12 minute read

ON THE LAND

WILMAR’S PROSERPINE MILL OPENS NEW STORE BUILDING

Wilmar Sugar

Advertisement

PROSERPINE Mill’s new store building is officially open for business.

Construction of the $2.8 million building was finalised in May, with Wilmar Sugar employees moving into their new offices last week.

The two-storey, prefab structure replaces the store and offices destroyed by fire in January 2020.

Wilmar Sugar General Manager Purchasing, Procurement and Supply Rohan Whitmee said the building was constructed in a new location on site to improve vehicle access and traffic management.

He said the purpose-built store featured a number of design improvements on its predecessor.

“It has a substantial increase in racking and shelving in the main storage area and has a climatecontrolled storage space,” Mr Whitmee said.

In addition to the store,

Weekly production figures

Burdekin region mills Week 3, ending 26 June 2021

Cane crushed This week Season to date Invicta 148,626 377,451 Pioneer 78,089 190,548

Kalamia

69,194 177,863 Inkerman 54,098 129,609

Burdekin 350,006 875,472

CCS

Invicta Pioneer 13.52 13.80 13.28 13.36

Kalamia 13.21

13.00 Inkerman 13.05 12.74

Burdekin 13.45 13.16

the new building houses the site’s first aid room, a training room, some offices, and amenities, including an ambulant toilet.

Mr Whitmee said that after more than a year working out of temporary store facilities, both on and off site, the store team was pleased to be back in a permanent home.

“The site was without a permanent store for the best part of two maintenance seasons and one whole crushing season,” he said.

“Despite the many challenges that presented, everyone on site worked well together to ensure there was no significant impact on operations.

“It’s a credit to the whole Proserpine team.”

A site barbecue was held on Thursday, 17 June to officially open the new building and to enable employees to check out the new facilities.

Proserpine Mill will start the 2021 crushing season on Tuesday (29 June).

Weekly variety performance for region

Variety % CCS Variety % CCS

Q240 40 13.72 Q208 5 12.46

KQ228 37 13.26

Q183 12 13.50

Q232 5 13.25

Comments:

Throughput for the Burdekin mills in week three was just over 350,000 tonnes. This was above budget even though wet weather again had an impact on cane supply.

Inkerman Mill had a mixed week, recording both good crush rates and extended stops. Wet weather from the previous week meant crushing did not resume until Sunday night (20 June). There was a 24-hour stop due to bagasse system issues, and more rain mid-week added to the already wet ground conditions.

The north bank mills experienced some cane supply shortfalls from the rain on Wednesday evening but much lower totals meant growers were able to burn and harvesters were able to get back into paddocks sooner.

Harvesting operators across the district are to be commended for keeping mud levels in the cane supply low, despite the wet conditions.

Average weekly CCS was 13.45. This was above budget and a good outcome given the wet conditions experienced across the region in the middle of the week.

The highest CCS sample was 16.3 from a rake of Q240 Plant cane in the Invicta Mill area.

John Tait Cane Supply Manager Burdekin Region

KAP: CROC POPULATION REPORT NOT A STATE SECRET

Katter Australia Party

THE Palaszczuk Labor Government is feeding North Queenslanders a load of croc as it continually refuses to reveal the findings of a detailed crocodile population survey that concluded in 2019.

In 2016 then-Environment Minister Steven Miles committed $5.8 million to a three-year crocodile management program that would include a “comprehensive crocodile population survey”.

At the time, the Minister said the survey was urgently needed to ascertain whether crocodile numbers were increasing in Queensland.

The funding immediately provided three additional FTE staff to deliver that program, rising to five staff in 2017/2018.

The report was touted at the time as “the most comprehensive crocodile population survey ever in Queensland”, with data promised to be compared to figures going back as far as 1979.

Despite being completed around two years ago, the report has not seen the light of day to date.

Katter’s Australia Party Leader and Traeger MP Robbie Katter said he suspected the report was being kept under lock and key.

He said it was undeniable encounters between humans and deadly estuarine saltwater crocodiles were increasing at astronomical rates in North Queensland.

This includes one fatal and two serious attacks in the region earlier this year and reports of the predators moving into private properties in residential areas such as Tully Heads.

“More people will die in North Queensland from crocodile attacks if the Government’s approach to this issue does not change radically,” Mr Katter said.

“Saltwater crocodiles and human communities do not mix.

“I find it mind-boggling that not wanting your pets, friends and family members eaten by crocs is considered radical these days.”

KAP Hinchinbrook MP Nick Dametto said the State Government was likely stalling on releasing the report as it would reveal uncomfortable truths.

“I am of the opinion that once the truth comes out, Brisbane will have to accept that crocodiles may no longer be a threatened species,” he said.

“For so long, the Government have relied on the conservation narrative as an excuse to failing to act – this report could be the end of that, and they need to come clean on the real numbers.”

Queensland Government representatives have previously acknowledged there has been a rapid increase in croc numbers in the North, supporting long-running anecdotal reports from locals who have been encountering the apex predators in places never seen before in their lifetimes.

Mr Katter said the KAP’s Safer Waterway Bill, which has failed to receive support from both major parties in the past, was designed to address the crocodile issues in the North.

Drafted and introduced twice into the parliament by KAP Hill MP Shane Knuth, this bill would seek to centre Queensland’s crocodile management framework to Cairns.

Cairns-based staff would decide on the number of crocs - which posed a safety threat – that should be culled annually (or less often if not necessary) and Indigenous groups would be enabled to host crocodile-hunting tours and allow crocodile eggs to be harvested, as is done successfully in the Northern Territory.

On the Land is proudly supported by

LOOK OUT FOR LIMNOCHARIS

Department of Agriculture and Fisheries

NORTH Queensland residents are urged to report any sign of the exotic weed limnocharis, which has been found growing from north of Mossman down to the South East Queensland area. Biosecurity Queensland’s Engagement Officer Kim Badcock said limnocharis was a highly invasive aquatic plant from South America.

“It was first found here 20 years ago and we need to eradicate this serious pest before it becomes permanently established,” he said.

“Limnocharis rapidly takes over waterways. It grows densely along the water’s edge to about one metre in height with pale green oval shaped leaves at the end of long triangular stems, and yellow flowers about the size of a 50 cent piece.

“The spread of this plant is partly due to people cultivating it as a vegetable, but you must not grow, sell, or keep limnocharis or you risk being fined.

“It may look nice, but it’s an invader that chokes waterways and pushes out native species causing all sorts of environmental and agricultural problems.

“Keep an eye out for it in ornamental ponds, dams, creeks, swamps, drains, backyards and being sold online, and immediately report anything suspicious to Biosecurity Queensland on 13 25 23.”

CONNECT NOW:

For more information call 13 25 23 or visit www. biosecurity.qld.gov.au

Bravus strikes coal at Carmichael

Bravus Mining & Resources

BRAVUS has now struck coal and exposed the first of the coal seams at our Carmichael Project.

Bravus Mining and Resources CEO David Boshoff said it was an exciting day for the 2600+ people on the Project; a day that has been in the making for over a decade.

“Throughout the last two years of construction and during the many years when we fought to secure our approvals, our people have put their hearts and souls into this Project – it is wonderful that we have now struck coal,” he said.

“Nearly two years ago today we received our final approvals to develop the Carmichael Mine and Rail Project. We have faced many hurdles along the way, but thanks to the hard work and perseverance of our team, we have now reached the coal seams.

Mr Boshoff said Bravus was on track to export first coal as promised, in 2021.

“We’re on track to export first coal this year, and despite reaching this significant milestone, we will not take our eyes off our larger goal of getting coal to market,” he said.

India will be a foundation customer for the Carmichael Mine and is the fourth largest global user of electricity as well as the source of the biggest growth in global energy demand.

Mr Boshoff said Bravus had already secured the market for the 10 million tonne per

Bravus personnel at the Carmichael site

annum of coal produced at the Carmichael Mine.

“The coal will be sold at index pricing and we will not be engaging in transfer pricing practices, which means that all of our taxes and royalties will be paid here in Australia. India gets the energy they need and Australia gets the jobs and economic benefits in the process,” he said.

Carmichael coal will contribute to Adani Group’s burgeoning energy portfolio that is designed to create a sustainable energy mix, incorporating, thermal power, solar power, wind power and gas.

Mr Boshoff said, the Adani Group had secured its position as the world’s largest solar company, following last month’s announcement that Adani Green Energy Ltd (AGEL) has acquired SB Energy Holdings Ltd, which will see AGEL achieve a total renewable energy capacity of 24.3GW.

“The 24.3 GW would be enough energy to power more than 8.5 million homes, or nearly all the households in Australia (*9.2 million) each year.

“Adani’s solar farm at Rugby Run in central Queensland is part of this portfolio, with a total capacity of 65 MW going into the regional Queensland grid, equivalent to powering about 27,500 homes each year.

“As a global company we are walking the talk when it comes to delivering a sustainable energy mix,” Mr Boshoff said.

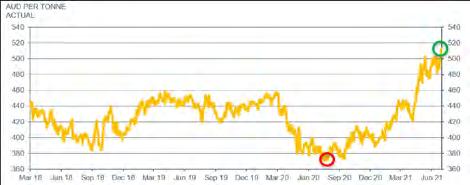

QSL Market Update

current as of 30 June 2021

Sugar

• After a choppy start to the week, raw sugar prices rallied following a bearish UNICA (Brazilian Sugar Industry

Association) report, closing the week up 2.9%. The Jul21

ICE 11 contract reached its high of 17.26 USc/lb on the

Friday and its low of 16.19 USc/lb on the Monday. • The latest UNICA report revealed multiple delays to Brazil’s harvest due to rain for the first half of June. Production numbers reported 35,959 tonnes of cane and 2192 tonnes of sugar were produced for the fortnight compared to 41,812 tonnes of cane and 2560 tonnes of sugar in the same period last year. This represents an approximate 14% reduction. The percentage of the cane crop used for sugar production is at 46.12% and the Total Recoverable Sugar (ATR) remains high, compensating for a portion of the crop reduction. • The latest Commitment of Traders data reported a sharper than expected liquidation of the net-long position as of 22 June. The net speculator position was down 35,000 lots to 185,000 lots net long. • The Brazilian currency made some gains last week and is now at 4.93 Reais against the US Dollar. Despite the efforts of the Central Bank of Brazil to keep the Real strong, there may be some periods of instability due to current investigations into the Brazilian government’s handling of the coronavirus pandemic.

2021-SEASON HISTORICAL ICE 11 CHART

This is a whole-of-season ICE 11 price chart for the 2021 Season, based on the current 1:2:2:1 pricing ratio applicable to QSL Target Price Contract growers. Source: Bloomberg

Currency

• The Australian Dollar (AUD) and equities markets are still to recover from last week’s Federal Open Market

Committee (FOMC) speech (see our Jargon Buster). Last week the AUD traded from its a low of 74.78 US cents on the Monday to peak on Friday at 76.17 US cents.

However, it has failed to hold above the 76 US cent level on a live basis. • The hawkish tone of the FOMC meeting continued to echo through markets for the week, with Federal Bank of

Dallas President Robert Kaplan telling media inflation was higher as a result of the US economy pushing into a much better position. Kaplan also said he was in favour of ‘taking the foot off the accelerator sooner rather than later’. • In the United States, President Joe Biden continues to invest in stimulus packages after announcing an agreement with a group of bipartisan Senators on a $1 trillion infrastructure package. The deal includes approximately $440 billion of funds saved from previous packages, and is scheduled to take place over 8 years. The news boosted both the S&P 500 (see our Bonus Jargon

Buster) and the NASDAQ to new record closing highs.

To read our full commentary in the QSL Market Update, please visit www.qsl.com.au or contact the Burdekin QSL team: Russell Campbell, Grower Relationship Manager 0408 248 385 Kristen Paterson, Grower Relationship Officer 0438 470 235 Rebecca Love, Grower Relationship Officer 0429 054 330

This report contains information of a general or summary nature. While all care is taken in the preparation of this report, the reliability, accuracy or completeness of the information provided in the document is not guaranteed. The update on marketing and pricing activity does not constitute financial, investment advice. You should seek your own financial advice. Nothing contained in this report should be relied upon as a representation as to future matters. Information about past performance is not an indication of future performance. QSL does not accept any responsibility to any person for the decisions and actions taken by that person with respect to any of the information contained in this report.