11 minute read

Is forex trading legal in Lesotho? A Comprehensive Guide

from Exness

by Exness_Blog

Introduction to Forex Trading

Definition of Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currencies on a global marketplace. The objective is to make a profit from fluctuations in currency values, typically through trading currency pairs like USD/ZAR (US Dollar/South African Rand) or EUR/USD (Euro/US Dollar). The forex market operates 24 hours a day, five days a week, and is considered the largest financial market in the world, with an average daily trading volume of over $6 trillion. Its decentralized structure, where trades are conducted over-the-counter (OTC) through electronic networks, makes it accessible and flexible for both institutional and individual traders.

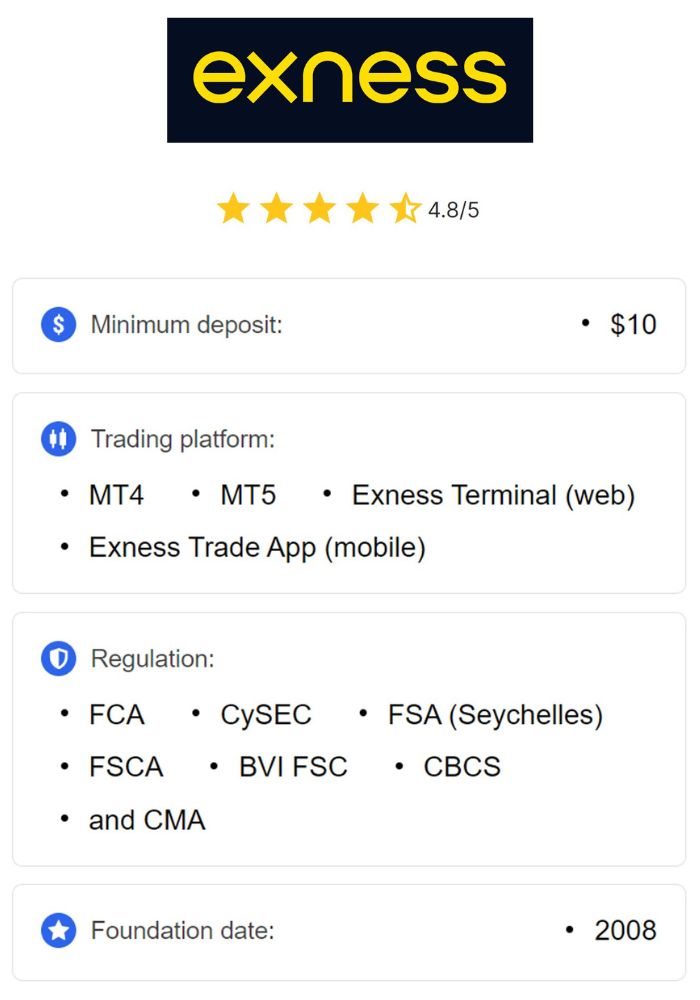

Top 4 Best Forex Brokers in Lesotho

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Importance of Forex Trading in the Global Economy

Forex trading plays a vital role in the global economy by facilitating international trade and investment. Businesses, governments, and investors depend on the forex market to conduct cross-border transactions, exchange currencies, and hedge against foreign exchange risks. The forex market’s liquidity and accessibility attract a wide range of participants, from large financial institutions to individual traders seeking to diversify their portfolios. For emerging economies like Lesotho, forex trading can be a source of economic growth and an avenue for citizens to access global financial markets.

Overview of Lesotho's Financial Regulations

Key Regulatory Authorities

In Lesotho, the main regulatory authority overseeing financial activities, including forex trading, is the Central Bank of Lesotho (CBL). The CBL is responsible for ensuring financial stability, protecting consumers, and overseeing currency regulations. While Lesotho’s financial sector is still developing, the CBL plays a crucial role in monitoring financial transactions and enforcing compliance with local laws. Other financial entities, such as the Lesotho Revenue Authority (LRA), are involved in aspects of tax collection and financial compliance, which indirectly impact forex trading.

Structure of Lesotho's Financial Services Sector

Lesotho’s financial sector includes commercial banks, microfinance institutions, insurance companies, and a limited number of investment firms. Due to its close economic ties with South Africa, Lesotho’s financial system is influenced by South African financial policies and trends. While the country does not have a large domestic forex trading industry, many local traders and institutions participate in the forex market through international brokers. The CBL and other financial institutions work together to create a safe financial environment, although regulations specific to forex trading are still evolving.

Legal Framework Governing Forex Trading

Specific Laws and Regulations

In Lesotho, there are currently no specific laws or detailed regulations that govern retail forex trading directly. However, forex transactions are generally permitted as long as they comply with the Central Bank’s foreign exchange regulations. These regulations mainly apply to financial institutions and banks, focusing on currency control and ensuring the stability of the Lesotho loti (LSL), which is pegged to the South African rand (ZAR). While individuals are not prohibited from trading forex, they are advised to use regulated brokers and comply with local financial policies.

Licensing Requirements for Forex Brokers

To operate legally in Lesotho, forex brokers would need to be licensed and regulated by the Central Bank of Lesotho. However, as the CBL does not currently issue specific forex trading licenses, most local traders use international brokers licensed by reputable regulatory bodies, such as the Financial Sector Conduct Authority (FSCA) in South Africa. Lesotho has yet to establish a framework that regulates and licenses forex brokers directly within the country. This gap in regulation emphasizes the importance of choosing reliable, internationally regulated brokers to ensure secure trading experiences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Compliance Obligations for Traders

While forex trading is not explicitly regulated in Lesotho, traders are still expected to comply with general financial policies and reporting requirements. This includes ensuring that any profits from forex trading are declared to the Lesotho Revenue Authority (LRA) for tax purposes. Traders are also encouraged to use brokers that adhere to global compliance standards, such as anti-money laundering (AML) and Know Your Customer (KYC) protocols, which protect against fraud and financial crime.

The Role of the Central Bank of Lesotho

Functions of the Central Bank

The Central Bank of Lesotho (CBL) is responsible for maintaining monetary stability, regulating the country’s financial institutions, and safeguarding the integrity of the local currency. The CBL enforces policies to protect the Lesotho loti’s value and support economic growth. It also oversees foreign exchange reserves and establishes foreign currency regulations that affect how financial institutions handle forex transactions. While the CBL’s primary focus is on domestic financial stability, its role indirectly impacts the forex trading landscape in Lesotho.

Central Bank Policies on Currency Trading

The CBL’s policies on currency trading are primarily focused on ensuring that foreign exchange transactions do not destabilize the loti. The loti’s fixed peg to the South African rand requires the CBL to maintain adequate foreign reserves and regulate cross-border currency flows carefully. As a result, the CBL monitors forex-related activities by banks and financial institutions. While it does not directly regulate retail forex trading, it encourages compliance with general foreign exchange policies, particularly for larger institutions and corporations engaging in currency exchange transactions.

Risks Associated with Forex Trading

Market Risks

Forex trading involves significant market risks due to the volatility of currency pairs. Prices can fluctuate rapidly in response to global economic conditions, geopolitical events, and monetary policies, leading to potential gains or losses. For traders in Lesotho, market risks are amplified when trading currency pairs involving less stable currencies. Understanding and managing these risks is crucial for successful forex trading, and traders are encouraged to use tools like stop-loss orders and conservative leverage ratios to mitigate potential losses.

Regulatory Risks

The absence of specific forex trading regulations in Lesotho creates regulatory risks for traders. Without a domestic regulatory framework, traders are more exposed to unregulated brokers and potential fraud. While international brokers may be regulated in their respective countries, they are not accountable to Lesotho’s financial authorities. This lack of local oversight can lead to disputes and challenges in obtaining recourse in cases of broker misconduct. As such, traders should use well-regulated international brokers to minimize regulatory risks.

Fraud and Scams in Forex Trading

The lack of specific forex regulations in Lesotho increases the risk of encountering fraudulent brokers and scams. Many unregulated brokers target inexperienced traders with promises of guaranteed profits, high leverage, and unrealistic returns. To avoid scams, traders in Lesotho should select brokers regulated by established authorities, such as the FSCA in South Africa or the FCA in the United Kingdom. Conducting thorough research and checking broker reviews can also help traders avoid fraudulent schemes.

Benefits of Forex Trading in Lesotho

Economic Opportunities

Forex trading presents new economic opportunities for individuals in Lesotho. It allows them to diversify their income sources, participate in the global economy, and access international markets. For many traders, forex trading offers an opportunity to generate income and develop financial skills that may not be available through traditional employment. This accessibility can foster economic growth, particularly in an emerging market like Lesotho, where financial options are often limited.

Accessibility to Global Markets

The forex market’s accessibility is a major advantage for traders in Lesotho. Through online trading platforms, traders can participate in the forex market from any location with internet access, gaining exposure to global currencies and financial instruments. This level of accessibility allows traders to capitalize on opportunities beyond Lesotho’s borders, providing greater financial flexibility and the potential for wealth creation. By choosing reputable brokers, traders in Lesotho can safely access global markets and benefit from the diverse opportunities available.

Popular Forex Platforms in Lesotho

Local vs. International Brokers

In Lesotho, most traders rely on international brokers, as there are few if any, licensed domestic brokers within the country. International brokers, particularly those licensed in South Africa or Europe, offer a wide range of trading platforms, currency pairs, and features tailored to both novice and experienced traders. These brokers are regulated by established authorities and offer reliable services. Lesotho traders should prioritize brokers that have a strong reputation, robust security measures, and customer support for a secure trading experience.

Comparison of Trading Platforms Available

The most popular trading platforms for forex traders in Lesotho include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, all of which are available through international brokers. MT4 and MT5 are widely favored for their user-friendly interfaces, technical analysis tools, and automated trading options, making them ideal for traders of all levels. cTrader offers advanced charting features and fast order execution, which appeals to more experienced traders. Comparing features like ease of use, technical tools, and customer support can help traders choose the best platform for their needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tax Implications for Forex Traders

Income Tax Considerations

Forex trading profits in Lesotho may be subject to income tax, depending on the individual’s overall income and trading activity. The Lesotho Revenue Authority (LRA) expects residents to report any taxable income, including gains from forex trading. However, due to the lack of specific tax guidelines for forex trading, traders are encouraged to consult with a tax advisor to ensure compliance with local tax obligations. Accurate reporting helps traders avoid penalties and ensures that they meet their tax responsibilities.

Capital Gains Tax on Forex Earnings

Capital gains tax may also apply to forex trading earnings in Lesotho, especially for traders who engage in forex trading as a primary income source. Since Lesotho does not have clear tax regulations specific to forex trading, individual tax obligations may vary. Traders should maintain detailed records of their trading activity to accurately calculate potential capital gains or losses. Seeking guidance from tax professionals can help traders understand their tax liabilities and comply with LRA requirements.

Perspectives from Local Forex Traders

Success Stories and Experiences

Many forex traders in Lesotho have achieved notable success, despite the challenges associated with unregulated markets. Success stories often emphasize the importance of education, discipline, and the use of well-regulated international brokers. Local traders who have gained expertise in forex trading have been able to generate consistent profits, diversify their investment portfolios, and improve their financial stability. Sharing these experiences can inspire and educate new traders, highlighting the potential rewards of forex trading.

Challenges Faced by Traders in Lesotho

Traders in Lesotho face various challenges, including the lack of domestic regulation, limited financial education resources, and the risk of fraud. Additionally, currency fluctuations and exposure to unregulated brokers can add to the risks associated with forex trading. Access to reliable internet connectivity and secure payment methods also pose challenges for some traders. Overcoming these obstacles requires dedication, knowledge, and a cautious approach, especially when choosing brokers and managing trading risks.

International Treaties and Forex Trading

How International Laws Affect Local Regulations

Lesotho is a member of several international organizations and treaties that impact its financial regulations, such as the Southern African Development Community (SADC) and the Common Monetary Area (CMA). These affiliations influence Lesotho’s currency policies and trade regulations, which indirectly affect forex trading. As part of the CMA, Lesotho pegs its currency to the South African rand, aligning its monetary policies with South Africa’s financial landscape. This alignment can shape how Lesotho approaches foreign exchange regulation and trading activities.

Trade Agreements and Their Impact on Forex Trading

Trade agreements, such as those with South Africa and other regional partners, facilitate cross-border transactions and currency exchanges. These agreements contribute to the stability of Lesotho’s financial system by providing access to foreign currency reserves and enhancing economic cooperation. However, they also mean that Lesotho’s financial policies are influenced by its regional partnerships, which could lead to future regulatory developments in forex trading. Traders should stay informed about international agreements that may impact their forex trading environment.

Conclusion

Forex trading is legal in Lesotho, but it operates in an environment with limited regulatory oversight. While individual traders are free to participate in the global forex market through international brokers, the lack of specific regulations means that traders need to exercise caution and prioritize reputable brokers regulated by recognized authorities. The Central Bank of Lesotho plays a central role in monitoring the country’s currency stability, while the Lesotho Revenue Authority oversees tax obligations for traders. Forex trading in Lesotho presents both opportunities and challenges, offering local traders access to global financial markets while requiring careful risk management due to the regulatory landscape. As the financial sector in Lesotho continues to evolve, future regulatory changes could provide further clarity and support for forex trading within the country.

Read more: