6 minute read

Agnew hybrid renewable microgrid completed. LESSONS LEARNED FROM GOLD FIELDS’ LANDMARK PROJECT

Gold Fields’ hybrid renewable microgrid at the Agnew gold mine in Western Australia’s northern goldfields was always meant to become a blueprint for the company. But it also holds lessons for its peers. When the A$112mn hybrid power plant was announced at the Energy and Mines Australia Summit in June 2019, it ticked a number of landmark boxes: largest renewables microgrid in the country; and the first mining energy project to integrate wind power. It took less than a year to commission the two stages of the 56 MW project — despite delivery challenges linked to Covid-19 and bushfires — and the mine is now powered by an average of 50 to 60% renewables.

The project, owned and operated by global energy producer EDL under a 10-year supply deal with Gold Fields, received A$13.5mn funding from the Australian Renewables Agency (ARENA), and first involved the construction of a 4 MW solar farm and a 21 MW gas/ diesel plant, which were completed in July 2019. Following the completion of Phase 2 — the integration of five wind turbines for 18 MW of generation and a 13MW/4MWh battery storage system — James Koerting, Energy Manager, at Australasia Gold Fields, shares lessons learned and the first operational results with Energy and Mines.

Advertisement

“The performance of the system at Agnew is meeting, and at times exceeding, our expectations, providing an immediate reduction in emissions from the supply of electricity to our operations. Since the commissioning of phase two (the wind turbines and battery storage system), our operating costs have come down, and we fully expect that once our initial capital investment has been amortized, we’ll see a further reduction, providing valuable long-term savings,” he explains.

Long-term storage for time-shifting

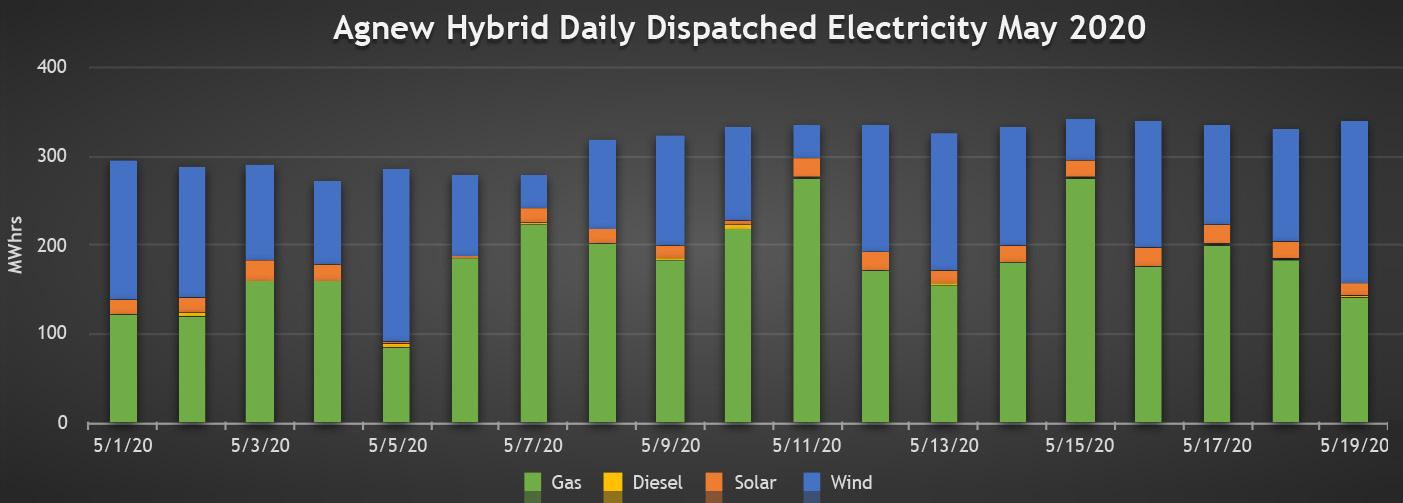

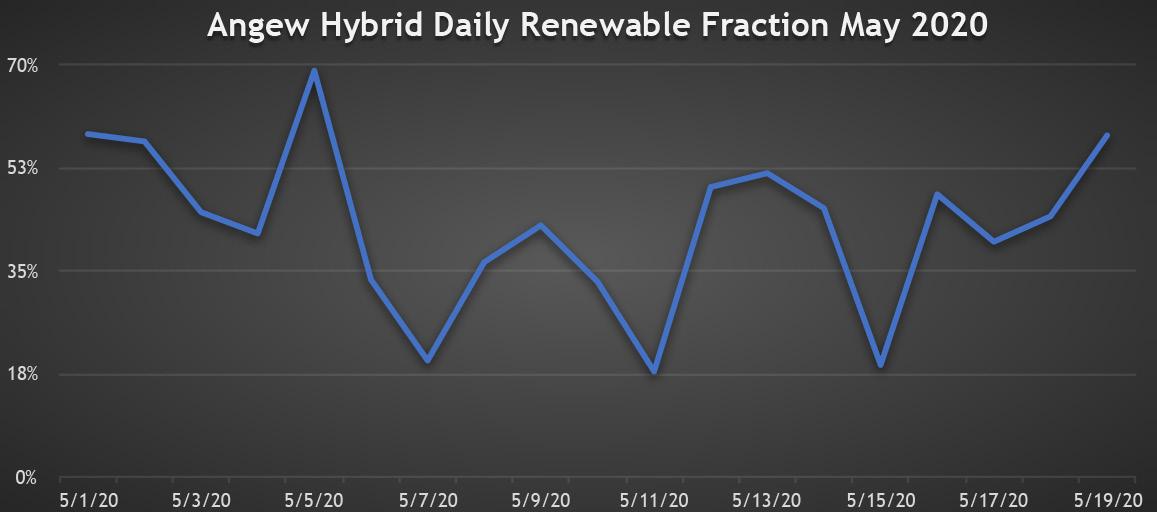

According to data shared by Gold Fields, in the first 19 days after project completion on 1 May 2020, the daily renewable fraction of the power system stood between a minimum of 18% and a maximum of 69%. This shows how high the renewable contribution can get in the right weather conditions, thanks to the addition of wind generation. “Complementing the daily solar resource, we get most of our wind during the night,” says Koerting. “The renewable contribution for the project will increase over the coming months as fine-tuning of the control systems improves”.

The next step to push generation even higher would be to integrate long-term storage technology for time-shifting. “If we had the ability to store the wind energy for use during the next day, we would be able to increase the microgrid’s overall renewable fraction,” he adds.

The addition of a long-term storage system would allow Gold Fields to limit the current curtailment of renewables, an inefficiency the company is eager to resolve. “The mine demand and system inertia requirements limit how much of the renewable energy we can use: the higher the renewable penetration in a microgrid, the higher the likelihood of curtailment. This is a commercial inefficiency that we believe will be most probably overcome with an innovative form of long-term storage that will enable us to time-shift excess renewable production,” says Koerting.

Long-term storage technologies such as flow batteries or hydrogen are not considered cost-effective yet, but are widely expected to become more competitive in time, and Gold Fields is keeping a close eye on developments in this area.

Balancing security and flexibility

One of the conclusions from the Agnew project is that where possible, the gas supply and system inertia needs to be designed to allow for renewables to take over at times of high generation. Koerting explains that the mine’s gas generator station cannot easily be shut down, forcing the system to continuously integrate some amount of gas, even when renewables are available ability to store to give full coverage.

“We know the microgrid has the potential for use during to deliver even more, once we overcome some of the technical constraints of the current system, particularly around the need to balance gas generator availability (for system security), with our desire to the microgrid’s run on 100% renewables when we can. It’s surmountable, and provides great learnings for future projects around system design,” he adds.

According to the data gathered in the month of May at Agnew, daily gas generation was never lower than 85 MWh, about a third of the overall power dispatched at the mine.

Next steps for Gold Fields

Now that the company has successfully completed its landmark gas/ wind/solar hybrid, it is ready to apply the lessons learned to other projects. Koerting reveals that Gold Fields has approved a mandate to start a renewable energy project at its South Deep mine in South Africa this year, and will be seeking regulatory approval in the short term.

He points out that the operational results from Agnew will help the team tweak its design and implementation at other sites. ”Agnew is seen as a blueprint, we’ve already had one workshop with our global energy group to present the project, and we’re now looking at ways in which we can use the data and learnings from Agnew to pursue opportunities at our other operations. We see further opportunities around gas supply (pipeline versus LNG), and optimizing the design of our battery storage. We’re also looking at thermal generator technology, and how this technology could better support the microgrid to push the renewables contribution even higher.”

JAMES KOERTING, Energy Manager, Australasia Gold Fields

Last year, the company also entered an agreement with Aggreko to integrate more than 20,000 solar panels and a 2 MW /1 MWh battery system with the existing 27.2 MW natural gas power plant at its Granny Smith mine, also in Western Australia. The project, which was commissioned earlier in 2020, is expected to reduce fuel consumption by 10-13% at the mine.

Advice for other miners

It is Koerting’s hope that other miners in Australia and around the world will be inspired by the success of the Agnew renewable microgrid. He believes that this type of project already makes financial sense for remote mines with a life of 10 years or more, and the learnings from Agnew will increase the sector’s confidence in the ability of the technology to deliver energy security as well as reduced carbon emissions and lower operating costs. However, he cautions that whilst the operational cost reductions can be compelling, these projects need to be carefully analysed:

“There is a lot that can be learned from the investment Gold Fields has made at Agnew and I think that we are likely to see further investments made in this space, particularly for longer-life mines,” he says. “The more capital invested in renewables, the lower your operating cost, but this needs to be balanced against the anticipated life of mine and the potential to on-sell renewable energy in the event of mine closure.”

At the time of writing, no other mine in Australia has integrated wind into a renewable hybrid, which is surprising considering the wealth of this resource in the country. But this is bound to change: first, the drop in costs is set to make more and more wind projects financially viable — ARENA expects new wind farms to deliver electricity at around A$50-65/MWh in 2020 and below $50/MWh in 2030. Additionally, landmark projects such as Agnew are playing a significant role in proving the efficiency of wind generation for mines, and getting the industry more comfortable with this type of energy generation.