6 minute read

Real Estate

Sarkisov & Roesch PLLC

602.428.5004 www.srlawpllc.com

Your Neighborhood Law Firm

• Work Related Injuries • Construction Site Injuries • Personal Injury Claims • Motorcycle and Auto Accidents • Wills and Trusts

Sarkisov & Roesch PLLC

Real Estate

Homeowners’ Net Worth 40 Times Greater Than Renters’

By John Cabezas with LIV AZ Realty

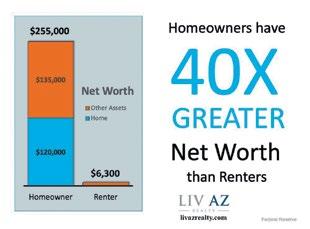

One of the most effective and best ways to build your family’s financial future is through real estate, primarily home ownership. In a recent study conducted by the Federal Reserve, it was found that the net worth of a homeowner is actually over 40 times greater than that of a renter. For the last seven years, studies have shown that home ownership is the single best way for the average American to create long-term wealth. Through a mortgage, every time you make a payment, you are adding to your equity. The longer you have your mortgage, the greater the amount of the payment that increases your equity.

Mortgage loans are amortized. This means that the first few years of your loan the majority of your payment goes toward paying the interest. The longer you have the loan the greater part of the payment that goes toward the principle.

Not only has real estate ownership outpaced the stock market, but also the risk of loss is almost zero. The only time you will lose financially with homeownership is if you sell during a downturn, but real estate always recovers and exceeds the previous mark.

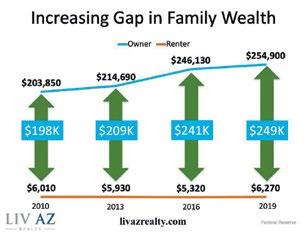

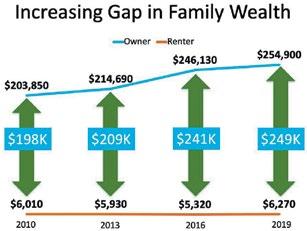

The Survey of Consumer Finances, a survey conducted every three years, clearly shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow. During the same time, the net worth of renters tends to hold fairly steady and is significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable.

Owning a home is the best way for the average American family to build wealth.

Statistically speaking, homeownership serves as a form of ‘forced savings’ for the average American family. It is no secret that most Americans have difficulty creating savings. Whether it is the economy, income, or lack of willpower, most Americans have very little savings.

Gallup reports that the impact of home equity is why Americans have picked real estate as the best long-term investment for the seventh year in a row. This year’s survey showed that 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today’s real estate market is a great opportunity for those planning to buy a home. The housing market, especially in Arizona, has made a full recovery. Add to that historically low interest rates, and you have the perfect market conditions for homeownership.

If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

To learn how you can use homeownership to build your family’s net worth, contact us today at LIV AZ Realty. We will guide you through the home buying process and put you on your way to longterm financial health. You can reach us at livrealty. com or by phone at 480-399-7051 or 602-3000797.

Solar Must Be Installed by Dec 31st or Miss Out on 26% Tax Credit

Arizona Home Owners have until December 31, 2020 to have a solar system installed and be “Operational” to qualify for the Federal Investment Tax Credit (ITC). If the system is installed after that date the tax credit will drop to 22% in 2021 and 0% in 2022.

Is there still time for a solar project to be initiated and completed before the end of the year? According to Val Berechet, President of SunSolar Solutions, a local solar company with over 6500 customers in Arizona, it only takes one or two days to complete a solar installation. The issue is, it can take anywhere from 60 to 90 days from the point of getting a proposal to having the permit from the city and approvals from APS. So it is getting close to the point where that will become impossible to accomplish. To remove the uncertainty for their customers SunSolar Solutions will guarantee customers an installation in 2020 if they call for a proposal through October 2020.

In addition to the Federal ITC, the State of Arizona will issue a $1000 tax credit that can be applied to 2020 state taxes.

According to Solar Energy Industry Association (SEIA): If a homeowner buys the solar energy system outright (either paying cash or fi nancing with a loan), they cannot use any commence construction safe harbor provisions. To receive the full 26% residential solar tax credit, the system must be “placed in service” before the end of the day December 31, 2020. It is not enough to have signed a contract, or to have made a down payment or even to have begun construction. There is no bright-line test from the IRS on what constitutes “placed in service,” but the IRS has equated this with “completed installation” in a Private Letter Ruling. The residential credit is claimed on the tax return for the year in which the qualifying expenditures are incurred, and the tax rules say the costs are incurred when the system installation has been completed. The 25D tax credit will step down to 26% in 2020, 22% in 2021, and 0% starting in 2022.

If a homeowner buys a newly built home with solar and owns the system outright, the year that they move into the house sets their credit eligibility. Expenditures are generally treated as incurred when the original installation of the solar energy system is completed on an existing home. However, if a new solar energy system is purchased in connection with the new construction of a home, the costs are treated as incurred when the taxpayer begins living in the home.

QUICK FACTS

The ITC is a 26 percent tax credit for solar systems on residential (under Section 25D) and commercial (under Section 48) properties. The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

The residential and commercial solar ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006, with an average annual growth of 50% over the last decade alone.

Congress passed a multi-year extension of the ITC in 2015.

A tax credit is a dollar-fordollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Both the residential and commercial ITC are equal to 26 percent of the basis that is invested in eligible solar property.

If you would like to receive a free proposal customized to your home’s roof and APS usage call Michael O’Donnell, VP of Sales at SunSolar Solutions at 602818-1355. Act now to ensure the installation in 2020 and receive the full 26% Federal ITC and the $1000 Arizona Tax Credit on this years taxes.

GO SOLAR

URGENT! LAST CHANCE AT 26% SOLAR TAX CREDIT!

Valid for new customers only. Not valid with any other offer. Call for details.

623-562-9004 9059 W Lake Pleasant Pkwy H800 Peoria AZ 85382 www.SunsolarSolutions.com Don’t Miss Out! Go Solar Today!

• $0 Down, No upfront cost • Save up to 90% off your electric bill • Protect against infl ation & energy costs increases from your Utility Company • Provide clean, reliable energy for your family powered by the sun