9 minute read

How to get unlimited leverage on Exness

Understanding Leverage in Forex Trading

What is Leverage?

Leverage is a powerful tool in forex trading that allows traders to amplify their market exposure using only a fraction of their own capital. It functions like a loan provided by a broker, enabling traders to control positions larger than their actual investment. For instance, with a 1:100 leverage, a trader can control a $10,000 position using only $100 of their own funds.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

This ability to control larger positions with a smaller capital base makes leverage attractive, but it also demands caution. While leverage can magnify profits, it also increases potential losses, making it essential for traders to understand the mechanics and risks associated with it.

Importance of Leverage in Forex Trading

In forex trading, currency pairs usually fluctuate by only small increments, often in pips (the smallest unit of price movement). Without leverage, traders would need substantial capital to make significant profits from these small price changes. Leverage allows traders to capitalize on even minor movements, transforming small price shifts into meaningful gains.

For experienced traders, leverage offers flexibility, efficiency, and the potential for increased returns on a relatively small investment. However, leveraging should be approached with a clear understanding of its potential impact on both gains and losses.

How Leverage Affects Margin Requirements

Margin is the minimum amount of capital a trader must maintain in their account to keep a leveraged position open. The higher the leverage, the lower the margin requirement. For example, with 1:100 leverage, only 1% of the total trade value is needed as margin, while 1:500 leverage would require just 0.2%. However, a lower margin requirement also means the account is more vulnerable to market fluctuations, increasing the likelihood of a margin call if the position moves unfavorably.

Managing margin requirements effectively is crucial for risk control, especially in highly leveraged trades. It’s essential for traders to keep track of their margin levels to avoid margin calls and forced liquidation of positions.

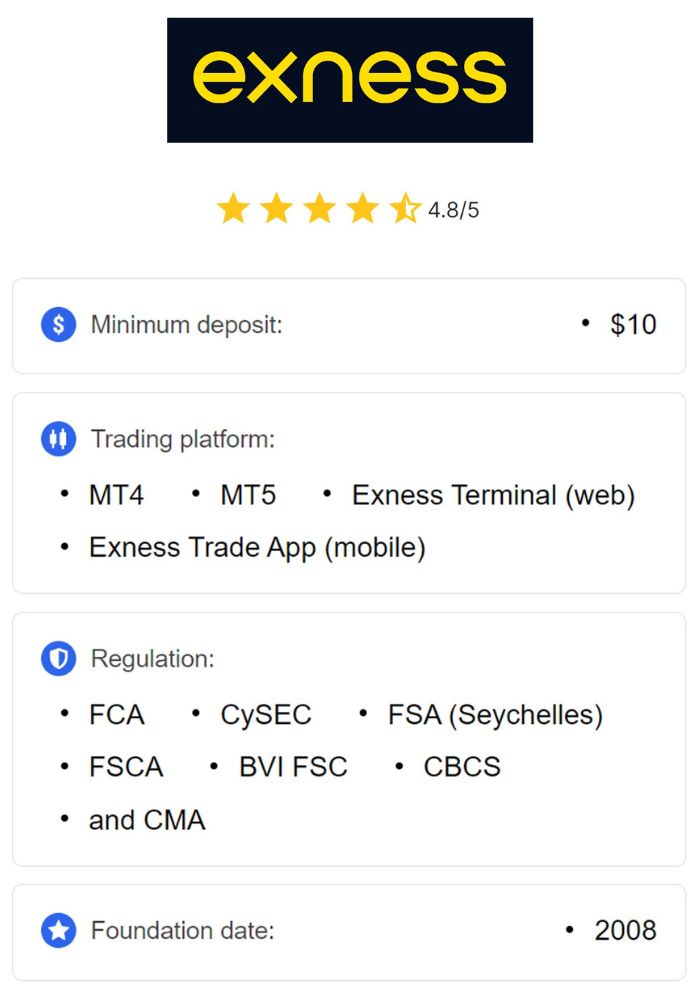

Overview of Exness Brokerage

Introduction to Exness

Exness is a globally recognized forex and CFD broker known for its user-friendly platforms, diverse trading instruments, and highly competitive trading conditions. Since its founding in 2008, Exness has expanded internationally, earning a reputation for transparent pricing, fast order execution, and reliable customer support. The broker offers access to a variety of financial markets, including forex, commodities, indices, and cryptocurrencies.

Exness is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK and Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight reinforces Exness’s commitment to safety, transparency, and client fund protection, making it a trustworthy choice for traders worldwide.

Key Features of Exness

Exness has become a popular broker thanks to its unique features that cater to both new and experienced traders:

Unlimited Leverage: For specific account types, Exness offers unlimited leverage, allowing traders to amplify their trading power with minimal capital.

Fast Withdrawals: Known for its efficient fund processing, Exness often completes withdrawals within minutes, offering liquidity and flexibility to traders.

24/7 Customer Support: Exness provides multilingual support, ensuring clients have access to assistance whenever needed.

Low or No Minimum Deposits: Many Exness accounts require low or no minimum deposit, making it accessible for traders of all levels.

These features make Exness a versatile platform, appealing to traders who seek efficiency, flexibility, and competitive trading conditions.

Types of Accounts Offered by Exness

Exness offers various account types to suit different trading needs and experience levels:

Standard Account: A popular choice for beginners due to its low trading costs and no commission.

Standard Cent Account: Ideal for new traders, this account operates in cents, allowing them to practice trading with minimal risk.

Pro Account: Suitable for experienced traders, the Pro account offers tighter spreads and faster execution.

Raw Spread and Zero Accounts: These accounts are designed for professional traders, offering minimal to zero spreads and a commission-based structure.

Each account type has unique features and leverage options, enabling traders to select the account that aligns with their goals, risk tolerance, and trading style.

The Concept of Unlimited Leverage

Definition of Unlimited Leverage

Unlimited leverage means there’s no maximum cap on the leverage a trader can use, allowing them to control extremely large positions with minimal capital. While most brokers offer leverage between 1:30 and 1:1000, Exness offers an unlimited leverage option for certain accounts, which allows for even greater market exposure. This feature is especially attractive to experienced traders who are skilled in managing risk and aiming for higher returns.

Unlimited leverage can amplify both potential gains and potential losses, making it crucial to use this option wisely and understand the associated risks.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Advantages of Unlimited Leverage

Unlimited leverage has several benefits, especially for seasoned traders:

Maximized Profit Potential: Unlimited leverage allows traders to control significantly larger positions, maximizing returns even on small market movements.

Minimal Initial Capital Requirement: Traders can access high levels of market exposure with a small amount of capital, making it accessible for those with limited funds.

Enhanced Flexibility in Position Sizing: With unlimited leverage, traders have more freedom to open multiple positions across various instruments without tying up large amounts of capital.

Potential Risks Associated with Unlimited Leverage

While the profit potential of unlimited leverage is enticing, it carries substantial risks:

Magnified Losses: Just as profits can be amplified, losses are also increased, which can lead to a rapid depletion of the trading account.

Risk of Margin Calls: Unlimited leverage requires lower margin, making it more susceptible to margin calls if the market moves against the position.

Increased Emotional Stress: Managing large positions with small capital can add emotional pressure, leading to impulsive decisions and potential mistakes.

How to Access Unlimited Leverage on Exness

Selecting the Right Account Type

To access unlimited leverage on Exness, it’s essential to choose an account that supports this feature. Unlimited leverage is available on certain accounts like the Standard Account and Pro Account, depending on specific conditions. Each account type offers different trading costs, spreads, and access to features, so it’s essential to evaluate which one aligns with your trading goals.

For instance, if you’re a beginner, the Standard Account might offer a suitable balance of features and leverage options. For experienced traders, the Pro Account may provide additional flexibility with tighter spreads and faster execution speeds.

Meeting Deposit Requirements

While Exness often has low or no minimum deposit requirements, accessing unlimited leverage may involve meeting specific conditions, such as maintaining a minimum balance or having an established trading history. These deposit requirements ensure that traders are financially prepared for the increased risks associated with high leverage.

For new traders, it may be wise to start with a smaller deposit and gradually increase it as they become familiar with high-leverage trading. Understanding these deposit requirements and account conditions will help traders access unlimited leverage confidently.

Choosing Appropriate Trading Instruments

Unlimited leverage is generally available for major forex pairs, such as EUR/USD, USD/JPY, and GBP/USD, which tend to be more stable and liquid than exotic pairs or highly volatile assets like cryptocurrencies. Major currency pairs are suitable for unlimited leverage due to their lower volatility, making them less likely to experience sudden price swings that could trigger margin calls.

Selecting the right trading instruments when using unlimited leverage is crucial for managing risk. Focus on pairs with high liquidity and relatively stable price movements to reduce exposure to large fluctuations.

Best Practices for Using High Leverage

Risk Management Strategies

Effective risk management is crucial for traders using high leverage. Key strategies include:

Limit Exposure Per Trade: Set a maximum risk-per-trade level to prevent overexposure. For example, only risk 1-2% of the account balance on each trade.

Maintain a Margin Buffer: Keeping an extra margin in the account helps prevent margin calls during unexpected market volatility.

Use Stop-Loss Orders: Automatically closing losing positions at predetermined levels prevents further losses and preserves capital.

Setting Stop-Loss and Take-Profit Levels

With high leverage, it’s essential to set stop-loss and take-profit levels to manage potential losses and secure profits. A stop-loss order automatically closes a position if it reaches a specific loss threshold, while a take-profit order locks in gains when the price hits a certain target. These orders help traders avoid emotional decision-making and keep their strategy disciplined.

Diversifying Your Trading Portfolio

Diversification spreads risk across multiple assets, reducing the impact of a single market’s adverse movements. By trading different forex pairs, commodities, or indices, traders can balance their portfolios, enhancing overall stability and reducing the likelihood of significant losses from a single position.

Common Mistakes to Avoid

Over-Leveraging Your Trades

Using the maximum leverage on every trade can lead to quick losses. Instead of maximizing leverage on all trades, traders should analyze each opportunity and use leverage based on the strategy and market conditions.

Neglecting Market Analysis

Failing to conduct market analysis can lead to poor decision-making, particularly in leveraged positions. Combine technical and fundamental analysis to understand market trends and price action, and use this information to inform your trades.

Failing to Adapt to Market Conditions

The forex market is dynamic, and conditions can change rapidly. Adapt your strategy based on market conditions, reducing leverage during high volatility periods to protect your capital.

Utilizing Tools and Resources on Exness

Trading Platforms and Their Features

Exness provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary Web Terminal, each equipped with advanced charting tools, indicators, and support for algorithmic trading. MT4 and MT5 are popular for their robust features and flexibility, catering to traders with different needs.

Educational Resources Available

Exness offers comprehensive educational resources, including webinars, tutorials, and eBooks. These resources help traders understand key concepts such as leverage, risk management, and trading strategies, promoting better trading habits and informed decision-making.

Customer Support and Assistance

Exness’s multilingual customer support is available 24/7 via live chat, email, and phone. This ensures that traders can get help with account-related issues, platform navigation, and technical problems whenever needed.

Regulatory Considerations

Understanding Exness Regulations

Exness is regulated by reputable authorities, including the FCA (UK) and CySEC (Cyprus), which enforce strict standards for fund protection and transparency. These regulations provide security for traders, ensuring that Exness adheres to ethical and financial practices.

Impact of Regulation on Leverage Options

In some regions, regulatory bodies impose limits on leverage. For example, European regulators restrict leverage for retail traders to a maximum of 1:30. However, in other regions with more flexible regulations, Exness can offer higher leverage, including unlimited leverage, to qualified traders.

Read more: