19 minute read

Raw spread vs standard account which is better?

from Exness

by Exness_Blog

When embarking on a journey into the world of online trading, one question often arises for both novice and experienced traders alike: Raw spread vs standard account which is better? This decision can significantly impact your trading outcomes, influencing everything from costs to execution speed. Understanding how these two account types operate is essential for optimizing your trading strategy and financial goals.

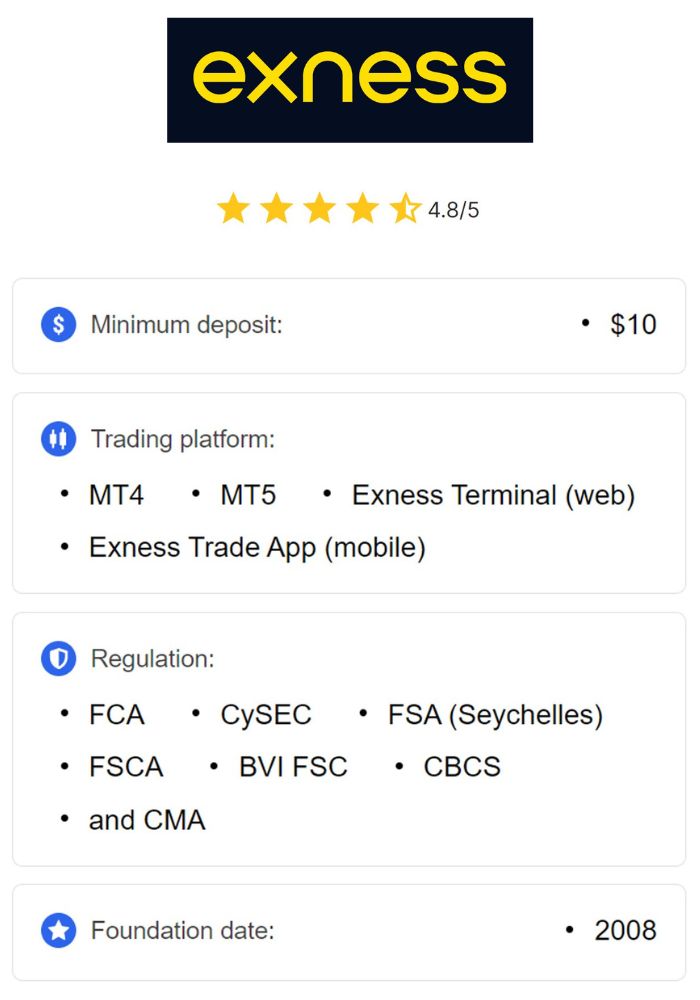

Top 4 Best Forex Brokers

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Understanding Trading Accounts

Before deciding between Raw Spread and Standard accounts, it’s essential to grasp what trading accounts entail and their function within the broader framework of Forex and CFD trading. A trading account acts as the portal through which you engage with the financial markets, allowing you to deposit funds, execute trades, monitor positions, and manage overall trading activities. Offered by brokers, these accounts cater to various trading styles and risk appetites.

Definition of Raw Spread Accounts

Raw Spread accounts are designed to provide traders with unfettered access to the market. As the name implies, they feature raw, unmarked spreads that directly mirror real-time market conditions.

With these accounts, traders essentially pay only for the actual cost of executing trades, represented by the spread between the bid and ask prices. The appeal lies in their transparency, making them particularly attractive to seasoned traders who often prioritize minimizing trading costs over other factors.

For those looking to execute numerous trades quickly—like scalpers—a Raw Spread account can be a valuable tool. It allows traders to experience tight spreads and gives them the ability to trade at the most competitive prices available in the market.

Definition of Standard Accounts

In contrast, Standard accounts represent a more traditional approach to trading. These accounts generally come with either fixed or variable spreads, which include a markup that covers the broker's operational costs and serves as a source of revenue.

While Standard accounts tend to be more straightforward and user-friendly, especially for beginners, they often feature wider spreads compared to their Raw Spread counterparts. This spread markup means that traders may end up paying more per trade, particularly if they frequently enter and exit positions.

Standard accounts typically cater to a wide range of traders—from novices starting their trading journeys to experienced individuals who prefer a simpler fee structure that doesn’t require an intricate understanding of commissions and spreads.

Key Differences Between the Two

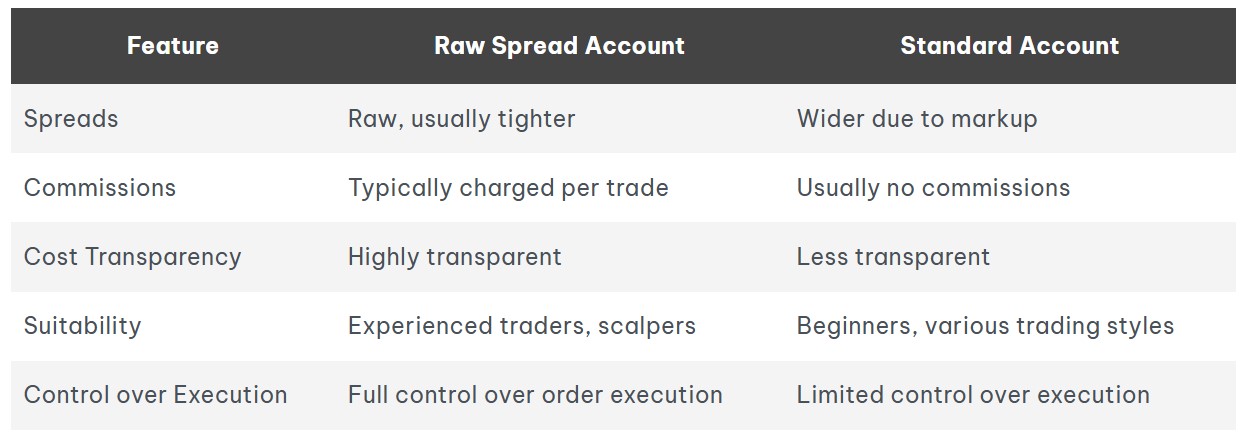

The fundamental distinction between Raw Spread and Standard accounts lies in how spreads are structured and presented to users. Below is a concise comparison of some key differences between the two account types:

Understanding these differences will lay the groundwork for evaluating which account type aligns more closely with your trading style and objectives.

Advantages of Raw Spread Accounts

The popularity of Raw Spread accounts among active traders is largely attributed to the compelling advantages they offer. Let’s take a closer look at these benefits, focusing on aspects like lower trading costs, pricing transparency, and direct market access.

Lower Trading Costs

One of the most significant advantages of Raw Spread accounts is the potential for lower trading costs. Since the spreads reflect genuine market conditions without any additional markup, traders can benefit from significantly reduced costs per trade.

For high-frequency traders, even small savings on each transaction can translate into substantial cost reductions over time. In such scenarios, the tight spreads of Raw Spread accounts become vital, enabling traders to maximize their profits even when engaging in rapid, multiple transactions.

Moreover, cost-efficiency becomes even more critical when considering the volume of trades executed. Day traders, who engage in numerous trades daily, find the low-cost structure of Raw Spread accounts particularly advantageous. This aspect alone often outweighs the commission fees that might apply, creating a net gain for the trader.

Transparency in Pricing

Transparency in pricing is another core trait of Raw Spread accounts. Traders have access to the raw spreads displayed on their trading platforms, allowing them to view the actual bid and ask prices dictated by the market.

This level of transparency fosters trust, as traders understand exactly what they are paying for every trade. Advanced traders appreciate this clarity, as they can make informed decisions based on real-time data, ultimately enhancing their trading strategies.

Having access to raw data can empower traders to develop effective strategies tailored to current market conditions. Moreover, it enables them to analyze price movements more intuitively, potentially leading to improved trading results.

