4 minute read

How Safe is the San Diego Housing market in Q2, 2021, by Denise Matthis.

By Denise Matthis

How safe is the San Diego Housing Market in Q2, 2021?

As is in the case of the entire nation, the housing market in San Diego is flourishing. The number of houses being put on the market might have gone down by 23.3% compared to those put up the same time last year, but houses are moving 23.9% more than the first quarter of 2021. Housing inventory in the San Diego market is therefore very tight, driving the prices on homes up. The prices for the second quarter are not going to go down either; if anything, they will appreciate further.

Looking at all these factors, it may seem as if we are in a price bubble. With the vaccination rate going up, will we see the bubble burst? Will the housing market crush as it did during 2007-2008, or will it maintain the momentum?

First, to assess the safety of the housing market in San Diego, we will have to look at the indicators of a crashing market, which include the downturn in economy, high inflation rates, the lending practices and the supply and demand of houses in San Diego.

1. DEMAND VS SUPPLY

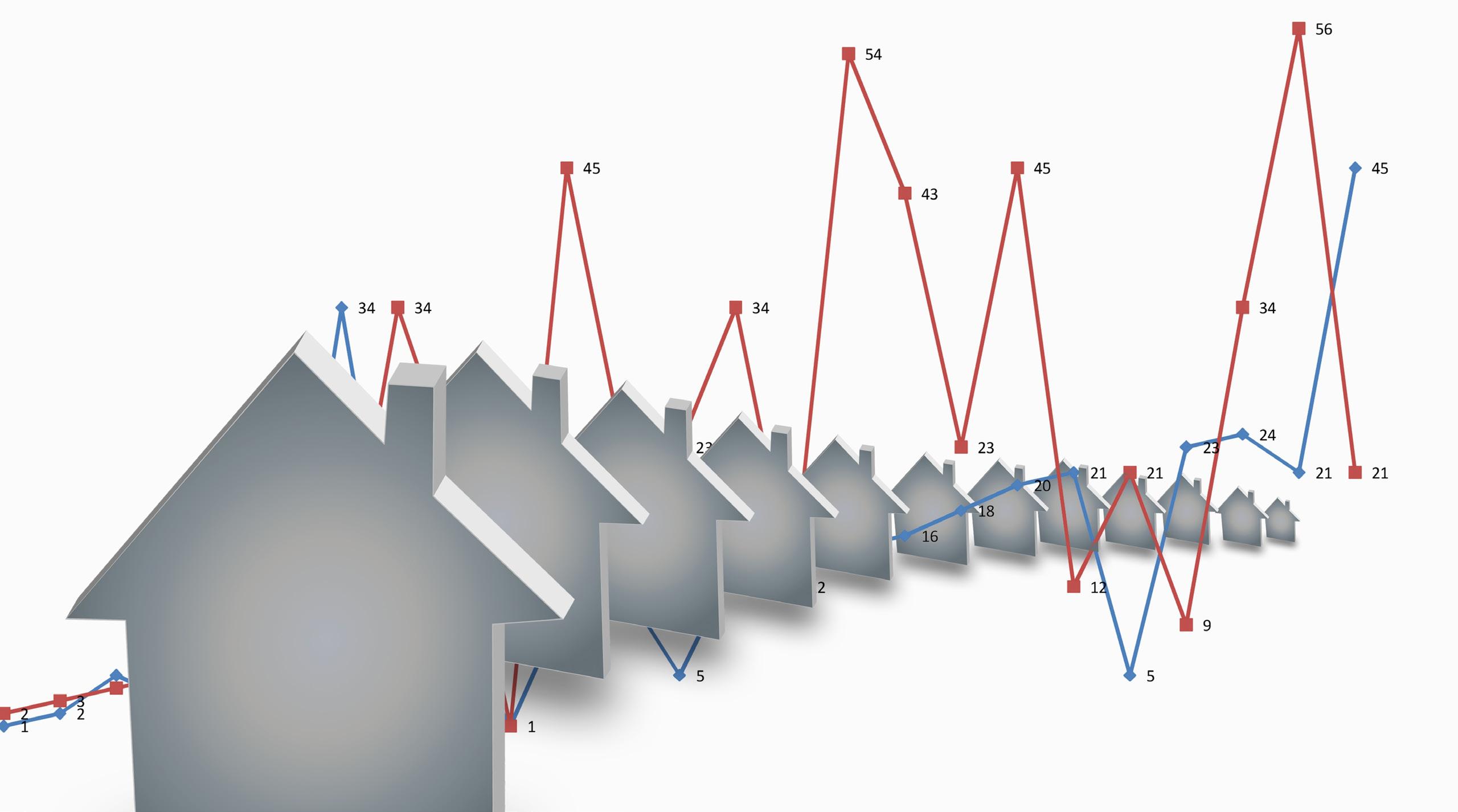

A recent Zillow market report indicated that there is a consistent demand and a low supply of homes in San Diego. For the market to crash, the demand must be exhausted and the supply be greater. For example, in 2007, there were about 15,000 houses on the market.

Currently the new homes that have come on sale are about 3000. The demand for these homes, however, in 2007 was a low of just 2000. Whereas, the current demand for homes currently is over what the market can sate with just a month supply of homes.

Therefore, the demand for houses in San Diego outweighs the supply and cannot exhaust the demand. This implies that inventory will not lie idle, it will move fast. This demand will drive home values up. Signaling a healthy housing market. This will remain constant throughout the year as people migrate into San Diego.

2. MORTGAGE RATES

San Diego is currently experiencing historically low mortgage rates. But just how stable are these rates? Experts forecast that there will be a 5.2% increase in mortgage rates. However, this will vary from one lender to the other. But as the rates are set to rise, they are not going to crash the housing market. The increase in mortgage rates is going to be very gradual.

Therefore, buyers will not be caught unawares with a sharp upward spike.

The low interest rates and the low unemployment rate of 2.7%, means the would-be home owners are able to afford homes. The time to buy a home is now, before the rates go higher.

3. THE LENDING PRACTICES.

Compared to 2007, the lending rules are a lot stricter. In 2007, it was possible to own a home without an established credit history and the down payments were very low. That meant anyone could afford a home. This subprime lending greatly inflated the housing bubble and saw home values plunge. Those that took out mortgages were unable to service them resulting in the financial crisis of 2008.

Lenders are now lending to people with impressive credit scores to minimize the risks involved. The lenders now rigorously vet applicants’ financials before approving loans. Banks now require applicants to put a sizable down payment and to prove they can be able to pay the mortgage. This shows that what happened in 2007-2008 will not repeat itself.

4. THE ECONOMY

For the economy to crash, there has to be a downturn in the economy. The economy of San Diego is currently strong.

Employment rate is up by 1.4% and expected to grow even further. A higher unemployment rate negatively affects the house pricing as it means that people won’t be able to afford a home. Currently, wages in San Diego are even higher than that of 2008. This means that people have a lot more disposable income and are able to afford homes.

The crisis of 2007 was majorly characterized with high interest rates that made homes largely unaffordable. In

San Diego people are currently able to afford homes because the income is very strong.

The housing market is not going to crash; it is safe to invest in San Diego. All the above indicators show the San Diego housing market is very healthy. San Diego has a strong economy that is set to continue growing. Moreover, with the mortgage rates set to increase, it is advisable for buyers to buy now than later when the prices are likely to rise.

Work cited.

http://www.welcometosandiego.com/2021/05/is-a-real-estate-marketcrash-coming/. https://www.sandiegorealestatehunter.com/blog/san-diego-mortgageforecast. https://www.investopedia.com/articles/07/housing_bubble.asp. https://www.sandiegouniontribune.com/business/story/2021-05-26/sandiegos-home-price-hits-a-record-700k-will-prices-ever-stop-rising