5 minute read

What most coastal agents do not want

What most Coastal agents don’t want to agree: A Coastal Exodus!

There is an upcoming thread recently where most San Francisco and Bay Area people are relocating away from the coastal areas to more inland places. This results from the growing need as city dwellers forced to work from home due to the ongoing pandemic are looking for more spacious homes. This movement has posed the question, is this a coastal exodus?

However, agents in the San Francisco and Bay Area differ with what we’re seeing. HousingWire approached some agents from the area to speak to them about what they’re experiencing in their respective markets. According to them, there’s no coastal exodus everyone is talking about.

A general manager and broker associate at Century 21 Real Estate Alliance, Romeo Aurelio, stated that the exodus is actually in the rental market since San Francisco comprises 70% renters. Aurelio added that July 2020 sales surpassed the July 2019 sales.

“There’s been such a pent up demand here in the Bay Area, where before the pandemic we received 10, 15, 20 offers on properties,” Aurelio said. “Now during the pandemic, things did take a bit of interest because it was such an unknown, but because interest rates have stayed so low and ended up in demand. Even though there’s maybe a little bit more inventory right now it’s actually making our markets even stronger. So on the sales side of things, things are absolutely fantastic.”

However, the story is told differently

on the other side. According to Hanna Ibrahim, an agent specializing in the San Jose and Silicon Valley markets, the number of listings, pending, and escrows give a different indication. “The fact of the matter right now…we have approximately 370 [listings] pending, that’s a huge amount, that’s quite a bit pending,” Ibrahim said.

On the other hand, Kate Davey, a leading agent with Century 21 and specializes in San Jose and Silicon Valley, it feels like “la la land” in her market currently as her clients are selling their smaller homes for more spacious ones. She adds that she’s having her best year in the business in five to six years.

“Most of my buyers are just buying in bigger homes and staying local, they just realize they need more of a home and a lot more space so that they can continue to work from home,” Davey says. “But, I noticed there’s this big thing about people wanting to leave California, and that could be true, I’m not seeing it. I’m seeing low inventory, people paying more for homes than what they should, in some cases, especially if they are updated home, and I’m encouraging my potential sellers to update during the shelter-in-place because buyers are looking for homes that are done and they can just move their families into their former home.”

Both Davey and Aurelio stated that they’re witnessing bidding wars. Davey says that the homes that got the most offers are “priced right, and have a lot of value in them.”

“They’re not seeing the 30, 40, 50 offers... and that’s mostly because we’re not getting 30, 40, 50 people coming in to see the properties anymore, with all the restrictions on being able to get into property,” Aurelio clarifies. “I would say that the quality of buyer has gone way, way up, and the percentage of buyers that are making offers versus coming to see the properties are way, way up.”

Work cited

https://www.housingwire.com/articles/a-coastal-exodus-these-century21-san-francisco-agents-dont-think-so/

YOU DESERVE TO LIVE SAFE FROM SEXUAL HARASSMENT.

Sexual harassment by a landlord or anyone related to your housing violates the Fair Housing Act. If you receive unwelcome sexual advances or are threatened with eviction because you refuse to provide sexual favors, you may fi le a fair housing complaint.

To fi le a complaint, go to hud.gov/fairhousing or call 1-800-669-9777

If you fear for your safety, call 911.

FAIR HOUSING IS YOUR RIGHT. USE IT.

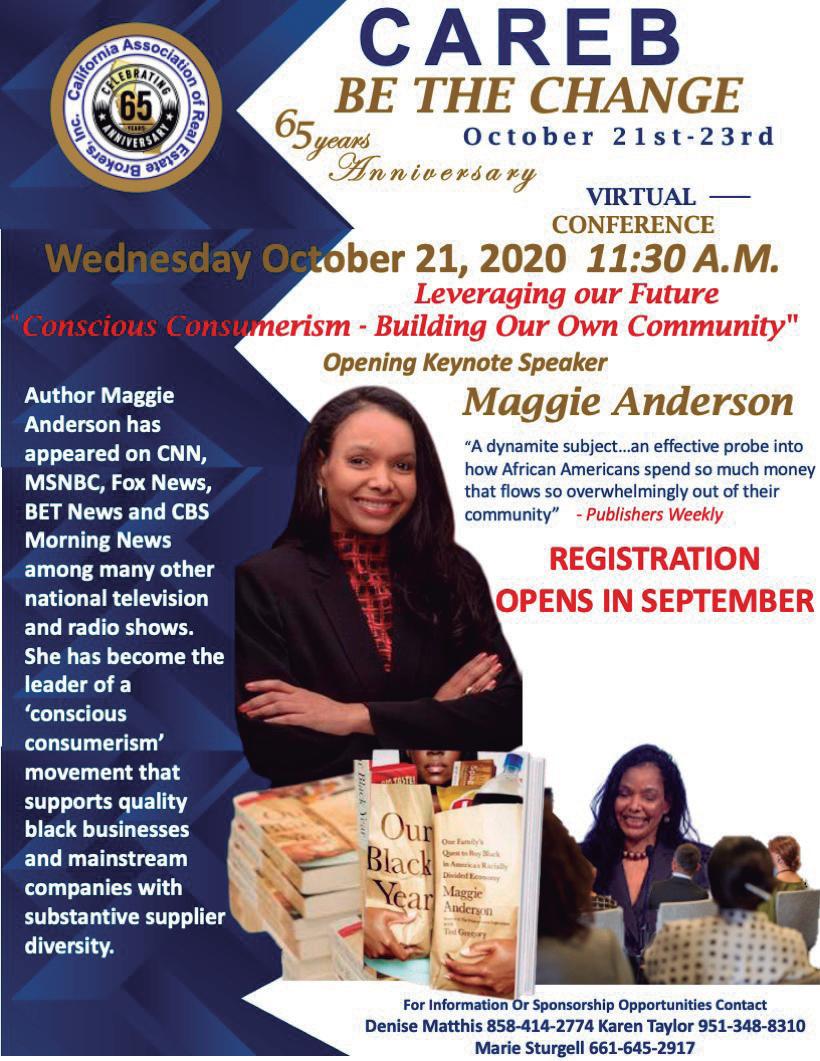

The Federal Housing Finance Agency recently postponed the implementation of the new adverse market fee on refinanced mortgages backed by the GSEs after an industry outcry. The implementation of the new Refi fee was pushed to December, which is almost a month after the November 3 presidential election.

As we all know, both presidential candidates (Donald Trump and Joe Biden) have distinct policies they plan to implement once elected to office. The distinct policies are likely to have different impacts on the financial sector and the housing market. President Trump has spent a lot of time in office rolling back Obama-era policies and regulations in the banking sector that cracked down on firms since the financial crisis, and policies that the industry regarded as costly and burdensome. Former Vice President Joe Biden plans to undo most of that, backstopping consumers’ finances and rendering depository institutions responsible to prevent the same financial crisis. As much as policies differ between the two candidates, the fact remains that the president cannot control rates. Instead, the market is usually the primary influence over rates, no matter what the president or the Fed wants.

Biden’s Agenda

Through his campaigns, Joe Biden has promised to reinstate most of the DoddFrank era financial reforms, which are Obama-era policies that he championed. In general, Biden wants to “strengthen and protect” Dodd-Frank Act provisions in efforts to ensure American’s finances aren’t harmed during a financial crisis resulting from negligent lending or investing, according to a laundry list of recommendations formed through a “unity taskforce” with Sen. Bernie Sanders of Vermont.

Biden also aims to strengthen consumer lending oversight through credit cards and regulate ”usurious” interest rates that may be regarded high for certain regions of the country and borrower demographics.

Wha t If? Just Wha t if Biden wins. Wha t happe ns to Re fi Fee ?

Moreover, he wants to utilize the Consumer Financial Protection Bureau (CFPB) to curb abusive or deceptive lending practices and make borrowing costs transparent by zip code.

Biden is also proposing to update the CRA and extend it to apply to mortgage and insurance companies.

If former Vice President Joe Biden wins the elections, “all bets are off,” said Stephen Myrow, managing partner of Beacon Policy Advisors in Washington, D.C. Even if FHFA implements the fee, it could be reversed by a Biden administration, who would likely stop plans to recapitalize and release the two GSEs, Myrow added.

Works Cited.

https://www.bankrate.com/banking/whatpresidential-election-trump-biden-means-forbanking/. https://truenorthtitle.com/what-happens-to-the-refifee-if-biden-wins/.