11 minute read

How much can i make with $200 in forex?

Understanding Forex Trading Basics

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of currencies on the foreign exchange market. This market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion. Forex trading allows traders to speculate on the value of one currency relative to another, aiming to profit from fluctuations in exchange rates.

Top 4 Best Forex Brokers

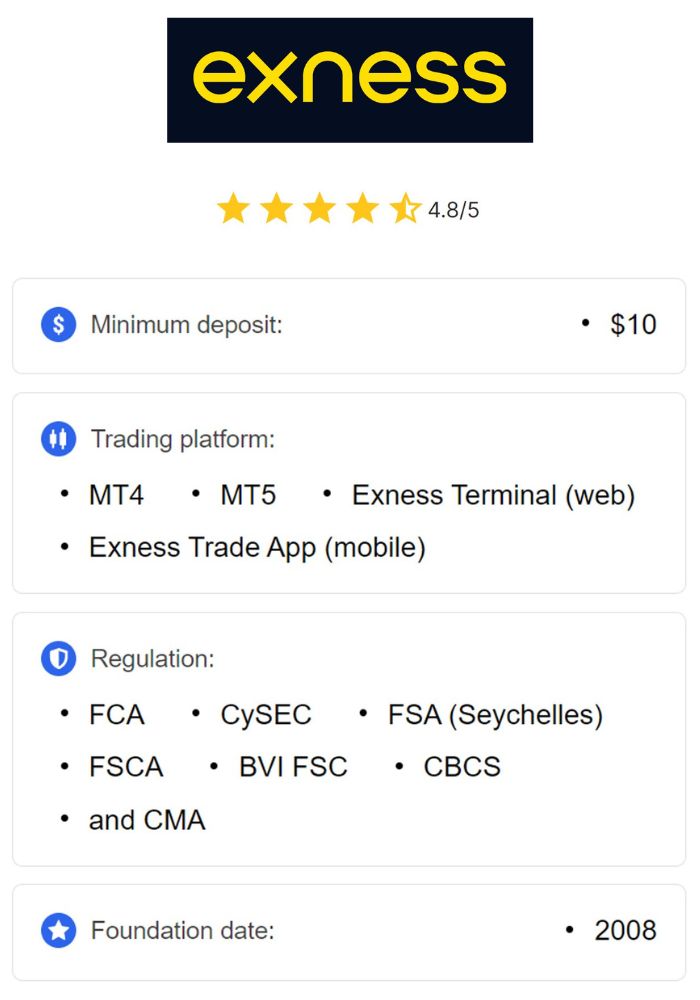

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

For instance, when a trader believes that the euro will strengthen against the US dollar, they may buy the EUR/USD pair. If their prediction is correct, they can sell the currency pair later for a profit. Forex trading is accessible to anyone with an internet connection, and many brokers allow individuals to start trading with relatively small amounts of capital.

How Forex Markets Operate

The Forex market operates 24 hours a day, five days a week, across major financial centers worldwide, including London, New York, Tokyo, and Sydney. This continuous operation allows traders to buy and sell currencies at any time, making it highly flexible.

Forex trading occurs through a network of banks, brokers, and financial institutions, rather than on a centralized exchange. This decentralized nature means that currency prices are influenced by a variety of factors, including economic indicators, geopolitical events, and market sentiment. Understanding these dynamics is essential for traders looking to capitalize on price movements in the Forex market.

Key Terminology in Forex

Before diving into trading, it’s important to understand some key terminology:

Currency Pair: A pair of currencies traded against each other, such as EUR/USD or GBP/JPY.

Pip: The smallest price movement that can occur in the exchange rate of a currency pair.

Spread: The difference between the bid (buy) and ask (sell) price of a currency pair.

Leverage: The ability to control a larger position with a smaller amount of capital.

Margin: The amount of money required to open a leveraged position.

Familiarizing yourself with these terms will enhance your understanding of Forex trading and help you navigate the market more effectively.

The Role of Leverage in Forex Trading

Understanding Leverage and Margin

Leverage is a powerful tool in Forex trading that allows traders to control larger positions with a smaller amount of capital. For example, if a broker offers a leverage of 1:100, a trader can control a position worth $10,000 with just $100 of their own funds.

Margin is the amount of money required to open and maintain a leveraged position. In the above example, the trader would need to have a margin of $100 in their account to open a $10,000 position. While leverage can magnify profits, it also increases risk, making it essential for traders to use it wisely.

Pros and Cons of Using Leverage

Leverage can significantly impact your potential returns and risks in Forex trading. Here are the pros and cons:

Pros:

Increased Buying Power: Leverage allows traders to open larger positions than they could with their own capital alone, potentially increasing profits.

Flexible Trading Strategies: With leverage, traders can implement various strategies, including day trading and swing trading, using smaller amounts of capital.

Cons:

Increased Risk: While leverage can amplify gains, it can also magnify losses. A small adverse price movement can result in significant losses.

Margin Calls: If the equity in your account falls below a certain level, your broker may issue a margin call, requiring you to deposit additional funds or close positions.

Understanding how leverage works is crucial for any trader, especially when starting with a small investment like $200.

Calculating Potential Returns on $200 Investment

Sample Trade Scenarios

To illustrate potential returns with a $200 investment, let’s consider a few sample trade scenarios using leverage.

Scenario 1: Using 1:50 Leverage

Investment: $200

Position Size Controlled: $10,000 (50 times leverage)

Pip Movement: Suppose the XAUUSD moves 50 pips in your favor and the pip value for your position is $1.

Profit: 50 pips x $1 = $50 profit.

Scenario 2: Using 1:100 Leverage

Investment: $200

Position Size Controlled: $20,000 (100 times leverage)

Pip Movement: If the XAUUSD moves 50 pips in your favor, and the pip value for your position is $2.

Profit: 50 pips x $2 = $100 profit.

In both scenarios, the profit is significant compared to the initial investment. However, it’s crucial to note that the opposite can also occur—if the market moves against you, losses can accumulate quickly.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Factors Influencing Profitability

Several factors influence the profitability of your Forex trades, including:

Market Volatility: Higher volatility can lead to larger price movements, which may increase profit potential but also risk.

Trading Strategy: The effectiveness of your trading strategy, whether it’s day trading, swing trading, or scalping, will impact your returns.

Risk Management: Implementing effective risk management strategies can protect your capital and maximize profitability.

By understanding these factors, traders can make informed decisions and improve their chances of success.

Risk Management Strategies

Importance of Risk Management in Forex

Risk management is a critical component of successful trading. It involves identifying potential risks in your trading strategy and taking steps to mitigate them. Effective risk management helps protect your capital and ensures that you can continue trading even after experiencing losses.

Traders should always prioritize risk management, especially when starting with a small investment like $200. By implementing sound risk management practices, you can minimize losses and increase the likelihood of long-term success.

Setting Stop-Loss and Take-Profit Levels

One of the most effective risk management techniques is setting stop-loss and take-profit orders.

Stop-Loss Order: This order automatically closes your position when the price reaches a specified level, limiting your potential losses. For example, if you buy XAUUSD at $1,800, you might set a stop-loss at $1,790 to limit your loss to $100.

Take-Profit Order: This order allows you to lock in profits when the price reaches a predetermined level. For instance, if you set a take-profit order at $1,810, your position will automatically close when the price hits that level, securing a $100 profit.

By using stop-loss and take-profit orders, traders can manage their risk effectively and maintain discipline in their trading.

Choosing the Right Forex Broker

Criteria for Selecting a Forex Broker

When starting your Forex trading journey with a $200 investment, choosing the right broker is crucial. Consider the following criteria:

Regulation: Ensure the broker is regulated by a reputable authority, which provides a level of security for your funds.

Trading Costs: Look for competitive spreads and commissions that won’t eat into your profits.

Leverage Options: Evaluate the leverage options available and choose a broker that aligns with your risk tolerance.

Trading Platform: Select a broker that offers a user-friendly and reliable trading platform, as this will affect your trading experience.

Customer Support: Good customer support is essential for addressing any issues or questions that may arise.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Importance of Regulation and Safety

Regulation is one of the most critical factors when choosing a Forex broker. Regulated brokers adhere to strict standards set by financial authorities, providing protection for your funds and ensuring fair trading practices.

Choosing a broker that is regulated in your jurisdiction can help safeguard your investment and give you peace of mind while trading.

Trading Strategies Suitable for Small Investments

Day Trading vs. Swing Trading

When trading with a small investment like $200, the choice between day trading and swing trading can impact your potential returns:

Day Trading: This strategy involves opening and closing positions within the same trading day. Day traders typically make multiple trades, aiming to profit from small price movements. This approach requires a significant time commitment and active market monitoring.

Swing Trading: Swing traders hold positions for several days or weeks, aiming to profit from larger price movements. This strategy allows for a more relaxed trading style, as it doesn’t require constant monitoring of the markets.

Choosing the right strategy depends on your trading style, time availability, and risk tolerance. For beginners, swing trading may be more suitable due to its lower time commitment.

Scalping Strategies Explained

Scalping is a short-term trading strategy that aims to profit from small price changes. Scalpers execute multiple trades throughout the day, looking to accumulate small profits on each trade.

To implement a successful scalping strategy, traders should consider:

Tight Spreads: Scalping requires brokers that offer tight spreads to minimize costs.

Quick Execution: A fast and reliable trading platform is essential for executing trades swiftly.

Technical Analysis: Scalpers often rely on technical indicators and chart patterns to identify quick trading opportunities.

While scalping can be profitable, it requires a solid understanding of the market and the ability to make quick decisions.

Time Commitment Required for Forex Trading

Daily Time Investment for New Traders

The time commitment required for Forex trading can vary based on your chosen strategy. For day traders, dedicating several hours each day to monitor the markets and execute trades is essential. This approach requires staying informed about economic news and trends that could impact currency prices.

Swing traders may only need to spend a few hours each week analyzing their positions and adjusting their strategies. This flexibility allows for a more manageable time investment, making it easier to balance trading with other responsibilities.

Balancing Trading with Other Responsibilities

Many traders have full-time jobs or other commitments. To succeed in Forex trading while managing these responsibilities, it’s essential to develop a schedule that allows for dedicated trading time without sacrificing other aspects of life. Consider setting specific trading hours or allocating time on weekends for analysis and planning.

Establishing a routine can help you stay disciplined and focused on your trading goals while maintaining a healthy work-life balance.

Psychological Aspects of Forex Trading

Importance of Emotional Discipline

Emotional discipline is a critical aspect of successful Forex trading. The ability to manage emotions, such as fear and greed, can significantly impact your trading decisions. Traders who let emotions dictate their actions often make impulsive decisions that lead to losses.

To cultivate emotional discipline, traders should adhere to their trading plans and avoid chasing losses. Setting realistic goals and maintaining a long-term perspective can help mitigate emotional influences.

Dealing with Losses Effectively

Losses are an inevitable part of trading. Learning how to deal with losses effectively is essential for long-term success. Here are some strategies to manage losses:

Accept Losses as Part of Trading: Understand that losses are a normal part of the trading process. Accepting this reality can help you stay focused on your strategy rather than dwelling on individual trades.

Analyze Your Trades: After a losing trade, take the time to analyze what went wrong. Identify any mistakes in your strategy or execution and use this knowledge to improve.

Stay Disciplined: Stick to your trading plan and avoid the temptation to take revenge trades. Consistency in your approach will lead to better long-term results.

Common Mistakes to Avoid When Trading Forex

Over-Leveraging Your Account

One of the most common mistakes traders make, especially with a small investment like $200, is over-leveraging their accounts. While leverage can amplify profits, it also increases the risk of significant losses.

To avoid this mistake, assess your risk tolerance and use leverage judiciously. A general rule is to risk no more than 1-2% of your trading capital on a single trade.

Ignoring Economic Indicators

Ignoring economic indicators can lead to missed opportunities and unexpected losses. Economic data releases often have a direct impact on currency prices, including XAUUSD.

Stay informed about upcoming economic events and their potential implications for the market. Using an economic calendar can help you track important releases and plan your trading accordingly.

Resources for Continued Learning in Forex

Recommended Books and Online Courses

Continuous learning is vital for improving your trading skills. Several books and online courses can help you expand your knowledge of Forex trading:

Books:

"Currency Trading for Dummies" by Kathleen Brooks and Brian Dolan

"Technical Analysis of the Financial Markets" by John J. Murphy

"Trading in the Zone" by Mark Douglas

Online Courses: Look for courses on platforms like Udemy, Coursera, or dedicated Forex education websites. Many of these courses offer insights into trading strategies, technical analysis, and risk management.

Joining Forex Trading Communities

Engaging with Forex trading communities can provide additional resources and support. Online forums, social media groups, and trading clubs allow you to connect with other traders, share experiences, and learn from one another.

These communities often serve as platforms for discussions on market trends, strategies, and best practices, fostering a collaborative learning environment.

Conclusion

Trading Forex with a $200 investment can be a viable way to enter the financial markets and potentially generate profits. By understanding the basics of Forex trading, leveraging the power of leverage wisely, and implementing effective risk management strategies, you can maximize your chances of success.

Continuous learning, emotional discipline, and avoiding common mistakes are crucial components of your trading journey. With dedication and a well-thought-out approach, you can navigate the complexities of Forex trading and work towards achieving your financial goals. Remember that every trader starts somewhere, and with the right knowledge and mindset, you can make the most of your $200 investment in the Forex market.

Read more:

Exness Review Bangladesh: Legit, Safe, Is a good broker?