, transparent fee structures, and responsive customer support. These elements work together to provide traders with a secure experience, minimizing the risk of fraud or loss due to broker misconduct.

Safety in forex trading also entails the presence of features like negative balance protection, fund segregation, and encrypted platforms to protect against unauthorized access or cyberattacks.

Importance of Regulation for Traders

Regulation is crucial in the forex industry, as it ensures brokers operate transparently and ethically. Regulated brokers are subject to audits, reporting requirements, and financial standards set by regulatory authorities. For traders, choosing a regulated broker means increased protection against issues like fund mismanagement or fraud. Regulatory bodies often require brokers to implement safety features like client fund segregation, regular audits, and investor compensation schemes.

For Indian traders, regulation is especially important, as it provides a legal framework for dispute resolution and fund protection, offering peace of mind while trading in volatile markets.

Regulatory Framework for Forex Brokers in India

Role of the Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) is the primary regulatory authority overseeing securities markets in India. SEBI regulates domestic brokers, ensures compliance with financial standards, and protects investor interests. In the context of forex trading, SEBI permits trading only in currency pairs involving the Indian Rupee (INR) and mandates that brokers offering forex services must be licensed by SEBI.

SEBI’s regulations are intended to safeguard Indian traders by promoting transparency, enforcing compliance, and reducing risks associated with unregulated brokers. However, due to restrictions on non-INR pairs, Indian traders seeking broader forex options often turn to international brokers like Exness.

Implications of Operating Without Indian Regulations

Exness does not possess a SEBI license, which means it operates outside the regulatory framework established by SEBI. While Exness is regulated internationally, the absence of local regulation has implications for Indian traders:

Limited Legal Recourse: Without SEBI oversight, Indian traders may face challenges in resolving disputes with Exness, as SEBI cannot intervene in cases involving unregulated foreign brokers.

Restrictions on Payment Processing: Regulatory guidelines on foreign remittances may complicate deposits and withdrawals, as transactions with foreign brokers might be scrutinized.

Potential Risk Exposure: Trading with an internationally regulated broker rather than a locally regulated one may expose traders to different levels of risk, given that international regulations may not fully align with Indian standards.

Indian traders should weigh these factors carefully when considering Exness as a trading platform.

Exness Regulatory Status

Licensing and Regulatory Authorities

Exness is regulated by multiple international authorities, providing a high level of credibility and oversight. These regulators include:

Financial Conduct Authority (FCA) in the UK: FCA oversight ensures that Exness adheres to strict standards on transparency and client fund protection.

Cyprus Securities and Exchange Commission (CySEC): CySEC regulation covers Exness’s European operations, enforcing EU financial regulations such as fund segregation and negative balance protection.

Financial Sector Conduct Authority (FSCA) in South Africa: FSCA provides regulatory oversight for Exness’s operations in South Africa, focusing on client fund security and fair trading practices.

While these licenses demonstrate Exness’s commitment to global standards, Indian traders should consider the lack of SEBI regulation when assessing the broker’s suitability.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparison with Other Major Brokers in India

Compared to SEBI-regulated brokers, Exness offers a broader range of trading instruments and higher leverage options, which appeal to many traders. However, SEBI-regulated brokers generally provide more compliant options for Indian traders, offering INR-based pairs and simplified fund transfer options.

Brokers with SEBI licenses may offer less variety but ensure compliance with local regulations, providing a secure alternative for traders prioritizing regulatory oversight within India.

Security Measures Implemented by Exness

Client Fund Protection Mechanisms

Exness employs several measures to safeguard client funds:

Segregated Accounts: Exness keeps client funds in separate accounts from its operational funds, reducing the risk of fund misuse.

Negative Balance Protection: This feature prevents traders from losing more than their account balance, which is particularly important in volatile markets like forex.

Investor Compensation Schemes: In regions regulated by the FCA or CySEC, Exness clients may be eligible for compensation if the broker fails to fulfill its financial obligations.

These fund protection mechanisms make Exness a safe choice for international clients, although they do not cover specific protections for Indian clients due to the absence of SEBI regulation.

Data Encryption and Privacy Policies

Exness prioritizes data security with advanced encryption technology, ensuring that sensitive information, including personal and financial data, remains protected from unauthorized access. The platform complies with General Data Protection Regulation (GDPR) standards, safeguarding clients’ privacy and maintaining secure data handling practices.

This level of security reduces the risk of data breaches, providing Indian traders with confidence that their information is protected.

User Experience and Feedback

Customer Reviews and Testimonials

Customer reviews about Exness are generally positive, with traders highlighting the platform's competitive spreads, fast withdrawal processes, and responsive customer support. Many users appreciate the ease of use of the MT4 and MT5 platforms and the availability of multilingual support.

However, some traders express concerns over regulatory ambiguity in countries like India, as well as occasional issues with withdrawal processing times. These reviews provide a balanced perspective for prospective Indian clients considering Exness.

User Experience and Feedback

Customer Reviews and Testimonials

Exness has garnered a substantial user base worldwide, with mixed reviews from Indian traders. Many traders appreciate Exness’s competitive trading conditions, including low spreads, high leverage options, and access to the popular MT4 and MT5 trading platforms. Fast execution times and near-instant withdrawals, especially for e-wallets, are also frequently mentioned as positive aspects of the Exness experience.

Testimonials often highlight Exness’s commitment to transparency, as users have access to real-time market data, risk management tools, and comprehensive market analysis. The broker’s 24/7 multilingual customer support is another point of praise, particularly among Indian traders who benefit from support in multiple languages. However, some reviews from Indian users indicate concerns over limited INR trading pairs, which SEBI-regulated brokers typically offer.

Common Concerns Among Users

Despite its positive features, Exness has received some feedback on areas where it could improve, especially concerning Indian users. Key concerns include:

Regulatory Ambiguity: Indian traders sometimes express concerns about Exness’s lack of SEBI regulation. Without SEBI oversight, traders may feel uncertain about the legal recourse available in case of disputes. While Exness is regulated internationally, the lack of a SEBI license may be viewed as a risk by some users.

Withdrawal Processing Times: Although Exness is known for fast withdrawals, some users have reported occasional delays, particularly with bank transfers. Processing times may vary depending on the payment method, and delays can be challenging for traders who need quick access to their funds.

Currency Conversion Fees: Since Exness does not support the Indian Rupee (INR) as a base currency, Indian traders may incur currency conversion fees when depositing or withdrawing funds. This additional cost can impact profitability, especially for traders with small account balances.

Payment Method Restrictions: Certain payment methods commonly used in India may not be available with Exness, or they may have additional fees or limitations. This can be a drawback for traders looking for locally tailored solutions.

Overall, while Exness is viewed positively by many traders, Indian users should consider these potential challenges and evaluate how the platform’s strengths and weaknesses align with their trading needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness Trading Conditions

Spreads and Commissions Overview

Exness offers competitive spreads and minimal commissions, making it an appealing choice for cost-conscious traders. Spreads vary based on the account type and market conditions, with tighter spreads available for professional accounts. On popular instruments like XAUUSD (gold) and EURUSD, Exness provides low spreads, which can help minimize trading costs.

For Indian traders, these competitive spreads are advantageous, especially when using high leverage. Exness also offers accounts with no commission fees, which further reduces costs for traders, making it a cost-effective option compared to other brokers.

Leverage and Margin Requirements

Exness provides flexible leverage options, with leverage ratios of up to 1:2000 on certain accounts. High leverage allows traders to control larger positions with smaller amounts of capital, which can be beneficial for experienced traders seeking to maximize returns. However, high leverage also increases risk, and traders should use it cautiously, especially when trading volatile instruments.

For Indian traders, Exness’s leverage options offer the flexibility to trade larger positions while managing limited capital. However, it is essential to practice risk management techniques, such as setting stop-loss orders, to mitigate potential losses in leveraged trades.

Withdrawal and Deposit Methods

Examination of Available Payment Options

Exness offers a variety of deposit and withdrawal methods to cater to the needs of its global user base, including Indian traders. The broker supports payment options such as:

Bank Transfers: Bank transfers provide a secure way to move funds, though processing times can vary based on the bank’s processing policies. Indian traders should note that, without direct INR support, currency conversion may be required.

Credit and Debit Cards: Exness accepts major credit and debit cards, which offer fast processing and ease of use. However, some traders may incur additional fees, particularly if their cards do not support direct forex transactions.

E-wallets: Popular e-wallets like Skrill, Neteller, and WebMoney are supported, known for faster processing times and lower fees. E-wallets are a preferred option for many traders because of their convenience and near-instant transaction capabilities.

Cryptocurrency: Exness also supports withdrawals and deposits via cryptocurrencies, such as Bitcoin. This is particularly beneficial for traders seeking fast, decentralized transactions.

Each payment method comes with its own fees and processing times, and traders are advised to choose the option that best fits their needs, especially if they prioritize speed and cost-efficiency.

Processing Times and Associated Fees

Exness is known for its relatively quick processing times, particularly with e-wallets and cryptocurrency transactions, which are often completed within minutes. For bank transfers and credit/debit card transactions, processing may take longer, typically between 3-5 business days, depending on the trader’s bank.

Exness does not generally charge fees for deposits or withdrawals, which makes it appealing for traders looking to maximize cost-efficiency. However, certain external fees may apply based on the selected payment provider, especially if currency conversion is involved. For Indian traders, this means that while Exness strives for fee transparency, the actual costs may vary according to the method used and any applicable currency conversion rates.

Account Types Offered by Exness

Standard vs. Professional Accounts

Exness offers two primary categories of accounts: Standard and Professional. Each is tailored to suit different trading levels and goals:

Standard Account: The Standard account is ideal for beginner and intermediate traders, featuring low minimum deposits, zero commissions, and accessible spreads. This account type is designed for those who prefer simplicity and minimal trading costs.

Professional Accounts: Exness’s Professional accounts include Raw Spread, Zero, and Pro accounts. These accounts offer tighter spreads, access to higher leverage, and lower commission rates, making them suitable for experienced traders who seek better pricing and more flexibility.

Indian traders can select the account type that best matches their trading style and experience level. Professional accounts generally offer more competitive conditions but may require higher initial deposits.

Suitability for Different Trader Profiles

With both Standard and Professional accounts, Exness accommodates a range of trader profiles. For Indian traders new to forex, the Standard account provides an accessible entry point with straightforward fees and a user-friendly experience. Meanwhile, seasoned traders may benefit from the Professional account options, which cater to advanced strategies through lower spreads and access to higher leverage.

By offering multiple account types, Exness ensures that traders of varying expertise and capital levels can find an account suited to their goals, enhancing its appeal as a versatile broker.

Customer Support and Resources

Availability and Quality of Customer Service

Exness is known for its strong commitment to customer service, offering 24/7 support to assist traders with any issues or questions. Indian traders can access Exness’s support through multiple channels, including:

Live Chat: Available on the Exness website, live chat offers immediate assistance for common inquiries and technical issues.

Email Support: For detailed questions, traders can reach Exness’s support team via email, which is useful for more complex issues that may require thorough explanations.

Phone Support: Exness provides phone support, which is often available in multiple languages. This option is particularly beneficial for Indian traders who may prefer direct communication.

Exness’s customer service has received positive reviews for its quick response times and knowledgeable support staff, which helps maintain a high level of customer satisfaction.

Educational Resources for Traders

Exness offers a range of educational resources to help traders develop their skills and understanding of the forex market. Resources include:

Market Analysis: Exness provides daily market analysis, which covers key events, trends, and forecasts, assisting traders in making informed decisions.

Trading Webinars: The broker regularly hosts webinars on various topics, including technical analysis, trading strategies, and risk management.

Video Tutorials: These cover platform features, account setup, and fundamental trading concepts, which are especially helpful for beginners.

These resources enable Indian traders to improve their trading skills and gain deeper insights into market behavior, making Exness a supportive platform for both learning and trading.

Risk Factors in Trading with Exness

Market Risks Associated with Forex Trading

Forex trading inherently involves market risks due to the volatility of currency pairs and commodities like gold (XAU) and oil. Factors such as economic data releases, geopolitical events, and central bank policies can lead to sudden price changes. Traders using high leverage, as available on Exness, must be especially cautious, as amplified exposure can result in rapid losses if the market moves unfavorably.

Indian traders should recognize that while Exness offers tools for risk management, such as stop-loss orders and negative balance protection, these tools cannot eliminate market risk. Understanding these risks is essential for successful trading.

Specific Risks Related to Exness Operations

Exness, like any international broker operating without SEBI regulation, carries certain risks for Indian traders:

Regulatory Uncertainty: As Exness is not regulated by SEBI, Indian traders may lack the legal protections that SEBI oversight provides. This could limit dispute resolution options and increase vulnerability to regulatory changes.

Potential Transactional Delays: Due to India’s banking regulations and foreign remittance policies, some traders may experience delays in transactions involving foreign brokers, particularly with bank transfers.

Currency Conversion Fees: Since Exness does not support INR as a base currency, Indian traders may face currency conversion fees that could impact profitability.

While Exness has a solid reputation and follows strict international standards, traders in India should carefully evaluate these risks and consider how they align with their trading objectives.

Conclusion on Exness Safety in India

Exness provides a globally recognized and regulated trading environment, with licenses from respected authorities like the FCA and CySEC. For Indian traders, Exness’s competitive spreads, flexible leverage, and secure trading platforms make it an attractive choice for forex trading. However, the lack of SEBI regulation and INR-based trading pairs may present challenges related to legal protections, currency conversion fees, and potential banking limitations.

For traders in India, Exness offers a range of account types, advanced security measures, and educational resources that enhance the trading experience. However, it is essential to weigh these advantages against the risks associated with trading with an international broker operating outside SEBI’s regulatory framework. By understanding Exness’s regulatory status, payment options, and market risks, Indian traders can make informed decisions about whether Exness meets their safety and trading needs.

In conclusion, Exness is a reliable broker with a strong international presence, but Indian traders should exercise caution and consider their own risk tolerance and regulatory preferences before engaging in trading.

Read more:

How to withdraw from Exness to Binance