STOREFRONT INVENTORY

DOWNTOWNAUSTIN

FALL2025REPORT

FALL2025REPORT

Downtown Austin’s storefront landscape remains one of the city’s strongest indicators of its vitality, creativity and economic resilience. The Fall 2025 Storefront Inventory reveals a dynamic mix of more than 740 active businesses, illustrating the downtown district’s thriving 18-hour environment that supports residents, workers, and visitors alike

Downtown’s cultural identity is reinforced by its 39 arts and cultural venues, ranging from world-class performance spaces to emerging comedy clubs. Together, these institutions sustain downtown’s role as Austin’s cultural epicenter

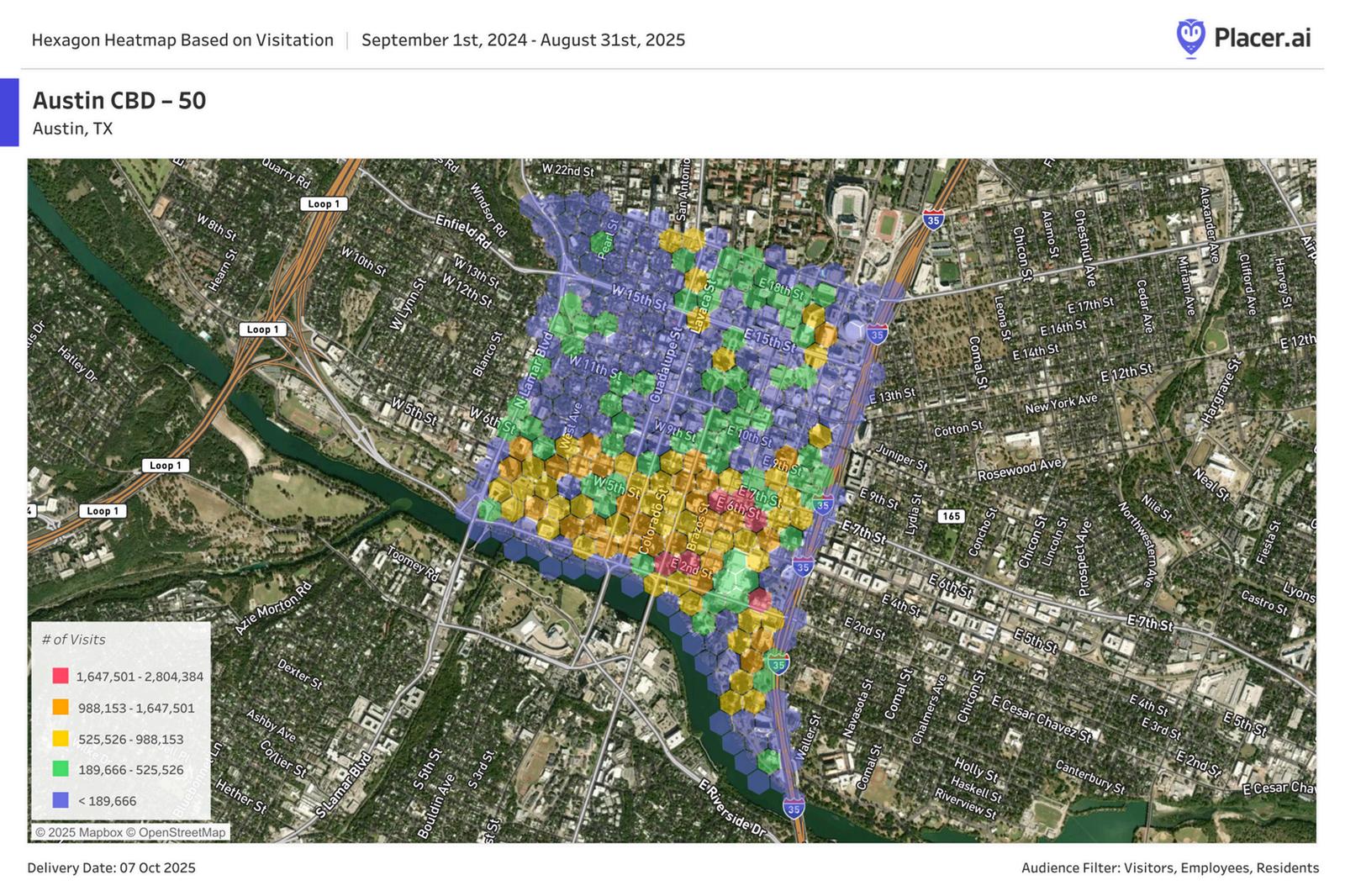

Foot traffic downtown has rebounded to 92% of pre-pandemic levels, driven by consistent weekday activity, robust visitor demand and the return of large-scale festivals. Average daily visits now exceed 160,000 people, underscoring downtown’s continued draw for both locals and visitors.

Demographically, downtown attracts a highly educated, high-income population of residents and workers, alongside visitors from across Texas and major U.S. metros. As housing and employment density rise, the retail mix is shifting to support a more balanced and sustainable urban core.

Looking ahead, the Downtown Austin Alliance is committed to cultivating a vibrant and inclusive retail ecosystem Strategic opportunities exist to expand essential goods and services, foster artistic and cultural experiences, and activate underutilized spaces through initiatives such as the Downtown Austin Space Activation (DASA) program. New economic development tools are also being created to improve storefront facades, interiors, dining and reduce construction impacts.

Downtown Austin’s storefronts not only reflect the city’s distinctive character, they shape its future as a place where commerce, culture and community converge

n is widely s vibrant nightlife inary scene, s from around residential workforce nd, traditional offering services have grown ncreasing owntown ue 18-hour has seen notable goods stores, ique clothing d continued ysical fitness e core

Year-to-date data from third-party provider Datafy indicates that the number of residents, employees, and visitors in Downtown Austin has decreased 25 12% compared to the previous year. Despite this decline, the Dining and Nightlife sector remains the strongest performer, accounting for more than 20% of all downtown spending. Notably, the top spending day of 2025 was Saturday, October 18, the day of the No Kings protest As the holiday season approaches, retailers are hopeful for stronger foot traffic and a boost in consumer spending

Downtown is home to 39 arts and cultural storefront venues and offers a rich array of cultural experiences Performance venues, including the Paramount Theatre and Austin City Limits Live, along with museums and cultural heritage centers, highlight the city’s diverse population and history. Austin’s comedy scene has also surged in recent years, and downtown has benefitted greatly, now hosting six comedy venues that draw both residents and visitors

Boutique clothing and footwear stores form the cornerstone of the Retail Goods sector downtown, with the 2nd Street District serving as a strong example of urban retail revival and walkable shopping. While downtown offers numerous grab-and-go grocery and convenience options, only two traditional grocery stores operate in the area, signaling an opportunity for expanded grocery services for residents and employees Within Retail Services, printing, shipping and postal businesses remain the most concentrated Downtown also hosts five car rental agencies, with a new electricvehicle rental service recently entering the market

The health, fitness, and beauty sector remains strong downtown, representing approximately 11% of all storefronts Upscale barbershops and hair salons lead the category, making up nearly 28% of the Body, Health & Fitness sector, with a notable cluster located in the Seaholm District Given Austin’s reputation as a physically active city, it’s no surprise that specialty fitness studios are plentiful, whereas only a small share of storefronts cater to traditional gym formats As downtown’s population continues to grow, demand for fitness and medical services is expected to further increase, encouraging additional providers to establish a presence in the area.

Quick Eats, defined as fast, casual food options available throughout the day, make up 16% of all downtown storefronts These offerings range from traditional fast-food establishments like Chick-fil-A and P. Terry’s to casual sit-down spots such as Texas Chili Parlor and Lamberts Barbecue, where orders are placed with wait staff Quick Eats are distinct from traditional downtown restaurants, many of which operate primarily in the evening and often require reservations.

Home to seven Michelin Guide–recognized restaurants, including two Michelin Star establishments, downtown boasts 90 eateries that extend beyond the Quick Eats category. Contemporary Mexican cuisine is the most prevalent, with 18 restaurants offering modern takes on regional flavors Many downtown restaurants also embrace fusion concepts, blending culinary traditions and experimenting with innovative flavor combinations.

With 32 coffee and tea shops currently operating downtown, and three more expected to open by early 2026, coffee bars have a well-established and successful presence in the market Starbucks holds the largest share by location count, operating six sites ranging from standalone stores to hotel lobby kiosks. Local coffee shops, defined as operators without a national footprint, remain the most prevalent across downtown While most coffee shops offer tea selections, only two storefronts are dedicated exclusively to tea.

Following a robust post-COVID resurgence driven by pent-up demand in Q2 2022, alcohol sales downtown have gradually softened, declining 12% from their Q2 2022 peak Although downtown has experienced slight decreases, its sales trends continue to outperform the broader metro area, where generational shifts and an expanding range of beverage products have contributed to declines in mixed-beverage tax revenue over the past three years

offers an abundance of d entertainment ering to a wide range and activities bars make up the e of nightlife venues, st 6th Street corridor senting 17% of the total Upscale establishments ded significantly over cade, driven by growing r curated, high-end s, particularly benefiting nges and speakeasies remains a major s well, with dedicated ce venues continuing to ocals and visitors

Despite growth in the downtown employee, visitor, and resident populations, financial services firms have remained largely stagnant over the past five years. Downtown hosts 15 traditional banking institutions, representing a diverse mix of regional, national, and international firms Wells Fargo is the only bank operating more than one location, with two branches downtown. Credit unions and investment firms round out the sector, each maintaining four locations within the CBD

activity downtown ed to 94% of prelevels Visitor activity ng the spring and fall sons, anchored by nts such as South by and the Austin City ival Downtown’s d historic districts o draw strong foot icularly on weekend e return of collegiate he fall also boosts entertainment s fans seek out vibrant, ngs to enjoy the d surrounding

Tuesday, Wednesday and Thursday remain the most popular in-office workdays downtown The average weekday employee count has reached roughly 82% of Q3 2019 levels, reflecting a mix of inbound commuters and downtown residents who work locally Inbound commuter activity continues to rise year over year and has reached approximately 72% of Q3 2019 levels Meanwhile, the rapid growth of residents living and working downtown has been a key driver of weekday foot traffic. Overall, Downtown Austin continues to maintain its appeal, offering a range of activities and amenities that attract both talent and investment.

The center of downtown attracts the highest levels of foot traffic, driven by scenic views and the retail experiences along Congress Avenue. The area south of 7th Street sees the most activity, reflecting the concentration of new office and residential development over the past several years. Congress Avenue and the 2nd Street District consistently draw strong crowds, as these microdistricts contain the highest share of daytime retail East 6th Street remains the most visited entertainment area downtown, attracting robust weekend nightlife activity And with Rainey Street now recognized as the most densely populated neighborhood in Texas, its micro-market is expected to experience significant growth in the years ahead

Average Daily Visits

Downtown residents are predominantly young, highly educated professionals with substantial incomes, along with a growing number of emptynesters. Downtown employees continue to benefit from higher wages, while the abundance of amenities attracts an eclectic mix of single travelers and families Most visitors come not only from the Austin MSA but also from major Texas cities such as Houston, San Antonio, and Dallas–Fort Worth Out-of-state visitors arrive from across the country, with the largest shares coming from California, New York, Florida, and Illinois. While much of the downtown workforce lives within Travis County, rising housing costs continue to push employees to surrounding areas particularly Williamson and Hays counties, which together account for 18% of downtown workers.

While downtown retail has long been dominated by food and nightlife, there is a wide array of additional offerings that can be enjoyed and utilized by all.

As downtown’s population grows and as workers and visitors drive up daily activity, opportunities will continue to emerge for new storefronts that address everyday needs

Expanded medical clinics, services, and grocery options remain priorities to ensure residents, employees and visitors have access to essential goods and services and to support residential growth

Retail demand remains strong, especially for second-generation spaces that require less buildout than new construction.

As downtown’s retail landscape evolves, the Downtown Austin Alliance remains committed to helping new retailers, nonprofits, and artists establish a presence and create meaningful experiences for all.

If you have available space or are seeking a location downtown, consider partnering with the Downtown Alliance through the Downtown Austin Space Activation (DASA) program

Collaborate with us to market your business! Email communication@downtownaustin.com to get started.

We update our small businesses resources packet regularly: Visit https://downtownaustin com/what-we-do/research/businessresources/

Luke Goebel: Economic Development Manager lgoebel@downtownaustin.com

Jenell Moffett: Senior Vice President, Economic Development, Marketing & Strategic Communication jmoffett@downtownaustin.com