13 minute read

Exness Trading tips for Traders

from Exness

by Exness_Blog

Understanding Exness as a Trading Platform

Overview of Exness

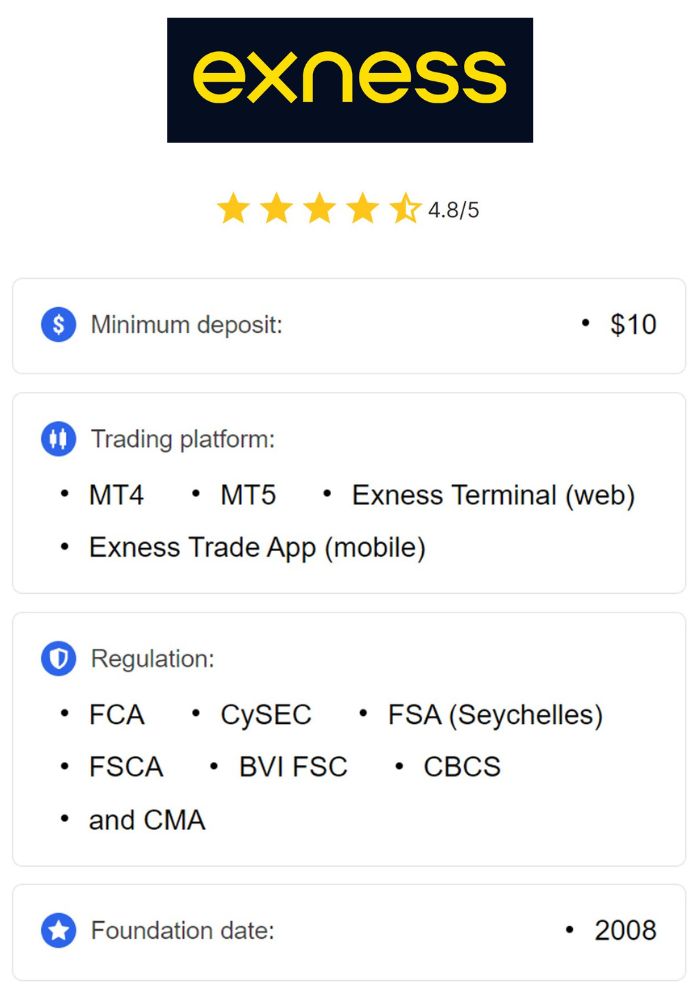

Exness is a globally recognized broker that offers access to various financial markets, including Forex, commodities, cryptocurrencies, and indices. Established in 2008, Exness has grown rapidly and is now known for its reliability, transparency, and advanced trading conditions. Exness provides a range of trading accounts and platforms to accommodate traders of all experience levels, from beginners to professionals.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

With a commitment to low spreads, high leverage, and 24/7 customer support, Exness has become a trusted choice for traders worldwide. The broker’s user-friendly platforms, coupled with a wealth of educational resources, make it a suitable option for those looking to enhance their trading skills and profitability.

Regulatory Status and Security Features

Exness is regulated by top-tier authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight ensures that Exness adheres to strict standards of transparency, client fund protection, and ethical business practices. For traders, regulatory compliance offers a level of security and peace of mind, knowing that their funds are safeguarded by a trusted broker.

In terms of security, Exness employs advanced encryption technologies to protect clients’ data and transactions. The broker also practices fund segregation, meaning that client funds are kept separate from the broker’s operational funds. This ensures an additional layer of protection, enabling traders to focus on their strategies without worrying about the safety of their assets.

Getting Started with Exness

Account Types Offered by Exness

Exness offers various account types to meet the diverse needs of its traders. These include Standard, Standard Cent, Pro, Raw Spread, and Zero accounts. Each account type comes with unique features, such as different spreads, commission structures, and leverage options, enabling traders to choose one that aligns with their goals and trading style.

For instance, the Standard Cent account is ideal for beginners who want to start with smaller positions, while the Pro account is tailored for experienced traders who require tighter spreads and faster execution speeds. By understanding the differences between these accounts, traders can make informed choices that maximize their trading potential.

How to Open an Exness Account

Opening an account with Exness is a straightforward process. Visit the Exness website, click on the “Open Account” button, and complete the registration form by providing your email, password, and country of residence. Once registered, you’ll need to verify your identity by submitting the required documents, which usually include a government-issued ID and proof of residence.

After verification, you can choose your preferred account type and deposit funds. Exness offers a demo account option, allowing beginners to practice trading in a risk-free environment before committing real money. This initial setup ensures that traders are ready to engage with the market confidently.

Funding Your Exness Account

Deposit Methods Available

Exness offers a range of deposit methods to cater to traders in different regions. These include bank transfers, credit/debit cards, e-wallets such as Skrill and Neteller, and cryptocurrency options like Bitcoin. Most deposits are processed instantly, allowing traders to access their funds without delays and begin trading right away.

It’s important to choose a deposit method that aligns with your budget and financial needs. Exness does not typically charge deposit fees, although traders should verify with their payment provider regarding any potential third-party charges. The flexibility in deposit options makes it easy for traders to fund their accounts conveniently.

Withdrawal Options and Procedures

Exness provides multiple withdrawal options, mirroring the available deposit methods for ease of access. Withdrawals are generally processed quickly, with e-wallets offering near-instant processing times, while bank transfers may take 1-3 business days. The withdrawal process is simple: log into your account, navigate to the withdrawal section, select your preferred method, and enter the amount.

Exness does not charge withdrawal fees on most methods, but as with deposits, traders should confirm with their financial institution about any applicable charges. Understanding the withdrawal process ensures smooth fund management and hassle-free access to profits.

Essential Trading Tools on Exness

Trading Platforms Supported

Exness supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and Exness WebTrader, giving traders access to powerful tools for analyzing markets and executing trades. MT4 and MT5 are popular for their robust charting tools, technical indicators, and support for automated trading through Expert Advisors (EAs). Exness WebTrader offers a browser-based alternative that requires no software download.

The variety of platforms allows traders to choose one that aligns with their trading style, whether they prefer desktop, mobile, or web-based access. These platforms are designed to accommodate both beginner and advanced traders, providing a versatile and reliable trading experience.

Mobile Trading Applications

For traders on the go, Exness offers mobile trading apps compatible with iOS and Android devices. These apps provide full access to account management, market analysis, and trade execution, making it convenient to trade from anywhere. Mobile trading apps are especially useful for keeping up with market movements and adjusting trades quickly.

The mobile apps are equipped with essential tools, such as price alerts and charting functions, enabling traders to stay connected to the market and make timely decisions. The flexibility of mobile trading supports traders with active lifestyles, ensuring that they don’t miss trading opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Developing a Trading Strategy

Importance of a Trading Plan

A well-structured trading plan is crucial for long-term success in the markets. It provides a roadmap that outlines your goals, risk tolerance, trading style, and the strategies you intend to use. A trading plan helps traders stay disciplined, reducing the likelihood of impulsive decisions driven by emotions or market fluctuations.

Traders using Exness should develop a clear plan that aligns with their chosen account type and market goals. By adhering to a trading plan, you can measure your progress, refine your approach, and maintain consistency, which are essential for achieving sustainable success.

Technical Analysis Techniques

Technical analysis is a popular method for predicting price movements based on historical data and chart patterns. Exness’s platforms support a wide range of technical analysis tools, including moving averages, Bollinger Bands, and RSI indicators. These tools allow traders to identify trends, support and resistance levels, and potential entry and exit points.

By mastering technical analysis, traders can make data-driven decisions that improve their chances of success. Using indicators effectively helps in identifying favorable trading opportunities and managing risk, enhancing the overall trading experience.

Risk Management in Trading

Understanding Leverage and Margin

Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and risks. Exness offers high leverage options, up to 1:2000, which can be advantageous for experienced traders. However, leverage also increases the potential for losses, making it essential to use responsibly.

Margin, the collateral needed to open a leveraged position, is equally important in managing risk. Exness provides margin calculators to help traders assess their required margin based on the chosen leverage level. Understanding how leverage and margin work enables traders to manage their capital effectively and avoid unexpected losses.

Setting Stop-Loss and Take-Profit Levels

Stop-loss and take-profit orders are essential tools for managing risk and protecting profits. A stop-loss order closes a trade at a predetermined loss level, preventing further losses if the market moves against your position. Conversely, a take-profit order automatically closes a trade once a certain profit level is reached, securing gains before the market reverses.

Using these orders strategically allows traders to manage risk proactively, setting limits on potential losses and ensuring profits are captured. Exness’s platforms support customizable stop-loss and take-profit settings, enabling traders to tailor their strategies for maximum effectiveness.

Emotional Discipline in Trading

Managing Trading Psychology

Emotional discipline is crucial in trading, as emotions like fear and greed can lead to impulsive decisions. Managing trading psychology involves developing self-awareness, maintaining patience, and sticking to your trading plan. Successful traders recognize the impact of emotions and develop strategies to manage them effectively.

For example, setting realistic goals and taking regular breaks can help maintain emotional balance. By managing emotions, traders improve their focus and decision-making, increasing their chances of consistent profitability.

Avoiding Common Trading Pitfalls

Common trading mistakes, such as over-trading, chasing losses, and ignoring risk management, can lead to significant losses. Traders should be aware of these pitfalls and work to avoid them by sticking to a trading plan, managing risk carefully, and avoiding excessive use of leverage.

Exness provides educational resources to help traders identify and avoid common mistakes, fostering a disciplined approach to trading. By learning from these resources, traders can improve their strategies and reduce the likelihood of falling into costly traps.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Market Analysis Techniques

Fundamental Analysis Essentials

Fundamental analysis involves evaluating economic indicators, political events, and financial reports to predict market movements. By analyzing these factors, traders gain insights into the underlying value of currencies and other assets. Key indicators include interest rates, GDP, and employment data, which can impact currency values significantly.

Exness’s platforms offer access to real-time news and economic calendars, enabling traders to stay updated on market events. Fundamental analysis is particularly useful for long-term trades, helping traders make informed decisions based on economic conditions.

Utilizing Economic Indicators

Economic indicators, such as inflation rates, manufacturing indexes, and consumer confidence reports, provide valuable insights into market trends. Understanding these indicators helps traders anticipate market movements and adjust their strategies accordingly. By incorporating economic data, traders can make more accurate predictions and take advantage of market opportunities.

Exness provides tools and resources for accessing economic data, making it easier for traders to incorporate fundamental analysis into their strategies. By staying informed about economic indicators, traders can enhance their understanding of market trends and improve their trading outcomes.

Staying Informed about Market Trends

Sources for Market News and Updates

Keeping up with market news is essential for making timely and informed trading decisions. Exness provides market updates, news feeds, and economic calendars on its platform, helping traders stay informed about global events that impact financial markets. Additionally, reputable financial news sources like Bloomberg, Reuters, and CNBC offer in-depth analysis and insights.

Access to reliable news sources enables traders to anticipate market trends and adjust their strategies accordingly. Staying updated on market news enhances trading performance by providing context for market movements.

The Role of Social Trading

Social trading allows traders to observe and replicate the strategies of experienced traders. Exness supports social trading, giving clients access to communities where they can learn from others, discuss strategies, and gain insights into successful trading techniques. Social trading platforms provide a valuable resource for beginners, allowing them to learn through practical examples.

By engaging in social trading, new traders can build confidence and develop skills that improve their performance. The insights gained from social trading can accelerate the learning process and provide a supportive environment for growth.

