10 minute read

How many types of accounts are in Exness?

Exness is a globally recognized forex and CFD broker, trusted by over a million traders for its competitive trading conditions, robust platforms, and diverse account offerings. Whether you're a novice dipping your toes into the financial markets or a seasoned trader executing high-frequency strategies, Exness provides a variety of account types tailored to different trading styles and experience levels. In this comprehensive guide, we’ll explore the types of accounts offered by Exness, their features, benefits, and how to choose the right one for your trading goals. By the end, you’ll have a clear understanding of Exness’s account offerings and which one aligns best with your needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overview of Exness Account Types

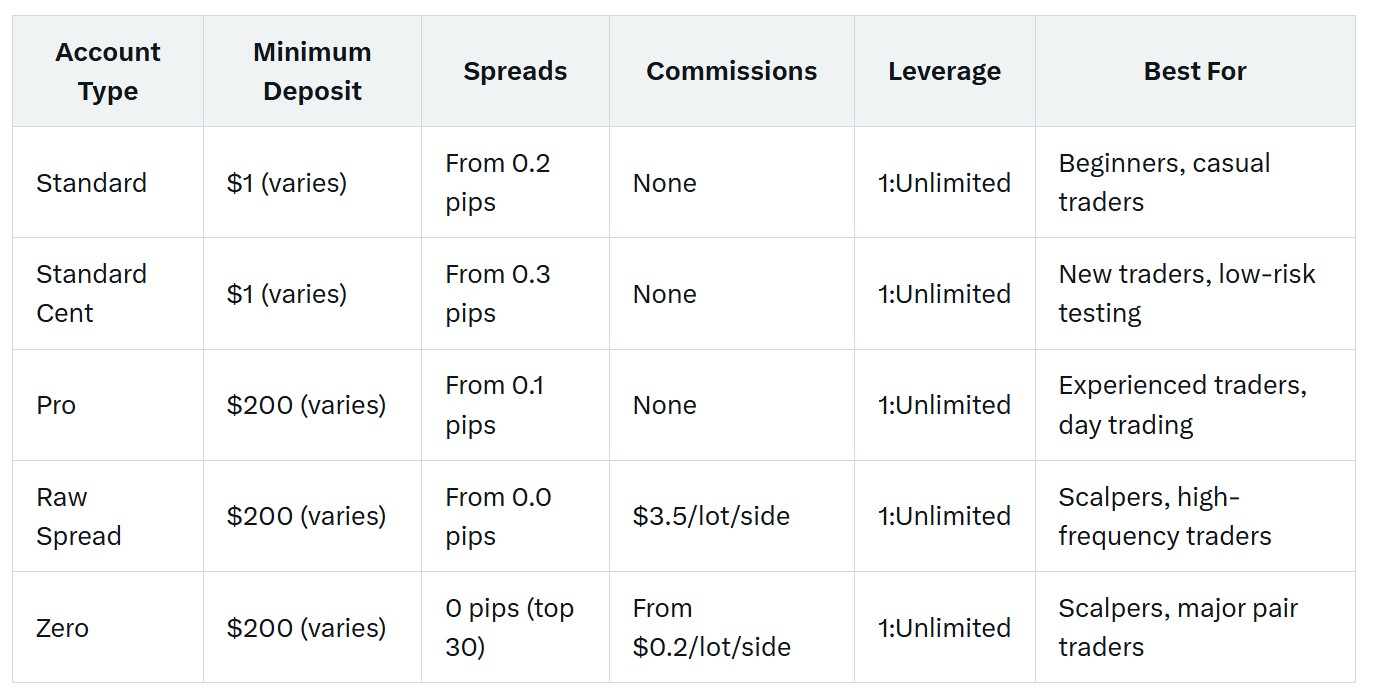

Exness offers a total of five main account types, categorized into two groups: Standard Accounts and Professional Accounts. Additionally, the broker provides Demo Accounts and Islamic Accounts to cater to specific needs. Below, we’ll break down each account type, highlighting their key features, minimum deposits, spreads, commissions, leverage, and ideal use cases.

1. Standard Accounts

Standard Accounts are designed for traders of all levels, particularly beginners and those looking for cost-effective trading with minimal complexity. This category includes two subtypes: Standard and Standard Cent.

a. Standard Account

The Standard Account is Exness’s most popular account, suitable for both beginners and experienced traders due to its versatility and low entry barriers. Key features include:

Minimum Deposit: As low as $1, depending on the payment method. This makes it highly accessible for traders with limited capital.

Spreads: Starting from 0.2 pips, which is competitive for a commission-free account.

Commissions: No commissions, making it cost-effective for casual traders.

Leverage: Up to 1:Unlimited (subject to regional regulations and trading conditions).

Trading Platforms: Available on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness’s proprietary WebTerminal.

Instruments: Access to forex, metals, cryptocurrencies, energies, stocks, and indices.

Execution Type: Market execution for timely order placement.

Lot Sizes: Minimum of 0.01 lots, with a maximum of 200 lots during daytime trading (7:00–20:59 GMT+0) and 60 lots at night (21:00–6:59 GMT+0).

Who It’s For: The Standard Account is ideal for traders who want a straightforward, commission-free trading experience. Its low minimum deposit and wide range of instruments make it perfect for beginners and intermediate traders exploring various markets.

b. Standard Cent Account

The Standard Cent Account is tailored for beginners who want to trade with minimal risk. It uses cent lots, meaning trade volumes are measured in cents rather than dollars, allowing traders to practice with smaller capital.

Minimum Deposit: Starts at $1, depending on the payment method.

Spreads: From 0.3 pips, slightly higher than the Standard Account but still competitive.

Commissions: No commissions.

Leverage: Up to 1:Unlimited (subject to regulations).

Trading Platforms: Available only on MT4.

Instruments: Limited to forex and metals, making it less diverse than the Standard Account.

Lot Sizes: Minimum of 0.01 cent lots, with a maximum of 200 lots (daytime) and 60 lots (nighttime).

Who It’s For: This account is perfect for new traders who want to experience real market conditions with minimal financial risk. It’s also suitable for experienced traders testing new strategies with smaller trade sizes.

2. Professional Accounts

Professional Accounts cater to experienced traders who require advanced features, tighter spreads, and faster execution. This category includes three subtypes: Pro, Raw Spread, and Zero.

a. Pro Account

The Pro Account is designed for traders seeking instant execution and low spreads without commissions. It’s ideal for those who trade larger volumes or employ advanced strategies.

Minimum Deposit: $200 (varies by region).

Spreads: From 0.1 pips, among the lowest for a commission-free account.

Commissions: No commissions.

Leverage: Up to 1:Unlimited (subject to regulations).

Trading Platforms: Available on MT4, MT5, and WebTerminal.

Instruments: Full access to forex, metals, cryptocurrencies, energies, stocks, and indices.

Execution Type: Instant execution for most instruments, ensuring excellent order fill with no requotes.

Who It’s For: The Pro Account suits experienced traders, including day traders and those using automated trading systems, who want fast execution and low spreads without commission costs.

b. Raw Spread Account

The Raw Spread Account offers ultra-low spreads with a fixed commission, making it ideal for high-frequency traders and scalpers who prioritize minimal trading costs.

Minimum Deposit: $200 (varies by region).

Spreads: From 0.0 pips, providing direct access to interbank market prices.

Commissions: Fixed at $3.5 per lot per side ($7 per round lot).

Leverage: Up to 1:Unlimited (subject to regulations).

Trading Platforms: Available on MT4, MT5, and WebTerminal.

Instruments: Full access to all Exness markets, including forex, metals, cryptocurrencies, and more.

Execution Type: Market execution with deep liquidity.

Who It’s For: This account is best for scalpers, high-volume traders, and those using Expert Advisors (EAs) who want the tightest spreads and are comfortable with commission-based trading.

c. Zero Account

The Zero Account provides zero spreads on the top 30 instruments for 95% of the trading day, making it a top choice for traders who prioritize cost efficiency on major currency pairs.

Minimum Deposit: $200 (varies by region).

Spreads: Zero on major instruments (e.g., EUR/USD, USD/JPY) for most of the day, with floating spreads during volatile periods like economic news or rollovers.

Commissions: Starts at $0.2 per lot per side, varying by instrument.

Leverage: Up to 1:Unlimited (subject to regulations).

Trading Platforms: Available on MT4, MT5, and WebTerminal.

Instruments: Full access to all markets.

Execution Type: Market execution with no requotes.

Who It’s For: The Zero Account is ideal for scalpers, high-frequency traders, and those focusing on major currency pairs who want minimal spreads and are willing to pay a small commission.

3. Demo Account

Exness offers a Demo Account for traders to practice strategies in a risk-free environment with virtual funds. Key features include:

Minimum Deposit: None (virtual funds provided, typically $10,000).

Spreads and Commissions: Mirrors the conditions of the selected real account type.

Trading Platforms: Available on MT4, MT5, and WebTerminal.

Instruments: Access to all markets available on real accounts.

Execution Type: Simulates real market conditions.

Who It’s For: Demo Accounts are perfect for beginners learning the ropes and experienced traders testing new strategies or Expert Advisors without risking real capital. Note that Demo Accounts are not available for the Standard Cent Account.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

4. Islamic Account

Exness provides Islamic Accounts (swap-free accounts) for Muslim traders who adhere to Sharia principles, which prohibit earning or paying interest. These accounts are available for all Standard and Professional Account types.

Swap-Free: No overnight interest charges or credits.

Features: Same as the corresponding Standard or Professional Account (e.g., spreads, commissions, leverage).

Eligibility: Available upon request for traders in Islamic countries or those who require swap-free trading.

Who It’s For: Muslim traders seeking Sharia-compliant trading conditions across all account types.

Comparing Exness Account Types

To help you choose the right account, here’s a comparison of key features:

Key Features of Exness Accounts

Exness accounts are designed with flexibility and trader needs in mind. Here are some standout features across all account types:

High Leverage: Up to 1:Unlimited, allowing traders to control larger positions with less capital (subject to regional regulations).

Wide Range of Instruments: Access to forex, metals, cryptocurrencies, energies, stocks, and indices (except Standard Cent, which is limited to forex and metals).

Fast Withdrawals: Over 98% of withdrawals are processed instantly, with funds leaving Exness’s custody in under a minute.

Multiple Platforms: Support for MT4, MT5, and Exness’s WebTerminal, ensuring compatibility with various trading styles.

Regulation and Security: Exness is regulated by multiple authorities, including CySEC, FCA, FSCA, and others, ensuring a secure trading environment.

Swap-Free Options: Available for Islamic Accounts and extended swap-free status for clients in non-Islamic countries.

How to Choose the Right Exness Account

Selecting the right Exness account depends on your trading experience, capital, and strategy. Here’s a guide to help you decide:

For Beginners:

Standard Cent Account: Ideal for those new to trading who want to practice with minimal risk using cent lots.

Standard Account: Suitable for beginners with slightly more capital who want access to a broader range of instruments without commissions.

Demo Account: Perfect for learning the platform and testing strategies without financial risk.

For Intermediate Traders:

Standard Account: Offers a balance of low costs and versatility, suitable for exploring various markets and strategies.

Pro Account: Provides tighter spreads and instant execution for traders transitioning to more advanced strategies.

For Experienced Traders:

Raw Spread Account: Best for scalpers and high-frequency traders who need ultra-low spreads and are comfortable with commissions.

Zero Account: Ideal for those focusing on major currency pairs and seeking zero spreads for most of the trading day.

Pro Account: Suits traders who prefer commission-free trading with fast execution and access to all instruments.

For Muslim Traders:

Islamic Account: Available across all account types, ensuring Sharia-compliant trading without swap fees.

How to Open an Exness Account

Opening an account with Exness is straightforward and takes just a few minutes. Follow these steps:

Visit the Exness Website: Go to the official Exness website: Open An Account or Visit Brokers 🏆

Register: Provide your details (name, email, phone number, and password).

Choose Account Type: Select your preferred account type (Standard, Standard Cent, Pro, Raw Spread, or Zero) and trading platform (MT4, MT5, or WebTerminal).

Verify Identity: Complete the Know Your Customer (KYC) process by uploading identification documents.

Deposit Funds: Choose from over 15 payment methods, including bank transfers, cards, and e-wallets, to fund your account.

Start Trading: Log in to your chosen platform and begin trading.

For Demo Accounts, you can skip the deposit and verification steps and start practicing immediately after registration.

Benefits of Trading with Exness

Exness stands out in the forex and CFD industry for several reasons:

Low Trading Costs: Competitive spreads and low or no commissions, depending on the account type.

High Leverage: Up to 1:Unlimited, allowing traders to maximize their capital (with caution due to high risk).

Fast Execution: Instant and market execution options ensure minimal slippage.

Global Regulation: Licensed by trusted authorities, ensuring transparency and security.

Flexible Platforms: Support for MT4, MT5, and WebTerminal caters to all trading preferences.

Instant Withdrawals: Over 98% of withdrawals are processed instantly, a rare feature in the industry.

Risks and Considerations

While Exness offers attractive trading conditions, forex and CFD trading carries significant risks. According to Exness, 84.19% of retail investor accounts lose money due to leverage. Traders should:

Understand the risks of high leverage, which can amplify both profits and losses.

Use Demo Accounts to practice before trading with real money.

Choose an account type that aligns with their risk tolerance and trading goals.

Be aware of regional restrictions, as Exness prohibits residents from certain countries (e.g., the U.S.) from opening accounts.

Conclusion

Exness offers a diverse range of account types to suit traders of all levels, from beginners to professionals. The Standard and Standard Cent accounts are ideal for those starting out or seeking low-risk trading, while the Pro, Raw Spread, and Zero accounts cater to experienced traders with advanced strategies. Additionally, Demo Accounts provide a risk-free environment for practice, and Islamic Accounts ensure Sharia-compliant trading.

When choosing an Exness account, consider your experience, trading style, capital, and risk tolerance. By selecting the right account and leveraging Exness’s competitive conditions, you can optimize your trading experience and work toward your financial goals. Visit the Exness website to open an account today and explore their robust trading platforms and tools.

💥 Note: To enjoy the benefits of the partner code, such as trading fee rebates, you need to register with Exness through this link: Open An Account or Visit Brokers 🏆

Read more: