14 minute read

What is leverage in Exness? A Comprehensive Guide

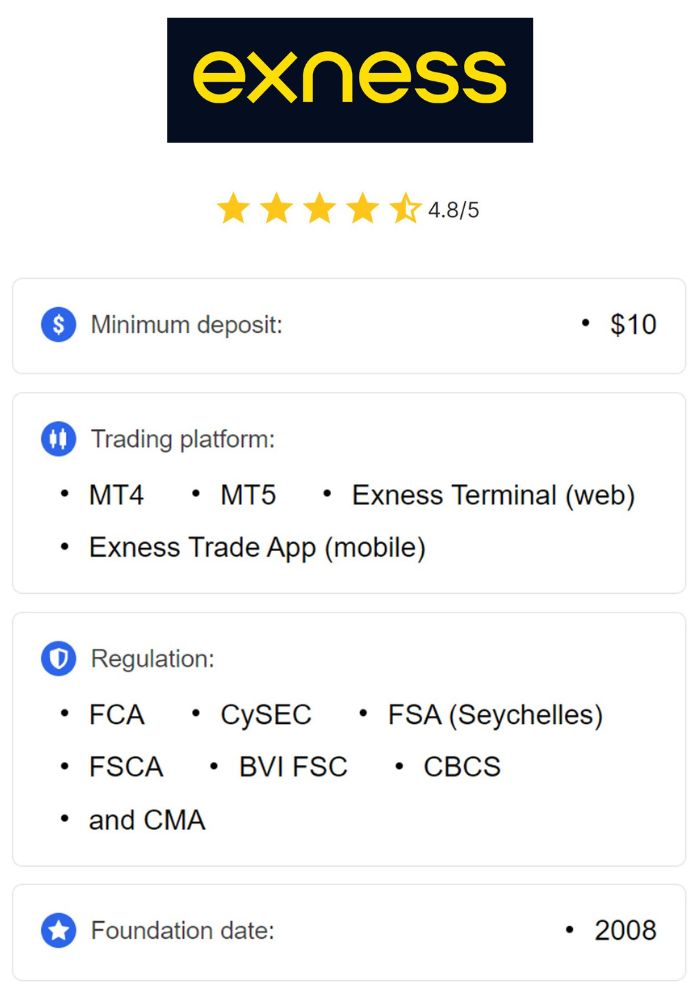

from Exness

by Exness_Blog

What is leverage in Exness? It’s a crucial concept that every trader must grasp to navigate the world of online trading effectively. Leverage allows traders to control larger positions in the market with a relatively small amount of capital. It represents both an opportunity and a risk, making it essential for traders of all experience levels to understand its mechanics, advantages, and potential pitfalls. This article provides an in-depth exploration of leverage within the Exness platform, offering valuable insights into how it works, its benefits and risks, and best practices for effective utilization.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Leverage

To fully appreciate the concept of leverage in trading, we must first delve into its definition and significance within the broader trading landscape. By doing so, traders can gain a clearer perspective on how to harness its potential to enhance their trading strategies.

Definition of Leverage

Leverage, simply put, enables traders to amplify their exposure to the market without requiring substantial capital investment. It acts as a financial tool that permits traders to control a larger position than they could ordinarily afford based solely on their account balance.

In the context of Exness, leverage functions by allowing traders to borrow funds from the broker, which lets them increase their buying power. For example, if a trader has a trading account with $100 and leverages it at 1:100, they can open a trade worth $10,000. While this mechanism presents attractive opportunities for profitability, it also carries significant risk, as losses can accumulate just as rapidly as gains.

Importance of Leverage in Trading

Understanding what is leverage in Exness extends far beyond its mere definition; it illuminates why this concept is indispensable in the realm of forex and CFD trading.

Firstly, leverage democratizes access to various financial markets, particularly for retail traders who may not have large amounts of capital available. With the help of leverage, novice traders can participate in markets that would otherwise be beyond their reach, thus fostering competition and diversity among market participants.

Secondly, leverage serves as a catalyst for amplifying profits. A successful trade can yield exponential returns when leverage is applied, transforming modest price movements into significant gains. However, this potential for high returns comes with the inherent risk of equally amplified losses, necessitating a cautious approach to leveraging trading capital.

Furthermore, leverage enhances flexibility in trading strategies. Traders can execute more complex strategies, such as day trading or scalping, while managing larger positions. This flexibility allows them to capitalize on even minor fluctuations in price, leading to higher potential rewards.

How Leverage Works in Exness

To comprehend how leverage operates within the Exness platform, one must explore its underlying mechanisms, including margin requirements that govern leveraged trading.

Mechanism of Leverage

The core mechanism of leverage in Exness revolves around the concept of margin. When you engage in leveraged trading, the broker requires you to deposit a specific percentage of the total trade value as margin—essentially a security deposit demonstrating your commitment to the trade.

By controlling a larger position through borrowed capital, traders can unlock greater potential in their trades. As previously mentioned, a trader opening a position valued at $10,000 with a leverage ratio of 1:100 only needs to set aside $100 as margin. The other $9,900 is borrowed from Exness, enabling them to play a much larger hand in the market.

This framework offers immense possibilities but also demands a thorough understanding of the implications involved. It is necessary to recognize that effectively managing margin and understanding its relationship with leverage is fundamental to achieving success in trading.

Margin Requirements

Margin requirements are pivotal when it comes to leveraged trading as they dictate the minimum amount of capital you need to maintain an open position. These requirements can vary significantly based on the asset class, trading instrument, and the leverage level chosen by the trader.

Exness clearly outlines its margin requirements for each asset on its platform. Generally, higher leverage ratios result in lower margin requirements. Nonetheless, it is essential to consider that while higher leverage may initially seem appealing, it could lead to increased risk exposure and the possibility of incurring losses rapidly.

Understanding margin requirements is crucial to avoid situations where your account equity dips below the required threshold, triggering margin calls or forced liquidation of positions.

Types of Leverage Offered by Exness

Exness caters to a diverse range of traders by offering different types of leverage options, ensuring that individuals can choose the right level to suit their trading style and objectives.

Standard Leverage

Standard leverage refers to the default leverage levels provided by Exness for most traders, typically ranging between 1:20 to 1:300. This type of leverage strikes a balance between risk and reward, making it suitable for traders who prefer to exercise caution and manage their exposure effectively.

Utilizing standard leverage empowers traders to navigate the markets while avoiding excessive risk. By adopting a moderate approach, traders can make informed decisions and implement risk management strategies without exposing themselves to undue volatility.

Professional Leverage

For seasoned traders, Exness offers professional leverage, which can reach staggering ratios of up to 1:2000. This option is designed for experienced traders who have demonstrated their ability to manage the heightened risk associated with such leverage levels.

While the allure of professional leverage lies in the potential for massive returns, the reality is that it demands exceptional skill, discipline, and risk management capabilities. Only those who thoroughly understand the dynamics of leveraged trading should consider utilizing professional leverage, as the consequences of mismanagement can be catastrophic.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Benefits of Using Leverage in Trading

When wielded judiciously, leverage presents numerous advantages that can elevate a trader's performance and effectiveness in the marketplace.

Increased Buying Power

One of the primary benefits of leverage is the increased buying power it affords traders. By utilizing leverage, traders can control positions significantly larger than their initial capital would enable.

This enhanced buying power becomes invaluable when a trader identifies promising opportunities in the market. Rather than being limited by their account balance, they can seize the moment and take larger positions, potentially generating higher returns on investment. Increased buying power opens doors to new strategies and trade ideas that may have been previously unattainable.

Potential for Higher Returns

The potential for higher returns remains the most compelling reason many traders flock to leverage. Even minor price fluctuations can translate into substantial profits due to the size of the leveraged position.

For instance, if a trader successfully predicts a market movement, a small percentage change can lead to significant profit margins. This amplification of returns captivates many traders and motivates them to explore various trading styles, from short-term scalping to long-term swing trading.

However, it is vital to remember that the flip side of this coin is that potential for loss is equally magnified. Therefore, careful consideration of how leverage is applied is paramount for sustained success.

Risks Associated with Leverage

While the benefits of leverage are clear, it is equally important to address the significant risks that come along with it.

Magnified Losses

The mechanism that can amplify profits also poses the risk of equally magnified losses. In leveraged trading, even minor adverse price movements can lead to significant declines in account equity.

For example, suppose a trader opens a position worth $10,000 using leverage of 1:100. If the market moves against them by just 1%, they would incur a loss of $100—effectively wiping out their entire initial investment of $100. Such scenarios underscore the necessity for implementing robust risk management strategies when trading on margin.

