22 minute read

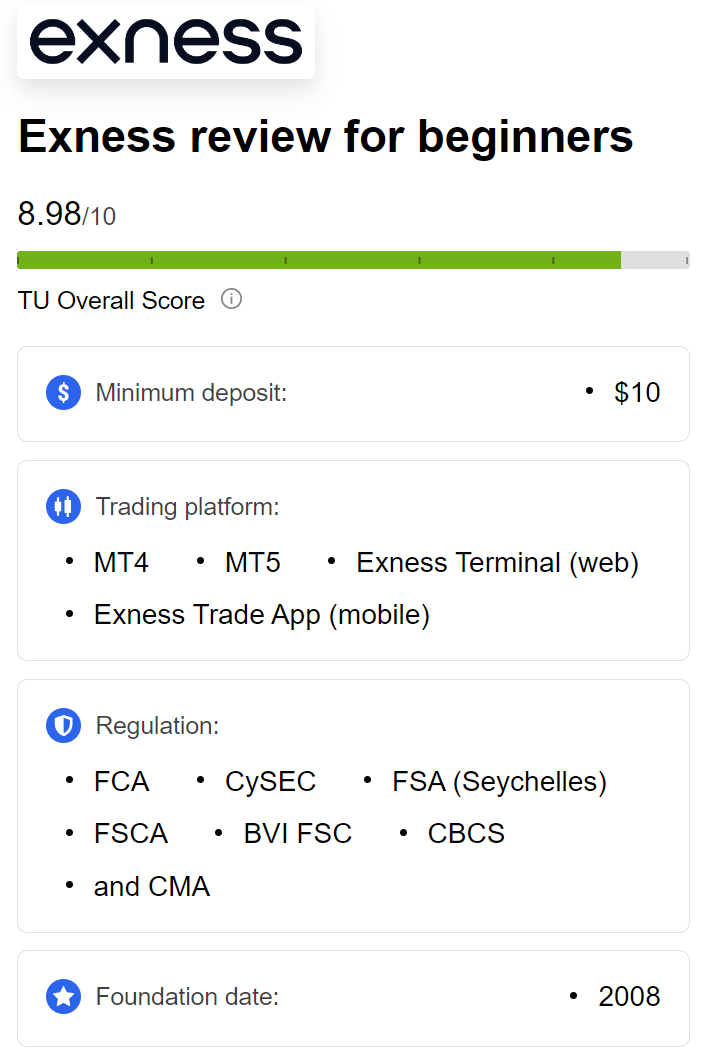

Exness Broker Review: Pros, Cons & Key Findings

from Exness

by Exness_Blog

In this Exness Broker Review, we will comprehensively explore the multitude of services and features offered by Exness, a globally recognized online broker. Our aim is to provide you with an in-depth understanding of what sets Exness apart from other brokers in the industry. We will delve into various aspects, including its history, regulatory compliance, trading platforms, account types, and more. By the end of this review, you'll have a clearer insight into whether Exness is the right fit for your trading needs.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness Broker

Exness has established itself as a reputable player in the online trading arena since its inception. The broker offers a wide array of services that cater to both novice and seasoned traders. With its user-friendly interface and comprehensive resources, Exness aims to enhance the overall trading experience for its clients. The following sections will take you through the essential components of Exness, detailing its offerings and how it operates in the competitive landscape of online trading.

Overview of Exness

Exness has positioned itself as a comprehensive trading platform catering to a diverse clientele across the globe. Its reputation is built on providing competitive trading conditions, a variety of instruments, and intuitive trading platforms that empower traders to maximize their potential. The broker's customer-centric approach emphasizes support and education, promoting not just trading but informed decision-making.

The ability to access numerous trading instruments, including forex, commodities, indices, and cryptocurrencies, allows traders to diversify their portfolios effectively. Furthermore, Exness prides itself on offering advanced tools and resources that help traders analyze markets efficiently. In this sense, Exness is not merely a trading platform but an ecosystem designed for traders' growth and success.

History and Background

Exness was founded in 2008, with the intent of democratizing access to financial markets for retail forex traders. From the outset, the broker focused on creating a sophisticated yet user-friendly platform, allowing traders to benefit from technology while making complex trading processes easier. Over the years, Exness has expanded significantly, building a global presence that now includes millions of active clients and thousands of trades executed daily.

The journey of Exness reflects a commitment to innovation and client satisfaction. Continuous improvements in technology and service delivery have allowed Exness to maintain a strong position within the online trading community. The broker's focus on transparency and reliability has fostered trust among its users, enabling sustained growth in an increasingly competitive market.