Advanced Trading Techniques

Scalping Strategies for Quick Profits

Scalping involves making multiple small trades throughout the day, aiming to profit from minor price movements. This technique requires a high degree of focus, as traders need to enter and exit positions quickly. Exness’s low spreads and high execution speeds make it suitable for scalping strategies, allowing traders to capture profits from frequent trades.

Scalping is ideal for traders with a high tolerance for risk and those looking to make fast profits. It’s essential to use tight stop-losses to manage risk effectively, as rapid market changes can impact trades significantly.

Swing Trading Tactics

Swing trading involves holding positions for several days to capture price “swings” within a trend. This technique suits traders who prefer less active monitoring than day trading and are willing to hold trades based on anticipated market movements. Swing trading requires a solid understanding of technical analysis and market trends.

Exness’s range of trading tools, including technical indicators and charting options, supports swing trading strategies. This technique allows traders to capitalize on medium-term trends and adjust their positions as market conditions evolve.

Leveraging Exness Promotions and Bonuses

Types of Promotions Available

Exness occasionally offers promotions and bonuses to reward new and existing clients. These promotions may include deposit bonuses, trading credits, and loyalty rewards. By participating in these offers, traders can increase their available capital, enhancing their trading capacity.

Promotions vary by region and account type, so it’s essential for traders to check Exness’s website for current offers. Understanding the terms and conditions of each promotion ensures that traders can take full advantage of these bonuses.

How to Make the Most of Bonuses

To maximize the benefits of Exness bonuses, traders should familiarize themselves with the conditions attached, such as trading volume requirements. Bonuses can be helpful for increasing leverage, but it’s important to use them strategically rather than relying solely on them for profits.

By integrating bonuses into a well-planned strategy, traders can extend their trading potential and reduce risk. Responsible use of bonuses allows traders to benefit from extra funds while maintaining disciplined trading habits.

Building a Community of Traders

Joining Trading Forums and Groups

Engaging with trading forums and groups provides valuable networking opportunities and insights into trading strategies. Exness clients can join various trading communities, including forums and social media groups, where they can share experiences, learn new techniques, and receive support from peers.

Participation in trading communities encourages learning and helps traders develop a well-rounded perspective on market dynamics. These groups also provide a platform for discussing trading challenges and exchanging valuable tips.

Networking Opportunities through Exness

Exness often hosts webinars, workshops, and other events that allow traders to connect and learn from industry experts. Networking with other traders and professionals provides insights into advanced strategies and market trends, enhancing a trader’s skill set and understanding of the industry.

By building connections within the trading community, traders can access a broader range of resources, support, and guidance that can be instrumental in their trading journey.

Continuous Learning and Improvement

Educational Resources Provided by Exness

Exness provides a wide array of educational resources, including articles, video tutorials, and trading guides. These materials cover essential topics like technical analysis, risk management, and market psychology, helping traders build a strong foundation.

By utilizing these resources, traders can improve their knowledge and skills, leading to more informed decisions and better trading performance. Continuous learning is essential for adapting to market changes and staying competitive.

Participating in Webinars and Workshops

Exness hosts webinars and workshops led by experienced traders and market analysts. These events provide in-depth insights into current market trends, trading strategies, and economic forecasts. Attending webinars is an excellent way to stay updated and expand your understanding of the markets.

Webinars and workshops also offer opportunities for live interaction, allowing traders to ask questions and receive real-time feedback. These events are valuable for both beginners and advanced traders looking to refine their techniques.

Conclusion

Exness provides a comprehensive platform with advanced tools, educational resources, and diverse account options to support traders in their journey. By following these trading tips—ranging from developing a solid trading strategy to utilizing Exness’s tools and resources—traders can build the skills and confidence necessary for successful trading. Exness’s commitment to innovation, customer service, and continuous learning makes it an ideal choice for traders aiming to grow and achieve their financial goals.

Read more: