14 minute read

By Marie Johnson

from HBJ Aug 2022 Issue

Imagining Huntsville’s Future: The City of the Stars

A claim, put forward by Yahoo Finance in April and further analyzed on AL.com last month, suggested that the average price of a home in Huntsville could reach a million dollars by 2030.

Advertisement

Seems a bit steep, doesn’t it?

And yet, this future may not be as outlandish as it appears at first glance. Gabrielle Athanasia, of the Center for Strategic and International Studies, penned a brief history of Silicon Valley, titled “The Lessons of Silicon Valley: A Well-Renowned Technology Hub.”

In it, Athanasia details the story of an otherwise unremarkable town, with an engineering college, hitting a breakthrough in a revolutionary post-war technology, landing lucrative contracts with NASA and the Department of Defense, then seeing a proliferation of startups, research laboratories, and venture capital, all concentrating into a hub, with a corresponding boom in housing prices as the town attracts many of the brightest minds in the world.

Sound familiar?

But all is not well with Silicon Valley, which is a victim of its own success. The cost of living in the Bay Area, especially housing, is unaffordable to the point of parody. A Palo Alto startup, Brownstone Shared Housing, is market testing module “sleeping pods” that are designed to enable up to 14 adults to share one single-family home.

The rent for a pod in a single home, in which one can expect to share a house, with only two bathrooms, with over a dozen other adults? $800 a month, which is half the price of a studio apartment in Palo Alto. The average cost of a single-family home in Palo Alto, California is a heart-stopping $3.5 million.

Suddenly, the $1.5 million price tag of the average single-family home in San Jose doesn’t seem quite so terrible.

Actually, yes, yes it does—how do we prevent that from happening here?

The first step is adjusting expectations for what Huntsville is, and will become in the future. The Huntsville Business Journal spoke with Katye Coats of consulting firm Warren Averett about Huntsville’s future development.

“In our area, based on our history and culture (60 years ago it was more heavily agricultural), we have an expectation as to how much we should have to spend on housing compared to our income, etc,” wrote Coats. “We don’t think of ourselves as a “booming metropolis” or an urban area – but we are. We want the infusion of industry from SpaceEx, Missile Defense, FBI, Facebook, etc., but that comes with these growing pains of increased housing prices, infrastructure (will 565 ever be done?), and the like.”

Coats sees a future Huntsville that is more analogous to other Southern metropoles.

“Did anyone think twenty years ago that Nashville would be the metropolis it is today? How much has Atlanta grown in that same time frame? Charlotte? Asheville? That’s where we’re headed. What successes did they implement? What failures did they experience? What can we stand to learn from their leaders?”

That’s the second step in preventing runaway pricing issues: infrastructure and planned development. Silicon Valley is located in California's Bay Area, where post-war urbanization sprung up and boomed around it; there just wasn’t much room for it to expand with the other urban pushes.

Huntsville, in contrast, is largely unpressured by neighboring cities. (Sorry Decatur, but you’re no San Francisco when it comes to sprawl). Investment in highway infrastructure has increased the commutability to and from nearby suburban areas of Madison County, such as Hazel Green, Harvest, and Madison itself. While prices in these suburbs have also risen, they still remain below the national average, and form a sort of release valve for urban density. At the very least, it seems unlikely that Huntsville will wind up emulating the resort town of Ketchum, Idaho, where last year, the crisis in housing prices pushed the vital working-class people critical for the functioning of the city out into further and further communities, with some reporting commutes of four to six hours daily. It reached the point where the Mayor of Ketchum proposed erecting a tent city in the town’s park for nurses, teachers, and service workers to stay.

The Mayor pretty quickly backed down from that suggestion, but it was proposed.

Another factor that differentiates Huntsville from its Californian counterpart is the nature of the industries around which each town was built. The transistors and semiconductors that gave Silicon Valley its name have a wide array of commercial, industrial, and consumer applications across the entire population. This enabled the tech startups to commercialize the technologies of Silicon Valley for a wide array of clientele.

In contrast, it seems highly unlikely that there will be a booming market for hypersonic missiles marketed to the individual consumer anytime soon.

Huntsville’s most lucrative client remains the US Federal Government. The technologies developed and deployed here are of critical importance to the future of American defense doctrine.

Space represents the ultimate high ground, the position from which an enemy might rain down death with impunity. It is of vital importance that the United States achieve total airspace supremacy. Failing that, the next best option is denying total air-space supremacy to the nation’s enemies. The aerospace and cyberwarfare technologies developed in Huntsville are crucial to that mission.

Even American defense spending is not unlimited; however, with the sheer significance of the technologies developed and deployed in Huntsville, the spending of the US government here will continue to remain strong, irrespective of private sector fluctuations. This does not make Huntsville “recession-proof” by any means. What it does mean is that there is a strong and resilient core of high-earning technical workers that will have needs that will need to be met by private businesses, and that core is what the rest of Huntsville’s economy is built around.

Then there is the privatization of space exploration to consider. There are physical factors to the aerospace industry that just are not present in Silicon Valley’s tech base. A spaceport in Huntsville is a spaceport in Huntsville and nowhere else, and presents one of no-doubt few locations equipped to handle spacecraft. Who knows how many decades it will be before numerous real challengers will emerge to threaten that sort of structural advantage? The Orbital Assembly Corporation moved its center of operations from California to Huntsville, and if their impressive robotic assembly tech can live up to the promises that the company makes, then they will be a key player in the first privately-owned, operating, and visited space habitats.

In short; while transistors and semiconductors can be researched, developed, and shipped off to anywhere, there are certain advantages that Huntsville can offer that are, at the very least, difficult to find elsewhere. This incentivizes keeping the price hike of housing to a dull roar in Madison County; the technicians need to be present to do much of the work, and while those jobs pay well, they don’t pay “$1.5 million average for a basic house” well.

Prognostication, of course, is tricky business, but while it appears that housing prices in Madison County will continue to rise, it appears unlikely that they will spiral out of all control. w

By Marie Johnson

Real Estate Update: High Inflation Hits Market

By Marie Johnson / Photos courtesy of HAAR

The Huntsville Area Association of Realtors’ (HAAR) Economic Report for Q1 2022 illustrates the rapid inflation that has hit all aspects of American economic life. The rate of inflation hit 8% in March, a four-fold increase since that month the previous year.

With the 8% inflation rate far outstripping the approximately 2% increase in median household income for 2021, it appears likely that economic distress is causing those looking to purchase a home in the $250,000 range and below to hold off on buying. Inflation, after all, affects every aspect of the economy. According to the U.S. Bureau of Labor Statistics, for the month of May, the price of gasoline jumped 48.7% from the previous year, electricity by 12%, and food products such as meat, poultry, eggs, and fish saw an increase in price of 14.2%

Put simply, those with the means to more comfortably endure the conditions of sharp inflation are the ones best positioned to buy a house at all, and they aren’t looking to buy in the $250k range.

The Economic Report shows that homes priced in the $300,000 - $350,000 range experienced a sales increase of 65% over that year, while sales of homes in the $250,000 and below range dropped nearly 50%.

The Huntsville Business Journal has previously reported on the particular pressures of a rising population and a limited inventory helping to drive up prices in Madison County. A new report from the National Association of Realtors provides further evidence of pandemic conditions disrupting housing inventory nationwide. According to the Nation Association of Realtors’ 2022 Members’ Profile report, 57% of realtors cite limited inventory as the leading factor in limiting potential clients from purchasing a home.

What remains to be seen is what will happen when the previouslyclogged supply of real estate inventory is introduced to the market. Will the reduction of supply pressure bring prices down? Will the growing demand for high-skilled, technical workers in Madison County result in previously inexpensive areas seeing a price increase due to the ability of these new residents to pay higher prices? Will those two factors cancel each other out, leading to a more gradual rise in housing prices commensurate with Huntsville’s rising prominence? Will rising prices for construction materials and other factors restrict the production of real estate inventory once more? Only time - and the imminent release of the HAAR’s Economic Report for Q2 - will tell. The Huntsville Business Journal will keep its readers informed of future analysis. w

By Dawn Suiter / Photos courtesy of U.S. Space Command

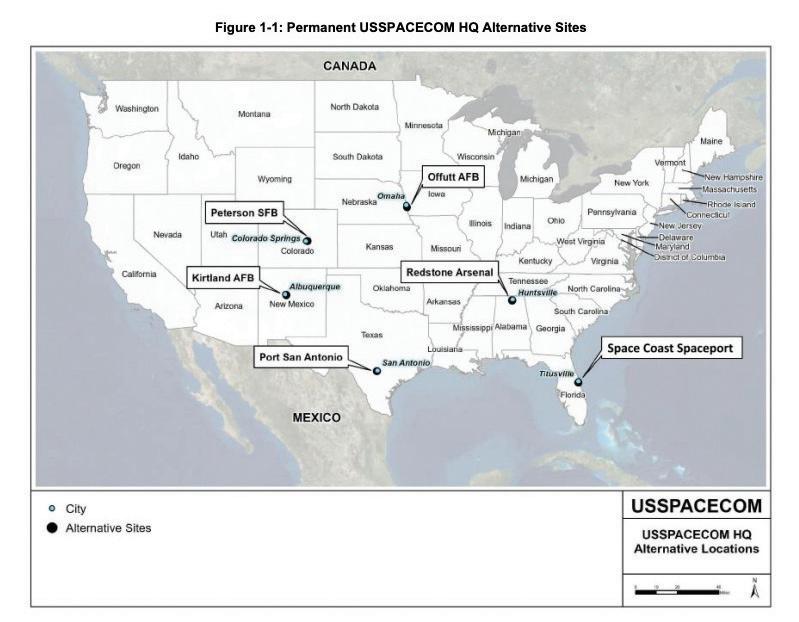

On July 13, Huntsville came another step closer to clinching the nomination for U.S. Space Command Headquarters (USSPACECOM HQ) with the release of a draft environmental assessment by the Department of the Air Force.

Space Command is responsible for providing satellite-based services to the U.S. military, as well as protecting those assets from foreign threats. While it is directly associated with U.S. Space Force, the Space Force HQ will be located in the Pentagon in Washington, D.C.

Despite challenges from Colorado lawmakers to Redstone Arsenal’s January 2021 selection as the preferred location, the DoD Inspector General and the Government Accountability Office determined that its selection was justified.

“We found that the process Air Force officials used to select Huntsville, Alabama, as the preferred permanent location for the U.S. Space Command headquarters (USSPACECOM HQ) complied with law and policy, and was reasonable in identifying Huntsville as the preferred permanent location,” a release from the Pentagon’s Office of Inspector General stated.

“We determined that, overall, the basing action process directed by the Secretary of Defense (SECDEF) complied with Federal law and DoD policy, and the Air Force complied with the SECDEF’s requirements for the basing action.”

The next step in the selection process consisted of a full environmental assessment of each of the remaining candidates.

In addition to Huntsville, the USAF also conducted environmental assessments of five other locations it considers “reasonable alternatives”-Peterson Space Force Base in Colorado; Kirtland Air Force Base in New Mexico; Offutt Air Force Base in Nebraska; Port San Antonio in Texas; and Space Coast Spaceport in Florida. Space Command is currently based at Peterson.

The report notes that while Peterson SFB currently serves as the provisional location, personnel and operations are also hosted in multiple other locations, including four leased commercial facilities in Colorado Springs, Colorado and government facilities at DoD installations across the nation.

The use of interim facilities means that USSPACECOM functions are spread thin, preventing operations from being fully consolidated and cohesive. In addition, the current facilities consist of less functional workspaces not purpose-built to support a Unified Combatant Command and are therefore not conducive to efficient operations. Factors studied in its environmental assessment included land use and zoning; noise, air quality and climate; earth, water, biological, and cultural resources; socioeconomics and environmental justice; transportation; and hazardous and toxic materials and waste. Based on these factors, each of the sites evaluated in the study was found to have “no significant impacts on the human or natural environment.”

Following the release of the draft document there is a 30-day public comment period, with the final environmental assessment taking comments into account before making the ultimate decision regarding the command’s headquarters.

According to a USAF representative, the final selection will be announced this fall.

Once the site of the consolidated USSPACECOM headquarters facility is determined, approximately 1,450 personnel will be assigned there. Staffing levels may vary depending on mission and operational requirements. In addition, the U.S. Space Command HQ may also support contractors and mission partners on site, bringing the total to 1,800 personnel.

With this need in mind, the main building will consist of approximately 464,000 square feet of office, administrative, and functional interior space across multiple stories. Along with the building will be approximately 402,000 square feet of parking spaces in surface lots and/or parking structures. While its final architectural design is dependent on the local landscape and other relevant factors, the main building’s footprint is expected to be approximately 2.3 acres.

The report states that due to the critical nature of the proposed facility, it would require Level 2 Force Protection, which involves secure perimeters, restricted access, and continual management by Air Force, DoD, or other federal security personnel. This effectively narrows the field of contenders from six to four, as two of the potential sites (Port San Antonio and Space Coast Spaceport) would need the addition of greater security measures, including additional personnel.

The Secretary of Defense set three minimum eligibility requirements for potential host cities: First, they had to be within one of the 150 largest Metropolitan Statistical Areas in the nation based on 2019 U.S. Census data. Second, they were required to

By Dawn Suiter / Photos courtesy of U.S. Space Command

be within no more than 25 miles of a military base, using straight line distance; and third, they had to have a Livability

Index score of at least 50 out of 100 points, as determined by the American Association of Retired Persons Public Policy Institute.

Each proposed location was quantitatively evaluated using 21 additional criteria organized into four main categories: mission requirements, infrastructure capacity, community support, and costs to the DoD. Factors under consideration included the available qualified workforce, proximity to mutually supporting space entities such as NASA and its contractors, cost of living, energy resilience, school quality, and area construction cost. During the final stages of the selection phase, the importance of quickly reaching Full Operational Capability was considered as a fifth decision factor by the Secretary of the Air Force. USSPACECOM focused its five high-level criteria on “being able to execute [its] mission on the worst day, when needed most.”

After taking all of the required factors into account, Huntsville moved firmly into first place on January 12, 2021, with the five remaining candidates categorized as “reasonable alternatives.”

The report states that “Huntsville compared favorably across more of these factors than any other community, providing a large, qualified workforce, quality schools, superior infrastructure capacity, and low initial and recurring costs. Additionally, the Huntsville community, with Redstone Arsenal coordination, offered a facility to support the headquarters, at no cost, while the permanent facility is being constructed.”

The offer of an interim facility at no cost is a significant contributor to Redstone Arsenal’s attractiveness to USSPACECOM. The Space Command Q&A page states that the Air Force had a clear scoring methodology for any incentives provided in the application questionnaires that would be reflected in the scoring, adding that the goal is to “minimize the initial investment cost of the USSPACECOM Headquarters, while also being economical for communities.”

The selected site at Redstone Arsenal is centrally located and covers approximately 60 acres. Redstone is the second largest of the proposed sites behind Space Coast Spaceport, which covers approximately 103 acres of mostly undeveloped, densely vegetated land with a large wetland at the center of the site and five other wetlands areas within the property. Kirtland AFB is the next largest with 59 acres, whereas Offutt AFB has an 11 acre site and Peterson SFB has a 12.9 acre site.

Weather is one of the criteria examined in the study. Despite the region’s history of occasional tornado outbreaks, Redstone Arsenal is significantly less prone to severe weather than any of the other primary sites, which list high winds, snow and tornado risk to be significant or high. Port San Antonio, meanwhile, is at extremely high risk for extreme heat and high risk for drought and wildfires, whereas Space Coast Spaceport is between medium and extremely high risk for hurricanes, sea level change, and flooding.

According to the USSPACECOM page, geological stability and inclement weather “drive costs for construction methods etc. needed to mitigate climate and weather related factors.” Because USSPACECOM seeks to minimize initial costs, “locations in less severe weather locales may be more competitive…when evaluated against certain cost criteria.”

Once the decision is finalized, construction on the permanent facility is slated to begin in April 2025. w