4 minute read

Market data

Martyn Reed, Managing Director

Here at Elmhurst we collect and analyse data from many sources in the belief that it helps us make better business decisions. Turning this data into a digestible form takes time and requires a detailed understanding of context.

Advertisement

In each edition of Energy Matters we will provide you with a snapshot of this data, with a brief commentary, which we hope you find of interest, and maybe help you prepare for the future.

COVID-19 has obviously had a major impact on the construction, housing and energy assessment markets which is reflected in each of the charts. Some of the data related to new build homes within the devolved authorities has not been updated since March 2020 and estimates have been used.

Existing Dwellings

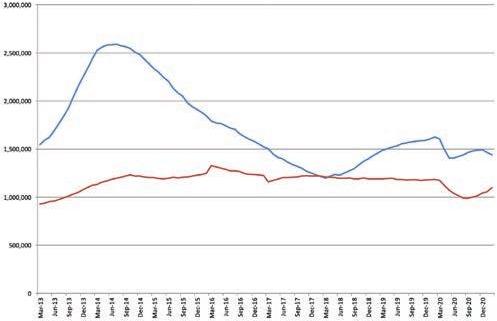

Volume of EPC lodgements and residential house sales on a rolling 12 month basis (by quarter).

n Volume of EPC lodgements on a 12 month rolling basis n Volume of Residential housesales on a 12 month rolling basis

Commentary

House sales spiked in March 2016 on the back of changes to stamp duty and then quickly fell back to a run rate of under 1.16 million. Until March 2020 the volume had been relatively constant and then the market feel away in March, recovered by July and has continued to grow ever since, probably helped by the short term reduction in stamp duty/LBTT.

The volume of EPCs peaked in the 12 months to May 2014, driven in a large part by ECO. This fell back sharply to a low of 1.2 Million in March 2018. Two years of recovery peaked again in February 2020 with year on year growth of 11%, largely due to minimum energy efficiency standards in the private rental sector. In March and April 2020 the volume dropped drastically, it then tracked the residential sales market until Christmas and then fell away quickly again as stamp duty cliff edge approached, and perhaps an incorrect public perception that “lockdown 3” meant the housing market was closed.

Outlook

With the stamp duty discount being extended into the summer (England and Wales) the market is likely to remain buoyant. As lockdown restrictions are eased other reasons to do an EPC, such as those for social housing, will boost the demand further. Government initiatives, such as MEES and parts of the Green Homes Grant, should also keep demand high.

New Build / On Construction

Volume of residential house starts and completions on a rolling 12 month basis (by quarter)

n Volume of residential house starts on a rolling 12 month basis n Volume of residential house completion on a rolling 12 month basis

n Volume of on-construction (new build residential) EPCs in the

UK issued on a rolling 12 month basis n Volume of Commercial property EPCs in the UK on a rolling 12 month basis n Non residential (commercial) property sales in the UK on a 12 month rolling basis

Recent data for Scotland and Wales is estimated since April 2020.

Volume of On Construction (new build residential) EPCs in the UK issued on a rolling 12 month basis

Commentary

House completions peaked at 214,000 in December 2019 but have been significantly impacted by Covid-19.

Starting before COVID-19, house starts have fallen back dramatically from their 204,000 peak in December 2018 to a six year low of 153,000 in September 2020. Fortunately since then starts have enjoyed a quarter of growth and now stand at 159,000.

The volume of EPCs in the last twelve months fell to 246,000 from its peak of 300,000, but the market has now flattened. Outlook

It is worrying that house starts are so far behind completions suggesting that we running at nearly half the government target of 300,000 per annum.

With completions now significantly ahead of starts “work in progress” will continue to fall and this is bound to impact completions in the medium term.

Non-Domestic / Commercial buildings

Non-residential (commercial) property sales in the UK on a 12 month rolling basis

Volume of Commercial property EPCs in the UK on a rolling 12 month basis.

Commentary

A sorry set of graphs. Commercial property transactions have continued to fall since October 2017 and are now at just 97,000, 25% down in the last year. The impact on EPCs has been similarly dramatic and, despite the recent very small uplift in sales, the volume of EPCs continues to fall and is now also down 25% year on year. Outlook

With great uncertainty in the business community it is difficult to imagine that there will be any major improvements in the commercial property sector. The impact of COVID-19 on the retail and office sectors may reduce demand for such properties but as an EPC is required whenever there is change of owner or change in tenant this may be some small piece of good news for Energy Assessors.

For further information about the services that Elmhurst Energy provides please visit: www.elmhurstenergy.co.uk