5 minute read

Exness Account Opening Charges in India

from Exness

by Exness_Blog

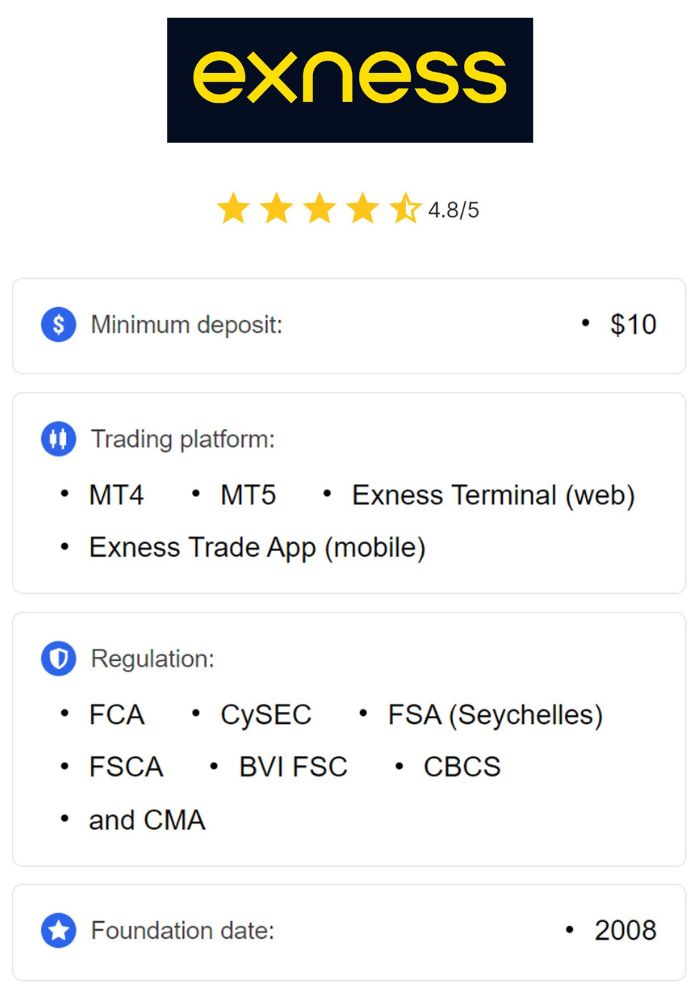

Are you considering trading on Exness but wondering about the account opening charges in India? Many traders hesitate to sign up due to concerns about hidden fees. However, the good news is that opening an Exness account in India is completely free!

Unlike many brokers that charge an account opening fee, Exness allows Indian traders to create an account without any charges. This makes it one of the most accessible and beginner-friendly trading platforms in the country.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In this detailed guide, we will cover:

✅ Exness account opening process & charges in India✅ Types of accounts available on Exness✅ Deposits, withdrawals, and trading costs✅ Hidden fees and how to avoid unnecessary expenses✅ Why Exness is a cost-effective broker for Indian traders

By the end of this article, you will have a clear understanding of Exness’s cost structure and why it is one of the best choices for traders in India.

1. Does Exness Charge a Fee for Opening an Account in India?

The simple answer is NO – Exness does not charge any fee for opening an account in India.

Many brokers impose registration or activation fees, but Exness offers a completely free account creation process. Whether you are a beginner or a professional trader, you can sign up and start trading without any upfront cost.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

1.1 Why Does Exness Offer Free Account Opening?

Exness is a globally trusted forex broker that prioritizes accessibility and transparency. By offering free account opening, they encourage more traders to explore the forex market without financial barriers.

✔ No registration fees✔ No activation charges✔ No minimum deposit for Standard Accounts

This makes Exness one of the best options for traders in India who want to start trading without worrying about extra costs.

2. How to Open an Exness Account in India? (Step-by-Step Guide)

Opening an Exness account in India is quick, easy, and completely free. Follow these simple steps:

Step 1: Visit the Exness Official Website

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Step 2: Enter Your Details

Fill in the registration form with:✔ Email address✔ Phone number✔ Secure password

Step 3: Verify Your Identity (KYC Process)

For regulatory compliance, Exness requires Know Your Customer (KYC) verification. Upload:✔ A government-issued ID (Aadhaar, PAN, or Passport)✔ Proof of address (Bank statement, utility bill, or rental agreement)

Step 4: Choose Your Account Type

Select the trading account that suits your strategy (Standard, Raw Spread, Zero, or Pro).

Step 5: Deposit Funds & Start Trading

While Exness does not charge an account opening fee, you will need to deposit funds to start trading.

3. What Are the Different Types of Exness Accounts?

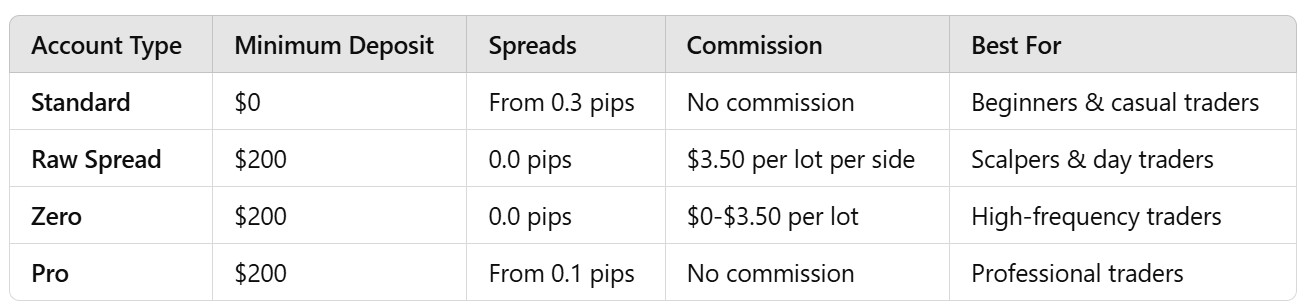

Exness offers four main types of accounts, each designed for different trading styles.

✔ If you are a beginner, the Standard Account is the best choice because there is no minimum deposit requirement.✔ If you want the lowest trading costs, the Raw Spread or Zero Account is ideal.

Regardless of which account you choose, opening an account remains 100% free.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

4. Exness Deposit & Withdrawal Charges in India

Exness provides instant deposits and fast withdrawals with no additional fees.

4.1 Deposit Charges

Exness does not charge any deposit fees in India. Traders can deposit funds using:

✔ UPI (Google Pay, PhonePe, Paytm, etc.)✔ Net Banking (IMPS, NEFT, RTGS)✔ Debit/Credit Cards (Visa, MasterCard, RuPay)✔ E-wallets (Skrill, Neteller, Perfect Money)✔ Cryptocurrencies (Bitcoin, Ethereum, USDT, etc.)

All deposits are processed instantly or within a few hours.

4.2 Withdrawal Charges

✔ No withdrawal fees for most payment methods.✔ Fast processing time (24 hours for bank transfers, instant for e-wallets).

However, some third-party payment providers may charge transaction fees, which are beyond Exness’s control.

5. Exness Trading Costs – What You Should Know

While opening an account is free, traders should be aware of standard trading costs.

5.1 Spread Charges

A spread is the difference between the bid and ask price. Exness offers:✔ Standard Account – Spreads from 0.3 pips.✔ Raw Spread & Zero Accounts – Spreads from 0.0 pips.

5.2 Commission Fees

✔ Standard & Pro Accounts – No commission.✔ Raw Spread & Zero Accounts – $3.50 per lot per side.

5.3 Swap Fees (Overnight Charges)

If you hold a position overnight, Exness may charge a small swap fee. However, Muslim traders can opt for a swap-free account.

6. Hidden Fees? What You Need to Know

Exness is one of the most transparent brokers in the forex industry. However, here are a few potential costs to be aware of:

✔ Inactivity Fee: Exness does not charge an inactivity fee. Your funds remain safe even if you don’t trade for months.✔ Conversion Fees: If you deposit in INR but your trading account is in USD, a currency conversion fee may apply.

💡 Tip: To avoid conversion fees, select a trading account in INR or use a multi-currency wallet.

7. Why Exness Is the Best Choice for Indian Traders?

Exness is one of the most affordable and beginner-friendly forex brokers in India.

✔ Zero account opening charges✔ No deposit or withdrawal fees✔ No inactivity fees✔ Low trading costs & tight spreads✔ Fast and easy KYC process

With over 600,000 active traders, Exness is a trusted platform that ensures cost-effective trading for Indian investors.

Conclusion – Exness Account Opening Is 100% Free in India!

If you are looking for a forex broker with no account opening fees, Exness is the perfect choice. Registering an account is completely free, and there are no hidden costs.

✔ No registration or activation charges✔ No deposit or withdrawal fees✔ Zero inactivity charges

Ready to start trading?👉 Sign up for Exness today and trade with zero account opening fees! 🚀

Read more: