2 minute read

Financial Literacy and Life Skills

Preparing Students for a Lifetime of Financial Success

The Career and Technical Education (CTE) courses offered in the Enumclaw School District introduce students to a diverse range of high-demand and high-skill career pathways, as well as practical life skills in innovative learning environments. With a strong emphasis on applicable, real-world skills, CTE guides students toward the necessary preparation for their upcoming endeavors. By integrating and applying 21st-century skills, technical knowledge, and fundamental academic learning, the CTE program offers a way for students to be equipped for success before and after graduation. Participation in CTE courses is beneficial for every student.

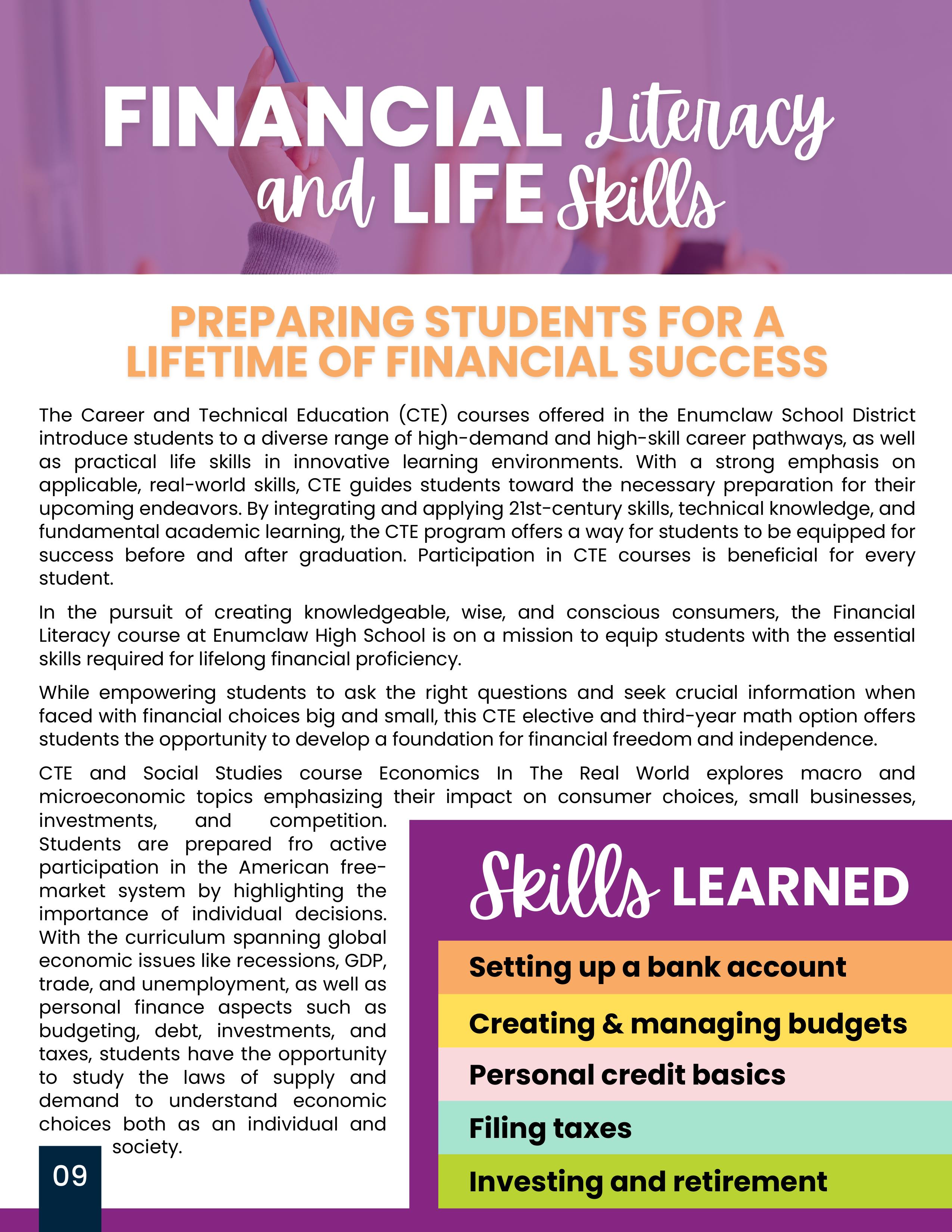

In the pursuit of creating knowledgeable, wise, and conscious consumers, the Financial Literacy course at Enumclaw High School is on a mission to equip students with the essential skills required for lifelong financial proficiency.

While empowering students to ask the right questions and seek crucial information when faced with financial choices big and small, this CTE elective and third-year math option offers students the opportunity to develop a foundation for financial freedom and independence.

CTE and Social Studies course Economics In The Real World explores macro and microeconomic topics emphasizing their impact on consumer choices, small businesses, investments, and competition. Students are prepared for active participation in the American free-market system by highlighting the importance of individual decisions. With the curriculum spanning global economic issues like recessions, GDP, trade, and unemployment, as well as personal finance aspects such as budgeting, debt, investments, and taxes, students have the opportunity to study the laws of supply and demand to understand economic choices both as an individual and society.

“... so much of this information begins to affect your life the day you graduate high school, yet if not educated on the matter you can make poor decisions without even knowing. A bad financial decision can take seconds to occur, but its impact can be felt many years down the road. In this class, we are learning to ask questions, seek alternative options, and fully understand the impact of our decisions. ” - Tyler Salsbury, EHS Financial Literacy Teacher