1 minute read

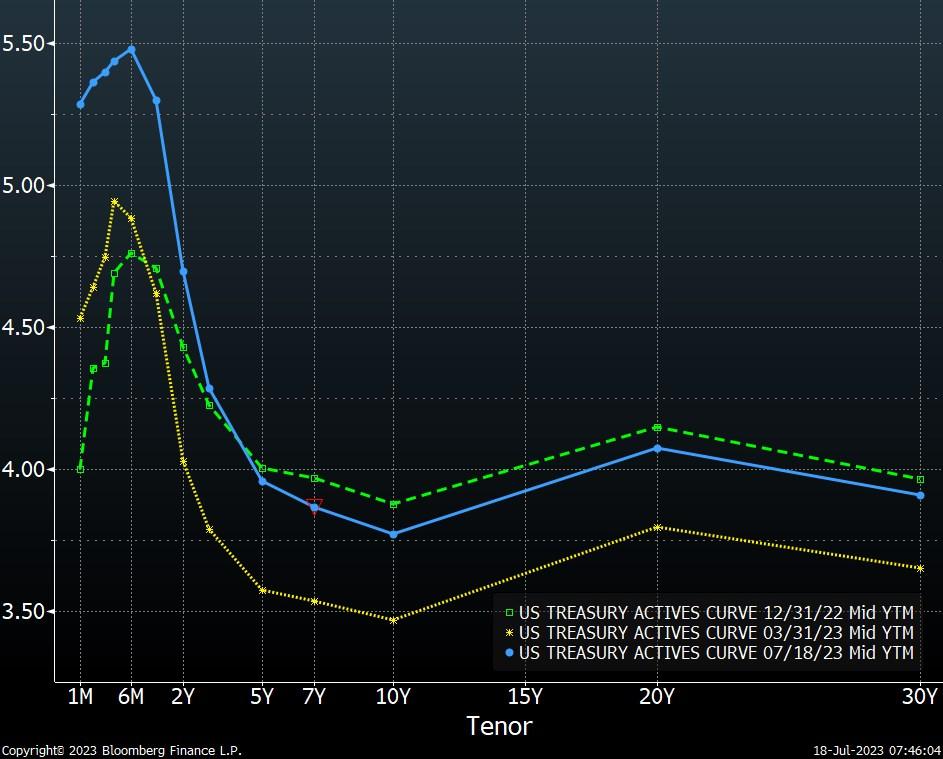

U.S. Treasury Yield Curve

Source: Bloomberg prepayment risk in today’s interest rate environment. They are especially attractive vis-à-vis corporate bonds, which face the risk that their spreads will widen as economic growth slows.

Taking a broader look, even with the risk that corporate spreads could widen in the coming months, the investment-grade bond market is very attractive today. The Bloomberg U.S. Mortgage-Backed Securities Index and Bloomberg U.S. Aggregate Index are both yielding 4.7%, and even higher yields are available on the short end of the U.S. Treasury yield curve (a 1 -year Treasury today yields 5.3%).

All of these figures are near 15-year highs.

We hold overweight positions to agency MBS within our intermediate duration and short duration bond strategies and will be looking to add to this asset class in the third quarter. In addition to MBS, our short duration bond strategies also have significant exposure to short-term Treasury bills (with a maturity of one year or less) to take advantage of attractive short-term yields. We remain close to