22 minute read

Top

from Spring 2021

by Equal Eyes

The Dan Franklin Scholarship

Each year the MAAO Scholarship Committee awards a $1,000 scholarship in memory of Dan Franklin

Advertisement

Written by Carrie Borgheiinck, SAMA Hennepin County

Dan Franklin

Dan Franklin

The Dan Franklin Collegiate Scholarship was established by MAAO in 1998. Dan Franklin was known as the “grandfather” of the assessor education system. Dan served as the Grant County Assessor and the Wilkin County Assessor during his career. He also served diligently on the MAAO Education Committee and was President of MAAO in 1963.

Funding

The scholarship is funded from donations of the 9 MAAO regions, the 50/50 drawing which occurs during the summer seminars banquet, and donations from the Dan Franklin family.

Past Recipients

Past recipients have gone onto having successful careers within the assessing field. • Justin Massmann is the Property Tax Compliance Officer Supervisor at the Department of Revenue. • Kari Theisen is a Principal appraiser at Hennepin County.

4 of the past scholarship recipients are now County Assessors: • Tina Diedrich-Von Eshen is the Kanabec County Assessor. • Shayne Bender is the Le Sueur County Assessor. • Karl Lindquist is the Grant County Assessor. • Laura Hacker is the Sibley County Assessor.

Laura and Shayne, along with Jonathan Crow (City of Edina) and myself, are now members of the scholarship committee as well.

Requirements

The scholarship is open to all majors, and students can be attending any college or university. The main requirement is the student must be enrolled in at least 10 semester credits. The application period is from August 1 to December 1 each year.

e Dae Dan Franklin Scholar The Dan Franklin Scholarship, continued -

Selection Process

This years scholarship winner was chosen by the scholarship committee members and MAAO Past President Daryl Moeller. These grading members rated each applicant on their application, connection to Minnesota, community or activity involvement, employment, interest in assessing, and their resume and/or cover letters. There were 25 applicants this year.

Recipient This year’s recipient of the Dan Franklin Scholarship is Luke Sturm.

Luke is a 2018 Providence Academy High School graduate that currently attends the University of St. Thomas. He has made the dean’s list every semester and will graduate in May 2022 with a double major real estate and finance.

He is the membership coordinator for the University of St. Thomas Real Estate Society and has been a summer intern with Upland Real Estate Group. Luke even flipped a house when he was 20 years old! Congratulations to Luke! He plans on attending summer seminar luncheon as well where we will all be able to congratulate him.

Luke Sturm

Request for Information

If anyone has any information on past scholarship recipients please send the update or information to me so I can add it to my list. Additionally, if you have any information, stories, photos or facts you want to share in regard to Dan Franklin to add it to our history, please share with me as well. You can contact me at carrie.borgheiinck@henneipn.us.

Press Release

The subject property of the Shopko Court case for the years 2015-2017 sold first in 2015 for approximately $10,400,000, then again in 2017 for $11,250,000 in fair market transactions between investors. The sales meet every statutory requirement constituting market value transactions, and unquestionably established the market value of Shopko on those two dates.

The property was appraised by a highly qualified independent fee appraiser for the County at $9,400,000. The property was assessed by the County Assessor at approximately $5,200,000 at the time of sale or 50% of market. Shopko sued the County opining a $2,400,000 appraisal (20% of market). The Court decided that the value was approximately $5,500,000. While this decision more or less affirms the assessed value, its memorandum clearly establishes Minnesota as a “fee simple” as opposed to “market value” State for taxation.

The decisions of the Minnesota Tax Court mean that assessors are not allowed to use sales of, or rental income from, leased single tenant property when valuing leased property. It renders the appraiser’s primary valuation method, the income approach, useless in the valuation of income producing property. It relegates the valuation to nothing more than a liquidation appraisal.

The reason why this decision is so important is that property tax needs to be applied equally to all property so that taxpayers can be assured fair treatment. The crux of the County argument is that valuation emphasis should be on the property (in rem), and not on the ownership (in personam). That way two identical properties would have the same value/tax regardless of who owns or occupies the property.

The Market Value method focuses on the property where its highest and best use (HBU) is the focal point for valuation. The emphasis on HBU is a fundamental purpose of property tax, because it encourages property being put to its most profitable use. Leased and owned properties sales would be used in kind, because it’s the physical attributes of the property that give it value.

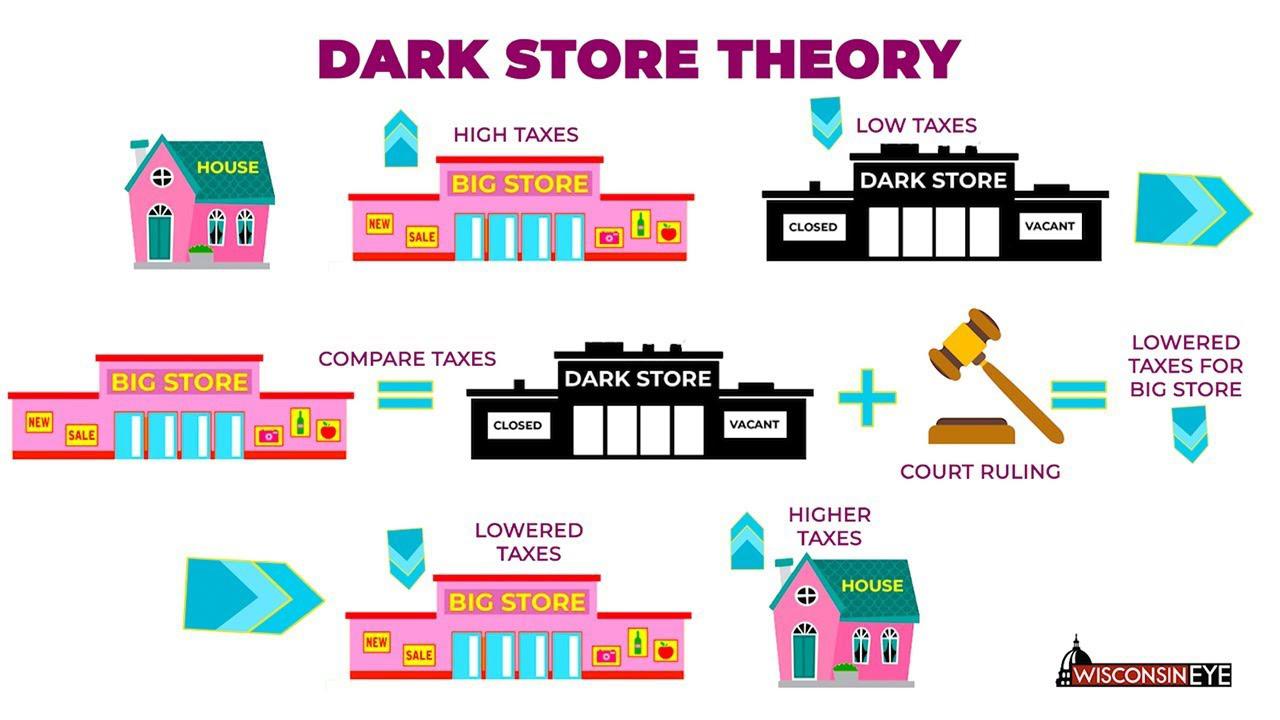

The contemporary view of the Court is fee simple as unoccupied (dark); it focuses on the ownership rather than the property. This leads to an inequity between owner occupied and leased property to the point where consideration of the latter is prohibited. This suspends the application of the most applicable (income) valuation approach.

The issue with fee simple becomes what to do with property that only exists in some form of a lease arrangement? As in the multi-trillion-dollar single tenant lease market segment that includes the Shopko and the majority of this nation’s Fortune 500 restaurant, service, and retail property. These properties occupy the very best commercial real estate locations in North America and are almost exclusively long term leased property. loophole”, looms large in the States where their property Tax Tribunals and Courts have abandoned the market value concept and opted for this legal construct. The potential ramifications of this policy are staggering. It potentially results in a tax policy that favors this market segment to an amount of as much as fifty billion dollars ($50,000,000,000) in annual property tax shift to the remaining taxpayers nationwide.

While this decision results in a modest increase (about $14,000 per year) in tax for the years in question for assessment at 50% of market value, there is still a public policy issue why approximately $180,000 of annual tax (assessment at 90% of market) is missed and annually redistributed to the other taxpayers in the County. This amount is significant in itself, but it pales in comparison to the overall tax shift when all properties of this kind are lowered from 50% to a level of 20% of their market value. This is why this case had to be so strenuously defended in Court

by the County.

I’m pleased that the Court didn’t lower the level of assessment to 20% of market value. I’m disappointed with the decision in that continues to validate the dark store loophole by adhering its fee simple construct.

It is wrong that any property be valued less than its market value for taxation, let alone a class of some of our most valuable properties being systematically valued at a fraction of their value for taxation. This is an intolerable inequity, because the remaining property classes throughout the County and State are valued at full market value.

The next step is how to right this wrong. I would submit to the Court of Public Opinion that legislation be made to clarify that Minnesota is a market value State for the reasons previously explained.

The State of Wisconsin in response to a potential $700,000,000 property tax shift is addressing this issue with two tax bills introduced, the “Dark Store Bill” (Assembly #386 Senate #292) and the “Walgreens Reversal Bill” (Assembly #387 Senate #291). There is a link to a youtube video: https://www.youtube.com/ watch?v=h7Kurxbd5qE called “Close the Dark Store Loopholes” which was put out by the League of Wisconsin Municipalities that interested readers may find very informative.

History

It seems incomprehensible to imagine how such a disparity could exist in the market valuation process. The truth is that there is no real disparity in statute, just a creative and well-orchestrated legal construct played on an unsuspecting public. The statutory market value standard was set aside in favor of a new focus on ownership rights instead of the property. For most of history the term fee simple was used to describe ownership as all rights that may be owned. In 1984 a publication by the American Institute of Real Estate Appraisers, The Dictionary of Real Estate Appraisal defined it as absolute ownership unencumbered by any other interest or estate. At the time most appraisers interpreted the change to simply mean ignoring all encumbrances (mortgage, lease, sublease, etc.) on the property. Other dictionaries did not and have not added the word unencumbered into their definition/s of the term.

The consensus of the period was that fee simple describes real estate ownership as consisting of basically: fee simple = lease fee + leasehold. That lease fee and leasehold may be a fraction of the fee simple. This sentiment is reflected in a 1994 Court decision TMG Life Insurance Company vs County of Goodhue (C9-94-479), where the owner of the lease wanted his valuation reduced because the lease was below market. The Court stated: “The task of the Assessor is to value the full market value of the entire fee interest of property for taxation. The property may be divided into different interests and estates … but the assessor values the whole, not the separate parts.”

A transformation occurred gradually over time through a series of Court precedents

Dark Store Theory

In 2009 David C. Lenhoff a Member of the Appraisal Institute (MAI) published an article You Can’t Get the Value Right If You Get the Rights Wrong, Appraisal Journal (Winter 2009, p.60-65). This controversial article used the term unencumbered to drive a proverbial wedge between market value and leased property. By stating fee simple is “how much an informed purchaser would pay for the property as unencumbered by the lease.”

He goes on to state “To properly approach such assignments, appraisers must suspend reality.” The appraisal assignments to which he refers are for “condemnation or tax purposes.” The logical construct goes something like this:

If, Fee Simple possesses all rights that may be owned.

And, a lease conveys (albeit temporarily) the right of occupancy to another.

Then, anything leased can never be used to value fee simple.

This strict interpretation goes so far as to state “even if the lease is at market rent, the fee simple does not necessarily equal the leased fee.” He presumes fee simple and lease fee to describe totally separate markets. When they’re supposed to describe ownership with one subordinate to the other. This thinking assumes that these properties don’t compete with one another in the market.

When I first read this article, I thought it absolutely ridiculous because it entirely negates the notion that rental income is relevant in valuing income producing property! Also, that he somehow ties obsolescence, a physical property condition

to ownership rights. Ownership type does not cause a property to become obsolete.

I really underestimated the amount and breadth of mischief this article has caused in the assessment world. It is quite remarkable that he sold the idea that any sale of a leased property can never be used to value it, not even its’ own sale. Also, that the rent associated with said sales cannot be used as market data. So, the known universe of income property sales has disappeared into the “dark store loophole”.

The theory is to appraise leased property with speculation building sales that are vacant (dark) and available for any use, where the renter is found, and rent negotiated after construction. The truth is spec builds don’t exist in today’s market. The only vacant sales available are second and third generation properties that are obsolete or failed for one reason or another.

For example, a Dairy Queen is sold by its owner/operator to an investor for $3 million dollars. The investor immediately leases the property to a third-party operator and resells it a year later to another investor for $3.2 million dollars.

According to this dark store theory, the subsequent sale and any rent figure associated with it is entirely off limits for fee simple valuation. Even if all market indicators corroborate the $3.2 million sale price. The rent in the second sale can never be used as fee simple rent (even though it is market rent), because there was a lease in place at the point of sale.

Many dark store enthusiasts would even go so far as to invalidate the first sale coining it a “value in use”, because the subject was going to continue to be used for the purpose for which it was designed. Imagine a homebuyer wanting to use their house as a home.

There are dozens of reasons why this theory fails to represent market value. Your own common sense should guide you to the answer to the question why would someone pay $11 million for something worth only $2.4 million. In the interest of brevity, I’ll move onto the ramifications of all this, or why this is a big deal.

THE LAW We need to look at statute to understand what “market value” is.

Minnesota Market Value Instructions & Definition

273.11 VALUATION OF PROPERTY. § Subdivision 1.Generally. Except as provided in this section or section 273.17, subdivision 1, all property shall be valued at its market value. … In estimating and determining such value, the assessor shall not adopt a lower or different standard of value because the same is to serve as a basis of taxation, nor shall the assessor adopt as a criterion of value the price for which such property would sell at a forced sale, or in the aggregate with all the property in the town or district; but the assessor shall value each article or description of property by itself, and at such sum or price as the assessor believes the same to be fairly worth in money. The assessor shall take

into account the effect on the market value of property of environmental factors in the vicinity of the property… All property, or the use thereof, which is taxable under section 272.01, subdivision 2, or 273.19, shall be valued at the market value of such property and not at the value of a leasehold in such property or at some lesser value than its market value.

Market value is definedby Minnesota Statute 272.03 Subdivision 8 “Market Value” means the usual selling price at the place where the property to which the term is applied shall be at the time of assessment; being the price which could be obtained at a private sale or an auction sale, if it is determined by the assessor that the price from the auction sale represents an arms- length transaction. The price obtained at a forced sale should not be considered.”

The statement “usual selling price” means usual as common, ordinary, customary, regular, or normal price. This nomenclature of “usual” infers some semblance of probability about the price. Other definitions often state that property should be valued at its most probable sale price as it exists on the date of assessment.

As it “exists” means in this context to have being or actuality. It means as it actually was or is. Statute also states a given point in time, “the time of assessment.” There is no intent of anything hypothetical or contemplative in the term.

There is no mention of fee simple in Minnesota statute.

Fee Simple Vacant/Dark

The Court or the Legislature needs to decide if Minnesota is a market value State or a fee simple as vacant State. When using the fee simple vacant and available standard, Assessors are faced with a situation where they cannot accurately appraise any leased property because the only reliable value indicators are banned. The only sales allowed for use are highly variable liquidation sales that are most often unverifiable.

The sales in this submarket are generally vacant because of negative conditions such as deed restrictions, poor location, bankruptcy, etc... This submarket demands a very robust verification of each sale. Most often these profoundly obsolete sales are subject to severe deed restrictions or other conditions that can only be revealed through labor intensive discovery procedures.

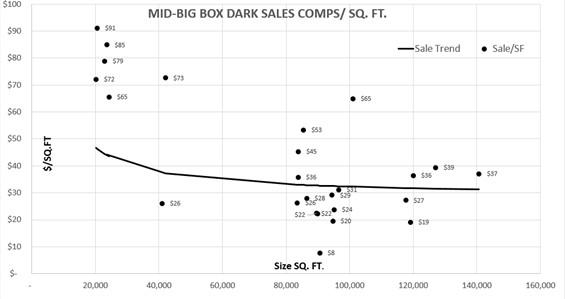

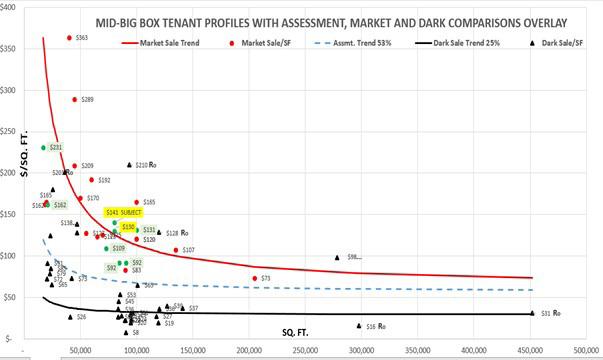

The hypothetical premise imposed can’t be overcome by traditional mass appraisal methodology. There is simply insufficient data to establish a statistically significant appraisal for these types of property. In the aforementioned court case, the petitioner’s universe of sales for Minnesota fell into this category, and all 25 of them are included on the above graph of sale price per square foot arrayed along the regression trend value of the sample.

This universe of sales ranges from $8 to $91 per square foot or 1,138% variation. The average deviation (consistency) from the trend line is 35% for this sample. This sample is simply too small and too erratic to provide a meaningful statistical analysis. If the sales with deed restrictions and other adverse conditions are removed, then there aren’t even enough sales left to provide a meaningful trend line.

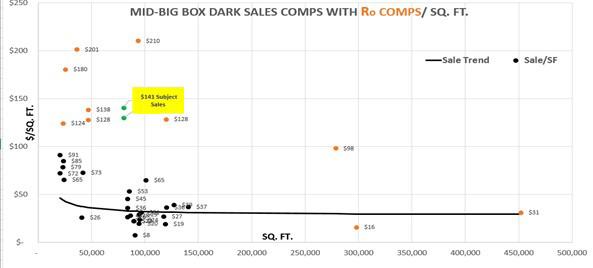

The fatal flaw of the as vacant strategy is when appraisers try to apply the income approach. It can’t be done because there is no occupant to pay rent. Appraisers who attempt this “suspended reality” application, resort to rents paid in dissimilar markets such as shopping centers and derive their cap rates (Ro) from the same or the banned single tenant net lease market as was done in the subject case.

This effort brings the comparable sale ranges from $8 to $210 per square foot or 2,625% variation. The consistency from the trend line is now 93% for this sample, which shouldn’t be considered acceptable in any forum.

Fee Simple Occupied

The banned single tenant net lease market is the subject market in this case. It is a serious omission to ignore the most obvious and active market for these types of property. This market consists of property advertised, bought, and sold on the open market from one investor to another with all condition’s requisite to a fair sale. Neither party is a user of the property, so it is a value in exchange, and market rent is the primary focus of the transaction. These are income producing properties for which the income approach to value was designed.

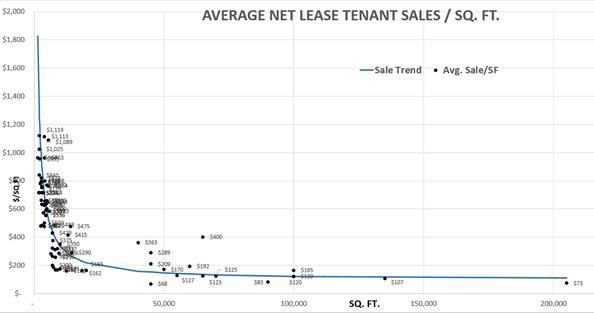

The following graph depicts the average sale prices per square foot over a 450,000-store sample valued at $1,256,564,000,000.

Many commercial appraisers consider this market the easiest and most consistent market in the world of real estate to appraise because it’s a large competitive multi-trillion-dollar national market with abundant income and sales information. A market that is unquestionably suitable for mass appraisal.

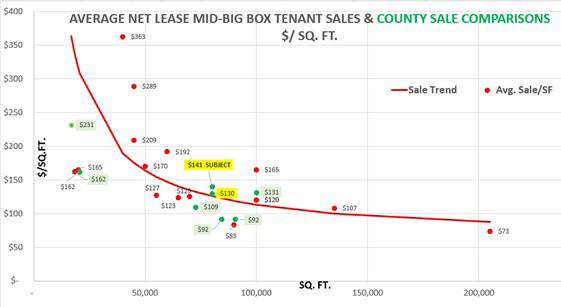

When you overlay the sales used by the County on the applicable portion (Mid-Big Box) of this Single Tenant Net Lease graph it is readily apparent that the sales are more consistent. More importantly it clearly demonstrates that the subject and the comparisons used are part of and consistent with this market. This universe of sales ranges from $73 to $363 per square foot or 497% variation. The average deviation (consistency) from the trend line is 27% for this sample.

The other benefit of this market is that you have income data to support and verify value. In other words, you can use the income approach to value. The Minnesota Court in this and other cases has repeatedly rejected the use of leased property comparisons, because the Court requires an adjustment to a vacant sub-market that doesn’t exist.

The Big Picture

The graph below details the difference between the occupied and dark markets. It also shows the trend-line where the 2016 assessed values lie in relation to the two markets.

I think it’s been established that the net lease market sets the bar as the relevant choice for market value, and the vacant/ dark submarket represents the bottom of the valuation spectrum.

The 2016 statewide assessment of property in this market stands at approximately fifty percent of market value, because of Court precedent favoring the latter market over the last ten to fifteen years. This has, for the of 2016 sample, resulted in a property tax shift of at least $100,000,000 to other taxpayers throughout the State. The potential for this in the coming years to reach over $160,000,000. The said estimate is conservative as it was confined only to property in the voluntary survey. A recent article in the Green Bay Gazette puts the number for Wisconsin at seven hundred million dollars ($700,000,000). The amount could be as much as fifty billion dollars ($50,000,000,000) in annual property tax shift nationwide.

The court precedent has now been maintained even in the face of subject sales to the contrary. Assessors have already lowered values to the fifty percent level. Now that the tax attorneys and their representatives have achieved the 50% level in Minnesota, they’re now going for the 20% level.

Shopko Case

In the current case the 50% level was defended, but only because the cost approach to value received emphasis by the Court. The cost approach favors newer property because there’s less depreciation. Had it been much older the outcome would have been very different.

It is wrong that any property be valued less than its market value for taxation, let alone a class of some of our most valuable properties being systematically valued at a fraction of their value for taxation. This is an intolerable inequity, because the remaining property classes throughout the County and State are valued at full market value.

The Court in this case didn’t acknowledge the arguments to value in rem or that subject sale was a relevant value indicator. A disappointment, but a clear indication that Minnesota is a dark store state. A Legislative solution must be pursued if change is to occur. EE

THE TOP 10

ten tips for office ergonomics

Jamie Freeman, SAMA Hubbard County Editorial Committee Member

10 Tips for Office Ergonomics

There is no doubt that COVID-19 has changed the way we work. As a number of workers are conducting all or a portion of their job from home, it is important to keep office ergonomics in mind.

So what is ergonomics? It is the science of designing a workstation to fit within the capabilities and limitations of the worker. The goal is to design your office workspace so that it fits you and allows for a comfortable working environment for maximum productivity and efficiency.

Here are ten quick and easy office ergonomics tips to decrease fatigue, discomfort and physical stress while also increasing comfort and safety.

10 Tips for Office Ergonomics, continued

Chair: Choose a chair that supports your spinal curves. You will want to adjust the height of your chair so that your feet rest flat on the floor or on a footrest and your thighs are parallel to the floor. Adjust armrests so your arms gently rest on them with your shoulders relaxed.

Desk: The height of your desk should be between 25 and 30 inches. Make sure there is clearance for your knees, thighs and feet under the desk. If the desk is too high and cannot be adjusted, raise your chair. Use a footrest to support your feet as needed. In addition, try not to store items under your desk.

Computer: Ideally, you should use a desktop computer. On their own, laptops and tablets do not allow you to separate the keyboard from the monitor, forcing you to look down at the screen. This will likely place excessive strain on your neck while working.

Monitor: Your monitor should be placed directly in front of you, about an arm’s length away. When looking at your monitor, the top third of the screen should be at eye level. The monitor should be directly behind your keyboard. It is also recommended to place your monitor so that the brightest light source is to the side.

Keyboard and mouse: Place your mouse within easy reach and on the same surface as your keyboard. While typing or using your mouse, keep your wrists straight, your upper arms close to your body and your hands at or slightly below the level of your elbows. Use keyboard shortcuts to reduce extended mouse use.

Key Objects: Keep key objects, such as your telephone, stapler or printed materials, close to your body to minimize reaching. Stand up to reach anything that cannot be comfortable reached while sitting.

Telephone: If your job requires you to frequently talk on the phone and type at the same time, place your phone on speaker or use a headset rather than cradling the phone between your head and neck.

Footrest: Your feet should not be dangling when you are seated. If your chair is too high for you to rest your feet flat on the floor, or the height of your desk requires you to raise the height of your chair, use a footrest.

Sitting vs. Standing: Should you sit or stand at your workspace? Research comparing standing and sitting while working at a computer is varied. Some studies indicate that standing may be better, while others show that sitting in the correct position is best. Most experts agree that the ability to spend some time sitting and some time standing while working is optimum.

Make time for exercise: One of the most important things you can do while working at a desk is to make time to exercise. There is a wide variety of exercises you can do while seated at your desk. Otherwise, simply taking a walk can help elevate your mood, and it may help decrease aches and pains that occur from working at your desk every day.