8 minute read

Is forex trading legal in Japan? A Comprehensive Guide

from Exness

by Exness_Blog

In recent years, the world of Forex (foreign exchange) trading has attracted investors from all corners of the globe, and Japan is no exception. As one of the largest financial markets globally, Forex trading in Japan is a topic of considerable interest. However, many aspiring traders are often left wondering whether Forex trading is legal in Japan and what regulations govern this dynamic and fast-paced market.

Top 4 Best Forex Brokers in Japan

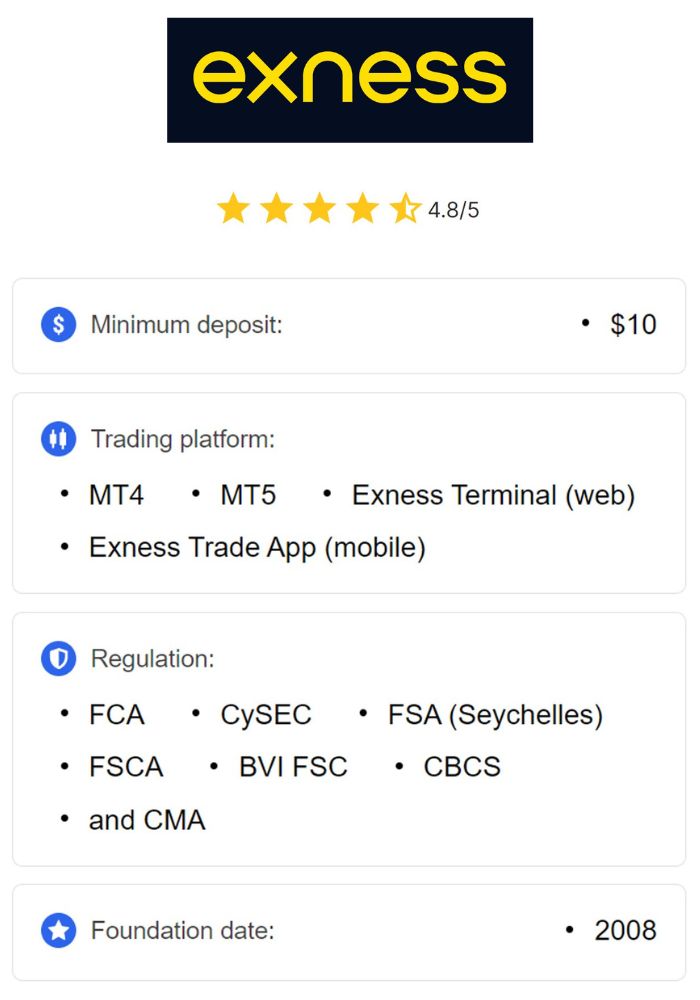

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this article, we will explore the legal framework surrounding Forex trading in Japan, the regulatory bodies involved, and the key considerations for those interested in engaging in this financial market. Whether you are a seasoned trader or just getting started, understanding the legalities of Forex trading in Japan is crucial to ensure compliance and make informed decisions.

Understanding Forex Trading: A Brief Overview

Before diving into the legalities, it's essential to understand what Forex trading entails. Forex trading involves the buying and selling of currencies on the global market. The goal is to profit from fluctuations in exchange rates between different currencies. The Forex market operates 24 hours a day, five days a week, and is considered the largest financial market in the world by daily trading volume.

In Forex trading, individuals can trade currency pairs, such as EUR/USD, JPY/USD, GBP/JPY, and others. Investors typically use leverage to maximize their trading potential. While Forex trading can be lucrative, it is also highly speculative and carries significant risk.

Is Forex Trading Legal in Japan?

Yes, Forex trading is legal in Japan. In fact, Japan is one of the most regulated Forex markets globally. Forex trading has gained immense popularity in the country, especially among retail traders. Japan's well-established financial system, coupled with advanced technological infrastructure, has created a conducive environment for Forex trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

However, like any financial activity, Forex trading in Japan is subject to strict regulations to ensure that investors are protected and that the market remains transparent and orderly. Understanding the legal framework surrounding Forex trading in Japan is essential to avoid falling foul of the law and to operate within the confines of established rules.

The Role of Japanese Regulatory Bodies in Forex Trading

Several regulatory bodies govern Forex trading in Japan to ensure fair practices, consumer protection, and financial stability. These institutions have set forth rules and guidelines that Forex brokers and traders must adhere to.

1. Financial Services Agency (FSA)

The Financial Services Agency (FSA) is the primary regulatory authority overseeing financial markets in Japan, including Forex trading. The FSA's role is to protect consumers, maintain the stability of the financial system, and ensure transparency in the financial markets.

The FSA oversees the operations of Forex brokers and financial institutions in Japan and ensures they comply with the country's legal and regulatory requirements. Forex brokers wishing to operate in Japan must be licensed by the FSA. This ensures that they meet specific standards for transparency, consumer protection, and financial soundness.

The FSA also sets guidelines regarding leverage limits, margin requirements, and the handling of client funds. These regulations help protect retail traders from excessive risk exposure, making Forex trading in Japan safer.

2. Japan Securities Dealers Association (JSDA)

The Japan Securities Dealers Association (JSDA) is another crucial regulatory body in the country. While the FSA primarily oversees the broader financial landscape, the JSDA focuses specifically on the securities and Forex markets. The JSDA has established guidelines for Forex brokers to follow and promotes best practices within the industry.

Forex brokers in Japan are required to be members of the JSDA, which means they must follow a code of conduct that prioritizes transparency, integrity, and fair dealing. The JSDA also provides investor education and works to ensure that traders have access to accurate information about the risks associated with Forex trading.

3. Financial Futures Association of Japan (FFAJ)

The Financial Futures Association of Japan (FFAJ) is another important regulatory body that governs Forex trading in Japan. The FFAJ is responsible for ensuring that Forex brokers adhere to strict standards regarding business operations, client protection, and risk management.

In addition to its regulatory duties, the FFAJ provides a self-regulatory framework for brokers and traders. It offers guidelines for handling client funds, managing risk, and maintaining fair practices within the Forex market.

Key Regulations for Forex Trading in Japan

As part of its commitment to maintaining a stable and transparent financial environment, Japan has implemented several regulations that govern Forex trading activities. Some of the key regulations include:

1. Leverage Limits

One of the most important regulations for Forex traders in Japan is the restriction on leverage. The FSA has imposed strict leverage limits on retail Forex traders to minimize the risk of excessive loss.

As of 2019, the maximum leverage allowed for Forex trading in Japan is 25:1 for major currency pairs and 10:1 for minors. This means that for every ¥1 of your own capital, you can control up to ¥25 worth of currency for major pairs, and ¥10 worth for minor pairs.

This limit is lower than the leverage available in many other countries, where traders can access leverage of up to 100:1 or even 500:1. While this regulation may seem restrictive, it is designed to protect retail investors from high levels of risk and prevent financial losses that could exceed their capital.

2. Margin Requirements

In addition to leverage limits, Forex brokers in Japan are required to adhere to strict margin requirements. Margin refers to the amount of capital a trader must deposit with a broker in order to open and maintain a position in the market.

The margin requirements are designed to ensure that traders have sufficient funds to cover potential losses. The FSA requires brokers to provide clear information about margin requirements and to ensure that traders are not overexposed to risk.

3. Disclosure and Transparency

Forex brokers in Japan are required to disclose important information to traders, including the risks associated with trading, the terms and conditions of their services, and their fee structures. Transparency is a critical aspect of Japan's regulatory framework, ensuring that traders can make informed decisions.

4. Client Fund Protection

Forex brokers in Japan are required to segregate client funds from their own operational funds. This ensures that client funds are protected in the event that the broker faces financial difficulties. Additionally, brokers must maintain capital reserves to cover potential liabilities and protect clients' interests.

5. Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Forex brokers in Japan must comply with strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These regulations are designed to prevent illicit activities such as money laundering and terrorist financing. Brokers are required to verify the identity of their clients and monitor transactions for suspicious activity.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Benefits of Forex Trading in Japan

Forex trading in Japan offers several advantages for both retail and institutional traders. Some of the key benefits include:

1. Highly Liquid Market

The Japanese Yen (JPY) is one of the most traded currencies in the world, making the Forex market in Japan highly liquid. Liquidity refers to the ability to buy or sell a currency pair without significantly affecting its price. A highly liquid market ensures that traders can enter and exit positions with ease.

2. Advanced Trading Platforms

Japan is home to some of the most advanced trading platforms and technologies in the world. Traders in Japan have access to a range of sophisticated tools for analyzing the market, managing trades, and executing orders. These platforms provide traders with real-time data, technical analysis tools, and automated trading options.

3. Strong Regulatory Framework

Japan's robust regulatory framework provides traders with a sense of security and confidence. The FSA, JSDA, and FFAJ work together to ensure that Forex brokers and traders operate in a transparent and fair environment. This reduces the risk of fraud and helps protect investors' interests.

4. Educational Resources

Japan has a well-established network of educational resources for Forex traders. Many brokers and financial institutions provide training materials, webinars, and seminars to help traders develop their skills and knowledge. Additionally, the government and regulatory bodies promote financial literacy, making it easier for traders to understand the risks involved in Forex trading.

Conclusion

Forex trading is indeed legal in Japan, and the country offers a well-regulated environment for retail and institutional traders alike. The stringent regulatory framework ensures that Forex brokers adhere to high standards of transparency, client protection, and financial stability. By complying with the guidelines set forth by regulatory bodies such as the FSA, JSDA, and FFAJ, traders can participate in the Forex market with confidence.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

However, it is essential for traders to be aware of the leverage limits, margin requirements, and other regulations that govern Forex trading in Japan. As with any financial activity, Forex trading carries inherent risks, and it is important to trade responsibly and with a clear understanding of the market.

If you are considering entering the Forex market in Japan, it is advisable to choose a licensed and regulated broker, familiarize yourself with the local regulations, and continuously educate yourself on the risks and opportunities in this dynamic market. With the right knowledge and tools, Forex trading can be a rewarding venture for those who approach it with caution and diligence.

Read more: