10 minute read

Commercial Real Estate market flounders

COMMERCIAL REAL ESTATE MARKET FLOUNDERS EVEN AS RESIDENTIAL MARKETS BOOM

Steve Peterson

The housing market, in general, is a beehive of activities amid the pandemic. Thanks to the historically low mortgage rates and the current trends where scores are fleeing the cities for the suburbs. However, not all sectors of the housing market are red hot with housing activities. Commercial real estate, in particular, is suffering a different kind of blow from the COVID-19 pandemic. With the rise of Zoom and Slack platforms, and other productivity tools, it has become easier for people to work from home. On the other hand, online stores such as Amazon and other online retailers are ripping big amid the pandemic as the shifting from physical stores to online shops is accelerating. ”There will likely be less demand for commercial real estate due to the rising popularity of online shopping and working from home,” said Ivy Investments global economist Derek Hamilton in an email.

Regarding that, corporates are laying off thousands of employees due to the plunge in operations. For example, Brookfield Property Partners (BPY), which owns malls and other shopping centers, including Tysons Galleria in Virginia, announced that it would lay off 20% of the 2000 employees in its retail arm. In an email obtained by CNN Business on September 22, 2020, Brookfield said, ”our business has been frustrated, interrupted and constrained” due to Covid-19 and that ”after thoughtful consideration, we have reached the heavy decision to reduce the size of our workforce.”

Elsewhere, it’s not the entire commercial real estate market sector that is suffering; some parts are holding up well.

”There are lot of subsectors in commercial real estate,” notes Fernando De Leon, managing partner at Leon Capital Group, a real estate investment firm. According to De Leon, properties that house warehouses used by e-commerce firms are well cautioned from the economic pain. The case is the same for self-storage companies, as storage rents remain stable as people look to remodel their living spaces, he added.

Moreover, “pharmacies, grocery stores and restaurants

with thriving takeout and delivery businesses are doing particularly well,” said Michael DeGiorgio, founder and CEO of CREXi, an online real estate marketplace that has partnered with Leon Capital Group. ”The lights are slowly turning back on. People may be anxious to go back out, go shopping and eat out again.”

However, some cite it as a case of the haves and have nots when it comes to commercial real estate as many hotels and office space owners, as well as specialty shops, are struggling. Hospitality and retail have been decimated. ”The office side is still up in the air,” said Ivan Kaufman, CEO of Arbor Realty Trust (ABR), a real estate firm that invests in mortgages tied to commercial real estate and multifamily apartments.

Despite some companies resorting to having their employees work from home, some are still committed to having their employees attend their workplaces physically occasionally. ”The complete elimination of offices is not happening. Many companies realize they still need them even though demand may be softer,” he said. ”It’s not all doom and gloom. It’s an adjustment.”

WHAT CAN BE DONE?

Congressman Van Taylor, a Texas Republican, wrote a bipartisan letter last summer urging the Fed chair Jerome Powell and Treasury Secretary Steven Mnuchin to boost financial aid for the commercial real estate industry to ”bridge the temporary liquidity deficiencies facing commercial real estate borrowers.” Van Taylor wrote that ”These industries don’t need a bailout, but they do need flexibility and support to keep their doors open,”

Moreover, Powell acknowledged and noted during a press conference in mid-September that many commercial real estate firms are not able to take advantage of the low-interest rates to borrow more finances due to the legal obligations in their debt covenant agreements. However, there is hope that Washington will do more to support commercial real estate.

Work cited.

https://edition.cnn.com/2020/09/22/investing/commercial-realestate-recession/index.html.

www.StopHigherPropertyTaxes.org

Split-Roll Property Tax Measure Hurts Immigrant and Minority Communities Background: Prop 13 Has Helped All Californians for More Than 40 Years

• For more than 40 years, Prop 13 has provided certainty to homeowners, farmers and businesses that they will be able to afford their property tax bills in the future. Under Prop 13, both residential and business property taxes are calculated based on 1% of their purchase price, and annual increases in property taxes are capped at 2%, which limits increases in property taxes, especially when property values rise quickly.

Split-Roll Property Tax Measure Destroys Prop 13 and Makes Our Economic Crisis Worse

• Amid an unprecedented economic crisis, special interests submitted petitions to qualify a measure for the

November 2020 statewide ballot that will destroy Prop 13’s property tax protections and will be the largest property tax increase in California history. The measure will raise taxes on commercial and industrial property by requiring reassessment at current market value at least every three years. This type of property tax is known as a “split-roll tax” because it splits the property tax roll, assessing business property differently than residential property. • We should reject this measure and maintain Prop 13 protections that have kept property taxes affordable and provided every taxpayer who buys a home or business property with certainty that they can afford their property tax bills in the future. Now is not the time to raise taxes and bring more uncertainty to businesses and all Californians.

Gentrifies Our Longtime Communities

• A split-roll property tax will provide a huge financial incentive for local governments to approve business projects to replace existing housing so they can receive higher property tax revenue. It will also push small minority- and immigrant-owned businesses out of our communities when they can’t afford the higher property taxes. This unintended consequence will intensify the gentrification already occurring in much of the Bay Area and Southern

California coastal counties.

Hurts Small Businesses and Consumers

• Most small businesses rent the property on which they operate. The measure’s higher property taxes will mean soaring rents at a time when the federal and state government is trying to provide small businesses with rent relief to keep their doors open. Ultimately, the measure’s tax hike on businesses will get passed on to consumers in the form of increased costs on just about everything people buy and use, including groceries, fuel, utilities, day care and health care.

Hits Minority-, Immigrant- and Female-Owned Businesses the Hardest

• Small businesses are already struggling. This measure will make it even more difficult for them to reopen their doors or stay in business as a result of this economic crisis. Increasing property taxes on businesses by up to $12.5 billion a year will hurt female- and minority-owned businesses the most and 120,000 jobs will be lost, according to a

Berkeley Research Group study. Voters are being asked to consider a measure that will only increase job losses at a time when millions of Californians are applying for unemployment benefits. • According to the latest data from the Harvard Business School, about 42% of new companies are founded by immigrants in California and the most recent 2012 Survey of Business Owners by the Census bureau found that 5% of businesses in the state are owned by African Americans. Additionally, the California Latino Economic Institute found that nearly one-quarter of all businesses in California are owned by Latinos, and they are the fastest-growing component of the state’s economy. Most of these businesses start small and stay small, meaning they often rent their property and are subject to higher rents when property taxes increase. • In the most recent 2012 Survey of Business Owners by the Census Bureau, 38% of all non-publicly traded businesses were owned by females and another 9% were owned equally by females and males.

Increases the Cost of Living for Everyone and Makes the Homelessness Crisis Even Worse

• In 2019, US Housing & Urban Development data showed California led the nation with more than one-quarter of the country’s homeless population. • California’s cost of living is already among the nation’s highest. We shouldn't do anything to make it even more expensive to live here. The split-roll measure will only increase homelessness and make life more difficult for

Californians already living paycheck-to-paycheck.

Homeowners Are Under Attack

• If businesses lose their Prop 13 protections, homeowners will be next. Supporters of the measure even admitted that this initiative was the first step in a plan to end Prop 13, which could mean skyrocketing property tax increases for all California homeowners.

Ad paid for by Californians to Save Prop 13 and Stop Higher Property Taxes, sponsored by California homeowners, taxpayers, and businesses Committee major funding from Western Manufactured Housing Communities Association California Business Roundtable California Taxpayers Association Funding details at www.fppc.ca.gov

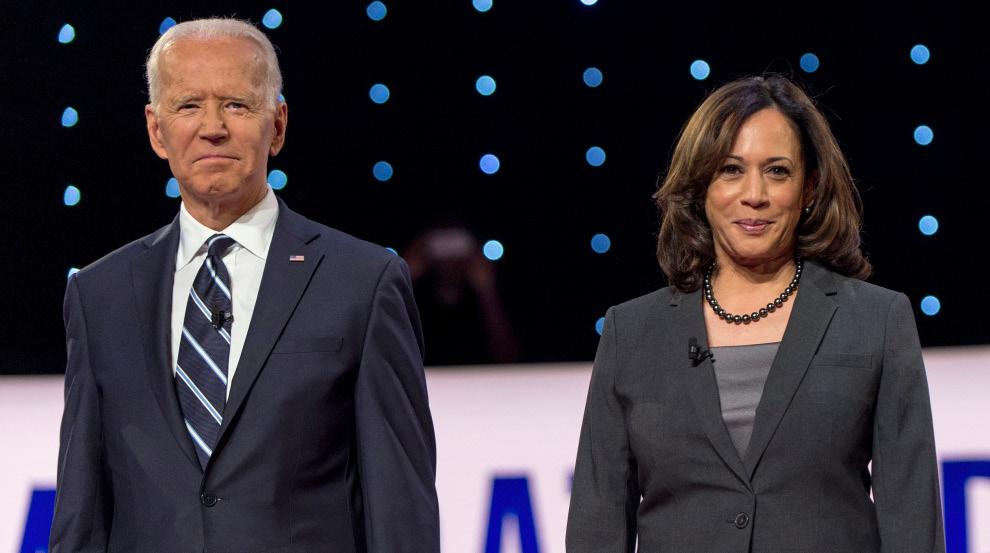

BIDEN’S TRANSITION TEAMS BRINGS IN BACK KEY CFPB PLAYERS: WHAT DOES THAT MEAN?

Now that the American people have decided and chosen former vice president Joe Biden to lead the nation effective from January, a lot is already underway. Although President Donald Trump is yet to concede defeat and the election result is still being challenged. However, President-elect Joe Biden has spared no time at all. He’s already putting in place his transition teams in preparation for the January 2021 Inauguration.

Biden brings in back key players to be a part of his Transition team for the Consumer Financial Protection Bureau? One of the key players is the hand-picked successor of former CFPB Director Richard Cordray — Leandra English.

Considering the occurrence that led to the emergence of the current CFPB Director under President Trump, it is logical to expect that a new director will emerge should Biden become president. In 2017, the immediate former director of CFPB — Richard Cordray, stepped down. However, before his step-down, he already promoted English to the deputy director’s position from the chief of staff.

This automatically makes English the right candidate for the CFPB director after Cordray stepped down. Unfortunately, President Trump didn’t agree to this. He, instead, went ahead to appoint Mick Mulvaney — former acting director of CFPB.

English took the case to court, resulting in a tussle regarding who is the real director of CFPB. Unfortunately, English lost the battle when the verdict was given, and it was against her. Rather than giving up, English further took the case to the U.S. Court of Appeals for the District of Columbia Circuit.

English later gave up the fight when Kathy Kraninger was officially named as a permanent replacement for Cordray’s permanent as CFPB Director. English then left the CFPB.

Now, there seems to be hope again for the former deputy director as she has been called upon to be a part of Biden’s Transition Teams for the Consumer Financial Protection Bureau.

The occurrence that led to her being denied the position of directorship under Trump seems politically instigated. Also, her presence in Biden’s Transition Teams looks political. Whichever way it is, English appears to be qualified for the position. If she later becomes the director of CFPB under the Biden administration, she can utilize her experience as the CFPB chief of staff and deputy director to provide the excellent leadership that the CFPB needs.

Biden bringing back English may also mean that he needs people we already know and recently worked with to form his new team. Remember that President-elect Joe Biden served as vice president under President Barack Obama. Since the administration was tagged successful by many Americans and ranked among the best in America’s history, Biden may also need the people he had a history working with to come aboard again. English has been in the CFPB for years and contributed to the success of the Consumer Financial Protection Bureau under the Obama/Biden administration. Therefore, it will be logical, defendable, and justifiable for Biden to bring him aboard again.

Nevertheless, English is not the only key member of key CFPB Players in Biden’s Transition Team, but, of course, she’s the most popular of them all, and the likely one to be the next CFPB Director.

References

https://www.housingwire.com/articles/bidentransition-team-brings-back-key-cfpb-players/amp/ https://debtconnection.com/biden-transition-teambrings-back-key-cfpb-players