2 minute read

A Storm May be Coming

A Storm May be Coming –As a Lender are you prepared?

John Thomas Rybak, LizzBarringer Lagomarsino, Bill Tryon, Jimmy Kirkland, Brenna Durden, Jessica Crutchfield, and Kathryn Peacock

Introduction Part I of III

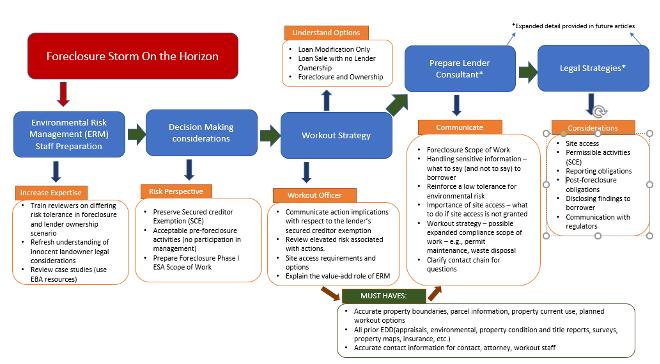

A team of Environmental Bankers Association (EBA) Members are collaborating on this three-part series of articles about foreclosure due diligence. In Part I, this article, we focus on things lenders can do to prepare for the challenges ahead. There are a variety of considerations for lenders including what types of due diligence to perform, how to avoid liability that comes with owning real estate, and what to do when Recognized Environmental Conditions (RECs) and other concerns have been identified on a property. Related future articles will include updates written from the vantage points of environmental legal counsel and consultants on common pitfalls and best practices and how to best advise lenders.

In Part II, our legal team will dig deeper into the various federal, state, and local environmental laws and programs that lenders need to be aware of, and strategies for identifying and avoiding liability. No foreclosure article would be complete without at least a cursory discussion of the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), which establishes strict, joint and several liability for owners and operators of contaminated sites. As we will cover in Part II, the Secured Creditor Exemption and Landowner Liability Protections can help to protect lenders from CERCLA liability, although liabilities resulting from the Resource Conservation and Recovery Act (RCRA), and the Clean Water Act (CWA) can also be significant. In addition, many states and local governments have separate statutes that may impose requirements and liabilities beyond the federal statutes and may impact the secured collateral. Careful assessment of the applicable federal, state, and local laws and regulations is an essential component of the foreclosure decision-making process.

In Part III, our consultant team will explore what to consider during foreclosure due diligence, as well as ways to mitigate risks identified in the due diligence process. When the foreclosure process begins and it becomes clear that a distressed asset may soon become a bank-owned asset, the due diligence process begins to look a bit different than during loan origination. Performing thorough due diligence at the pre-foreclosure stage is critical. In fact, the due diligence a lender completes at this stage should go above and beyond what was completed during the origination of the loan. Each lending institution should consider their baseline Phase I Scope of Work and include amended scope items case by case. Considerations may include, but are not limited to, compliance status, temporary closure of USTs, evaluation of asbestos, lead-based paint, radon and mold, maintenance issues, stormwater management, hazardous waste inventories, construction status safety issues and building issues.

You can look forward to further discussion on Part II and Part III in future EBA Journal submissions by this group. Now we will return our focus to Part I, preparing a lender for foreclosures.

Foreclosures, as a Lender are you prepared?

Preparing for the Storm

When a storm is on the horizon, it is important to prepare to minimize damage and batten down the metaphorical hatches. For nature-based storms the Red Cross advises to listen to the national weather forecasts, be prepared, check your disaster supplies, stronghold your house, turn up your refrigerator/freezer, charge your communication devices, make sure backup charging devices are 100% and stock up on non-perishable food and water. A similar process should be undertaken to prepare for business storms.