Margin Calls and Liquidation

Among the most pressing risks associated with leverage are margin calls and potential liquidation. When market conditions shift unfavorably and the equity in a trader's account falls below the required margin level, Exness may issue a margin call, alerting the trader to deposit additional funds to maintain their position.

If the necessary funds are not deposited within the specified timeframe, the broker may proceed to liquidate the trader's positions, closing them automatically to limit further losses. This can result in considerable financial setbacks, especially if the liquidation occurs at an unfavorable price point.

Traders must remain vigilant, monitor their account status, and actively manage their risk to mitigate these dangers effectively.

Choosing the Right Leverage Level

Determining the appropriate leverage level is a crucial decision that can significantly influence a trader's overall experience and success rate.

Factors Influencing Leverage Choice

Several factors play a critical role in guiding traders toward selecting the appropriate leverage level.

First, trading experience greatly influences the choice of leverage. Novice traders are often advised to start with lower leverage levels to gain hands-on experience and develop a comprehensive understanding of the risks before gradually increasing their leverage as they grow more confident.

Additionally, individual risk tolerance varies from trader to trader. Those with a lower risk appetite tend to favor lower leverage levels that align with their comfort zones. Conversely, aggressive traders may pursue higher leverage for the chance of amplified gains.

Moreover, the trader's strategy and market conditions impact leverage decisions. Scalpers might prefer lower leverage to minimize exposure during rapid price changes, whereas swing traders may utilize higher leverage to capture larger price movements over time.

Risk Management Strategies

Employing effective risk management strategies is essential when engaging in leveraged trading.

Stop-loss orders are a vital tool for limiting potential losses. By setting predefined exit points, traders can ensure that they do not exceed their risk threshold if a trade goes awry. This proactive approach helps protect their capital while maintaining disciplined trading practices.

Position sizing is another key element in risk management. Calculating the appropriate position size based on account balance, risk tolerance, and expected market movement ensures that traders do not overextend themselves on any single trade.

Diversification can also prove beneficial, allowing traders to spread their capital across multiple assets and strategies, thereby minimizing the risk of catastrophic losses. Regular monitoring of open trades fosters a responsive approach to changing market conditions, allowing traders to react promptly when necessary.

Emotional control is equally vital in leveraged trading. Traders must resist the urge to act impulsively, remembering that emotional decisions often lead to poor outcomes. Sticking to a well-defined trading plan and adhering to predetermined strategies can go a long way in achieving consistent results.

How to Set Leverage in Exness

Setting the appropriate leverage level in Exness is a straightforward process that can greatly enhance your trading experience.

Step-by-Step Guide to Setting Leverage

To set your leverage level in Exness, follow these simple steps:

Start by logging into your Exness Traderoom. Access your trading account through the Exness Traderoom or the Exness Trading App.

After logging in, navigate to the settings section of the platform. Look for either the profile or account settings area.

Within the settings, locate the leverage adjustment option. Depending on the interface, it may be under trading settings or account preferences.

Once you find the leverage settings, select the desired leverage level that aligns with your trading objectives and risk tolerance.

Finally, confirm your selection by clicking on the Save or Apply button to finalize your changes.

Adjusting Leverage Settings

Traders have the flexibility to adjust their leverage settings at any time. However, it is advisable to consider the implications of such adjustments carefully.

Frequent changes to leverage levels can lead to confusion and mismanagement, so it is wise to reassess your trading strategy and financial goals before making modifications. Additionally, Exness may impose restrictions on frequently adjusting leverage depending on account type and trading activity.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Leverage and Different Assets in Exness

Different assets present unique opportunities and challenges when it comes to leveraging. Understanding these nuances is essential for traders aiming to utilize leverage effectively across various markets.

Currency Pairs

Currency pairs are some of the most commonly traded financial instruments due to their inherent liquidity and volatility. Leverage in currency trading can significantly enhance a trader's ability to capitalize on price movements and economic trends.

The forex market is known for its rapid and sometimes unpredictable price fluctuations. As a result, the use of leverage can magnify both gains and losses, making sound risk management practices more crucial than ever. Traders must remain vigilant and adapt their leverage choices based on market conditions and their trading strategies.

Commodities and Indices

Commodities and indices offer traders alternative avenues to explore leveraging. These assets often exhibit different volatility characteristics compared to currency pairs.

For example, commodity markets may be influenced by factors such as supply chain disruptions, geopolitical events, or natural disasters, leading to price swings that can impact leveraged positions. Similarly, indices reflect the performance of a specific market sector and can be subject to rapid changes based on economic news or corporate earnings reports.

Understanding the unique dynamics of commodities and indices is vital for leveraging positions effectively and mitigating risk exposure.

Regulatory Aspects of Leverage in Exness

Navigating the regulatory landscape surrounding leverage is essential for traders seeking to operate within legal and ethical boundaries.

Compliance with Financial Authorities

Exness adheres to strict regulations imposed by relevant financial authorities in the jurisdictions where it operates. These regulations often delineate maximum allowable leverage ratios, ensuring that brokers maintain a responsible approach to leveraging clients’ funds.

Compliance with such regulations serves to protect traders from excessive risk exposure and maintain market integrity. It is crucial for traders to familiarize themselves with the regulatory environment governing leverage in their respective regions before making trading decisions.

Impact of Regulations on Leverage Options

Regulations can significantly impact the leverage options available to traders. In certain jurisdictions, limitations on leverage ratios have been implemented to protect retail investors from the inherent risks of leveraged trading.

Such measures may restrict traders from accessing higher leverage levels, thus encouraging a more cautious approach to trading. While this may initially appear limiting, it ultimately fosters a safer trading environment where risk management practices take precedence.

Traders should remain informed about changes in regulations and how they may affect their trading strategies and leverage choices.

Common Misconceptions about Leverage

As traders navigate the complexities of leverage in trading, several misconceptions can cloud their judgment and hinder their success.

Leverage Equals Guaranteed Profits

One prevalent misconception is that leverage guarantees profits. Many novice traders mistakenly believe that leveraging large amounts of capital will automatically result in substantial gains.

In reality, leverage amplifies both profits and losses. While it can enhance potential returns, relying solely on leverage without proper risk management can lead to significant financial setbacks.

Higher Leverage Always Means Better Opportunities

Another common belief is that higher leverage always translates to better trading opportunities. While higher leverage may tempt traders to pursue larger positions, it also increases the likelihood of substantial losses if the market moves unfavorably.

It is essential for traders to evaluate their risk tolerance and strategic approach rather than blindly chasing higher leverage levels. A well-balanced approach can lead to sustainable success in the long run.

Case Studies: Leverage Scenarios in Trading

Examining real-world case studies can provide valuable insights into how leverage impacts trading decisions and outcomes.

Successful Use of Leverage

Consider a hypothetical scenario where a trader utilizes leverage effectively. With a solid understanding of the market and a well-defined trading strategy, the trader decides to enter a long position in a currency pair poised for growth.

By employing a leverage ratio of 1:100, the trader controls a position worth $10,000 with only $100 in margin. As anticipated, the market moves favorably, resulting in a 2% price increase. The trader realizes a profit of $200, showcasing the power of leverage when used correctly in conjunction with sound trading principles.

Lessons from Over-leveraging

Conversely, let’s examine a cautionary tale involving over-leveraging. In this case, a trader enters the market with a 1:500 leverage ratio, seeking quick profits without adequate risk management. Shortly after placing the trade, the market experiences unexpected volatility, resulting in a swift decline in the trader's position.

Due to the high leverage employed, the trader quickly finds themselves facing significant losses. A margin call is issued, prompting the trader to deposit additional funds to maintain their position. Failing to meet the margin call leads to the automatic liquidation of positions, resulting in the complete depletion of the trading account.

This example underscores the perils of excessive leverage, emphasizing the necessity of prudent risk management practices and a disciplined trading approach.

Conclusion

Understanding what is leverage in Exness is paramount for any trader looking to succeed in the dynamic world of online trading. Leveraging can significantly amplify both profits and losses, making it a double-edged sword that demands careful consideration.

By comprehensively exploring the mechanics of leverage, its benefits, risks, and best practices for implementation, traders can equip themselves with the knowledge needed to navigate the complexities of the financial markets. Ultimately, a balanced approach to leveraging, coupled with effective risk management, can pave the path toward achieving trading success in the competitive landscape of Exness and beyond.

Read more: How to open account in Exness in India