3 minute read

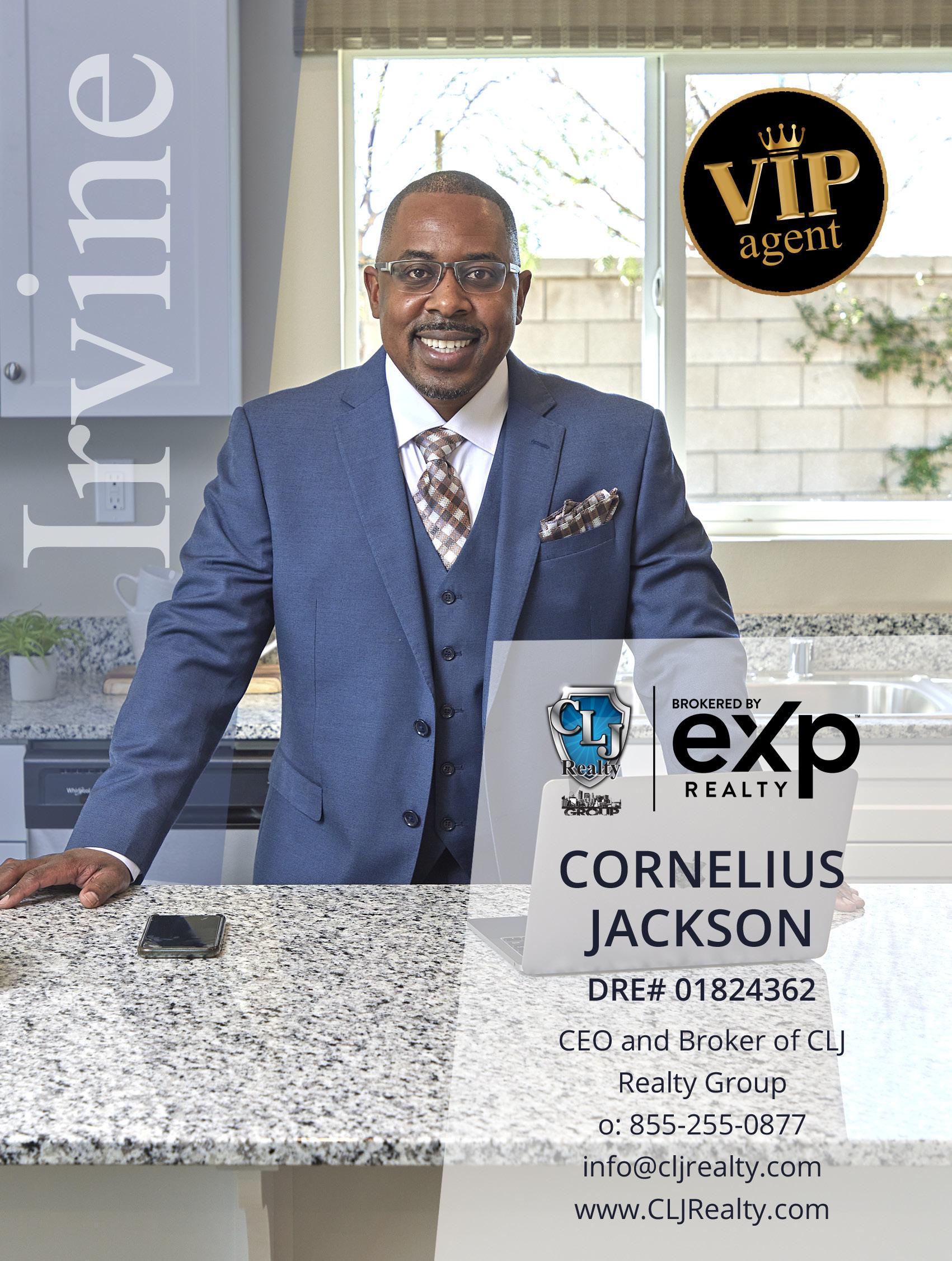

Work with CLJ Realty to make your dream of owning a home a reality, by Cornelius Jackson.

Work with CLJ Realty to make your dream of owning a home a reality

By Cornelius Jackson

The desire to purchase a house is a typical goal for many Americans. If you want to purchase a home this year, start by speaking with a local real estate expert to learn more about the process. Then, with the help of a trusted professional, you may proceed to answer the following questions to ensure that you are prepared to purchase a property.

WHAT CAN I DO TO HAVE A BETTER UNDERSTANDING OF HOW THINGS WORK?

A house purchase is a significant financial commitment that should not be done lightly. It would help if you decided on important factors such as how long you want to stay in a certain place, which school districts you want, which commute works best for you, and how much money you have.

Keep in mind that you’ll need to apply for a mortgage before you start the house-hunting process. Lenders consider several aspects of your financial history, including your credit score. They’ll want to examine how you’ve managed previous debts, so be sure you’ve paid off all of your college loans, credit cards, and vehicle loans. If your financial condition has changed lately, you should speak with your lender about it. Most organizations

have loan officers on staff and will recommend you to one. Housing should not consume more than 25% of your monthly budget, according to financial gurus.

WHAT IS THE APPROXIMATE AMOUNT OF MONEY I’LL NEED AS A DOWN PAYMENT?

Knowing how much you’ll need for a down payment is just as important as knowing how much you can afford to pay on a monthly mortgage payment. There are various alternatives and approaches available to help you lower the amount you anticipate having to pay down. Start small and stay committed if you’re worried about saving for a down payment. A little monthly donation may make a significant difference. Automate a part of your monthly pay into a separate savings account or a home fund to jumpstart your savings. Automatic deposits accumulate over time. $50 per month grows to $600 each year and $3,000 after five years because of compounding interest. If you’re persistent and methodical in your approach, you’ll have enough for a down payment before you realize it.

IS IT POSSIBLE FOR ME TO ADAPT TO A LOW-INCOME LIFESTYLE?

While it may be tempting to spend the extra time you have at home these days shopping, putting that money toward a down payment could help you get on the road to homeownership sooner. It’s the little things that matter, so if you haven’t already, start living on a tighter budget. A budget may assist you in saving more money for your down payment while also assisting you in paying off other bills and improving your credit score.

According to a study of their spending habits, shelter in place orders helped 68 percent of millennials save for a down payment.

Mortgage rates are still at historically low levels, a silver lining in the present economic situation.

Furthermore, many people who were lucky enough to maintain their employees could save money for a down payment, which is one of the most difficult aspects of house ownership. Many millennials can minimize the time it takes to purchase a house because of lowinterest rates and the capacity to save. While you don’t have to give up all of your comforts, making more informed decisions and restricting your spending in areas where you can save money may help you lose weight.

CONCLUSION

Think about what you can prioritize this year to help you realize your goal of becoming a homeowner. To discover the actions you need to take to get started, contact a local real estate professional right now.

2021