20 minute read

Does Exness work in Sweden? Regulated, Registered, Legal?

from Exness

by Exness_Blog

Exness is a well-established global forex broker, known for offering competitive trading conditions and a wide range of services to traders worldwide. For Swedish traders, one of the key considerations before opening an account is whether Exness is regulated, registered, and legal to use in Sweden. In this article, we will explore Exness's background, regulatory status, and the legal framework for forex trading in Sweden to help you determine if it is a safe and suitable option for your trading needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Overview of Exness

Company Background and History

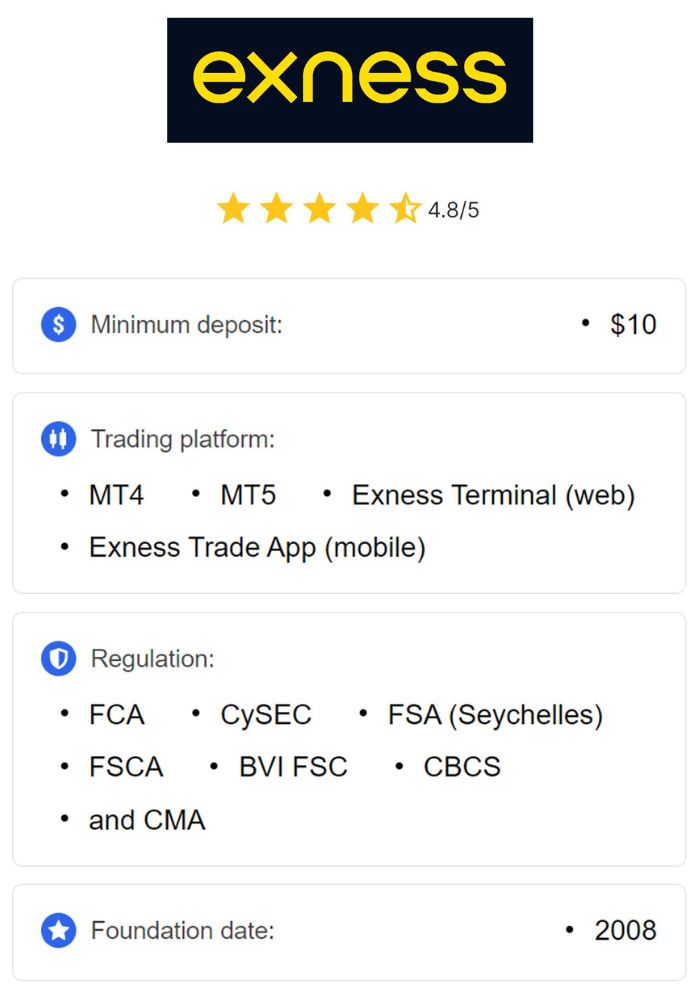

Exness is an established global forex and online trading broker that has been providing its services to traders worldwide since 2008. Headquartered in Cyprus, Exness offers a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies. Over the years, Exness has gained a reputation for its transparency, competitive spreads, and innovative trading platforms, making it a popular choice for both beginners and experienced traders.

Exness is known for its commitment to providing a secure and user-friendly trading environment, with advanced tools and a robust infrastructure designed to meet the needs of traders across various financial markets. It holds numerous licenses and is regulated by some of the most reputable financial authorities, ensuring that its operations are in line with industry standards.

Key Services Offered by Exness

Exness provides traders with access to an extensive selection of trading instruments, ranging from currency pairs to commodities and cryptocurrencies. The broker offers both standard and professional accounts to cater to different types of traders, from novices to experts. Additionally, Exness offers trading on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are among the most widely used platforms in the forex industry.

Traders can also take advantage of high leverage, competitive spreads, and a wide array of order types. Exness is renowned for its fast execution speeds, which is critical in the volatile forex market. Moreover, it offers a range of educational resources, webinars, and market analysis tools to help traders enhance their skills and knowledge.

Regulatory Framework in Sweden

Financial Supervisory Authority (Finansinspektionen)

In Sweden, the financial markets are regulated by the Finansinspektionen (FSA), the Swedish Financial Supervisory Authority. The FSA is responsible for ensuring that financial services in Sweden are provided in a secure and transparent manner. It regulates various types of financial institutions, including banks, insurance companies, and investment firms. Forex brokers operating in Sweden are required to meet strict regulatory standards set by the FSA.

As a part of the European Union (EU), Sweden follows EU financial regulations and directives, ensuring that brokers adhere to high standards of operation, investor protection, and market integrity. The FSA works closely with other EU regulators to create a safe and reliable trading environment for investors, including those trading with international brokers like Exness.

Regulations Impacting Forex Trading

Forex trading in Sweden is subject to EU-wide regulations, which are designed to protect investors and ensure the stability of the financial markets. One of the key regulations impacting forex brokers is the Markets in Financial Instruments Directive (MiFID II), which establishes rules for investment firms and forex brokers operating within the EU. MiFID II aims to enhance transparency, ensure fair market practices, and provide investor protection.

Exness, as an international broker, is expected to comply with these regulations when offering services to Swedish traders. This includes providing clear and transparent information about its fees, trading conditions, and risk disclosures. MiFID II also mandates that brokers offer negative balance protection, which ensures that traders cannot lose more than the amount they have deposited into their accounts.

Is Exness Regulated in Sweden?

Licensing Information

Exness is licensed and regulated by several financial authorities globally, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority (FSA) of Seychelles, and the Financial Conduct Authority (FCA) in the UK. While Exness is not directly regulated by the Swedish Financial Supervisory Authority (Finansinspektionen), it operates within the EU regulatory framework, which includes MiFID II compliance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

As a result, Swedish traders are protected under the same regulations that apply to brokers licensed in the European Union, including the ability to claim investor compensation if necessary, as well as access to dispute resolution services. The EU’s strict regulatory standards ensure that Exness operates in a transparent and secure manner.

Compliance with European Union Directives

Exness complies with various EU directives, such as MiFID II and the Anti-Money Laundering (AML) regulations. This ensures that the company follows stringent guidelines for financial reporting, transparency, and customer protection. As part of its commitment to compliance, Exness provides a clear explanation of its terms and conditions, risk warnings, and potential conflicts of interest to Swedish traders.

Exness’s adherence to these regulations makes it a reliable choice for Swedish traders who want to trade in a well-regulated environment, ensuring that the broker maintains high standards of operation and investor protection.

Registration Status of Exness

Global Presence and Operations

Exness is a globally recognized forex broker that operates in multiple countries, offering its services to clients in Europe, Asia, Africa, and beyond. Although the broker is not directly registered with the Swedish FSA, it has a significant presence in the European market and complies with EU regulations, including MiFID II.

Exness’s global operations are supported by licenses in multiple jurisdictions, which allows the broker to offer its services to Swedish traders in a legally compliant manner. By adhering to EU standards and regulations, Exness ensures that its services remain accessible and transparent to clients in Sweden.

Local Registration Details

While Exness does not have a specific registration with Sweden’s Finansinspektionen, it operates in Sweden under the EU’s "passporting" system, which allows brokers licensed in one EU member state to offer services in other member states. This means that Swedish traders can access Exness’s trading platform without any legal barriers.

As part of its operations in the EU, Exness is required to adhere to the same rules and regulations that apply to other brokers operating within the region, ensuring that Swedish traders benefit from the same protections as traders in other EU countries.

Legality of Using Exness in Sweden

Understanding Forex Trading Legislation

Forex trading is legal in Sweden, and the Swedish government regulates the industry in accordance with EU laws. Swedish traders are allowed to trade with both local and international brokers, as long as these brokers comply with the relevant regulatory frameworks. Exness, being compliant with EU regulations, ensures that it operates legally and transparently in Sweden.

Swedish traders can legally use Exness’s platform to trade forex, stocks, and other financial instruments, as long as they follow local tax and reporting requirements. The legality of using Exness in Sweden is ensured by the broker’s adherence to EU directives and its global licenses.

Legal Considerations for Traders

Swedish traders must be aware of the legal implications of trading forex, including the need to report any trading income to the Swedish Tax Agency (Skatteverket). Although Exness is a regulated broker, traders must ensure they meet all local legal requirements when it comes to taxes, reporting, and compliance with Swedish financial regulations.

To ensure full compliance, Swedish traders should seek advice from a tax professional regarding their trading activities, especially if they are generating significant profits from forex trading. Failure to report trading income can lead to penalties, so it is essential to understand Sweden's tax obligations for forex traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Pros and Cons of Trading with Exness in Sweden

Advantages of Using Exness

Exness offers several advantages for Swedish traders, including competitive spreads, high leverage options, and a wide range of financial instruments. The broker’s adherence to EU regulations provides an additional layer of protection, ensuring that traders can trade in a secure and compliant environment. Furthermore, Exness offers advanced trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely used by traders around the world for their powerful charting and technical analysis tools.

Another advantage of trading with Exness is its customer support. The broker offers 24/7 multilingual support, which is beneficial for Swedish traders who require assistance with their accounts or trading activities. The availability of educational resources, including webinars, tutorials, and market analysis, also helps traders improve their skills and make informed decisions.

Potential Risks and Drawbacks

While Exness offers many benefits, there are some potential risks and drawbacks to consider. One challenge for Swedish traders is the currency conversion issue, as deposits and withdrawals are typically processed in major currencies such as EUR and USD. Traders may need to convert SEK (Swedish Krona) into these currencies, which can incur additional fees and exchange rate fluctuations.

Additionally, while Exness is regulated under EU laws, the absence of a direct Swedish FSA license may concern some traders. However, the broker’s compliance with EU regulations provides a sufficient level of security and trust.

Account Types Available for Swedish Traders

Standard Accounts

Exness offers Standard Accounts that are designed for beginner to intermediate traders who are looking to start trading with a reliable and user-friendly platform. The Standard Account offers competitive spreads and a flexible leverage system, making it an attractive choice for traders who want to enter the forex market without the complexities that come with more advanced trading accounts. With no commissions on trades, this account type ensures that traders can enjoy lower costs when executing their trades.

One key feature of the Standard Account is its accessibility. It allows traders to get started with a relatively small initial deposit, making it ideal for those who are new to forex trading or those who prefer to test their strategies with minimal risk. Furthermore, the Standard Account offers access to a wide range of instruments, including major and minor currency pairs, commodities, and indices.

Professional Accounts

For more experienced traders, Exness provides Professional Accounts, which are designed to offer advanced trading features, higher leverage, and more complex tools to enhance trading performance. These accounts are best suited for traders who are comfortable with higher risk levels and want to take advantage of the various financial instruments offered by Exness.

Professional accounts come with tighter spreads and no commission fees on most trades, allowing for more cost-efficient trading. Traders can also access higher leverage options, enabling them to control larger positions with smaller capital. The increased leverage provides traders with the flexibility to amplify their profits, but it also carries a higher degree of risk, so it's crucial for traders to implement strong risk management strategies.

Islamic Accounts

Exness also offers Islamic Accounts for traders who adhere to Sharia law and prefer trading in a way that complies with Islamic principles. Islamic accounts are swap-free, meaning that traders do not incur overnight interest charges, which is important for those who follow the guidelines of Islamic finance. These accounts are available for both Standard and Professional account types, ensuring that Muslim traders have access to the same trading opportunities without violating religious beliefs.

Demo Accounts

For those who are new to forex or want to test strategies before committing real capital, Exness provides a Demo Account. This account mirrors the conditions of a live trading account, allowing users to practice without risking their own money. The demo account comes with virtual funds, providing traders with the opportunity to explore the Exness trading platform, test different strategies, and understand how the market works before opening a real account.

Trading Platforms Provided by Exness

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Exness offers two of the most popular and widely used trading platforms in the forex industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their user-friendly interface, advanced charting tools, and technical analysis capabilities.

MetaTrader 4 (MT4): MT4 is the platform of choice for many traders due to its simplicity, reliability, and powerful charting tools. It offers a wide range of order types, automated trading with Expert Advisors (EAs), and extensive customization options, making it suitable for traders of all levels. The platform is especially popular among forex traders for its speed and efficiency in executing trades.

MetaTrader 5 (MT5): MT5 is the more advanced version of MT4, offering additional features like more timeframes, additional charting tools, and the ability to trade a broader range of instruments, including stocks, indices, and futures. MT5 also supports more advanced order management options, making it an ideal choice for professional traders who want to trade multiple asset classes.

Both platforms are available for desktop, web, and mobile devices, ensuring that Swedish traders can access their accounts from anywhere, at any time.

Mobile Trading Options

Exness also offers mobile trading applications for both MT4 and MT5, allowing traders to trade on-the-go. The mobile apps are designed with the same functionality as their desktop counterparts, offering the same charting tools, trade management features, and real-time market data. This makes it easy for Swedish traders to stay on top of their trades and manage their accounts while traveling or away from their computers.

The mobile trading apps are available for both iOS and Android devices, making them accessible to a wide range of users. With push notifications, real-time price alerts, and instant order execution, mobile trading ensures that Swedish traders can make the most of market opportunities wherever they are.

Customer Support and Resources

Availability of Support Channels

Exness offers 24/7 customer support to help traders with any inquiries or issues they may encounter. Swedish traders can contact the support team through various channels, including live chat, email, and phone support. The support team is available in multiple languages, ensuring that Swedish traders can receive assistance in their native language, making communication smoother and more effective.

Exness also provides an extensive Help Center with a wide range of FAQs, guides, and tutorials to help traders resolve common issues on their own. This helps Swedish traders access immediate assistance and find solutions to technical problems or account-related queries.

Educational Resources for Traders

Exness is committed to supporting traders at all levels by providing educational resources to enhance their trading knowledge. The broker offers a variety of resources, including:

Webinars and Live Sessions: Exness hosts live webinars and online training sessions led by professional traders and market analysts. These sessions cover various topics, from the basics of forex trading to advanced strategies and market analysis techniques.

Video Tutorials: Exness provides step-by-step video tutorials that guide traders through the platform’s features, explaining how to use the tools available, open and close positions, and analyze the markets.

Market Analysis and Insights: Exness offers daily market analysis, economic calendars, and trading signals, helping traders make informed decisions and stay updated on market trends.

These educational tools ensure that Swedish traders can continue improving their trading skills, whether they are new to forex or have years of experience.

User Experience and Reviews

Feedback from Swedish Traders

Exness has received a generally positive reception from traders in Sweden, with many praising its user-friendly platforms, competitive spreads, and professional customer support. Swedish traders appreciate the low fees and ease of use when navigating the trading platforms, as well as the ability to trade on mobile devices while on the go.

However, some traders have noted that Exness’s lack of a direct license from the Swedish Financial Supervisory Authority (Finansinspektionen) may be a concern for those who prioritize local regulation. Despite this, the broker’s compliance with EU regulations, particularly MiFID II, reassures most traders that Exness operates transparently and securely within the European framework.

Reputation in the Forex Community

Exness has built a strong reputation in the global forex community, with many traders considering it a trusted and reliable broker. The broker’s commitment to transparency, regulatory compliance, and customer support has made it a top choice for traders worldwide, including those in Sweden.

Exness’s strong reputation is further solidified by its long-standing presence in the forex industry, having been in operation since 2008. The broker’s commitment to innovation, trader education, and market analysis tools has earned it a loyal customer base and positive reviews from traders of all experience levels.

Security Measures Implemented by Exness

Data Protection Protocols

Exness takes the security of its clients very seriously, employing state-of-the-art security protocols to protect sensitive data. The broker uses 256-bit SSL encryption to secure all personal and financial information transmitted through its platform. This encryption technology ensures that traders' data is kept confidential and protected from unauthorized access.

Exness also adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, ensuring that all clients are properly verified and that transactions are conducted in compliance with international regulations.

Fund Safety and Segregation

To ensure that client funds are protected, Exness holds client funds in segregated accounts, separate from the company’s operating funds. This means that even in the unlikely event of Exness facing financial difficulties, client funds remain secure and cannot be used for company liabilities. This practice enhances trader confidence in the safety of their investments.

Payment Methods Accepted

Deposit Options for Swedish Clients

Exness offers a variety of deposit methods for Swedish traders, including bank transfers, credit and debit cards, e-wallets like Skrill and Neteller, and even cryptocurrencies. These options ensure that traders can deposit funds quickly and conveniently, without incurring high fees or long processing times. Most deposits are processed instantly, allowing traders to fund their accounts and start trading immediately.

Withdrawal Procedures and Fees

Withdrawals from Exness are typically processed within 24 hours, depending on the chosen payment method. For Swedish traders, e-wallets and credit/debit cards tend to be the fastest options for withdrawals. Bank transfers may take a bit longer, but they are also available for those who prefer traditional methods. Exness does not charge withdrawal fees, but traders should be aware of any fees that may be imposed by third-party payment providers.

Tax Implications for Swedish Traders

Reporting Forex Trading Income

In Sweden, forex trading is treated as taxable income, which means that profits earned from trading must be reported to the Swedish Tax Agency (Skatteverket). The Swedish tax system requires traders to declare all income from forex trading, whether it's from capital gains, interest, or dividends. Traders should keep detailed records of their trades, including the dates, profits, losses, and any associated fees, as these will be necessary for tax reporting purposes.

Traders in Sweden are subject to the country's capital gains tax on profits earned from forex trading. This tax is typically assessed at a flat rate of 30% for capital gains from financial assets, including forex. If the trading is considered part of a business or professional activity, the taxation might differ, and other regulations could apply. It's advisable for Swedish traders to consult with a tax professional or accountant to ensure that they comply with all local tax laws.

Potential Tax Obligations

In addition to capital gains tax, Swedish traders may also need to pay social security contributions if they are deemed to be trading as a business. For individuals who engage in trading as a hobby or secondary source of income, the tax burden is generally lower and more straightforward. However, anyone actively trading and earning substantial profits may be classified as a professional trader, which could result in higher tax obligations.

Moreover, Swedish traders should also be aware of the potential VAT (Value Added Tax) implications, although trading activities like forex are typically exempt from VAT. However, if traders engage in other financial activities, such as providing trading advice or managing portfolios for others, VAT may apply.

To avoid issues with the Swedish tax authorities, it's important for traders to accurately report their earnings and consult a tax expert to ensure compliance.

Comparing Exness with Other Brokers in Sweden

Key Differentiators

Exness offers several key features that set it apart from other forex brokers operating in Sweden. One of the main differentiators is its global regulatory compliance, which ensures that Exness adheres to the highest standards of security and transparency. While some brokers in Sweden are only licensed by local authorities, Exness operates under multiple licenses from some of the most reputable financial regulatory bodies in the world, including the FCA (Financial Conduct Authority) in the UK, CySEC (Cyprus Securities and Exchange Commission), and ASIC (Australian Securities and Investments Commission). This broad regulatory oversight ensures that Swedish traders can trust the broker’s operations.

Additionally, Exness provides a wide range of account types, from beginner-friendly options like Standard accounts to more advanced options like Professional accounts. It also offers tight spreads and the flexibility to use MetaTrader 4 and MetaTrader 5, both of which are highly regarded in the trading community. These features, along with high leverage options, make Exness a compelling choice for Swedish traders who are looking for a trusted and feature-rich broker.

Another advantage of Exness is its excellent customer support, available in multiple languages, including Swedish. This ensures that traders have access to assistance whenever they need it, whether it's through live chat, email, or phone support.

Overall Competitiveness in the Market

While Exness has a strong global presence and a reputation for offering competitive trading conditions, it's essential to compare it with other brokers in Sweden to determine its competitiveness in the market. Brokers such as Nordea Markets, Avanza, and Saxo Bank are also popular in Sweden, offering varying levels of service and trading conditions. However, Exness stands out for its diverse range of account types, flexibility in payment methods, and extensive educational resources, which appeal to both new and experienced traders.

In terms of costs, Exness typically provides lower spreads and no commissions on most accounts, making it a cost-effective choice for traders. This can be a significant advantage for those who engage in frequent trading, as even minor cost savings per trade can add up over time.

When compared to other brokers offering forex trading in Sweden, Exness's global reach and strong regulation make it an excellent choice for traders who prioritize safety and a comprehensive trading experience. Its extensive list of supported payment methods, user-friendly platforms, and robust educational resources make it highly competitive in the Swedish market.

Conclusion

In conclusion, Exness is a regulated and legal broker that works well for Swedish traders, offering a combination of competitive trading conditions, a variety of account types, and robust customer support. While Exness is not directly licensed by the Swedish Financial Supervisory Authority (Finansinspektionen), its licenses from reputable global regulatory bodies, such as the FCA and CySEC, offer sufficient protection to ensure the broker operates transparently and safely. Swedish traders can trade confidently with Exness, knowing that the company complies with high international standards of regulation.

Exness provides a wide range of account options, advanced trading platforms, and a host of educational resources, making it suitable for traders at all levels. While there are some challenges, such as the potential for high taxes on forex profits, these can be managed with proper planning and reporting. The flexibility, cost-effectiveness, and customer support offered by Exness make it a strong contender in the Swedish market for those looking to engage in forex trading.

Swedish traders who are looking for a reliable, secure, and well-regulated broker for their forex trading activities will find Exness to be a worthy option. With the added benefit of MetaTrader 4 and MetaTrader 5 platforms, tight spreads, and a comprehensive educational offering, Exness is well-equipped to serve the needs of traders in Sweden.

By choosing Exness, Swedish traders gain access to a trustworthy global forex broker that combines advanced tools with user-centric support, ensuring they have the resources needed to navigate the forex market successfully.

Read more: