6 minute read

ON THE LAND

On the Land is proudly supported by

Advertisement

SUGARCANE FORUM SPOTLIGHTS OPPORTUNITIES FOR PRODUCERS

Daniel Shirkie

REPRESENTATIVES from AgForce and a panel of Sugarcane industry experts have met with local producers during a conference in Brandon to discuss what awaits in the sugarcane industry’s future.

AgForce’s Michael Kern was on hand as one of those who spoke about the challenges and opportunities that producers and industry leaders will face in the coming years.

“We were very happy with the turnout, this is the third of the forums we’ve run, we’d previously run them in Mackay and Ingham,” Mr Kern said.

“We got about 51 people last night in Brandon, so we’re very happy, obviously you always want more, but people are very busy at the moment planting and picking their other crops or taking a quick holiday before the season gets going proper.”

Mr Kern said it was imperative to keep a connection between local producers and the wider industry and that ongoing communication would be key for the industry’s future.

“We saw these forums as an opportunity to get people to come together and start those conversations,” Mr Kern said.

“It’s a really good opportunity for all those people to throw the ideas out there, discuss the challenges that are out there and learn about the opportunities.

“I’m hoping the take-away for everyone that was there is that we need to keep these conversations going.”

Mr Kern said that based on the Australian Sugar Milling Council’s recent estimates in

Representatives from Horan and Bird were on hand to discuss alternate energy plans

Local producers met with industry representatives at the forum in Brandon

2017, the total contribution by the industry to the Burdekin region is in the ballpark of $429 million.

“That represents 52% of gross regional product, it’s about 202,000 odd jobs, which is about 31% of the total employment from that year,” Mr Kern said.

“This industry makes a huge contribution to the local economy and to agriculture in general.”

Along with traditional uses for sugarcane, the forum also explored the viability of using other, alternative purposes such as hydrogen, ethanol, electricity production and other uses.

“There’s so much to be gained from working together and trying to lift the industry’s productivity and profitability, if we can do that, everyone’s a winner.”

QSL introduces improved payment process

QSL is introducing an improved payment process for their Burdekin growers from 1 July 2021, incorporating: • New, easy-read statements • Simplified GST arrangements • New payment features on the QSL App The improvements reflect grower feedback and include redesigned statements delivering new features, such as a new Tax Summary section which provides the key QSL figures required for bookwork in one, easy-to-find spot.

Payment paperwork has been streamlined and growers also be able to access key payment information and notifications via the QSL App.

GST arrangements have also been simplified, with QSL applying GST to QSL transactions and issuing an RCTI/Tax Invoice for payments made from 1 July 2021. This will enable growers to enter their QSL sugar income, expenses and GST information into their bookwork just like any other RCTI, and distribute their GST more evenly through the year.

WHEN THE CHANGES APPLY

Existing statement and GST arrangements will continue to apply to all payments made in the current financial year. The change to the new statement format will align with the GST change on 1 July 2021, making it easy for growers to identify when the new GST arrangements come into effect and which payments it applies to. From 1 July 2021: 1. QSL will apply 10% GST to its sugar payments in

Wilmar milling districts 2. QSL will issue RCTI/Tax

Invoices featuring a Tax

Summary section noting expenses, revenue and GST 3. Th ese amounts can be treated just like any other RCTI – simplifying bookwork Note: QSL Growers will still need to record the income, expenses and applicable GST from their Wilmar RCTI and tax invoice.

CONNECT NOW:

For further information contact your local QSL office or head along to the next local QSL Information Session, to be held at the Burdekin PYCY at 11.30am this Friday.

QSL Market Update current as of 26 May 2021

Sugar

• Macroeconomic weakness and small trading volumes caused the ICE 11 raw sugar market to drift slightly lower last week. The prompt Jul21 contract traded as high as 17.36 USc/lb and closed the week lower at 16.67 USc/lb. • As expected, ethanol parity has slightly fallen across the week as new crop ethanol increases the supply. However, the parity still firmly supports the market with the latest estimates sitting at approximately 16.09 USc/lb ICE 11 equivalent. • The government of India spontaneously announced a reduction of their export subsidy for the current season from IND (Indian rupee) 6000 down to IND 4000 per metric tonne (mt) - a reduction of about USD $27/mt.

The revision appears to be symbolic only as the majority of the 6 million metric tonne quota has already been exported with only 300k mt remaining, however it could be an indication for next year’s export policy. • The Commitment of Traders report confirmed speculators liquidated a portion of their position as of 18 May 2021. They are reported to now be holding a 233,000 lot net long position (down from 259,000 the previous week).

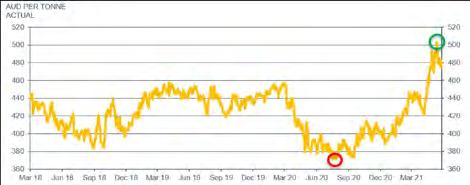

2021-SEASON HISTORICAL ICE 11 CHART

This is a whole-of-season ICE 11 price chart for the 2021 Season, based on the current 1:2:2:1 pricing ratio applicable to QSL Target Price Contract growers. Source: Bloomberg

Currency

• It was a relatively quiet week for foreign exchange markets as the Australian dollar traded in a small range between its high of 78.13 US cents on Tuesday and its low of 77.11 US cents on Wednesday. • Without any important data this week, markets remain directionless as they attempt to digest the importance of the previous week’s inflation reports. Risk sentiment (see our Jargon Buster) appeared to rebound slightly in the latter half of the week as investors decided the US Federal

Reserve are still a long way off taking action and moving interest rates. • Cryptocurrencies made headlines throughout the week as Elon Musk reported Tesla would not be using bitcoin as a payment method and the Chinese government announced the banking and payment industry were not to conduct business through cryptocurrencies. The highly unpredictable asset class was even more volatile than usual, moving up to 30% in a day. Investors are yet to form a collective opinion on how cryptocurrencies will affect other global markets.

To read our full commentary in the QSL Market Update, please visit www.qsl.com.au or contact the Burdekin QSL team: Russell Campbell, Grower Relationship Manager 0408 248 385 Kristen Paterson, Grower Relationship Officer 0438 470 235 Rebecca Love, Grower Relationship Officer 0429 054 330

This report contains information of a general or summary nature. While all care is taken in the preparation of this report, the reliability, accuracy or completeness of the information provided in the document is not guaranteed. The update on marketing and pricing activity does not constitute financial, investment advice. You should seek your own financial advice. Nothing contained in this report should be relied upon as a representation as to future matters. Information about past performance is not an indication of future performance. QSL does not accept any responsibility to any person for the decisions and actions taken by that person with respect to any of the information contained in this report.