1 minute read

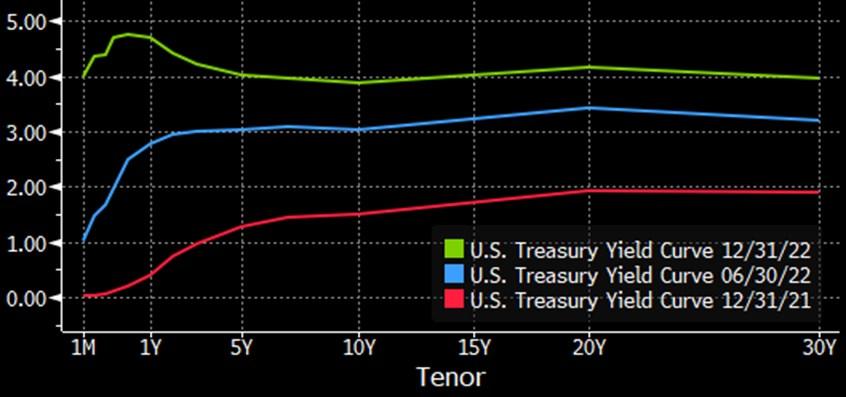

U.S. Treasury Yield Curve

Source: Bloomberg

U.S. Inflation Breakeven Rates

Source: Bloomberg

Bloomberg U.S. MBS Fixed Rate Average Option-Adjusted Spread

Source: Bloomberg today is greatly improved from a year ago. Despite the continued war in Ukraine and recent spike of COVID-19 cases in China, global supply chain pressures are likely to ease further in the longer term. Additionally, there is considerable evidence that Federal Reserve policymakers’ tightening regime is negatively impacting aggregate demand. We believe that these two factors point to supply and demand coming into balance, decreasing price pressures.

In addition to lower inflation, we’re forecasting that the real rate of interest (roughly U.S. Treasury yields minus inflation expectations) will decrease as Fed policymakers begin to slow monetary policy tightening this year. Consequently, we have extended duration in our intermediate duration bond strategies, while maintaining duration of short duration portfolios slightly longer than that of their benchmark. We have been adding to agency mortgage-backed security positions and hold an overweight position to the sector across all our fixed income strategies. MBS option-adjusted spreads have fallen recently but remain attractive vis-à-vis U.S. Treasury bonds, given the diminished prepayment risk that exists for most MBS coupons.

Rising interest rates made for a difficult environment for the bond market during the last 12 months, but the outlook today is much improved. Bonds are attractive, with U.S. Treasury bond yields near 15year highs and macroeconomic factors pointing toward a much more favorable environment for fixed income in 2023.