13 minute read

How to trade forex with $50

from Exness

by Exness_Blog

Understanding Forex Trading Basics

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves the buying and selling of currency pairs in a global marketplace. It’s one of the largest and most liquid markets in the world, with a daily trading volume exceeding $6 trillion. The goal of forex trading is to profit from fluctuations in currency exchange rates, such as EUR/USD or GBP/USD.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Unlike stock trading, forex operates 24 hours a day, five days a week, providing flexibility for traders in different time zones. It’s accessible to anyone with an internet connection and a small amount of capital, making it appealing to new traders looking to start with as little as $50.

Key Terminology in Forex

Before diving into trading, it’s crucial to understand key forex terms that form the foundation of trading:

Currency Pair: Represents the two currencies being traded, such as USD/EUR. The first currency is the base, and the second is the quote currency.

Pip: The smallest price movement in forex, typically 0.0001 for most pairs. It’s used to measure profits and losses.

Additionally, terms like spread (the difference between the buy and sell price), lot size (the amount traded), and leverage (borrowed capital for larger trades) are essential for understanding how trades work and evaluating potential profits or risks.

The Importance of Starting Small

Benefits of Trading with a Small Capital

Starting with $50 in forex trading offers a controlled and low-risk entry point into the market. It allows new traders to experiment with trading strategies and familiarize themselves with trading platforms without risking significant funds. Small capital also encourages a disciplined approach to risk management, as every trade must be calculated carefully to avoid overexposure.

Moreover, trading small provides emotional comfort. Losing a small portion of $50 is less stressful than losing a larger amount, which helps traders focus on learning rather than worrying about their capital. This approach ensures that beginners develop confidence before scaling up their investments.

Risks Associated with Low Capital Trading

While starting small has its advantages, it comes with unique challenges. The most significant is the limited profit potential. With $50, even high-percentage gains might translate into small dollar amounts, which could frustrate traders looking for quick wealth.

Another risk is the temptation to use excessive leverage to amplify returns. Although leverage increases potential profits, it also magnifies losses. For instance, a small unfavorable market movement could wipe out the entire account. Traders must balance their risk-to-reward ratio carefully when working with limited capital.

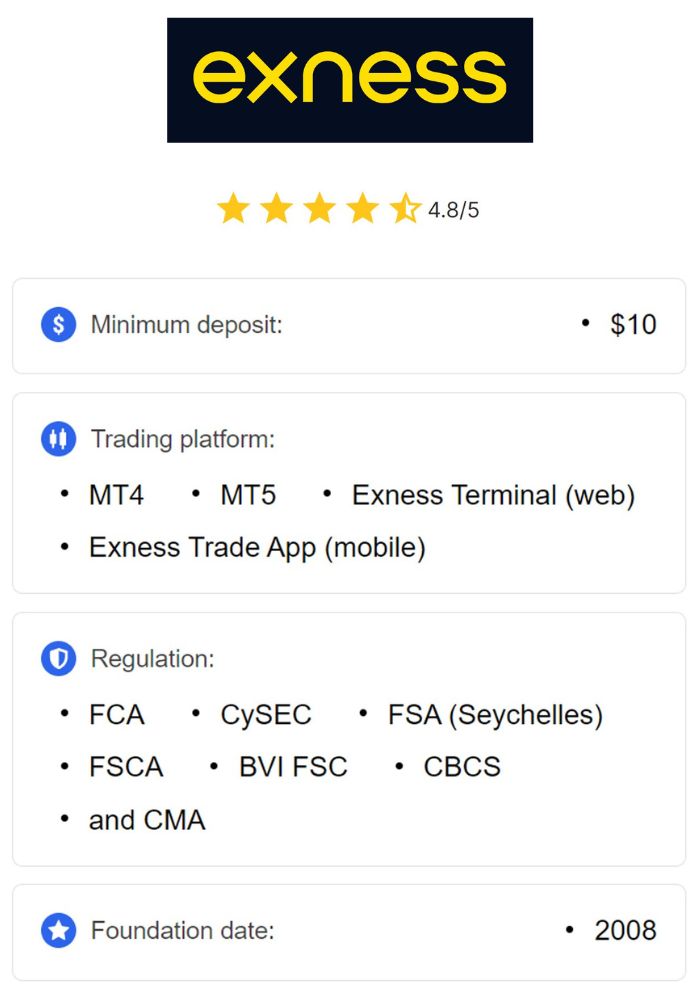

Choosing the Right Brokerage

Factors to Consider When Selecting a Forex Broker

Finding the right broker is critical when starting with $50. Look for brokers with low minimum deposit requirements, preferably those offering micro or cent accounts that are specifically designed for small traders. These accounts allow trading with fractions of standard lots, making it easier to manage risks.

Additionally, ensure the broker provides a user-friendly platform, fast trade execution, and reliable customer support. Features like demo accounts, educational resources, and trading tools are also beneficial for beginners seeking to build their skills.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Evaluating Broker Fees and Spreads

For a small trading account, fees and spreads can significantly impact profitability. Opt for brokers with tight spreads, especially on major currency pairs, as these are the most cost-effective to trade. Some brokers also offer commission-free accounts, which are ideal for reducing costs.

Be cautious of hidden charges, such as withdrawal fees or inactivity fees. It’s important to review the broker’s fee structure thoroughly to ensure that your $50 isn’t eroded by unnecessary charges.

Importance of Regulation and Security

Regulation ensures that a broker operates ethically and complies with financial laws. Always choose a broker regulated by reputable authorities like the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC).

Regulated brokers typically offer segregated client accounts, fraud protection, and transparent trading conditions. These measures safeguard your funds and provide peace of mind, especially when starting with a small investment.

Setting Up Your Trading Account

Types of Accounts Offered by Brokers

Forex brokers offer various account types tailored to traders with different experience levels and capital. For a $50 budget, consider these options:

Micro Accounts: Allow trading with smaller lot sizes (0.01 lots), making it easier to manage risks and capital.

Cent Accounts: Show balances in cents rather than dollars, providing more flexibility for low-budget trading.

These accounts are ideal for beginners as they allow participation in the market with minimal risk while providing a real trading experience.

How to Fund Your Trading Account with $50

Funding your account is straightforward and typically involves bank transfers, credit/debit cards, or e-wallets like Skrill and PayPal. Ensure that the broker’s minimum deposit requirement aligns with your $50 budget.

When depositing, be aware of any transaction fees. Some brokers offer zero-fee deposits, while others may charge a small percentage. Additionally, confirm the processing times to avoid delays in starting your trading journey.

Developing a Trading Strategy

Overview of Popular Trading Strategies

With a $50 budget, selecting a suitable trading strategy is crucial for managing risks and maximizing returns. Scalping is a popular strategy among small-budget traders. It involves making numerous quick trades to capture small price movements. Scalping requires tight spreads and fast execution, making it ideal for traders with access to low-cost brokers.

Another effective strategy is swing trading, which involves holding trades for several days to capitalize on medium-term trends. Swing trading requires less frequent monitoring and allows traders to make informed decisions based on both technical and fundamental analysis. This approach is particularly helpful for traders balancing forex with other commitments.

Importance of Risk Management in Trading

Effective risk management is the cornerstone of successful trading, especially with a small account. One common rule is to risk no more than 1-2% of your account balance per trade. For a $50 account, this translates to a maximum risk of $0.50 to $1 per trade.

Using stop-loss orders is essential to prevent excessive losses during volatile market movements. Additionally, traders should focus on position sizing, ensuring that the trade size aligns with their risk tolerance. Risk management not only protects your capital but also helps maintain emotional stability during market fluctuations.

Creating a Trading Plan

A trading plan serves as a roadmap for achieving your trading goals. It should outline your preferred trading strategies, risk management rules, and criteria for entering or exiting trades. For instance, if you’re scalping, your plan might specify using tight stop-loss orders and trading during high-liquidity sessions.

Consistency is key when following a trading plan. Deviating from the plan often leads to impulsive decisions and losses. Regularly reviewing and refining your trading plan based on performance ensures continuous improvement and better outcomes.

