7 minute read

Luncheon Follow Up

August and October Luncheon follow-up

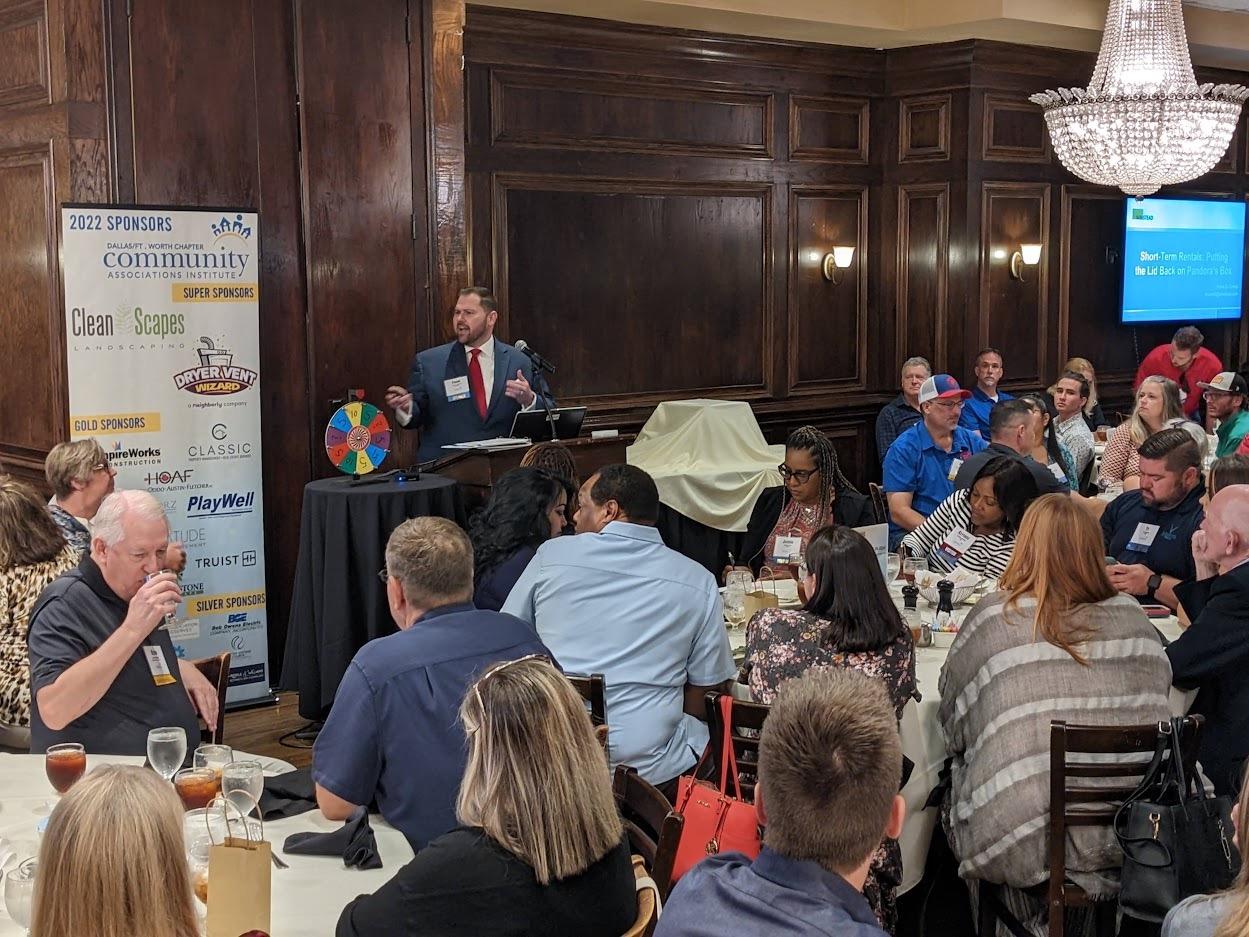

In August, we were joined by Frank Carroll, III, of Winstead, PC where he presented on the state of “ShortTerm Rentals.”

Frank Carroll is a business litigation attorney with Winstead, PC whose practice focuses on land use matters and real estate litigation. Frank is a board-certified civil trial advocate, and frequently represents developers, property owners’ associations, non-profit corporations, and individuals in lawsuits before federal and state courts involving office, retail, residential, and multi-family properties.

And in October, Garrison Wynn joined us with his presentation on “Influencing People You Have No Authority Over.” This enlightening, research-based session dove into the human condition, revealing that the true key to influence is not intelligence or logic, but an understanding of what people really value. Through a collaborative toolkit, this program delivered tips and strategies our attendees need to make people see the value of their ideas, so they’re well positioned to gain agreement.

With talents that established him as a Fortune 500 leader and professional stand-up comedian, Garrison Wynn, CSP, fuses comic timing and research to deliver motivational business expertise. For 26 years, he has given keynote presentations to clients (such as Bank of America, Amazon, Caterpillar, Walmart, Berkshire Hathaway, Intel, McDonalds, the NFL, and NASA) at corporate and association events. He is also an Amazon #1 bestselling author who has been featured in Forbes and Inc. Magazines.

Options for Determining Replacement Cost in Our Inflationary Environment

By: James L Shelby, CPCU, CIC | LaBarre/Oksnee Insurance

One of the duties of Community Association Boards is to procure insurance to protect the Community’s assets. Condominium Associations and Townhomes Associations may be responsible for insuring the buildings, including units, as well as other commonly owned property. The Association’s governing documents may state that the property must be insured for 100% of replacement cost. Owners’ mortgage companies are pushing more and more for confirmation that the property is insured for full replacement cost. While some HOAs and POAs may have little or no commonly owned property, many have walls and fencing, gates, guard houses signs, pools with cabanas or bathrooms, athletic courts, playgrounds, clubhouses, and amenity centers. Owners expect those amenities to be repaired or replaced if they are damaged or destroyed. Determining replacement cost can be challenging, but there are resources Boards can utilize.

An appraisal is the most accurate resource to determine replacement cost, as the appraiser inspects the property in person and provides a detailed report of his/ her findings. It can be difficult to find an appraiser who does replacement cost appraisals as opposed to market value appraisals, and they tend to be costly.

Another option would be a Reserve Study. While Reserve Study providers are not appraisers, they do have access to local construction cost indexes and can help a Board estimate the replacement cost for buildings and other property such as walls/ fences, pools, sports courts, etc. If an onsite study has not been done recently or has never been done, the time may be right to schedule a study.

If an Association is still under development or was recently built out, the developer/ contractor may be able to provide some insight into current reconstruction costs. This may not be a viable option if the Association has been built out for a while.

Cost estimator programs like Core Logic, formerly Marshall & Swift, can be useful in determining replacement cost for buildings. While the programs are not as accurate as an appraisal, they give a good estimate based on regional construction costs. Most agents and insurance companies can run these estimators for their Association insureds.

With inflation driving up construction costs, now is a good time for Community Associations to confirm their insurance limit is adequate for full replacement cost.

James L Shelby, CPCU, CIC | Regional Account Executive LaBarre/ Oksnee Insurance (657) 207-4915 | (214) 250-8648 cell | jamess@hoa-insurance.com | www.hoains.com

Budget Season

By Tracy Wolin, CMCA, AMS, PCAM

Wondering how you are going to create a budget in today’s world with inflation continuing an upward swing and then following the experts predicted recession? Many Associations are on a calendar fiscal year which means it is time to begin thinking about starting the budget.

Check your governing documents, especially if you are a new manager, for the budget procedures. Who approves the budget, when is the budget due, when does the budget need to be presented to the membership, etc.

Call a meeting with your president/treasurer to begin discussions on the upcoming budget. Will your Board entertain an increase in assessments? If not, what area can you possibly cut out of next year’s budget?

Consider forming a budget committee to assist you and to help “sell” the Board and membership on an increase. I suggest you keep this committee small limiting to three people. The more people sitting on this committee, the harder it will be for you to manage but if you can entice a few Owners to join, guide them through the process, and use them to help push the pro forma budget, you just may just create an awesome tool.

Being proactive, you will probably develop a pro forma budget as a starting point for the committee, president/treasurer to review, adding notes to explain your thinking including any trends you need to highlight.

First step is to create your spreadsheet with historical data by G/L code, perhaps the last two to three years. This will allow you to analyze each line item.

Second step, contact your contract vendors to inquire about any increases in their monthly, yearly fees. Look back at the vendor history to determine when the last increase was approved. If nothing else, you might be able to use this information to negotiate rates.

Utilities are typically a large expense. Have you considered utilizing an energy consultant? If you do not already have one, this might be a great source to ensure the association is receiving the best rates possible when it comes to utility fees. Most consultants do not charge if there are no savings and if moneys are realized, charge a small fee based off any savings for a period.

Salaries are a big-ticket category. Chances are you have a separate spreadsheet or perhaps there is a previous salary spreadsheet in the files you can use. If this is the case, each employee name is most likely a separate line item, and you can apply a few increase scenarios to evaluate what wage increases you are proposing. Don’t forget to add a line item(s) for any new staff members you might be pondering for next year.

Next step might be to think about your upcoming projects over the next few years. It never hurts to think strategically for today and the future. In this instance, we will start with projects that would be considered under the Operating Budget such as repairs. Consider sending out an RFP (Request for Proposal) for all known projects that are on the radar for the next year.

This is a good time to think about funding the Reserve Account. You might just use any funds left over, in excess of your income versus expenses, as the reserve fund number. You might look at the upcoming projects, some of which may be a straight reserve item, to guide you as to how much contribution is required for the Reserves to accomplish the goal by sending out an RFP so you have budgetary numbers, thereby simplifying the process. If your project is slated for a few months down the road, you might have to budget for the worst-case scenario meaning adding extra funds as a contingency for continuing inflation. Don’t forget to check your last Reserve Study to check on the recommended contribution. It might even be time for a new Reserve Study.

One negative aspect of the budget is to consider delinquencies. As times get tougher, there might be Owners who are unable to pay their assessments timely or at all. While I personally hate to budget for bad debt, it might be a must to consider. This may possibly allow you to offset some of the anticipated delinquencies and avoid ending up with a budget deficit. By now, you are probably ready to fill in the remainder of your budget spreadsheet and continue tweaking before sending it up the ladder for review.

Regardless of how you plan your budget, don’t be shy about negotiating with current and new vendors and try thinking outside the box. For instance, I negotiated with my trash vendor recently. I had one 8 cubic yard bin in my maintenance yard that got picked up twice a week. I negotiated a second 8 cubic yard bin, with pickup once a week and saved $175.00 a month in the process.

Remember you have tools at your disposal. CAI has books on budgeting to purchase and other Managers make great sounding boards. Best of luck this upcoming budget season!

ADDISON, TEXAS | 972.404.0155 | allegratx.com