9 minute read

How to change USD to INR in Exness

from Exness

by Exness_Blog

Changing currencies is an essential process for traders, especially those who deal with different markets around the world. This article provides a comprehensive guide on how to change USD to INR in Exness, a popular trading platform known for its user-friendly interface and competitive features.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Currency Conversion on Exness

Currency conversion is a fundamental aspect of trading in forex markets. It allows traders to switch from one currency to another, enabling them to make profits based on exchange rate movements. In this section, we will delve into the basics of currency pairs, why understanding exchange rates is crucial, and how these factors come into play when trading through Exness.

Understanding Currency Pairs

In forex trading, currencies are traded in pairs, such as USD/INR, which represents the value of the US Dollar against the Indian Rupee.

Knowing how to read currency pairs is vital for effective trading. The first currency (the base currency) is the one you are buying or selling, while the second currency (the quote currency) tells you how much of the second currency is needed to purchase one unit of the first currency.

When converting USD to INR, it's important to keep an eye on the current exchange rate and market trends. Knowing how to interpret these pairs can be the difference between making a profit or incurring losses.

Importance of Exchange Rates

Exchange rates fluctuate due to various factors, including economic conditions, political stability, and market speculation.

For traders on Exness, understanding these rates is critical because they directly affect the profitability of trades. An unfavorable exchange rate can lead to significant losses, while a favorable one can yield substantial gains. Hence, monitoring exchange rates is essential when planning to convert USD to INR.

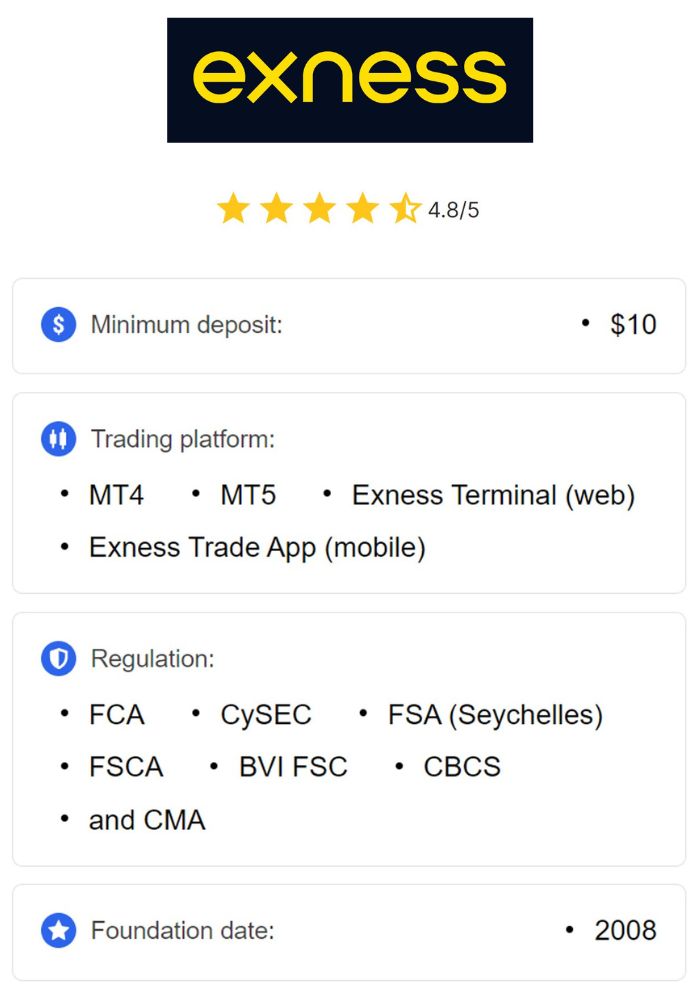

Overview of Exness Trading Platform

Exness is renowned for its robust trading platform that caters to both novice and experienced traders. This platform offers various features and account types, allowing users to tailor their trading experience according to their needs.

Key Features of Exness

One standout feature of Exness is its intuitive trading interface, designed to facilitate seamless navigation.

The platform supports multiple types of orders, enabling traders to execute their strategies effectively. Moreover, Exness provides advanced tools, such as real-time analytics and customizable charts, helping users stay informed about market movements.

Additionally, the low spreads offered by Exness allow traders to maximize their potential profits.

Types of Accounts Offered by Exness

Exness provides different account types, each catering to varying trading styles and needs.

From standard accounts suitable for beginners to professional accounts that cater to seasoned traders, the platform ensures that users can choose an account type that aligns with their trading objectives. Some accounts also offer leverage options, which can amplify both gains and risks.

Understanding the differences between these account types is crucial before deciding how to change USD to INR in Exness.

Steps to Create an Exness Account

Setting up an account on Exness is straightforward, but it requires attention to detail to ensure that all requirements are met for a smooth trading experience.

Registration Process

To begin, prospective traders must visit the Exness website and complete the registration form.

This involves providing personal details like name, email address, and phone number. Once registered, the platform will send a verification link via email to confirm the user's account.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

After confirming the email address, users can log in to their Exness account and proceed to set up their trading profile.

Verification Requirements

Verification is a crucial step in the registration process.

Exness mandates that users submit identification documents to comply with regulatory standards. Typically, this involves uploading a government-issued photo ID and proof of residence.

Completing this step promptly not only secures the account but also facilitates smoother transactions when converting USD to INR.

Setting Up Your Trading Account for Currency Conversion

Once your Exness account is created and verified, it's time to set up your trading account specifically for currency conversions.

Choosing the Right Account Type

Selecting the right account type is imperative for successful trading.

Each account type at Exness has unique features and benefits tailored to different trading goals. For example, if your primary focus is on forex trading, a standard or pro account may be appropriate due to lower spreads and better execution speeds.

Consider your trading frequency, required leverage, and risk tolerance when choosing the account type best suited for converting USD to INR.

Selecting Base Currency

The base currency in your trading account determines the currency you’ll use for deposits and withdrawals.

Exness allows you to choose your base currency when setting up your account. If you plan to convert USD to INR frequently, consider selecting USD as your base currency. This choice minimizes conversion fees and makes the trading process more efficient.

Understanding USD to INR Exchange Rate

Having a firm grasp of the USD to INR exchange rate is essential when trading on Exness. Understanding what influences this rate can provide valuable insights for traders.

Factors Influencing Exchange Rates

Several factors influence exchange rates, including interest rates, inflation, and economic stability.

For instance, if the Federal Reserve announces an increase in interest rates, the USD could strengthen against the INR, making it more expensive to convert USD to INR.

Other elements, such as geopolitical events or impending elections, can also cause fluctuations. Keeping abreast of news related to these factors is vital for making informed trading decisions.

How to Monitor Live Exchange Rates

Exness provides tools to monitor live exchange rates, ensuring traders have real-time data at their fingertips.

Utilizing platforms like trading terminals or mobile applications enables traders to track changes swiftly. Many traders prefer using technical indicators within these platforms to predict price movements and capitalize on opportunities.

How to Deposit Funds in Exness

Before converting USD to INR, traders must deposit funds into their Exness account. The following sections outline available deposit methods and minimum requirements.

Available Deposit Methods

Exness offers several deposit methods, including bank transfers, credit/debit cards, and e-wallets.

Each method has its advantages and disadvantages. For example, e-wallets might provide faster processing times, while bank transfers may be more suitable for larger deposits. Traders should select a method that aligns with their financial strategies and urgency.

Minimum Deposit Amounts

The minimum deposit amount varies depending on the chosen method and account type.

While some accounts may allow deposits as low as $1, others might require higher amounts. It's essential to check Exness's guidelines regarding minimum deposits to avoid any inconveniences during the funding process.

Converting USD to INR within Exness

Now that you have deposited funds, let’s discuss how to convert USD to INR on the Exness platform successfully.

Accessing the Trading Terminal

Once logged into your Exness account, navigate to the trading terminal, which serves as the hub for executing trades.

Here, you'll find a range of options, including currency pairs, charts, and market analysis tools. Familiarize yourself with the layout to enhance your trading efficiency.

Executing a Currency Trade

To convert USD to INR, search for the USD/INR currency pair within the trading terminal.

Select the amount you wish to trade and choose the order type. You can opt for market orders, which execute immediately at current prices, or limit orders that execute when the price reaches a specified level. Execute the trade, and the conversion will occur instantly.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Fees and Charges

Trading often comes with associated costs, so understanding fees and charges is crucial for maintaining profitability.

Transaction Fees for Currency Conversion

Exness generally does not charge transaction fees for currency conversions; however, always check for updates, as policies may change.

It’s advisable to review the fee structure before placing any trades, as other costs related to spreads and swaps may still apply.

Spread and Swap Rates Explained

Spread is the difference between the bid and ask price in a forex trade.

A narrower spread can enhance profitability, especially for frequent traders. Additionally, swap rates come into play for overnight positions and vary by currency pair. Understanding these concepts is vital for managing trading expenses.

Tips for Successful Currency Trading

Successful trading requires knowledge and strategy. Below are some tips to enhance your currency trading experience.

Analyzing Market Trends

Staying abreast of market trends allows traders to make proactive decisions rather than reactive ones.

By regularly analyzing economic reports and global events, traders can better anticipate price movements and adjust their strategies accordingly. Utilizing trend analysis tools can provide additional insights into potential opportunities.

Utilizing Technical Analysis Tools

Technical analysis involves studying historical price data to forecast future movements.

Exness offers various analytical tools that traders can use to identify patterns and make informed decisions. Combining these tools with fundamental analysis can provide a well-rounded approach to trading.

Risk Management in Currency Trading

Risk management cannot be overlooked when engaging in currency trading. Implementing effective strategies can protect your capital and improve overall results.

Importance of Setting Stop Loss

One of the vital components of risk management is setting stop-loss orders.

These orders automatically close a trade at a predetermined price, limiting potential losses. By establishing stop-loss levels before entering a trade, traders can safeguard their investments effectively.

Diversification Strategies

Diversification is key in managing risk.

Instead of concentrating solely on USD/INR, consider exploring other currency pairs or asset classes. This strategy helps minimize the impact of adverse price movements on any single trade, enhancing portfolio stability.

Common Mistakes to Avoid When Converting Currency

Learning from mistakes is part of the trading journey. Here are common pitfalls to avoid when converting USD to INR.

Misjudging Market Trends

Failing to accurately assess market trends can lead to misguided trades.

It's essential to remain vigilant and not rush into positions without thorough research. Continuously monitor market dynamics and adjust your strategy as needed.

Ignoring Economic Indicators

Economic indicators, such as GDP growth and employment rates, significantly influence currency values.

Ignoring these indicators can result in poor trading decisions. Stay informed about economic releases and adjust your trading plans accordingly.

Learning Resources and Tools on Exness

Exness provides numerous resources to help traders develop their skills and knowledge.

Educational Material and Webinars

Exness offers educational materials, including webinars, articles, and e-books.

These resources cover various topics, from basic trading principles to advanced strategies. Taking advantage of this information can enhance your trading proficiency.

Customer Support Options

Exness prides itself on its exceptional customer support, available 24/7.

Whether you have questions about account setup, trading procedures, or technical issues, the support team is there to assist you. Engaging with customer support can resolve issues quickly and efficiently.

Conclusion

Mastering how to change USD to INR in Exness requires an understanding of the platform, currency fundamentals, and effective trading practices. By following the guidelines outlined in this article—from account creation and fund deposits to executing trades and managing risks—you can navigate the world of currency trading confidently. Remember, continual learning and adaptability are key to thriving in the ever-changing landscape of forex markets.

Read more: