6 minute read

Is forex trading legal in Jamaica? A Comprehensive Guide

Forex trading has become a popular way to invest and trade currencies worldwide, and many Jamaican traders are interested in entering the market. However, a key question arises: Is forex trading legal in Jamaica?

The short answer is yes, forex trading is legal in Jamaica, but it is not heavily regulated compared to other financial markets. The Bank of Jamaica (BOJ) and the Financial Services Commission (FSC) oversee financial activities, but forex trading remains largely unregulated, meaning traders must take extra precautions when choosing brokers.

Top 4 Best Forex Brokers in Jamaica

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

In this guide, we will cover:

The legal status of forex trading in Jamaica.

The regulatory authorities governing financial markets.

The challenges and risks for Jamaican forex traders.

The best forex brokers for Jamaica.

How to trade forex legally and safely in Jamaica.

1. The Legal Status of Forex Trading in Jamaica

Forex trading is legal in Jamaica, but it is not fully regulated by local financial authorities. This means:

✅ Jamaican residents can trade forex through international brokers.✅ There are no laws prohibiting forex trading for individuals.✅ Jamaican traders must use foreign forex brokers, as local brokerage firms do not offer forex services.

What is Allowed?

✔️ Trading forex through regulated offshore brokers.✔️ Using online trading platforms such as MetaTrader 4, MetaTrader 5, cTrader.✔️ Depositing and withdrawing funds via bank transfers, credit cards, and e-wallets.

What is Restricted?

❌ No locally licensed forex brokers operate in Jamaica.❌ No official regulatory framework for forex brokers in Jamaica.❌ High-risk trading schemes and unregulated brokers can lead to scams.

Since forex trading in Jamaica is not fully regulated, traders must be cautious when selecting a reliable broker to avoid fraud and financial losses.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

2. Regulatory Authorities Governing Forex Trading in Jamaica

Jamaica has two main financial regulatory bodies:

A. Bank of Jamaica (BOJ)

The Bank of Jamaica (BOJ) is the central bank and oversees:

Monetary policy and foreign exchange transactions.

Commercial banks and licensed financial institutions.

Foreign exchange dealer regulations.

However, BOJ does not directly regulate forex brokers or provide any licensing framework for them.

B. Financial Services Commission (FSC)

The Financial Services Commission (FSC) regulates Jamaica’s financial sector, including:

Securities and investment firms.

Insurance companies and pension funds.

Fraud prevention and financial market monitoring.

Despite overseeing financial markets, the FSC does not regulate forex brokers, meaning forex trading in Jamaica operates in a gray area.

This means that Jamaican traders must rely on foreign brokers regulated by international authorities such as:✅ Financial Conduct Authority (FCA) – UK✅ Australian Securities and Investments Commission (ASIC) – Australia✅ Cyprus Securities and Exchange Commission (CySEC) – Europe

By using well-regulated offshore brokers, Jamaican traders can enjoy a secure trading environment and avoid fraudulent schemes.

3. Challenges and Risks of Forex Trading in Jamaica

Although forex trading is legal in Jamaica, traders face several challenges and risks:

A. Lack of Local Regulations

Jamaica does not have a formal regulatory framework for forex brokers, which means:

No Jamaican forex brokers are licensed locally.

Traders must rely on offshore forex brokers, which may not always be safe.

There is no government protection for forex traders in case of disputes.

B. Risk of Forex Scams

Since forex trading is unregulated in Jamaica, many fraudulent brokers target Jamaican traders with:❌ Fake forex investment programs.❌ High-leverage trading schemes.❌ Unlicensed brokers offering unrealistic returns.

To avoid scams, traders must only use brokers regulated by top-tier financial authorities.

C. Currency Exchange Restrictions

The Jamaican dollar (JMD) is not a major currency, which means:

Forex trading is mostly done in USD, EUR, or GBP.

High conversion fees may apply when depositing and withdrawing funds.

Some forex brokers may not support Jamaican bank transfers.

D. Limited Access to Forex Education

Many Jamaican traders face difficulties in accessing high-quality forex education, which leads to:

Lack of proper risk management.

Higher chances of losing money due to inexperience.

Increased exposure to scam brokers and investment schemes.

To become successful in forex trading, Jamaican traders must invest in proper education, risk management strategies, and use reputable brokers.

4. Best Forex Brokers for Traders in Jamaica

Since there are no locally licensed forex brokers in Jamaica, traders must rely on internationally regulated brokers. Here are some of the best options:

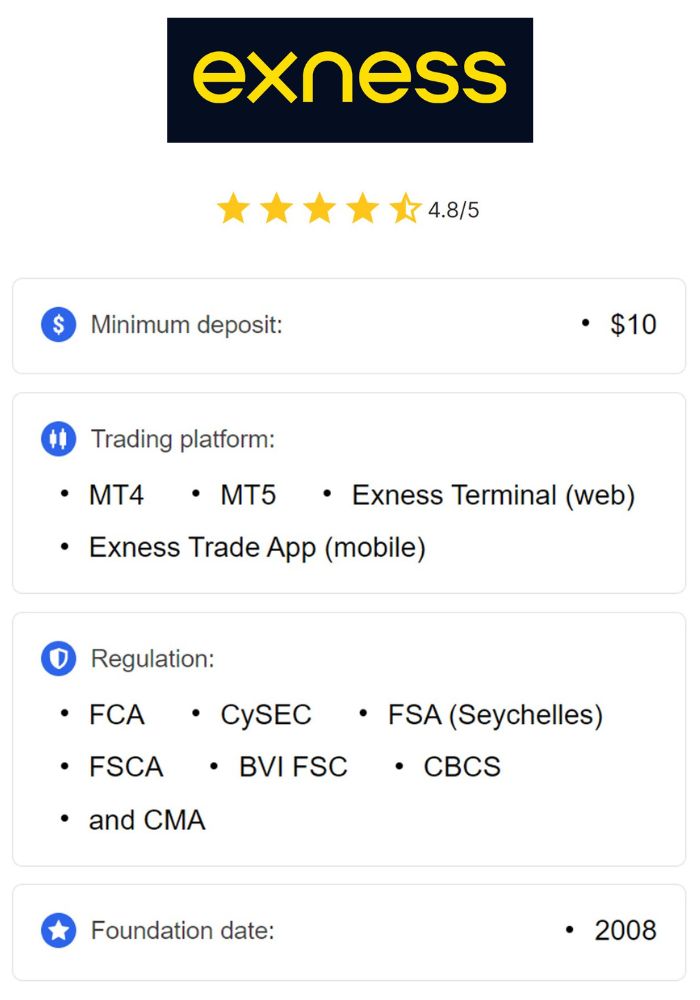

1. Exness 🏆

Best overall broker for Jamaicans

Low spreads and fast execution

Regulated by FCA, CySEC, and FSCA

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

2. IC Markets

Best for ECN trading and low commissions

Supports MetaTrader 4, MetaTrader 5, and cTrader

Regulated by ASIC and CySEC

3. Pepperstone

Excellent for scalping and day trading

No dealing desk execution

FCA and ASIC regulated

4. XM

Best for beginner traders

Low deposit requirements

Offers free forex education and webinars

5. FXTM

Strong presence in the Caribbean

Multiple deposit and withdrawal methods

Regulated by FCA, CySEC, and FSCA

When choosing a forex broker, ensure they offer:✔️ Regulation by top-tier authorities✔️ Low trading fees and fast withdrawals✔️ Jamaican-friendly payment options

5. How to Trade Forex Legally and Safely in Jamaica

Since forex trading is not regulated in Jamaica, traders must take extra precautions to trade safely. Follow these steps:

Step 1: Choose a Reputable Forex Broker

✅ Check for FCA, ASIC, or CySEC regulation.✅ Ensure the broker offers secure deposit and withdrawal methods.✅ Look for low spreads, fast execution, and strong customer support.

Step 2: Use Secure Payment Methods

✅ Jamaican-friendly deposit options (credit cards, e-wallets, crypto).✅ Check for low transaction fees.✅ Avoid brokers with long withdrawal processing times.

Step 3: Learn Forex Trading Strategies

✅ Use demo accounts before trading real money.✅ Study risk management techniques (stop-loss, take-profit).✅ Learn from reputable forex education platforms.

Step 4: Avoid Forex Scams

❌ Stay away from brokers offering guaranteed profits.❌ Do not invest in "get-rich-quick" forex schemes.❌ Verify broker licenses before signing up.

6. Conclusion: Is Forex Trading Legal in Jamaica?

Yes, forex trading is legal in Jamaica, but it is not regulated by local financial authorities. This means traders must rely on offshore forex brokers that are licensed by reputable regulators.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Key Takeaways:

✔️ Forex trading is allowed but unregulated in Jamaica.✔️ The BOJ and FSC do not license forex brokers.✔️ Traders must use offshore brokers regulated by FCA, ASIC, CySEC.✔️ Avoid scams and high-risk trading schemes.✔️ Choose reputable brokers and practice proper risk management.

By following these guidelines, Jamaican traders can participate in forex trading legally and safely while minimizing risks. 🚀

Read more: