3 minute read

DCHFA@40 Timeline

TIMELINE

1979 Legislation w as passed by the Council ofthe District Of Columbia and signed by Mayor Marion Barry to create the DC Housing Finance Agency

Advertisement

1993 Land Development Program was e stablished to provide management, inspection, monitoring, and ac counting services for public infrastructure construction

1996 The D .C . Council, Mayor Barry, DC Control Board And U .S . Congress eliminated DCHFA’s appropriated debt, allowing the Agency to become an independent agency

1982 DCHFA financed its first affordable multifamily h ousing group of developments 1994 The Agency offered amortgage in terest rate of 6 .5%, the lowest rate offered in Washington, D.C. since the late 1960s

1995 Became one of the first housing finance agencies to be approved bythe U .S . Departmentof Housing And Urban Development for its Risk-Share Program

1998 DCHFA purchased its headquarters at 815 Florida Avenue, NW, and received its first Issuer Credit Rating of BBB from Standard and Poor’ s

2003 D .C . Council approved legislation allowing DCHFA to own and develop property

1999 The Home Resource Center was opened to provide free housing counseling services to potential b uyers

2004 DCHFA celebrated it s 25th year anniversary

2005 DCHFA issued more than $76 million in tax-exempt bonds to the DC Housing Authority tohelp rehabilitate an d modernize 6,858 public housing units

2007 Financed 100th affordable rental housing development in the District

2009 DCHFA celebrated its 30th Anniversary a nd received Issuer Credit Rating upgrade To “A-“ from Standard & Poor’s

2010 DCHFA is awarded over $20 million to help District homeowners p revent foreclosures through the HomeSaver program

2014 Receives Issuer Credit Rating upgrade to “A2” and launches HomeSaver II to help homeowners at r isk of foreclosure

2017 Department of Housing and Community Development (DHCD) announces DCHFA as new Home Purchase Assis-tance Program (HPAP) coadministrator, and DCHFA launches the Housing Investment Platform (HIP)

2010 Launches DC Open Doors to help first-time homebuyers and homeowners looking to upgrade purchase homes by providing down payment and closing cost assistance

2015 DC Open Doors c elebrates f unding $100 million in mortgage loans

2016 DCHFA names housing and r eal e state industry veteran Todd A . Lee, Executive Director

Launches Mortgage Credit Certificate Program and DC Open Doors r eaches $200 million in mortgage loans

2019 DCHFA launches DC Mortgage Assistance Program (DC MAP) for furloughed federal government employees

2019 DCHFA launches the Reverse Mortgage Insurance And Tax Payment Program (ReMIT) for District residents at risk of foreclosure

2019 Todd A . Lee named District Of Columbia Building Industry Association (DCBIA) Gover nment Sector Awardee 2019

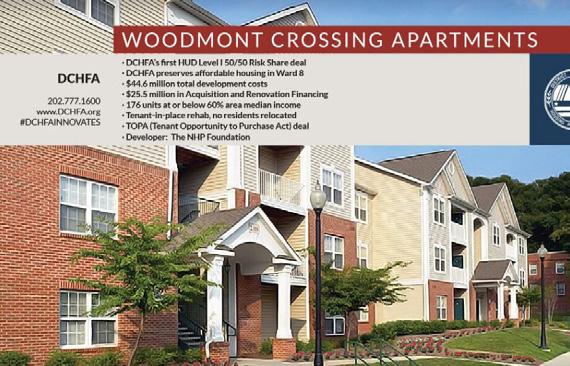

2018 DCHFA closes first HUD Level I 50/50 Risk Share transaction by financing the preservation of 176 affordable units in Ward 8 at Wood mont Crossing

2018 DCHFA rebrands with a new logo, website, updated Mission Statement and its first ever Statement of Values

2019 DCHFA launches DC4ME PLUS, a mortgage assistance program for District governmentemployees