10 minute read

How much can you make with $1000 in forex?

from Exness

by Exness_Blog

Understanding Forex Trading

What is Forex Trading?

Forex trading is the act of buying and selling currencies on the foreign exchange market, the world’s largest financial market with a daily trading volume of over $6 trillion. In forex trading, currencies are traded in pairs, such as EUR/USD, where the value of one currency is compared to the other. Traders speculate on the direction of exchange rates to make a profit, taking advantage of market movements driven by economic indicators, geopolitical events, and market sentiment.

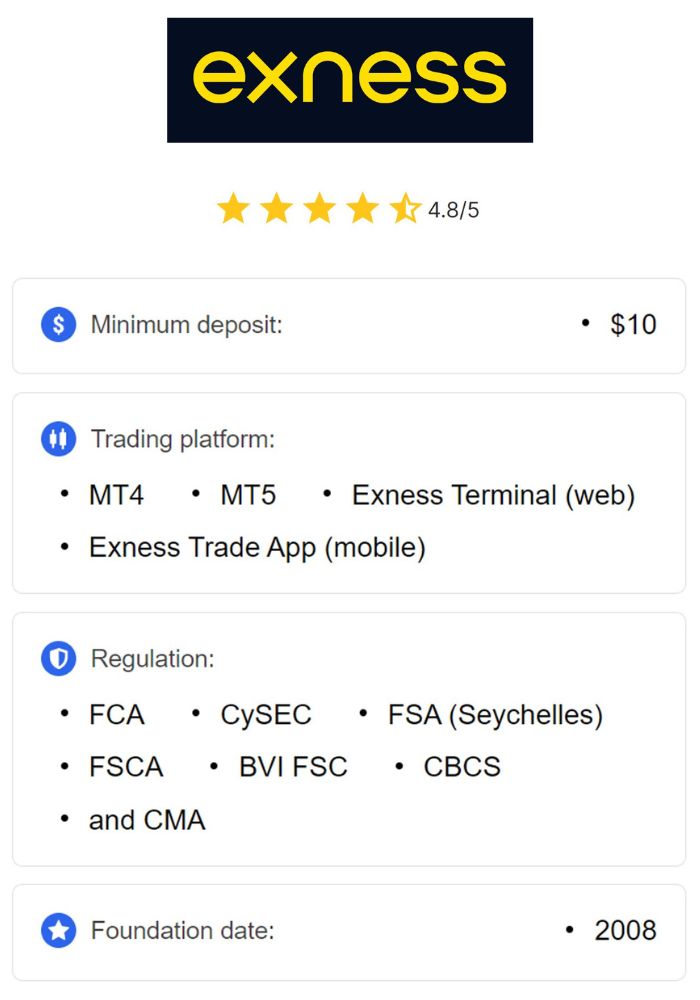

Top 4 Best Forex Brokers

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Forex trading offers opportunities for both small and large investors to participate in the global market. With the right strategies and tools, even a modest investment, such as $1000, can be leveraged to achieve reasonable profits, provided that traders exercise caution and sound decision-making.

Key Terms to Know in Forex

In forex trading, there are essential terms to understand:

Pip: A pip (percentage in point) is the smallest unit of price movement in forex, often representing a 0.0001 change in the exchange rate.

Spread: The spread is the difference between the bid and ask price and is essentially the broker’s fee for executing trades.

Leverage: Leverage allows traders to control a larger position with a smaller investment, amplifying potential profits and risks.

Margin: Margin is the amount of capital required to open a leveraged position, serving as a form of collateral.

These terms are fundamental for anyone starting in forex trading, as they directly affect trading decisions and potential profitability.

Starting with $1000 in Forex

Setting Realistic Expectations

Starting with $1000 in forex is a feasible way to enter the market, but it's essential to set realistic expectations. Forex trading is not a guaranteed way to make money quickly, and high returns often come with higher risk. With proper strategies and risk management, a $1000 account can grow over time, but significant gains require patience and consistency.

Traders should aim for modest monthly returns of 5-10%, which may not seem substantial initially but can accumulate over time. Compounding returns and adding to your account gradually can lead to sustainable growth, transforming an initial $1000 investment into a more significant sum over months or years.

Choosing the Right Broker

Selecting a reliable broker is critical to a successful trading journey. A good broker should offer competitive spreads, fast execution speeds, and secure trading conditions. Additionally, regulated brokers provide greater protection, ensuring compliance with industry standards that safeguard client funds.

When starting with $1000, look for brokers with low minimum deposit requirements, transparent fee structures, and access to leverage options that align with your risk tolerance. Reputable brokers also offer demo accounts, allowing you to practice trading without risking real capital.

Leverage and Margin Explained

What is Leverage in Forex?

Leverage in forex allows traders to control a larger position than their initial investment. For example, with 1:100 leverage, a $1000 deposit enables traders to control $100,000 in the market. Leverage can amplify potential returns, allowing traders to earn more on smaller price movements. However, leverage is a double-edged sword, as it also magnifies losses, potentially depleting an account quickly if trades go against the trader.

Understanding leverage and using it wisely is key to balancing profit potential and risk. Beginners should consider using conservative leverage ratios to minimize risk exposure.

Risks of Using High Leverage

While leverage increases buying power, it also elevates risk. High leverage can lead to rapid losses, particularly in volatile markets. For example, with 1:500 leverage, a 0.2% adverse move in the market could result in a 100% loss of the initial capital.

To mitigate this risk, many traders use lower leverage levels and prioritize risk management techniques like stop-loss orders. By keeping leverage under control, traders can maintain a more balanced approach, preserving their $1000 investment and reducing the likelihood of large losses.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Potential Earnings with $1000

Calculating Possible Returns

Estimating potential earnings with $1000 in forex depends on factors like trading strategy, leverage, and market conditions. With a conservative target of 5-10% monthly returns, a $1000 account could yield between $50 and $100 monthly. While this may seem modest, consistent monthly gains can result in compounding returns, leading to substantial growth over time.

For example, achieving an average monthly return of 8% could turn $1000 into over $2500 in a year, thanks to compounding. While aggressive strategies may promise higher returns, they come with increased risk, highlighting the importance of setting realistic targets and maintaining steady growth.

Factors Influencing Profitability

Profitability in forex is influenced by a range of factors, including:

Market volatility: Highly volatile markets offer more opportunities but require careful management due to rapid price fluctuations.

Risk management: Traders who use strict risk management are more likely to protect their capital and achieve steady returns.

Skill level and strategy: A well-designed trading plan can significantly enhance profitability, while novice traders often experience losses due to inexperience.

Leverage and position sizing: Using appropriate leverage and position sizes allows traders to balance potential returns with risk.

By focusing on these factors, traders can improve their potential earnings and reduce the risk of significant losses.

Different Trading Strategies

Scalping Strategy

Scalping involves making numerous trades within short timeframes, often lasting only a few seconds or minutes. This strategy capitalizes on small price movements and requires high concentration, quick execution, and access to tight spreads. Scalping can be profitable but is highly demanding and may not be suitable for beginners.

With a $1000 account, scalping can generate small, consistent profits, but requires strict risk management and low-latency trading conditions to be effective.

Day Trading vs. Swing Trading

Day trading involves entering and exiting trades within the same day, taking advantage of intraday price movements. It requires active monitoring and often relies on technical analysis. Day trading can yield substantial returns on a $1000 account, but it also requires discipline and a solid understanding of market trends.

Swing trading, on the other hand, involves holding positions for several days to weeks, capturing larger price swings. Swing trading suits those who cannot monitor the market constantly and allows for more significant potential gains with a $1000 account. It generally involves lower transaction costs and less stress than day trading, making it suitable for traders with full-time commitments.

Position Trading Overview

Position trading is a long-term strategy, where trades are held for weeks, months, or even years based on fundamental analysis and long-term market trends. With a $1000 account, position trading allows for gradual gains without the need for constant monitoring. It is less affected by daily volatility and can be a less stressful approach for those with limited time to trade actively.

Risk Management in Forex Trading

Importance of Risk Management

Effective risk management is vital for protecting your $1000 investment in forex. Without a risk management plan, it’s easy to deplete capital, especially in volatile markets. Setting stop-loss orders, using appropriate leverage, and adhering to a risk-per-trade rule (such as 1-2% of the account balance) can help traders limit losses and protect their account.

Common Risk Management Techniques

Some widely used risk management techniques include:

Stop-loss orders: Automatically close trades at predetermined price levels to limit losses.

Position sizing: Adjust the size of each trade based on the account balance and risk tolerance.

Diversification: Avoid putting all funds into a single trade or currency pair to reduce risk exposure.

Trailing stops: Move the stop-loss as the price moves in your favor to lock in profits.

Implementing these techniques helps traders manage their risk effectively, preserving capital over the long term.

Psychological Aspects of Trading

Managing Emotions in Trading

Forex trading can evoke emotions such as fear, greed, and impatience, which can lead to impulsive decisions and losses. Successful traders learn to manage these emotions by sticking to their trading plan and not letting short-term market fluctuations affect their decisions. Practicing discipline and maintaining a clear mindset can make a substantial difference in trading success.

Discipline and Consistency

Discipline and consistency are crucial in forex trading. Traders who follow a structured approach, consistently apply their strategies, and avoid deviating from their plans are more likely to achieve long-term success. Consistency in following a strategy builds confidence, reduces errors, and enhances the potential for sustainable profits.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Case Studies: Success and Failure

Successful Traders’ Stories

Many traders have achieved success by starting with small accounts and gradually growing them over time. For example, traders who adopted conservative risk management and applied consistent strategies have managed to turn modest investments into larger portfolios. These success stories highlight the importance of patience, risk management, and a well-defined trading plan.

Lessons from Failed Trades

While success stories are inspiring, learning from failed trades is equally important. Many traders who started with $1000 lost their entire balance due to over-leveraging, emotional trading, or lack of discipline. Analyzing these failures provides valuable lessons, reminding traders to avoid risky behavior and prioritize risk management.

Tools and Resources for Traders

Essential Trading Platforms

Trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms offered by brokers provide essential tools for analysis and order execution. These platforms feature charting tools, indicators, and automated trading options, helping traders make informed decisions and execute trades efficiently.

Using Forex Signals

Forex signals offer trade suggestions based on market analysis, helping traders identify potential entry and exit points. While signals can be beneficial, it’s crucial to use them cautiously and understand the underlying analysis before relying on them. Signals can supplement a trader’s strategy, but independent decision-making is essential for long-term success.

Read more: 10 RBI Approved Forex Broker in India

Tax Implications of Forex Trading

Understanding Forex Taxes

Forex trading profits are subject to capital gains tax, depending on the trader’s country of residence. It’s essential to understand the tax implications of forex trading and report earnings accurately to avoid penalties. In some jurisdictions, forex trading may be taxed as regular income, while in others, it’s taxed under capital gains.

Reporting Requirements

Traders must keep accurate records of trades and profits to ensure compliance with tax regulations. Reporting requirements may vary, and consulting a tax professional can help traders navigate the tax obligations associated with forex trading.

The Future of Forex Trading

Trends in the Forex Market

The forex market continues to evolve, with trends like increased automation, algorithmic trading, and the use of AI-driven analysis. These trends present new opportunities for traders, allowing them to access sophisticated tools and strategies to enhance their trading experience.

Technological Advancements

Advances in technology, such as mobile trading, high-frequency trading, and data analytics, are reshaping the forex landscape. These advancements make forex trading more accessible and efficient, enabling traders to stay connected to the market and make informed decisions in real-time.

Conclusion

Starting with $1000 in forex trading offers potential but requires realistic expectations, disciplined strategies, and risk management. By understanding leverage, choosing the right broker, and focusing on consistent growth, traders can navigate the forex market effectively. While $1000 may not yield significant profits immediately, it provides a solid foundation for building experience and gradually growing a trading account. With patience, discipline, and continual learning, forex traders can harness the opportunities this dynamic market offers.