14 minute read

Is it Safe to trade in Exness in India

from Exness

by Exness_Blog

Is it Safe to trade in Exness in India? This question has become increasingly relevant as more Indian traders explore online forex trading platforms. With the rapid growth of digital trading and accessibility to global markets, it’s vital for traders to assess the safety and reliability of their chosen platforms. One of the popular choices among Indian traders is Exness, an online brokerage that promises a range of features and competitive trading conditions. However, understanding whether it is safe to trade with Exness requires a deep dive into various aspects, including regulatory compliance, security measures, user experiences, and legal considerations specific to Indian traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

Exness has emerged as a well-known name in the world of online trading. As a platform, it offers a comprehensive suite of services tailored to meet the diverse needs of traders. The firm claims to cater to both novices and seasoned professionals by providing robust tools, educational resources, and an overall transparent trading environment. For many traders in India, Exness represents not just a way to engage in forex trading but also a gateway to global financial markets.

Overview of Exness as a Trading Platform

At its core, Exness is designed to be user-friendly and accessible. Navigating through its interface is relatively straightforward, making it an appealing option for those who may be unfamiliar with trading complexities. Traders can access a variety of financial instruments, ranging from forex pairs to commodities and cryptocurrencies.

The platform's competitive trading conditions, such as tight spreads and low commissions, have attracted a considerable number of users globally. Moreover, Exness provides advanced trading tools, like automated trading systems and analysis resources—essentially empowering traders to make informed decisions. It is not merely about executing trades; it's about creating an ecosystem where traders feel supported and equipped to handle market volatility effectively.

History and Background of Exness

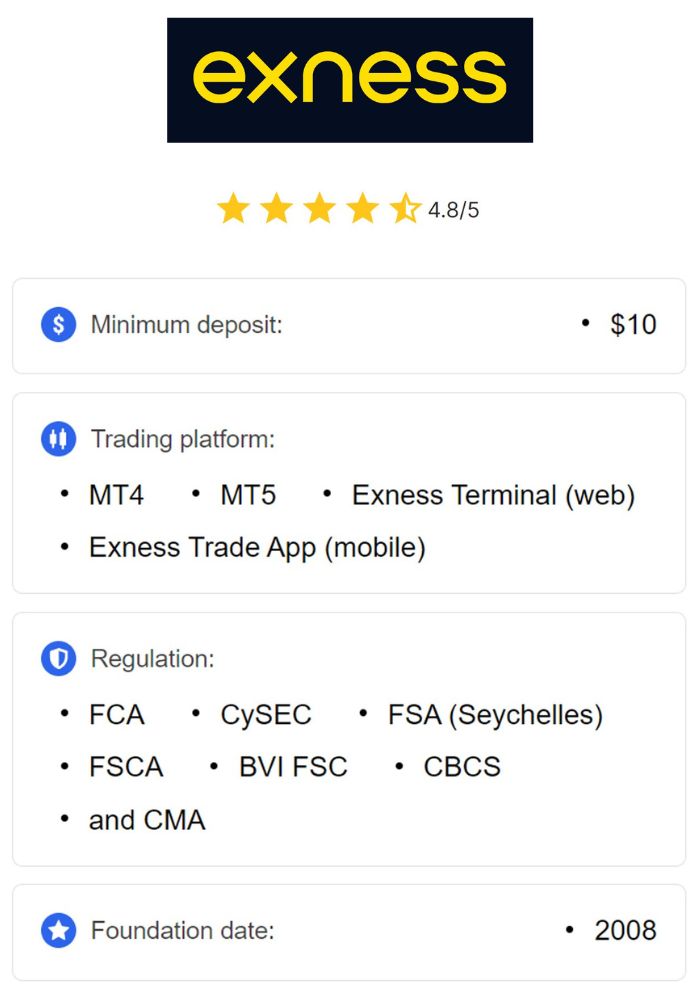

Founded in 2008, Exness quickly established itself as a credible player in the online brokerage space. The company's rapid ascent in the industry can be attributed to its commitment to client satisfaction and regulatory compliance. By focusing on transparency and stringent operational practices, Exness has fostered trust among its clients, which is crucial in the trading realm.

Over the years, Exness has expanded its reach, catering to millions of clients across various geographic regions. Its operational model reflects an understanding of the importance of regulation, particularly in emerging markets like India. While it operates under several international licenses, its adaptability to local regulations showcases its dedication to creating a safe trading environment.

Regulatory Compliance

Navigating the forex landscape requires an understanding of the regulations governing the market. In India, this oversight falls primarily under the purview of the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Understanding these regulatory frameworks allows traders to assess the safety of their chosen brokerages.

Regulatory Authorities Governing Forex Trading in India

In India, the regulatory framework for forex trading is structured primarily around two key authorities: RBI and SEBI. The RBI governs the foreign exchange market and ensures that all transactions comply with the Foreign Exchange Management Act (FEMA) of 1999. On the other hand, SEBI regulates the securities market, promoting investor protection and overseeing the functioning of stock exchanges.

Both organizations ensure that traders are protected and that brokers adhere to stringent compliance requirements. This includes guidelines on fund segregation, risk management, and transparency in operations. For Indian traders, it is imperative to select brokers that align with these regulations to mitigate potential risks associated with forex trading.

Exness’s Regulatory Status and Licensing

While Exness does not possess a specific license from Indian authorities, it holds several well-respected international licenses, including those from the Financial Commission, Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA) in the UK. These licenses signify that Exness operates within regulated environments and adheres to strict standards associated with client funds and operational practices.

Despite the absence of Indian-specific licensing, the international regulatory status adds a layer of credibility to Exness. Traders should recognize that while the lack of local regulation might raise concerns, the firm's dedication to compliance with international norms demonstrates its focus on maintaining a safe trading environment.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Security Measures Implemented by Exness

Safety in trading isn't solely reliant on regulatory compliance but is bolstered by robust security measures that protect user data and funds. Exness recognizes this need and has implemented various features to enhance the security of its platform.

Two-Factor Authentication (2FA)

To tackle unauthorized access, Exness places significant emphasis on account security by offering Two-Factor Authentication (2FA). By requiring users to provide a unique verification code generated by an authenticator app or device during login, Exness minimizes the chances of unauthorized access.

This extra layer of security is particularly crucial in today's digital age, where cyber threats are increasingly sophisticated. By implementing 2FA, Exness empowers users to take charge of their account security and enhances the overall safety of the platform. Traders using 2FA can feel more confident knowing that even if their login credentials were compromised, unauthorized individuals would still be unable to access their accounts without the second factor of authentication.

Data Encryption and Privacy Policies

Exness prioritizes the protection of its clients’ personal and financial information by employing high-level SSL encryption protocols. This technology safeguards communications between users' devices and the Exness trading platform, ensuring that sensitive information remains secure from potential hackers.

Moreover, Exness adheres to comprehensive privacy policies that outline how user information is collected, stored, and utilized. Transparency is a critical component of building trust; therefore, Exness ensures that users are informed about their data handling practices. Traders can rest assured that their information is treated with respect and confidentiality, further solidifying the argument for the safety of trading with Exness.

Assessing the Safety of Trading with Exness

When evaluating the safety of trading with Exness, it's essential to consider user experiences and reviews. Personal testimonials can provide valuable insights into the strengths and weaknesses of the platform.

User Reviews and Experiences

User feedback can illuminate the real-world effectiveness of a trading platform. Exness has cultivated a significant online presence, with many traders sharing their experiences. A majority of reviews highlight the platform’s speed of execution, competitive spreads, and available trading tools as standout features.

However, like any platform, Exness is not without its criticisms. Some users report experiencing challenges with customer service responsiveness and occasional delays in trade execution during peak times. Analyzing these mixed reviews is crucial for gauging the overall reliability of the platform. It becomes necessary for prospective traders to conduct thorough research and consider both positive and negative experiences before engaging with Exness.

Common Concerns Among Traders

Even with generally favorable reviews, some common concerns persist among traders regarding Exness. Principal among these is the lack of specific regulation in India, which raises questions about the broker's adherence to the local laws and guidelines set by Indian authorities. This ambiguity can lead to uncertainty for traders seeking assurance in their choice of broker.

Additionally, some users have expressed dissatisfaction with the withdrawal process, claiming it can be slow at times. Such concerns underscore the importance of conducting due diligence and being aware of potential limitations before beginning the trading journey. Ultimately, recognizing these common issues aids traders in deciding whether the benefits offered by Exness outweigh the risks they’re willing to accept.

Payment Methods and Withdrawal Processes

Evaluating payment methods and the withdrawal process is vital in determining the practicality and safety of trading with any platform, including Exness. Inadequate options or lengthy withdrawal processes can significantly impact the overall user experience.

Available Payment Options for Indian Users

Exness provides a variety of payment methods tailored to accommodate Indian traders. These typically include bank wire transfers, credit/debit cards, e-wallets like Skrill and Neteller, and local payment systems commonly used in India. The diversity of payment options enables users to choose methods that are most convenient for them, enhancing the overall trading experience.

Having multiple payment methods caters to different preferences among traders, allowing each individual to select the option that best suits their transaction needs. This consideration for user convenience demonstrates Exness’s commitment to providing a user-friendly trading environment.

Withdrawal Times and Fees

Withdrawal times represent a critical aspect of trading safety and efficiency. Exness generally processes withdrawals within hours or a few business days, depending on the selected payment method. The platform aims to facilitate smooth and efficient withdrawal processes, allowing traders to access their funds promptly.

While Exness does not typically impose withdrawal fees, it is important for traders to be aware that certain payment methods may come with their associated charges. It's advisable for users to review the detailed information provided by Exness regarding their chosen payment methods to understand any potential fees that could affect their withdrawals. Awareness of these factors plays a critical role in ensuring a seamless trading experience.

Customer Support Services

Effective customer support can significantly enhance a trader's experience with any trading platform. The availability and responsiveness of support channels directly influence traders’ confidence and comfort level.

Availability and Responsiveness of Support

Exness prides itself on offering comprehensive customer support to address user queries and concerns. The primary channels available typically include live chat, email, and phone support. This multi-channel approach facilitates quicker interactions and helps users find answers promptly.

In general, the platform is recognized for its responsive customer support, particularly through live chat, where traders can communicate with support agents in real time. Nonetheless, responsiveness may vary based on time zones or the complexity of inquiries, which can occasionally lead to longer wait times for resolution. Being mindful of these variables can help traders adjust their expectations when seeking assistance.

Support Channels Offered by Exness

Beyond direct communication channels, Exness also provides a wealth of self-service resources, including an extensive FAQ section and a library of educational materials. These resources can empower traders to resolve common issues independently, saving them time and effort.

Additionally, the educational materials offered serve a dual purpose: answering immediate questions while simultaneously building traders’ knowledge base over time. Providing resources that facilitate self-learning enhances the user experience and equips traders with information that can assist them in navigating the complexities of online trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Education and Resources for Traders

Education is a cornerstone of successful trading, and Exness recognizes the importance of empowering its users with knowledge. A well-informed trader is better equipped to navigate market volatility and make sound decisions.

Educational Materials Provided by Exness

Exness offers a plethora of educational materials that cater to both novice and experienced traders. From foundational articles to advanced trading strategies, the content is designed to equip traders with essential knowledge. Webinars, video tutorials, and e-books are readily available, providing diverse learning formats to suit different preferences.

These educational resources not only enhance traders’ understanding but also encourage continuous learning—a crucial element in the fast-paced trading environment. The more informed traders are about market dynamics, the more effectively they can manage risks and seize opportunities.

Access to Market Analysis and Tools

Market analysis serves as an invaluable tool for traders looking to make informed decisions. Exness provides access to various analytical tools, including technical indicators and charts, which allow traders to interpret market trends and fluctuations effectively.

Additionally, economic calendars keep traders updated on upcoming events that could impact currency movements. Access to timely and relevant market analysis empowers traders to remain proactive instead of reactive, ultimately leading to better trading outcomes. The combination of educational resources and analytical tools positions Exness as a valuable partner for traders seeking to thrive in the forex market.

Risks Associated with Forex Trading in India

Understanding the inherent risks associated with forex trading is essential for any trader, especially those operating in dynamic markets like India. Recognizing these risks enables traders to adopt appropriate measures to mitigate them.

Understanding Market Volatility

Forex trading comes with significant risks primarily due to the volatile nature of currency markets. Fluctuations in exchange rates are influenced by various factors, including global economic data, geopolitical events, and market sentiment. This volatility presents opportunities for profit but also poses the risk of substantial losses.

Traders must develop robust strategies to manage these risks, focusing on sound risk management principles. Implementing stop-loss orders, diversifying portfolios, and staying informed about market developments are ways to navigate this unpredictable terrain. Awareness of market volatility equips traders with the insight needed to make calculated decisions amid uncertainty.

Potential Scams and Fraudulent Activities

Unfortunately, the forex landscape can attract fraudulent activities, potentially putting traders at risk. Unauthorized access to accounts, misleading promotions, and dishonest brokers are some examples of scams that traders encounter. Protecting oneself from such dangers necessitates a vigilant approach and due diligence when selecting a broker.

To avoid falling victim to scams, traders should familiarize themselves with safety practices and red flags associated with fraudulent schemes. Researching the broker's reputation, reading user reviews, and verifying regulatory compliance are fundamental steps in safeguarding their interests. By remaining cautious and informed, traders can minimize their exposure to potential threats.

Comparing Exness with Other Trading Platforms

As traders weigh their options, comparing Exness to other trading platforms can provide valuable context. Each platform comes equipped with its unique advantages and disadvantages, influencing traders' choices.

Advantages of Choosing Exness

Exness boasts numerous advantages that make it an attractive option for traders in search of a reliable platform.

Competitive Trading Conditions: One of the standout features of Exness is its competitive trading conditions, characterized by tight spreads. Low trading costs can significantly enhance profitability, especially for active traders.

Wide Range of Trading Instruments: Another noteworthy advantage is Exness's diverse array of financial instruments. By offering access to forex, commodities, indices, and cryptocurrencies, traders can efficiently diversify their portfolios—potentially increasing their trading opportunities.

User-Friendly Platform: The platform's intuitive design simplifies navigation, enabling traders of all levels to engage seamlessly with the trading environment. A user-friendly experience fosters confidence, encouraging traders to explore the platform's features fully.

Disadvantages and Limitations

Despite its advantages, Exness does have some limitations that may concern traders.

Lack of Specific Indian Regulation: As previously mentioned, one notable drawback is the absence of specific regulatory authorization from Indian authorities. This lack of local oversight can lead to apprehension among traders who prioritize compliance with domestic regulations.

Reported Customer Service Issues: Some users have shared experiences of slower withdrawal processing times and occasional difficulties with customer service responsiveness. Such shortcomings can undermine the overall user experience, leading traders to consider alternatives.

Ultimately, weighing the pros and cons of Exness against individual trading goals will help traders determine whether the platform aligns with their trading aspirations.

Legal Considerations for Indian Traders

Trading forex in India inherently comes with legal implications that traders must understand. Recognizing these considerations ensures that traders comply with local laws and regulations.

Tax Implications of Trading in Forex

Indian traders need to be cognizant of the tax implications associated with forex trading. Profits made from trading are considered capital gains and are subject to taxation. Depending on the duration of holding positions—whether short-term or long-term—different tax rates may apply.

Furthermore, maintaining accurate records of all trades, including profits and losses, is essential for reporting purposes. Consulting with a tax professional can aid traders in navigating the complexities of tax obligations related to forex trading in India.

Legal Framework Surrounding Forex Trading in India

The legal framework governing forex trading in India is primarily dictated by the FEMA, which regulates foreign exchange transactions and promotes orderly development of the forex market. While trading in currency pairs is permitted under certain conditions, traders must adhere to regulations that restrict speculative trading practices.

Understanding the legal landscape surrounding forex trading in India is crucial for ensuring compliance and avoiding potential penalties. Indian traders must stay informed about evolving regulations and adapt their trading strategies accordingly to operate within the confines of the law.

Conclusion on the Safety of Trading in Exness in India

Ultimately, the question "Is it Safe to trade in Exness in India?" hinges on several factors, including regulatory compliance, security measures, user reviews, and legal considerations. While Exness lacks specific Indian regulatory licensing, its adherence to reputable international standards and strong security measures enhances its credibility as a trading platform.

Potential traders should conduct thorough research, analyze user experiences, and consider their own risk tolerance before engaging with Exness or any other trading platform. By equipping themselves with knowledge and understanding the associated risks, traders can make informed decisions that contribute to their success in the forex market.

Whether you are drawn to Exness for its competitive trading conditions or its user-friendly interface, the decision to trade should always be accompanied by due diligence and awareness of the ever-evolving landscape of online trading.

Read more: Does Exness work in Europe?