Access to Market Prices

With Raw Spread accounts, traders gain direct access to market prices, which allows them to execute orders at optimal points. This capability is crucial for specific trading strategies that rely on quick and precise execution.

For instance, scalping strategies, which depend on taking advantage of small price fluctuations, stand to benefit immensely from this direct access. By executing trades at the best possible price, traders can capitalize on fleeting opportunities that arise throughout the trading day.

Additionally, having access to market prices can help traders identify trends and reversals more efficiently, contributing to better-informed trading decisions. Overall, the combination of lower costs, transparent pricing, and direct market access makes Raw Spread accounts a favorable option for active traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Disadvantages of Raw Spread Accounts

Despite the enticing advantages, Raw Spread accounts are not without their drawbacks. Understanding these downsides is crucial, particularly for those who may be less experienced in navigating the complexities associated with these accounts.

Commission Fees Explanation

While the tighter spreads offered by Raw Spread accounts are appealing, traders should be aware that these accounts typically involve commission fees that vary according to the volume of trades.

These commission structures can be either fixed or variable and must be factored into the overall cost of trading. For inexperienced traders, calculating total costs can become complicated, especially if they are not accustomed to managing commissions alongside spreads.

It's essential to fully understand how these fees impact your trading strategy. If not calculated accurately, commission costs may diminish anticipated profits, negating some of the advantages provided by the tighter spreads.

Complexity for New Traders

Another drawback of Raw Spread accounts is their inherent complexity, which can pose challenges for new traders. The need to navigate fluctuating spreads and commission fees may create confusion, leading to potentially costly mistakes.

Beginners typically benefit from simpler fee structures, allowing them to focus on developing their trading skills rather than getting bogged down by intricate cost considerations. As such, the absence of a clear-cut pricing model in Raw Spread accounts may deter traders just starting out.

Consequently, new traders might find themselves overwhelmed, affecting their confidence and trading performance. Without a solid foundation in understanding spreads and commissions, the complexity of Raw Spread accounts could hinder their growth in the trading arena.

Availability and Conditions

Raw Spread accounts are not universally available across all brokers. Some brokers may offer them only under specific account types or conditions, limiting options for traders seeking this account type.

Moreover, certain Raw Spread accounts may have stricter minimum deposit requirements compared to Standard accounts. This factor can also restrict access for beginner traders who may not have substantial capital to invest right away.

As a result, potential traders considering a Raw Spread account should thoroughly research various brokers to determine their offerings and conditions. Understanding these parameters is vital to ensuring you choose the right account type for your trading needs.

Advantages of Standard Accounts

Standard accounts have long been a favorite among many traders due to their straightforward nature and focus on simplicity. Let's delve into the core advantages of these accounts, emphasizing their fee structure, suitability for beginners, and fewer hidden costs.

Simple Fee Structure

The primary allure of Standard accounts lies in their simple fee structure. Unlike Raw Spread accounts that involve separate commission fees, Standard accounts generally incorporate all costs into a single spread markup.

This arrangement makes it easier for traders to predict their trading expenses, allowing them to plan their strategies effectively. The simplicity of this fee structure appeals to both beginners and more experienced traders who prefer a hassle-free approach to managing costs.

Furthermore, the straightforward fee model eases the learning curve for new traders. Rather than juggling various commission rates, they can concentrate on mastering trading techniques and strategies without being sidetracked by complex calculations.

Suitable for Beginners

Due to their uncomplicated nature and user-friendly structures, Standard accounts are well-suited for beginners venturing into the world of trading. Their design minimizes the initial burden of understanding complex fee structures, making entry into trading more accessible.

With Standard accounts, new traders can gradually acclimate to the ecosystem without overwhelming themselves with detailed analyses of spreads and commissions. This gradual exposure helps build confidence and familiarity with the trading process.

As they gain experience, novice traders can always transition to more complex account types, such as Raw Spread accounts, once they feel comfortable navigating the intricacies of trading.

Fewer Hidden Costs

Another significant advantage of Standard accounts is the reduced likelihood of hidden costs. Since the broker incorporates their fees within the spread, traders often encounter fewer unexpected charges compared to Raw Spread accounts.

While transparency concerning costs remains a concern, the simplified structure of Standard accounts provides reassurance to traders about what they are paying for their trades. Fewer hidden costs mean that traders can allocate their resources more effectively, improving their overall trading experience.

This aspect can be particularly appealing for those who wish to avoid surprises that might occur in other account types. With clarity regarding costs, traders can execute their strategies with greater confidence.

Disadvantages of Standard Accounts

While Standard accounts hold numerous advantages, they also come with certain limitations that may impede specific trading strategies. For instance, higher spreads, potential lack of transparency, and limitations on scalping strategies can affect particular trading approaches.

Higher Spreads Explained

One of the most apparent disadvantages of Standard accounts is that they typically feature wider spreads compared to Raw Spread accounts. The built-in markup necessary for broker operations contributes to this disparity.

Wider spreads can considerably impact profitability, especially for traders employing short-term strategies that rely on quick price movements. For scalpers and day traders, where profit margins are often razor-thin, the increased cost can substantially erode gains.

Traders may find it challenging to achieve profitable outcomes if they regularly engage in rapid buy-and-sell actions. Hence, those whose strategies hinge on tight spreads may want to consider alternative options to optimize their trading efficacy.

Potential Lack of Transparency

Although Standard accounts simplify the trading process, the presence of a markup can lead to a lack of transparency. Traders may not see the raw market prices dictating their trades, which can obscure the true cost of trading.

This opacity can frustrate traders seeking clarity on how much they pay for individual trades and may detract from their ability to make informed decisions. Those who thrive on data-driven analysis may find this limitation particularly problematic, as it hinders their ability to evaluate market conditions accurately.

Limitations on Scalping Strategies

Standard accounts may not be suitable for scalpers and high-frequency traders, primarily due to the wider spreads. For those relying on tiny price movements to generate profits, the added expense can eat into potential gains.

Scalping requires immediate execution and tight spreads to ensure a favorable risk-to-reward ratio. However, with the larger spreads characteristic of Standard accounts, traders might find it increasingly difficult to maintain the profitability of their chosen strategies.

As such, anyone interested in implementing scalping tactics would be wise to explore Raw Spread accounts to align their trading approach with the necessary market dynamics.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Comparing Trading Costs

Ultimately, the decision between a Raw Spread and Standard account hinges significantly on the comparison of trading costs. Assessing various aspects like spreads, commissions, and overall cost efficiency will provide valuable insights.

Spread Comparison

The spread represents the difference between the bid and ask prices and is indicative of the cost incurred when entering and exiting positions. Raw Spread accounts generally boast tighter spreads compared to Standard accounts, resulting in lower trading costs overall.

For traders who frequently enter and exit positions, the narrow spreads afforded by Raw Spread accounts can contribute to a more favorable trading environment. In contrast, the wider spreads in Standard accounts can lead to increased costs that may accumulate over time.

A thorough analysis of your trading habits and frequency will be essential in determining which account type offers the most economical spread structure for your needs.

Commission Comparison

Commission fees in Raw Spread accounts can either be fixed or based on trade volume. While these accounts typically feature tighter spreads, the commissions incurred can add complexity to overall trading costs.

Standard accounts, conversely, usually do not have commission fees, but the accompanying wider spreads may offset any potential savings. Evaluating the relationship between spreads and commissions is crucial for gaining a comprehensive understanding of total trading costs.

To ascertain which account type aligns better with your trading style, consider your expected trading volume and frequency. Ultimately, the goal is to minimize costs while maintaining the desired flexibility and control.

Overall Cost Efficiency Analysis

Determining overall cost efficiency necessitates assessing your trading style and anticipated trade volume. High-frequency traders and scalpers may find that the tighter spreads of Raw Spread accounts outweigh the commission costs. Conversely, infrequent traders or those with a longer-term perspective might be better served by the straightforward fee structure of Standard accounts.

Conducting a personal analysis of your trading patterns will enable you to make an informed decision that promotes financial efficiency while aligning with your trading objectives.

Suitability for Different Trading Styles

The choice between Raw Spread and Standard accounts is inherently tied to individual trading styles and strategies. Understanding how each account type caters to specific approaches can help inform your decision-making process.

Scalping With Raw Spread Accounts

Scalpers thrive on short-term price movements and often make numerous trades throughout the day. The tightly priced spreads found in Raw Spread accounts are indispensable for maximizing profits on small fluctuations.

In this fast-paced trading environment, direct access to raw market prices is crucial. Raw Spread accounts allow scalpers to execute orders at the most competitive prices, thereby capitalizing on fleeting opportunities before they evaporate.

Additionally, minimizing trading costs is essential for scalpers, as even minor differences in costs can significantly impact overall profitability. Thus, for those dedicated to short-term strategies, opting for a Raw Spread account is likely the most advantageous route.

Swing Trading With Standard Accounts

On the other hand, swing traders who capitalize on medium-term trends may find Standard accounts well-suited to their trading objectives. By holding positions for several days, weeks, or even months, they can afford to accept slightly wider spreads without adversely affecting their bottom line.

The simplicity of Standard accounts allows swing traders to focus more on analyzing market trends than managing complex fee structures. The consistent fee structure provides peace of mind, enabling traders to develop and implement strategies without constant concern about commission variability.

For swing traders, the overall cost implications of wider spreads become less pronounced, given their longer investment horizon, making Standard accounts an attractive option.

Long-Term Investing Considerations

For long-term investors, the decision between Raw Spread and Standard accounts comes down to individual preferences and investment strategies. Long-term investing typically involves fewer trades, allowing investors to absorb the impact of wider spreads more comfortably.

Whether choosing a Raw Spread or Standard account, long-term investors should evaluate the total costs associated with their trading habits. In this context, even modest differences in spreads and commissions can accumulate over time, thus requiring careful consideration.

Choosing an account type should ultimately align with your investment approach and long-term financial objectives, ensuring you remain focused on achieving your target returns.

Broker Selection Criteria

Selecting the right broker plays a pivotal role in determining your trading success, regardless of whether you choose a Raw Spread or Standard account. Several criteria should guide your evaluation process, emphasizing aspects like regulation, services offered, and customer support.

Importance of Regulation

When selecting a broker, regulatory oversight is paramount. Engaging with a broker regulated by a reputable authority instills confidence, assuring traders that their funds are safeguarded and that the broker adheres to ethical practices.

Regulatory bodies impose stringent standards on brokers, ensuring transparency and fair dealings. As such, checking for licenses and certifications is the first step in the selection process, providing a level of assurance that your trading experience will remain secure.

Review of Broker Services Offered

Beyond regulation, traders should assess the variety of services offered by potential brokers. This includes examining the trading platform's functionality, available trading tools, and educational resources provided.

A comprehensive suite of services can enhance your overall trading experience and facilitate growth. For example, robust charting tools, advanced analytics, and educational materials can empower traders to make informed decisions, thereby improving trading outcomes.

Additionally, consider the availability of customer support, which can be invaluable if you encounter issues or technical glitches during trading hours. A responsive support team can alleviate stress and aid in navigating challenges effectively.

Customer Support Evaluation

Customer support is an often-overlooked yet crucial aspect of broker selection. A reliable support system enhances the overall trading experience, enabling traders to resolve queries quickly and efficiently.

Evaluating customer service response times and the availability of multiple communication channels—such as live chat, phone support, and email—will give you insight into the quality of service that a broker offers.

In a fast-moving market, timely assistance can mean the difference between executing a successful trade or missing out on an opportunity. Therefore, prioritizing brokers with strong customer support systems will enhance your trading journey.

Performance Metrics

Besides the aforementioned criteria, the performance metrics of a broker should be scrutinized to ensure a smooth trading experience. Key metrics include execution speed, slippage considerations, and the reliability of trading platforms.

Execution Speed Analysis

Execution speed is vital for traders, particularly those employing strategies reliant on rapid transactions. A broker's ability to execute orders promptly can significantly influence your trading performance.

Slow execution speeds can result in missed opportunities or unfavorable trade prices, especially for scalpers and day traders who require precision. Therefore, it’s essential to assess the execution speed provided by potential brokers, checking for any reported delays in order processing.

Some brokers may advertise optimal execution speeds, but independent reviews and trader testimonials can offer a clearer picture of actual performance. Ensure that the broker you choose maintains a reputation for swift and efficient order execution.

Slippage Considerations

Slippage refers to the difference between the expected price of a trade and the executed price. While slippage is often a reality in fast-moving markets, excessive slippage can diminish profitability.

Understanding a broker's approach to slippage and their mechanisms for mitigating its impact can help you make an informed decision. Some brokers may employ measures such as guaranteed stop-loss orders or limit orders to keep slippage at bay.

Ultimately, minimizing slippage is critical for maintaining profitability, particularly in volatile market conditions. Researching a broker's performance in this area is essential for achieving your trading goals.

Reliability of Trading Platforms

The reliability of trading platforms cannot be overstated. A stable and intuitive trading platform is crucial for facilitating seamless trading experiences and ensuring traders can execute orders without interruptions.

Factors such as platform downtime, ease of navigation, and compatibility with various devices should be evaluated. Any technical glitches or frequent outages can disrupt your trading activities and lead to unforeseen losses.

Choosing a broker with a reputation for providing reliable trading platforms will equip you with the tools necessary to conduct effective trading. Additionally, reading user reviews can help gauge the performance and reliability of the platforms offered by different brokers.

Read more: 10 legal forex trading apps in India

User Experience and Feedback

Personal insights and user experiences play a significant role in guiding your broker selection process. Exploring trader testimonials, community insights from Forex forums, and case studies of successful traders can provide valuable perspectives.

Trader Testimonials

Hearing from fellow traders can illuminate the strengths and weaknesses of various brokers and account types. Testimonials often reveal firsthand experiences that highlight both the advantages and drawbacks of trading with a particular broker.

For instance, traders may share insights regarding execution speed, customer service quality, and overall satisfaction with their chosen account type. By collating these testimonials, you can make more informed decisions that align with your trading aspirations.

Community Insights from Forex Forums

Forex forums serve as platforms where traders congregate to share knowledge, strategies, and experiences. Engaging with these communities can provide you with diverse viewpoints on account types and broker choices.

Active participation allows you to tap into collective wisdom and learn from the successes and failures of others. Additionally, forums often discuss trending topics, which can help you stay updated on industry developments and evolving market dynamics.

Case Studies of Successful Traders

Studying case studies of successful traders can provide inspiration and practical insights into effective trading strategies. Analyzing their approaches toward broker selection, account types, and trading methods can serve as a roadmap for your own journey.

By dissecting their experiences, you can identify key takeaways that may enhance your trading effectiveness. Learning from both triumphs and challenges faced by seasoned traders can accelerate your growth and improve your overall trading acumen.

Conclusion

In conclusion, the debate surrounding raw spread vs standard account which is better? ultimately hinges on individual trading styles, preferences, and objectives. Raw Spread accounts offer unparalleled advantages for active traders who prioritize minimal trading costs and seek precise execution, while Standard accounts cater to those valuing simplicity and lower entry barriers.

Understanding the nuances of these account types—ranging from cost structure to suitability for various trading strategies—will empower you to make informed decisions aligned with your trading aspirations. Thoroughly evaluating broker selection criteria, performance metrics, and user feedback further enriches your decision-making process.

Whichever account type you choose, remember that ongoing education and adaptability remain paramount in the ever-evolving world of forex trading. Empower yourself with knowledge and insights to navigate the complexities of the market successfully, ultimately leading to enhanced trading outcomes.