Regulatory Compliance

As a broker operating in the online trading space, regulation plays a crucial role in ensuring client safety and transparency. Exness takes compliance seriously and adheres to strict regulatory standards set forth by different international authorities. This section will discuss the licensing and regulations that govern Exness, as well as the security measures implemented to protect clients.

Licensing and Regulation

Exness operates under several prestigious licenses, reflecting its commitment to maintaining high industry standards. One of its key regulatory affiliations is with the Cyprus Securities and Exchange Commission (CySEC), which ensures that Exness complies with European Union regulations. The broker is also authorized by the Financial Services Authority (FSA) of Seychelles, allowing it to extend its services to various jurisdictions.

Additionally, Exness is a member of the Financial Commission, an independent dispute resolution organization. This membership reinforces the broker's dedication to fairness and protection for traders in case of disputes. Overall, the multi-faceted regulatory framework surrounding Exness instills confidence among its clients, assuring them that their funds and trading activities are safeguarded.

Security Measures in Place

Beyond regulatory compliance, Exness prioritizes the security of its clients' funds and data through various robust measures. These measures include:

Segregation of Client Funds: Exness holds client funds in segregated accounts separate from its operational funds. This practice mitigates risks associated with potential insolvency, ensuring that clients’ money remains protected.

Negative Balance Protection: To safeguard traders from incurring losses greater than their account balance, Exness provides negative balance protection. This feature is particularly beneficial during volatile market conditions, preventing traders from facing unexpected financial setbacks.

SSL Encryption: All communication and data transmission via the Exness website and trading platforms are secured using SSL encryption. This advanced security protocol protects personal and financial information from unauthorized access.

Regular Security Audits: Exness routinely undergoes security audits and assessments to identify vulnerabilities and enhance overall security. This continuous improvement mindset contributes to maintaining a high level of client security.

Trading Platforms Offered

An essential aspect of any trading experience is the platform used for executing trades. Exness provides its clients with access to some of the industry's leading trading platforms—MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are equipped with advanced functionality and are tailored to meet diverse trading styles. Below, we will delve deeper into these platforms and the unique features they offer.

MetaTrader 4 (MT4) Overview

MetaTrader 4 is arguably one of the most widely used trading platforms in the world. Its popularity stems from its user-friendly interface, customizable features, and powerful trading tools. Traders can utilize MT4 to execute trades across a vast range of financial instruments.

Key Features of MT4:

Expert Advisors (EAs): One of the standout features of MT4 is the ability to use Expert Advisors—automated trading systems designed to execute trades based on predefined strategies. This feature appeals to traders looking to automate their trading processes and capitalize on opportunities without being tied to the screen.

Technical Indicators: MT4 boasts an extensive library of technical indicators, aiding traders in analyzing price trends and identifying potential trading opportunities. The platform’s charting tools allow users to visualize market movements effectively.

Customizable Charts: Users can tailor charts according to personal preferences, incorporating various technical indicators, drawing tools, and timeframes. This flexibility enables traders to create a personalized trading environment that suits their strategies.

One-Click Trading: The one-click trading feature simplifies the process of executing trades, allowing traders to act quickly amid fast-moving markets.

Exness's MT4 platform is accessible on desktop, web, and mobile devices, giving traders the freedom to monitor their accounts and execute trades from anywhere in the world.

MetaTrader 5 (MT5) Features

Building on the foundation laid by MT4, MetaTrader 5 introduces enhanced features and functionalities that cater to traders seeking more control and flexibility. While it shares many similarities with MT4, MT5 offers additional capabilities that appeal to a broader spectrum of traders.

Key Features of MT5:

Expanded Market Depth: MT5 provides traders with access to a wider range of pricing information, enhancing execution decisions. This feature aids traders in determining optimal trade entry and exit points.

Advanced Order Types: Unlike MT4, MT5 supports a broader selection of order types, including pending orders and stop-limit orders. This variety gives traders greater control over their trade management.

Economic Calendar: An integrated economic calendar within the MT5 platform informs traders about upcoming economic events and their potential market impact. This feature is vital for traders looking to leverage fundamental analysis in their trading strategies.

More Technical Indicators: MT5 comes with a larger collection of technical indicators compared to its predecessor, enabling traders to conduct in-depth market analysis and refine their strategies.

Similar to MT4, MT5 is available on desktop, web, and mobile, ensuring seamless access to trading operations regardless of location.

Exness Trading App

For traders who value mobility, the Exness Trading App serves as a convenient solution for managing trades on the go. Available for both Android and iOS devices, the app mirrors the functionality of the desktop platforms, providing traders with essential features at their fingertips.

App Features:

Manage Trading Accounts: Traders can easily view their account balances, trade history, and ongoing positions through the app, allowing for real-time monitoring of their trading performance.

Execute Orders: The app facilitates quick placement and management of orders across various instruments, ensuring traders can act promptly on market movements.

Access Charts and Indicators: The app includes charting capabilities and access to technical indicators, empowering traders to analyze market trends while away from their desktops.

Receive Notifications: Traders can receive real-time notifications regarding important market developments and account updates. This feature helps traders stay informed and responsive to market changes.

The Exness Trading App ensures that traders can manage their positions anytime, anywhere, making it an invaluable tool for those who are always on the move.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Account Types Available

Understanding the different account types offered by a broker is crucial for selecting one that aligns with your trading style and goals. Exness offers a range of account options designed to cater to the diverse needs of its clientele. Below, we will explore the various account types, outlining their unique characteristics.

Standard Accounts

Standard accounts provided by Exness strike a balance between low spreads and decent execution speeds. These accounts are ideal for beginners entering the forex market, as they offer a user-friendly trading experience without overwhelming new traders with complexity.

Benefits of Standard Accounts:

Low Spreads: Standard accounts typically come with narrow spreads, allowing traders to minimize their trading costs.

Ease of Use: The straightforward nature of standard accounts makes them an excellent choice for novice traders who may feel daunted by more complex account structures.

Versatile Trading Options: Standard accounts permit trading across a broad range of instruments, facilitating diversified trading strategies.

Traders using standard accounts can gradually become familiar with the intricacies of forex trading while benefiting from favorable market conditions.

Pro Accounts

Designed for experienced traders, Pro accounts offer tighter spreads and faster execution speeds. This account type empowers traders to capitalize on fleeting market opportunities and refine their trading strategies.

Advantages of Pro Accounts:

Tighter Spreads: Pro accounts typically feature lower spreads, reducing the cost of trading and enhancing profit margins.

Faster Execution Speeds: With priority order processing, Pro account holders can execute trades swiftly, which is crucial for those aiming to capitalize on rapid market movements.

Greater Control: Pro accounts allow traders to employ more advanced trading strategies and techniques, including scalping and day trading.

Overall, Pro accounts are tailored for traders seeking a more sophisticated trading experience and the ability to maximize profits through strategic execution.

Zero Accounts

For traders focused on minimizing trading costs, the Zero account offers the tightest possible spreads available. This account type is especially suitable for high-frequency traders who prioritize minimal slippage and low transaction costs.

Key Features of Zero Accounts:

Competitive Spreads: As the name suggests, Zero accounts offer extremely tight spreads, allowing traders to enter and exit positions with minimal cost.

Commission Structure: While Zero accounts feature tight spreads, they incur a commission on each trade. For high-volume traders, this structure can still result in lower overall trading costs.

Ideal for High-Frequency Trading: The tight spread environment in Zero accounts caters to traders engaged in high-frequency trading strategies, maximizing profit potential through frequent trades.

Traders utilizing Zero accounts can operate in a highly competitive environment where every pip counts toward profitability.

Raw Spread Accounts

Similar to Zero accounts, Raw Spread accounts provide exceptionally tight spreads; however, the commission is charged per lot traded rather than per trade. This structure enables traders to potentially save on commissions when engaging in higher-volume trading.

Highlights of Raw Spread Accounts:

Transparent Trading Environment: Raw Spread accounts offer a clear picture of trading costs, allowing traders to make informed decisions regarding their strategies.

Minimal Charges: By charging commission only per lot traded, Raw Spread accounts can be advantageous for traders executing multiple trades throughout the day.

Flexibility for Volume Traders: This account type is particularly appealing to high-volume traders who can benefit from reduced commissions without compromising on spread quality.

Raw Spread accounts offer a transparent and efficient trading environment, catering to traders looking for cost-effective solutions in their trading endeavors.

Trading Instruments

A diverse selection of trading instruments provides traders with the opportunity to build multidimensional portfolios. Exness stands out for its expansive range of instruments, encompassing forex, indices, commodities, and cryptocurrencies. This section will delve into these offerings.

Forex Currency Pairs

Forex trading forms the core of Exness's product offerings. The broker provides access to an extensive collection of major, minor, and exotic currency pairs, allowing traders to participate in the world's most actively traded market.

Diversity in Currency Pairs:

Major Currency Pairs: These pairs, such as EUR/USD and GBP/USD, are known for their liquidity and volatility, making them attractive to traders seeking consistent trading opportunities.

Minor Currency Pairs: Minor pairs like AUD/NZD and GBP/CHF offer additional trading avenues, providing exposure to less commonly traded currencies.

Exotic Currency Pairs: Exotic pairs, such as USD/TRY and EUR/HUF, present unique trading opportunities characterized by increased volatility and wider spreads.

Traders can capitalize on fluctuating currency values, leveraging their understanding of geopolitical and economic factors influencing forex markets.

CFDs on Indices

Contract for Differences (CFDs) on indices provide traders with exposure to the performance of major global stock indices. Trading CFDs allows individuals to speculate on the movement of indices like the S&P 500, FTSE 100, and DAX 30, among others.

Benefits of Trading Indices:

Diversification: Indices represent a basket of stocks, enabling traders to diversify their portfolios without needing to analyze individual stocks.

Market Sentiment Analysis: Indices often reflect broader market trends and sentiments, allowing traders to gauge market direction effectively.

Leverage Opportunities: Trading CFDs on indices allows traders to leverage their positions, magnifying potential returns (and risks).

By incorporating index trading into their strategies, traders can tap into the collective performance of numerous companies across various sectors.

Commodities and Cryptocurrencies

Exness's instrument selection extends beyond traditional financial markets to include commodities and cryptocurrencies. This diversification enhances traders' ability to capitalize on volatility inherent in these markets.

Commodities:

Precious Metals: Gold and silver are popular commodities among traders seeking safe-haven assets during economic uncertainty.

Energy: Crude oil and natural gas trading offer opportunities for profit based on supply-demand dynamics and geopolitical factors affecting energy prices.

Cryptocurrencies:

Emerging Asset Class: The rise of cryptocurrencies like Bitcoin, Ethereum, and Ripple has created new trading avenues, attracting both speculative and long-term investors.

Volatility Potential: Cryptocurrencies are known for their price volatility, presenting opportunities for traders willing to navigate this dynamic market.

With this diverse array of trading instruments, Exness enables traders to craft strategies that align with their risk tolerance and market outlook.

Spreads and Commissions

Understanding the cost of trading with a broker is vital for making informed decisions. The two primary components impacting trading costs are spreads and commissions. This section will dissect how Exness structures its spreads and commissions across various account types.

Spread Structures

Exness offers a variety of spread structures depending on the type of account opened. The spreads are generally variable, meaning they can fluctuate based on market conditions and liquidity.

Account-Specific Spread Characteristics:

Standard and Pro Accounts: These account types typically feature moderate spreads conducive to traders who prefer a balanced approach to trading costs.

Zero and Raw Spread Accounts: In contrast, these accounts prioritize exceptionally tight spreads, appealing to traders keen on minimizing their trading expenses.

Market Conditions Influence: Factors such as liquidity, market volatility, and economic news releases can affect spread sizes, emphasizing the need for traders to stay informed.

Traders should choose the account type that best aligns with their trading volume and strategy to optimize their potential returns.

Commission Rates

Commissions are fees charged for executing trades, and Exness maintains a transparent commission structure aligned with its account types. Understanding the commission rates can help traders gauge the overall cost of trading.

Commission-Free Trading:

Standard and Pro Accounts: These accounts do not carry commissions, making them attractive for traders who prefer a straightforward fee structure.

Commission Model for Tight Spreads:

Zero and Raw Spread Accounts: These accounts incur commissions on trades, which are displayed clearly on Exness’s website, allowing traders to assess their total trading costs.

Overall, Exness's commission rates are competitive relative to other brokers, especially for those engaged in high-frequency trading.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Leverage Options

Leverage is a potent tool that allows traders to control larger positions with smaller initial investments. Exness offers flexible leverage options for its clients, accommodating varying degrees of risk appetite and trading strategies.

Understanding Leverage

Leverage amplifies the potential gains of a trader's investment, allowing them to open positions that exceed their actual capital. Exness provides a maximum leverage ratio of up to 1:2000 on certain account types, a significant factor for those looking to maximize their trading potential.

Benefits of Leverage:

Capital Efficiency: Traders can take positions larger than their account balance, enhancing their ability to capitalize on market movements.

Broader Market Participation: Leverage allows traders to engage in various markets without needing substantial capital upfront.

However, while leverage can magnify profits, it can also lead to increased risks, necessitating cautious and informed usage.

Risk Associated with High Leverage

Though leverage offers enticing opportunities for profit, it inherently carries risks that traders must recognize. High leverage can result in substantial losses if trades do not go as planned, underscoring the importance of risk management.

Potential Risks:

Margin Calls: If a trader's equity falls below the required margin level due to adverse price movements, a margin call can occur, forcing the trader to deposit more funds or close positions.

Emotional Stress: The amplified nature of both profits and losses can induce emotional stress, leading to impulsive decision-making.

It is paramount for traders, especially those using high leverage, to implement sound risk management practices to protect their capital.

Read more: Exness App is Legal in India?

Deposit and Withdrawal Methods

The ease of depositing and withdrawing funds directly impacts the overall trading experience. Exness recognizes this and offers a variety of payment methods to facilitate transactions for its clients. We will explore accepted payment methods, processing times, and withdrawal fees.

Accepted Payment Methods

Exness supports a wide array of payment methods, providing clients ample choices for funding their accounts and cashing out profits. Some of the accepted methods include:

Credit/Debit Cards: Major cards such as Visa and Mastercard enable swift deposits and withdrawals.

E-Wallets: Popular e-wallet options like Skrill, Neteller, and PayPal allow for instant transaction processing.

Bank Transfers: Clients can also utilize bank wire transfers for secure transactions; however, this method may entail longer processing times.

Having diverse payment options ensures that traders can select the method that fits their preferences while maintaining convenience and security.

Processing Times for Transactions

Timely processing of deposits and withdrawals is crucial for traders who need access to funds quickly. Exness is known for its efficient processing times across various payment methods:

Instant Deposits: Most deposit methods, especially e-wallets and card transactions, are processed instantly, allowing traders to fund their accounts immediately.

Withdrawal Processing: Withdrawals are typically processed promptly, with e-wallets often seeing the quickest turnaround times, while bank transfers may take longer to complete.

Fast processing times contribute to an overall positive trading experience, allowing traders to manage their accounts with ease.

Withdrawal Fees

While Exness strives to maintain transparency regarding all fees associated with trading, it also has policies in place concerning withdrawal fees. Generally, Exness does not impose withdrawal fees on most payment methods, although traders should review specific terms related to each method.

Clients should be aware of potential fees associated with third-party payment processors, as these charges might vary based on the chosen method.

Customer Support Services

Reliable customer support is critical for traders who may require assistance or have questions while navigating the trading landscape. Exness places significant emphasis on providing robust customer support services to ensure traders receive timely assistance.

Availability of Support

Exness offers customer support around the clock, catering to traders in different regions and time zones. This availability is essential for addressing issues or inquiries promptly, fostering a positive relationship between the broker and its clients.

Dedicated Support Team: Trained representatives are available to assist clients via various communication channels, ensuring that inquiries are handled with professionalism and efficiency.

Communication Channels

Exness provides several communication channels for clients to reach out for support:

Live Chat: The live chat feature on the Exness website offers real-time assistance, allowing traders to get immediate responses to their queries.

Email Support: Clients can also contact Exness via email for more detailed inquiries or issues that may require further documentation.

Telephone Support: For urgent matters, telephone support is available, providing an alternative option for traders seeking direct communication.

These varied communication channels ensure that clients can select their preferred method of interaction based on urgency and convenience.

Educational Resources and Tools

To empower traders and enhance their trading skills, Exness provides a wealth of educational resources and tools. These resources serve as valuable aids for both novice and experienced traders seeking to improve their knowledge and strategy.

Webinars and Tutorials

Exness offers regular webinars and tutorials covering various topics relevant to trading. These informative sessions provide insights from industry experts, contributing to traders' ongoing education.

Benefits of Participating in Webinars: Attending webinars allows traders to gain practical knowledge, ask questions, and learn effective trading strategies from experienced instructors.

Market Analysis and Research

In addition to educational content, Exness provides comprehensive market analysis and research reports. This information equips traders with the necessary insights to make informed decisions in their trading activities.

Daily Market Updates: Regular updates keep traders informed about significant market movements and potential trading opportunities.

Analytical Tools: Access to analytical tools and resources assists traders in evaluating market conditions and developing their strategies.

By combining education with actionable insights, Exness empowers its clients to make informed decisions in a competitive trading environment.

User Experience and Interface

A user-friendly interface is vital for ensuring that traders can navigate their chosen platforms efficiently. This section evaluates the user experience and interface of both Exness's website and trading applications.

Website Navigation

The Exness website is designed with user experience in mind, featuring an intuitive layout that allows traders to find the information they need quickly. The navigation menus are organized logically, making it easy for users to access account details, educational resources, and trading platforms.

Responsive Design: The website’s responsive design ensures that users can achieve an optimal browsing experience on various devices, whether on desktop or mobile.

Mobile Trading Experience

The accessibility of trading on mobile devices has become increasingly important in today's fast-paced financial landscape. Exness recognizes this and has developed a mobile trading application that mirrors the functionalities available on its desktop platforms.

Seamless Functionality on Mobile: The mobile app provides traders with a seamless trading experience, allowing them to monitor accounts, execute trades, and analyze market movements effortlessly from their smartphones or tablets.

The combination of an intuitive website and a powerful mobile app ensures that traders can manage their accounts conveniently and efficiently, regardless of where they are.

Pros and Cons of Exness

No broker is without its strengths and weaknesses. To provide a balanced perspective, this section outlines the advantages and drawbacks of choosing Exness as a trading partner.

Advantages of Choosing Exness

Regulatory Compliance: Exness operates under stringent regulations, instilling confidence in traders regarding the safety of their funds.

Diverse Trading Instruments: The extensive range of instruments offered allows traders to diversify their portfolios and adapt to changing market conditions.

Robust Trading Platforms: The user-friendly interfaces of MT4, MT5, and the Exness Trading App provide traders with the necessary tools to navigate the markets effectively.

Competitive Costs: Low spreads and transparent commission structures make Exness a cost-effective choice for many traders.

Drawbacks to Consider

Limited Educational Content: While Exness offers some educational resources, the depth and breadth of content may not be as extensive as that of other brokers.

Higher Leverage Risks: The availability of high leverage can be both an advantage and a disadvantage, as inexperienced traders might over-leverage their accounts.

Withdrawal Processing Times: Although many payment methods ensure quick transactions, bank transfers may involve longer waiting periods.

Being aware of these pros and cons can guide traders in making informed decisions about their broker choice.

User Reviews and Testimonials

Listening to the experiences of current and former clients can provide valuable insights into a broker's performance. This section summarizes user reviews and testimonials regarding Exness.

Positive Feedback from Traders

Many traders express satisfaction with Exness's trading conditions, citing low spreads, competitive commissions, and reliable execution speeds. Users appreciate the availability of diverse instruments and the prompt customer support provided.

Community Trust: The broker's strong regulatory standing has helped cultivate a sense of trust among its clients, reinforcing their confidence in its operations.

Common Complaints

Despite the positive feedback, some traders report challenges related to withdrawal times, particularly when using bank transfers. Others mention a desire for more educational content to aid their trading journey.

Acknowledging both positive reviews and complaints helps prospective clients form a balanced view of the broker's overall performance.

Comparison with Other Brokers

Exness operates in a competitive landscape alongside numerous other brokerage firms. Assessing how Exness compares to its competitors can help traders determine its unique selling points.

How Exness Stands Against Competitors

When compared to other brokers, Exness stands out for its extensive range of instruments, competitive spreads, and robust trading platforms. Many users highlight the accessibility and flexibility of Exness's account types, allowing traders to find options that align with their trading styles.

Regulatory Confidence: The multi-faceted regulatory compliance sets Exness apart, providing traders with reassurance regarding the integrity of their trading activities.

Unique Selling Points

Exness's unique selling points include its high leverage options, innovative trading apps, and dedicated customer support. Additionally, the broker's commitment to transparency regarding fees and commissions is appreciated by users.

In summarizing these factors, it's evident that Exness possesses distinct advantages that may appeal to certain traders over others.

Conclusion

In conclusion, our Exness Broker Review reveals a comprehensive trading platform that caters to a wide range of traders, from novices to seasoned professionals. With its impressive selection of trading instruments, competitive costs, and reliable customer support, Exness presents itself as a strong contender in the online brokerage landscape.

However, traders should remain mindful of potential drawbacks, such as withdrawal processing times and the need for more extensive educational resources. Ultimately, prospective clients must evaluate their trading styles, preferences, and risk tolerance before deciding if Exness is the right broker for them. With its strong regulatory framework and user-focused approach, Exness continues to position itself as a trusted partner for traders globally.In conclusion, our Exness Broker Review reveals a comprehensive trading platform that caters to a wide range of traders, from novices to seasoned professionals. With its impressive selection of trading instruments, competitive costs, and reliable customer support, Exness presents itself as a strong contender in the online brokerage landscape.