4 minute read

Total State Revenue as it Affects Local School District Budgets

By Vernon Florence, CCOSA Consultant

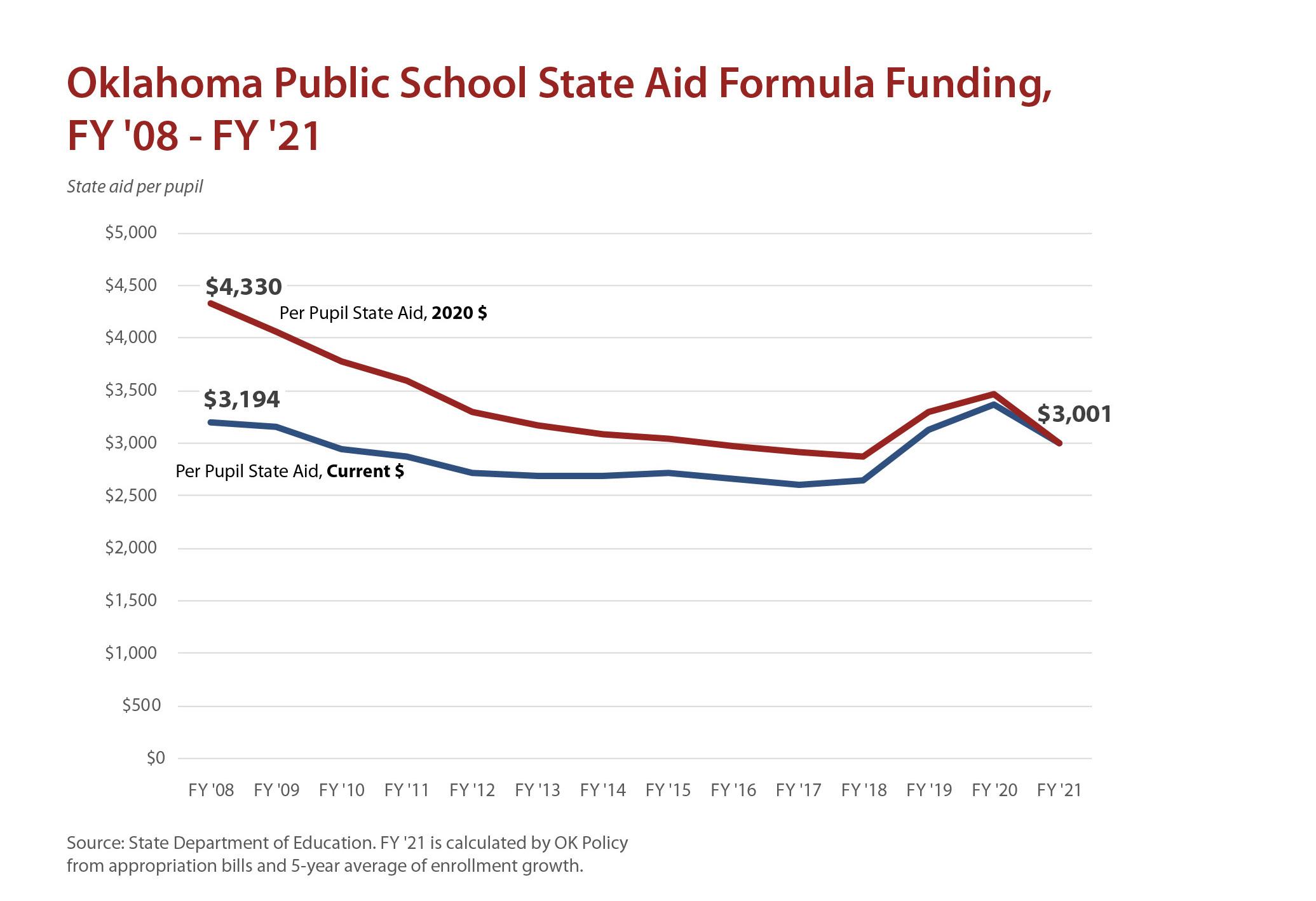

Developing a revenue budget for the local school district depends, to a great extent, on the state revenue collections. According to the State Department of Education (SDE) OCAS report for FY 20, approximately 61 percent of the current year’s revenue is from State sources.

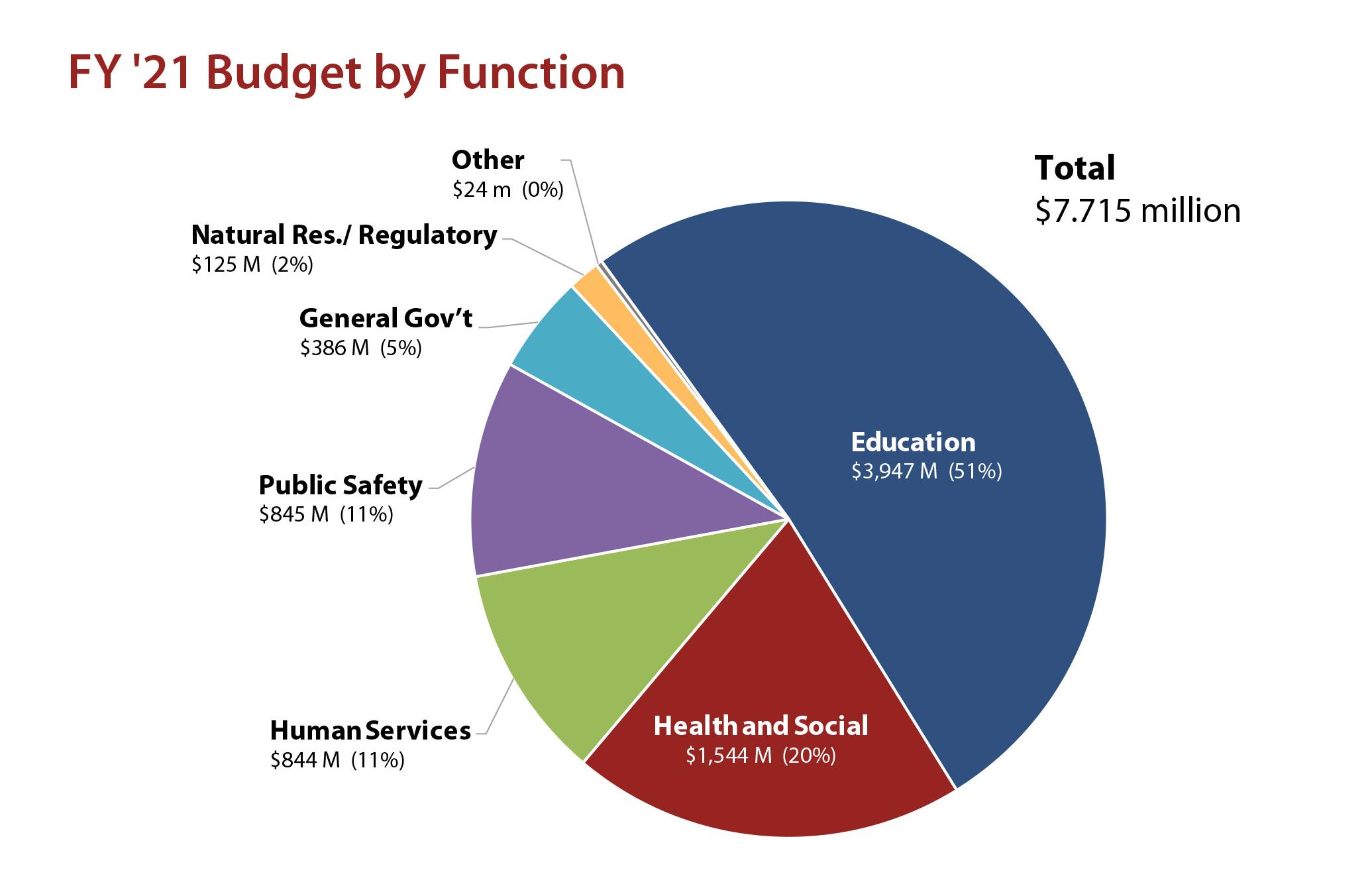

The Total State Revenue represents all the daily revenue collections received by the Oklahoma State Tax Commission. Approximately 78-80 sources of revenue are included in the $12B to $13B of State Revenue annual collections. These revenue collections are appropriated, through the legislative process, to the various state agencies. (Some agencies receive a direct appropriation without legislative approval.) The five funds that provide revenue for the SDE to distribute to the various school districts include General Revenue Fund, HB 1017 Fund, Common Ed Tech Fund, Educational Lottery Fund, and the Mineral Leasing Fund.

THE TOTAL STATE REVENUE

An analysis of the State Revenue status for FY 21 is critical for the projection of FY 22 State Revenue since the State Revenue determines the revenue budget for all other state funds and to a great extent, local school district revenue budgets. This analysis will start with the first half of FY 21 collections and then attempt to project the second half of revenue collections for FY 21.

The most widely used revenue analysis is a comparison of current YTD collections with the same YTD prior year collections. As of December 31, 2020, the YTD collections for FY 21 is 2.72% above the same FY 20 time period. Collections for FY 21 have been greater each month compared to the same FY 20 time period. This is true largely to the April 15 to July 15 delayed Income Tax payments. This skewed reality does not represent a true picture. By removing the YTD Income Tax delayed payments from the December YTD collections, the FY 21 YTD collections are (-) 2.29% compared to FY 20 YTD collections.

Of the approximately 78-80 sources of Total State Revenue, only three of these sources provide the largest portion of the total. These are Individual Income Tax, Sales Tax (which includes Use Tax), and Gross Production Tax. At this time there is a projected sales tax decrease for FY 21 compared to FY 20. This is to be expected due to the depressed economy caused by the pandemic and the energy crisis. However, some of this decrease in sales tax could be associated with the increase in use tax, which is the Internet Sales Tax. The combined Sales and Use Tax provides a more accurate indicator of Sales Tax collections. When the two taxes are combined the revenue is flat for the FY 21 projection compared to the FY 20 actual collection. If this pattern continues for the remainder of FY 21, it will show signs of stability. It will not show economic recovery until FY 21 collections exceed FY 20 collections.

The major revenue problem for the State of Oklahoma for FY 21 is the decrease in gross production. Not all of the Gross Production Tax downfall is due to the virus pandemic. This decline was well on its way before the pandemic due to the overproduction of oil compared to consumption. This trend started toward the end of 2019. The curtailed use of oil products (gasoline, diesel fuel, and jet fuel) caused by the pandemic further contributed to the consumption decline.

CONCLUSIONS:

FY 21 REVENUE PROJECTION:

The most optimistic outlook for FY 21 is for the Total State Revenue collections to continue the rest of the year at the same rate of return as the first half of the fiscal year. If this holds, schools should not be concerned about a revenue failure this year.

It appears that the Individual Income Tax will sustain a flattened level of collection for the rest of this fiscal year.

Sales and Use Tax collections should be flat or slightly down for the rest of the fiscal year.

Gross Production collections will show some improvement but will not reach the FY 19 level for some time.

FY 22 REVENUE PROJECTION:

Revenue predictions for FY 22 involve two areas of concern. How quickly will the economy recover from the pandemic and how quickly will the energy sector approach stability?

How quickly the widespread vaccination occurs will determine the timeliness of the pandemic economic recovery. This will take a minimum of eight months and probably closer to 18 months before substantial recovery affects Individual Income Tax and Sales Tax collections. These are the two indicators to observe going forward for the next several months.

Closely associated with the pandemic recovery is the energy sector recovery. As the pandemic recovery progresses, the increased consumption of gasoline, diesel fuel, and jet fuel will stimulate economic recovery. But the energy industry also should regulate production in line with consumption to maintain economic stability.

Considering these issues, the best approach for FY 22 is to proceed with a flat revenue budget until the economic recovery is well established. The FY 23 revenue outlook shows promise unless there is another catastrophe that directs the recovery downward.

The final analysis is that there is light at the end of the tunnel. The problem is that the length of the tunnel is not specific at this time. Therefore, schools could expect economic recovery sometime during the latter part of FY 22 and into FY 23. Until the recovery is evident, proceeding with caution is the best course of action.