Leveraging Your Capital

Understanding Leverage in Forex

Leverage allows traders to control larger positions than their initial capital. For example, with 1:100 leverage, a $50 deposit enables you to trade positions worth $5,000. While leverage amplifies potential profits, it also increases the risk of significant losses, making it a double-edged sword.

Brokers typically offer various leverage levels, with options ranging from 1:10 to 1:500. Beginners should start with low leverage to reduce risks and gradually increase as they gain confidence and experience.

Pros and Cons of Using Leverage

Leverage can be a powerful tool if used responsibly. The primary advantage is that it maximizes profit potential without requiring substantial capital. For instance, a small price movement in your favor can yield significant returns when leverage is applied.

However, the downside is that leverage magnifies losses just as effectively as it boosts gains. A minor unfavorable market movement can wipe out a small account entirely. For traders with $50, the key is to use leverage conservatively and pair it with robust risk management practices to avoid catastrophic losses.

Choosing Currency Pairs Wisely

Major vs. Minor Currency Pairs

Major currency pairs, such as EUR/USD and GBP/USD, are ideal for small accounts due to their high liquidity and tight spreads. These pairs are heavily traded, resulting in stable price movements and lower transaction costs, which are essential when working with limited capital.

Minor pairs, such as EUR/AUD or GBP/NZD, offer less liquidity and higher spreads, making them less suitable for $50 accounts. However, they can be traded strategically if a trader identifies strong trends or market opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Best Currency Pairs for Small Accounts

For traders starting with $50, focus on major pairs that align with your broker’s lowest spreads. Popular options include:

EUR/USD: High liquidity and tight spreads make it a favorite among traders.

USD/JPY: Offers steady price movements and is less volatile compared to other pairs.

Avoid exotic pairs, such as USD/TRY or EUR/ZAR, as their high volatility and wide spreads can quickly deplete a small account. Researching the behavior of your chosen currency pairs is crucial for building confidence and accuracy in trading decisions.

Technical Analysis Fundamentals

Introduction to Charts and Indicators

Technical analysis involves studying price charts and using indicators to predict future market movements. Beginners should familiarize themselves with basic chart types, such as candlestick charts, which display price movements in an intuitive format.

Commonly used indicators include:

Moving Averages: Identify trends by smoothing price data over a specific period.

Relative Strength Index (RSI): Measures overbought or oversold conditions in the market.

Bollinger Bands: Highlight volatility and potential breakout points.

Learning how to interpret these tools is essential for making informed trading decisions, especially with a limited budget.

Understanding Support and Resistance Levels

Support and resistance levels are key concepts in technical analysis. Support represents a price level where buying interest is strong enough to prevent further decline, while resistance is a level where selling pressure halts upward movement.

Identifying these levels helps traders determine entry and exit points for their trades. For instance, buying near support and selling near resistance can enhance profitability and reduce the likelihood of losses. Combining this knowledge with indicators ensures a well-rounded approach to market analysis.

Staying Updated with Market News

Economic Indicators That Impact Forex Trading

Staying informed about economic indicators is crucial for forex traders, especially when trading with limited capital. Key indicators to watch include:

Interest Rates: Central banks’ rate decisions, such as those by the Federal Reserve or European Central Bank, directly influence currency value. A rise in interest rates typically strengthens a currency.

Inflation Data: Rising inflation often weakens a currency’s purchasing power, while controlled inflation may stabilize it.

Employment Reports: Reports like the Non-Farm Payroll (NFP) in the U.S. significantly impact currency movements and create trading opportunities.

For traders in forex, these indicators provide insight into market trends and help in predicting currency pair movements, allowing them to make informed decisions even with a $50 account.

Utilizing Financial News Sources

To stay ahead, traders should regularly consult reliable financial news platforms like Bloomberg, Reuters, and Investing.com. These platforms provide real-time updates, market forecasts, and detailed economic reports.

Additionally, subscribing to broker newsletters or using trading apps with integrated news feeds can be beneficial. Many brokers also offer economic calendars that highlight upcoming events, ensuring traders are well-prepared for potential market volatility. Staying updated minimizes risks and maximizes opportunities.

Practicing with a Demo Account

Benefits of Simulation Trading

Demo accounts are invaluable for beginners, allowing them to practice trading in a risk-free environment. These accounts simulate real market conditions, enabling traders to test strategies, understand platform features, and familiarize themselves with market dynamics.

For traders with $50, using a demo account ensures they refine their skills before committing real money. It reduces the likelihood of impulsive mistakes and builds confidence, setting the stage for long-term success in live trading.

How to Transition from Demo to Live Trading

Transitioning from demo to live trading requires careful preparation. Start by applying the strategies that were successful in the demo environment but scale down the risk. For example, if you were trading multiple positions in the demo account, limit yourself to fewer trades when starting with $50.

Emotional discipline is crucial during this phase. Unlike demo trading, real money trading involves psychological pressure, as every gain or loss feels personal. Maintaining the same level of objectivity as in demo trading ensures smoother adaptation and minimizes unnecessary risks.

Psychology of Trading

Managing Emotions While Trading

Emotions like fear and greed often dominate a trader’s decision-making process, leading to impulsive actions. For example, fear may cause premature trade closures, while greed might result in overtrading. Both behaviors can be detrimental, especially when managing a small $50 account.

To counteract these emotions, traders should rely on their trading plan and avoid reacting to short-term market fluctuations. Regular breaks, mindfulness techniques, and reflecting on past trades can also help maintain emotional stability.

Cultivating Patience and Discipline

Patience and discipline are essential traits for successful trading. Profitable opportunities may not arise daily, and forcing trades can lead to losses. With $50, it’s important to wait for high-probability setups rather than engaging in speculative trades.

Discipline involves adhering to predefined rules, such as risk management limits and entry/exit criteria. By consistently following these guidelines, traders can avoid costly mistakes and develop a sustainable approach to forex trading.

Common Mistakes to Avoid

Overtrading and Its Consequences

Overtrading is a common mistake, especially among new traders eager to grow their accounts quickly. Frequent trading increases transaction costs, which can erode a $50 account rapidly. It also exposes traders to unnecessary market risks, leading to potential losses.

To avoid overtrading, focus on quality over quantity. Stick to well-researched trades and avoid entering the market without a clear rationale. Maintaining a trading journal to track your activity can also help identify patterns and prevent excessive trading.

Ignoring Risk Management Principles

Ignoring risk management is another frequent pitfall. Many traders fail to set stop-loss orders, leaving their accounts vulnerable to sudden market reversals. For a $50 account, even a small mistake can result in significant losses.

Always define the maximum acceptable risk per trade and ensure it aligns with your overall capital. Consistently applying risk management principles protects your account and increases the likelihood of long-term profitability.

Building Long-Term Success

Importance of Continuous Learning

Forex trading is a dynamic field that requires ongoing education. Market conditions, strategies, and tools evolve over time, and traders must stay updated to remain competitive. Regularly attending webinars, reading forex-related books, and participating in forums can enhance your knowledge and skills.

For traders with $50, leveraging free resources like broker tutorials and YouTube channels can provide valuable insights without incurring additional costs. Dedication to learning ensures gradual improvement and better trading outcomes.

Networking and Engaging with Other Traders

Connecting with fellow traders offers numerous benefits, from sharing insights to gaining emotional support. Joining online trading communities or local meetups allows you to learn from others’ experiences and avoid common pitfalls.

In addition, engaging with more experienced traders can provide mentorship opportunities. They can offer personalized advice and help you refine your approach, making it easier to succeed even with limited capital.

Conclusion

Starting forex trading with $50 is not only possible but also a smart way to enter the market with minimal risk. By selecting a reliable broker, developing a sound trading strategy, and practicing effective risk management, small capital traders can build a strong foundation for long-term success.

Patience, discipline, and continuous learning are the keys to navigating the challenges of forex trading. While the journey may start small, adopting the right habits and leveraging available tools can turn a modest beginning into a rewarding trading career. With the proper mindset and approach, even a $50 account can open the doors to substantial growth and financial independence.

Read more: