20 minute read

Is Exness Trusted in India? Review Broker

from Exness

by Exness_Blog

Introduction to Exness

Overview of Exness as a Broker

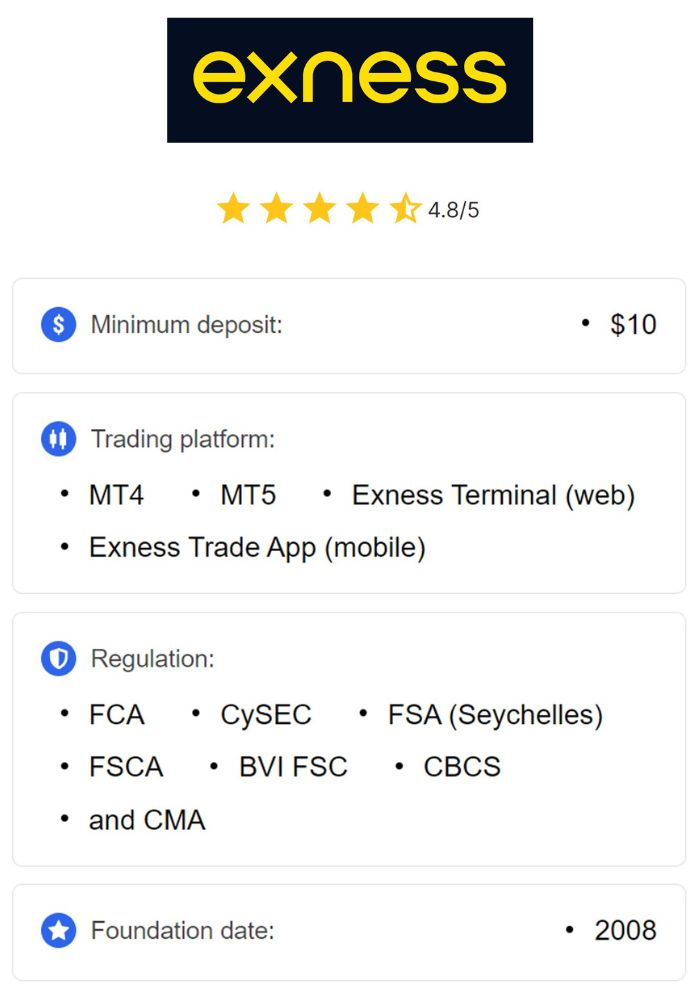

Exness is a prominent global broker that offers services to traders across the world, including India. The company has gained a strong reputation for its commitment to providing a secure, reliable, and user-friendly platform for retail traders. Exness offers access to a wide array of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies, catering to various trading styles and risk appetites.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

One of the key strengths of Exness is its transparency and competitive pricing. The broker provides low spreads, fast execution speeds, and high leverage options, making it an attractive choice for traders in India and globally. Exness also stands out by offering several trading platforms, such as MetaTrader 4 and MetaTrader 5, which are known for their advanced features, reliability, and ease of use. With a focus on user experience, Exness ensures that even novice traders can easily navigate their way through the platform and execute trades efficiently.

History and Evolution of Exness

Exness was founded in 2008 with the aim of creating a transparent and professional trading environment. Initially, the company focused on providing forex trading services to clients globally. Over time, Exness expanded its offerings to include a wide range of CFDs, such as commodities, stocks, and indices. The company's evolution was marked by a commitment to innovation, which led to the development of advanced trading platforms and powerful trading tools.

Exness has grown rapidly due to its dedication to customer satisfaction, operational transparency, and regulatory compliance. It now boasts a global presence, serving over 150,000 active traders. As Exness continued to grow, the company also became known for its strong regulatory compliance, earning licenses from several major financial regulators worldwide. This evolution has helped Exness become a trusted broker in numerous markets, including India.

Regulatory Framework

Understanding Forex Regulations in India

In India, forex trading is governed by the Foreign Exchange Management Act (FEMA), which is administered by the Reserve Bank of India (RBI). FEMA outlines the legal framework for foreign exchange transactions and ensures that all forex activities in India adhere to strict rules to prevent illegal activities such as money laundering or terrorism financing. The act regulates the trading of foreign currencies, but the Securities and Exchange Board of India (SEBI) does not specifically regulate forex trading.

Indian traders can participate in forex trading but are subject to the country's regulations. For instance, they are only allowed to trade currency pairs involving the Indian Rupee (INR) under FEMA. This means that trading in forex pairs like USD/INR, EUR/INR, or GBP/INR is allowed, but trading other currency pairs like EUR/USD or GBP/USD with foreign brokers like Exness might not be fully legal unless the proper steps are followed to comply with Indian laws.

Despite these restrictions, many Indian traders still opt for international brokers like Exness to access global markets. Exness does not provide services directly under the Indian regulatory framework, which means traders need to understand the legalities before using the platform for trading.

Exness Licenses and Regulatory Authorities

Exness operates under a wide array of licenses and regulatory authorities across various jurisdictions. The company is regulated by several major financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Services Commission (FSC) in the British Virgin Islands. These regulators ensure that Exness adheres to stringent financial laws and regulations, offering a high level of protection for traders worldwide.

Although Exness is not directly regulated by Indian authorities like SEBI, its licenses from reputable financial regulators provide strong assurance that the broker operates in a secure and compliant manner. The licenses require Exness to meet strict operational standards, including fund segregation, transparency, and regular audits. This international regulatory framework helps foster trust among Indian traders who wish to engage with Exness despite the lack of direct Indian regulation.

Safety of Funds

Client Fund Protection Policies

Exness has implemented several robust client fund protection policies to ensure the safety of its users’ investments. One of the key aspects of its protection policies is segregating client funds from the company’s operational funds. This means that traders’ money is kept in separate accounts, which prevents it from being used for any business-related purposes by Exness. In case the company faces financial difficulties, segregated accounts provide an extra layer of security, ensuring that client funds are protected.

In addition to segregated accounts, Exness adheres to global anti-money laundering (AML) regulations and performs strict identity verification for all traders through its Know Your Customer (KYC) processes. These measures help ensure that only legitimate clients are able to access the platform and trade, further safeguarding funds and preventing fraudulent activities.

Segregated Bank Accounts Explained

Segregated bank accounts are an essential part of Exness’s strategy to protect clients' funds. By keeping client funds separate from company operational funds, Exness minimizes the risk of clients losing their money in case of financial issues or bankruptcy. These accounts are held with top-tier financial institutions that adhere to strict regulatory standards.

For Indian traders, the use of segregated accounts means that their investments remain safe, even though Exness operates under international regulations. It provides confidence that funds will be protected in the event of any unforeseen circumstances, and traders’ capital will not be at risk due to the company’s business activities. This commitment to fund security is one of the reasons why Exness is considered a trusted broker by traders in India and globally.

Trading Conditions Offered by Exness

Account Types Available for Indian Traders

Exness offers a variety of account types to cater to different levels of trading experience and investment preferences. These account types include Standard accounts, Pro accounts, and ECN accounts, among others. Each account type is designed with specific features such as different minimum deposit requirements, spreads, and commission structures, ensuring that traders can find an account that suits their trading style.

For Indian traders, the Standard account is particularly attractive due to its low minimum deposit requirement and competitive spreads. The ECN account offers direct access to the interbank market, providing faster execution speeds and tighter spreads for more experienced traders. Exness also offers the flexibility of trading in various instruments, making it a versatile choice for Indian traders seeking diverse investment opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Spread and Commission Structure

Exness’s spread and commission structure is one of its major selling points. The broker offers both fixed and variable spreads, depending on the type of account chosen. For example, the Standard account offers fixed spreads, which can be ideal for traders who prefer consistency, while ECN accounts offer variable spreads, often narrower than fixed spreads, with a small commission charged on each trade.

For Indian traders, the low spreads and competitive commission rates make Exness a cost-effective choice for forex and CFD trading. These trading conditions help traders maximize their profits, as they can avoid high transaction costs while benefiting from transparent pricing. Exness's pricing structure is especially beneficial for those who engage in frequent trading and need low-cost execution to stay competitive in the market.

User Experience and Platform Features

Trading Platforms Supported by Exness

Exness supports two of the most popular trading platforms in the world: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their powerful features, reliability, and ease of use, making them ideal for both novice and professional traders. With MT4 and MT5, Indian traders can access real-time charts, execute trades, and analyze the market with sophisticated tools.

MT4 and MT5 are both highly customizable, allowing traders to set up their workspace according to their preferences. The platforms are equipped with various technical indicators, charting tools, and automated trading features. Exness ensures that these platforms run smoothly, providing a seamless trading experience to its users. Additionally, Exness offers a web-based platform, which allows traders to trade directly from their browser without downloading any software, enhancing flexibility for Indian traders who prefer a quick and hassle-free trading experience.

Mobile Trading Experience

Exness recognizes the importance of mobile trading and offers a well-designed mobile app for both iOS and Android devices. The Exness mobile trading app allows traders to manage their accounts, monitor the markets, and execute trades on the go. This is particularly beneficial for Indian traders who may not always be near a computer but want to stay connected to the markets.

The mobile app offers the same functionality as the desktop platforms, including access to trading tools, real-time data, and account management features. It also provides push notifications for account activity and market updates, helping traders stay informed at all times. The user-friendly interface and smooth performance of the app make it a valuable tool for traders who need flexibility and convenience in their trading activities.

Customer Support Services

Availability and Accessibility of Support

Exness offers excellent customer support that is available 24/7, ensuring that traders can get assistance whenever needed. Indian traders can contact Exness through various channels, including live chat, email, and telephone support. The availability of round-the-clock customer service makes it easy for Indian traders to resolve any issues or ask questions, regardless of their time zone.

The responsiveness and professionalism of Exness’s support team is highly regarded by many traders. The team is trained to address a wide range of concerns, from technical difficulties to account-related inquiries. Whether it's for assistance with platform navigation, account issues, or general queries about trading, Exness ensures that customers are supported efficiently and effectively, enhancing the overall user experience for traders in India.

Languages Supported by Customer Service

Exness understands the importance of offering multilingual support to its global clientele. For Indian traders, this is particularly beneficial as customer service is available in several languages, including Hindi and English. The ability to communicate in their native language makes it easier for Indian traders to resolve issues quickly and feel more confident when interacting with the support team.

Additionally, Exness has a wide-reaching customer service network that spans across various regions, ensuring that traders in India have access to a local support system. The availability of customer support in multiple languages helps ensure that communication is clear and effective, making it easier for traders from diverse backgrounds to navigate their trading journey.

Payment Options for Indian Traders

Deposit Methods Accepted

Exness offers a range of deposit methods for Indian traders, making it easy to fund trading accounts in their local currency. Some of the most common deposit options available for Indian traders include bank transfers, credit/debit cards, and e-wallets like Skrill, Neteller, and Paytm. The flexibility in payment methods allows traders to choose the option that best suits their preferences and ensures fast, secure transactions.

Exness also provides the benefit of local bank transfers, which helps Indian traders avoid international transfer fees and enjoy quicker deposit processing times. In most cases, deposits are processed instantly, allowing traders to start trading without delays. This convenience is particularly appealing for Indian traders who value speed and ease when it comes to funding their trading accounts.

Withdrawal Processes and Fees

When it comes to withdrawals, Exness offers a smooth and transparent process for Indian traders. Most withdrawal methods mirror the deposit options, allowing traders to withdraw funds via bank transfer, credit/debit cards, and e-wallets. The withdrawal process is generally fast, with Exness processing most requests within 24 hours, depending on the chosen method.

One important consideration for Indian traders is the potential withdrawal fees associated with certain methods. While most e-wallet withdrawals are free, bank transfers may carry small fees, depending on the financial institution used. However, Exness’s transparent fee structure ensures that traders are well-informed about any associated costs before initiating a withdrawal. This clarity is essential for managing trading profits effectively and avoiding unexpected charges.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Advantages of Trading with Exness in India

Low Minimum Deposit Requirements

One of the standout advantages of trading with Exness in India is its low minimum deposit requirement. Exness offers traders the opportunity to start trading with as little as $1, which is a great benefit for new traders or those looking to test the waters without risking significant amounts of capital. This low barrier to entry makes it easier for Indian traders to begin their trading journey without needing substantial upfront capital.

The flexibility of having a low minimum deposit also allows Indian traders to diversify their portfolios by trading with smaller amounts, allowing for a less risky approach. Furthermore, this feature makes Exness a suitable option for those who want to practice trading strategies without the pressure of large financial commitments.

Leverage Options for Indian Traders

Exness offers attractive leverage options for Indian traders, allowing them to control larger positions with a smaller initial investment. The leverage available to traders can go as high as 1:2000, depending on the account type and the financial instrument being traded. This flexibility enables traders to maximize their potential returns, especially when engaging in short-term trading strategies like scalping or day trading.

However, it is important for Indian traders to understand the risks associated with high leverage. While it can amplify profits, it can also magnify losses. Therefore, traders should use leverage wisely and ensure that they are fully aware of the risks involved in margin trading. With proper risk management, leverage can be an excellent tool for enhancing trading opportunities in the Indian market.

Disadvantages and Concerns

Limitations on Certain Trading Instruments

While Exness offers a wide range of trading instruments, there are some limitations that Indian traders should be aware of. Due to regulatory restrictions in India, Indian traders are unable to trade certain products, such as binary options, and may face limitations on specific currency pairs that are not linked to the Indian Rupee (INR). This restriction can be limiting for traders who wish to explore all the available global trading opportunities.

Despite these limitations, Exness still offers a diverse range of instruments, including forex, commodities, indices, and stocks, which can still provide Indian traders with ample opportunities to diversify their portfolios. However, it's essential for traders to understand the restrictions before committing to the platform.

Potential Withdrawal Delays

Although Exness is generally known for its fast withdrawal processing times, there have been occasional reports of delays in withdrawals for Indian traders. These delays can occur for various reasons, such as verification procedures or issues with the payment provider. While these occurrences are rare, they can be frustrating for traders who need to access their funds quickly.

To avoid delays, Exness recommends that traders complete the necessary verification processes promptly and use trusted payment methods. Additionally, traders should be aware of the timeframes for their preferred withdrawal method and plan accordingly. Overall, Exness remains committed to providing timely and efficient withdrawal services.

Reviews and Feedback from Indian Traders

Common Themes in Positive Reviews

Indian traders have generally expressed a high level of satisfaction with Exness, citing its transparent pricing, low spreads, and excellent customer support. Many traders appreciate the ease of use of the platform, especially with the availability of the MetaTrader platforms, which are well-regarded in the trading community. The low minimum deposit requirement also stands out as a key benefit, allowing new traders to start with minimal risk.

In addition, traders have praised Exness for its fast execution speeds and competitive leverage options, making it an attractive choice for those who want to take advantage of short-term trading strategies. The platform's mobile app also receives positive feedback for its functionality and ease of use, enabling traders to manage their accounts on the go.

Criticisms Highlighted by Users

While Exness has received largely positive feedback from Indian traders, there are some criticisms worth noting. Some users have reported issues with withdrawal delays, especially when using certain payment methods. Additionally, a few traders have expressed concerns about the lack of direct Indian regulatory oversight, which could make some traders hesitant to use the platform.

Furthermore, certain traders have mentioned that the range of available trading instruments could be broader, particularly for those looking to trade non-INR currency pairs. However, these criticisms are relatively minor compared to the positive aspects of Exness’s offering.

Comparison with Other Brokers in India

How Exness Stands Against Competitors

Exness is often compared to other well-known brokers in India, such as IC Markets, FBS, and OctaFX. When compared to these brokers, Exness stands out due to its low minimum deposit requirement, competitive leverage options, and excellent customer support. Additionally, Exness's long-standing reputation and strong regulatory framework give it an edge over some of its competitors.

However, some competitors may offer slightly better trading conditions for certain instruments, so it's important for Indian traders to compare brokers based on their specific needs. Ultimately, Exness offers a comprehensive trading experience with strong regulatory backing, making it a popular choice for many traders in India.

Key Differentiators of Exness

What sets Exness apart from its competitors in India is its transparency and user-centric approach. Exness is known for its straightforward pricing structure, high-level client protection policies, and low-cost trading options. The multiple platform options and advanced trading tools further enhance the overall experience for traders looking for a seamless, professional trading environment.

Another key differentiator is Exness’s mobile app, which offers a smooth and feature-rich experience for traders on the go. While other brokers may offer mobile apps, Exness’s app is especially praised for its reliability and ease of use.

Is Exness Suitable for Beginners?

Educational Resources Provided by Exness

Exness offers a wealth of educational resources designed to assist both novice and experienced traders. For beginners in India, Exness provides various learning materials that help users understand the basics of trading, such as tutorials, articles, and webinars. These resources are tailored to suit traders at different levels of experience, offering valuable insights into topics like market analysis, risk management, and trading psychology.

In addition, Exness offers an extensive knowledge base that can be accessed at any time. This includes articles and guides on various trading strategies and the features of the Exness platform itself. For Indian traders, these resources are an invaluable tool to improve their trading skills and gain a better understanding of the forex market.

Account Management Tools for New Traders

Exness also provides a range of account management tools to help beginners navigate the complexities of the trading world. These tools include demo accounts, which allow users to practice trading without risking real money, and various account types tailored to different trading needs. Beginners can open a cent account, which allows them to start trading with very small amounts of capital.

Additionally, Exness's user-friendly trading platform makes it easier for beginners to execute trades, manage their accounts, and monitor their portfolio’s performance. The MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available through Exness, are widely used by traders around the world and are highly intuitive, even for those new to trading.

Advanced Trading Features

Access to Trading Signals and Analysis

For more experienced traders, Exness offers a range of advanced features, including trading signals and market analysis tools. These tools help traders make informed decisions based on technical and fundamental analyses of the markets. Exness provides daily updates on market trends, allowing traders to gain valuable insights and improve their strategies.

The availability of expert-level analysis and trading signals allows traders to optimize their trading strategies and make more informed, data-driven decisions. Indian traders who are looking to take a more advanced approach to trading will appreciate these tools as they can significantly enhance their ability to execute trades profitably.

Automated Trading Options

Exness also offers automated trading options through expert advisors (EAs), which can be used on the MetaTrader platforms. This feature allows traders to set up automatic trades based on predetermined conditions, such as market trends or technical indicators. Automated trading is particularly useful for traders who are unable to constantly monitor the markets or those who want to implement complex trading strategies without having to manually execute each trade.

For Indian traders looking for a more hands-off approach, automated trading is a great way to leverage their strategies efficiently. By utilizing EAs, traders can potentially increase their chances of making successful trades without dedicating excessive time to the market. However, like any form of leveraged trading, automated trading comes with its own risks, and traders should fully understand these tools before relying on them.

Security Measures Implemented by Exness

Data Protection Protocols

Exness places a strong emphasis on the security of its traders' data. The platform implements a range of data protection protocols, including encryption technologies, to safeguard sensitive information. All personal and financial data is encrypted using SSL (Secure Socket Layer) technology, ensuring that it remains secure during transmission over the internet.

Additionally, Exness complies with international data protection regulations, including GDPR, which governs the handling of personal data for individuals in the European Union. While India has its own data protection laws, Exness follows best practices to ensure that traders' data is kept safe, which is especially important in an industry where confidentiality and trust are key.

Anti-Money Laundering (AML) Policies

Exness adheres to Anti-Money Laundering (AML) policies to ensure that it complies with international standards and regulations. These policies are in place to prevent money laundering and fraud, and Exness has a dedicated compliance team to monitor suspicious activities and transactions. Indian traders can feel confident knowing that Exness takes significant measures to maintain the integrity of its trading environment.

Exness also implements Know Your Customer (KYC) procedures to verify the identity of traders before they can make withdrawals or engage in certain financial transactions. These checks are designed to reduce the risk of fraud and ensure that the platform is used by legitimate traders. By complying with strict regulatory requirements, Exness offers a secure trading environment that protects both traders and the platform itself.

Community Engagement and Reputation

Social Trading and Community Forums

Exness also offers a unique aspect for traders who enjoy social trading. The platform allows traders to share strategies, ideas, and insights through community forums and social trading networks. Indian traders, like many others worldwide, can benefit from this feature by following successful traders, copying their strategies, or even interacting with them in online communities.

This community-driven aspect of Exness allows users to tap into the collective knowledge and experience of other traders, which can be particularly useful for those looking to enhance their trading skills. It also fosters a sense of connection and support among traders, making it easier to learn from others and share ideas on market trends.

Influencer and Affiliate Partnerships

Exness has made significant strides in collaborating with influencers and affiliates to reach a wider audience. Through these partnerships, the broker enhances its reputation and visibility in the trading community. Many prominent influencers and traders in India have recommended Exness due to its user-friendly platform, competitive conditions, and strong reputation for reliability.

These partnerships also help raise awareness about Exness’s offerings and bring new traders into the fold. For Indian traders, these endorsements from trusted figures in the financial community can provide additional reassurance about Exness’s credibility and trustworthiness.

Conclusion on Trustworthiness of Exness in India

Exness has proven itself to be a trusted and reliable broker for Indian traders. With a strong regulatory framework, multiple payment options, competitive spreads, and a user-friendly platform, Exness has established itself as a leading choice in the global forex market. The availability of both beginner-friendly tools and advanced features for more experienced traders makes it an attractive option for a wide range of users.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

While there are a few areas where Exness could improve, such as in withdrawal processing times and limitations on certain instruments, the overall advantages outweigh these minor concerns. For Indian traders, Exness offers a secure and efficient trading environment with excellent customer support and robust security protocols.

Given the strong reputation and positive feedback from traders in India and worldwide, it’s clear that Exness is a trustworthy broker. Whether you're a beginner or an experienced trader, Exness provides the tools, resources, and support necessary to navigate the forex market with confidence. Therefore, it is safe to say that Exness is indeed trusted in India.

Read more: